Jump to winners | Jump to methodology | View PDF

Consumer demand for brokers’ services reached an all-time high in 2024, with nearly 75% of mortgages in Australia facilitated by brokers.

In such an environment, MPA’s 2025 Rising Stars successfully battled the continued challenges of:

This uptick in demand has offered new opportunities for young, less experienced brokers to thrive in an industry undergoing rapid transformation, evidenced by the fact that 98% of MFAA members reported seeing new clients for the first time who sought to refinance due to serviceability buffer constraints.

By developing leading-edge knowledge, client relationship and business skills, and committing to ongoing professional development, the promising young brokers – recognised as MPA’s Rising Stars – have a pivotal role to play in the sector’s future.

“I think it’s an extremely exciting time for new-to-industry brokers,” says MFAA CEO Anja Pannek. “This is a fantastic industry to build a business and a career. The industry is in a strong position and, importantly, growing.”

This robust demand for brokers also extends to those supporting commercial lending needs. The latest MFAA Industry Intelligence Service report, covering 1 October 2023 to 31 March 2024, reveals that the number of mortgage brokers writing commercial loans rose to 6,755, a 15.19% increase.

“The first few years of a broker’s career can be challenging, without a doubt,” Pannek says. “New brokers have to get across lender products and policy, build referral partnerships and establish processes in their business.”

Underlining how the best young mortgage brokers demonstrate their leadership potential, Pannek emphasises the following approaches:

“As a new broker, utilise the resources and support available from your association, your aggregator BDMs, and your lender BDMs,” she adds. “Also, don’t forget to reach out to other brokers in your network who are always more than willing to share their experiences and insights.”

FBAA managing director Peter White agrees that even in difficult times, broking remains a resilient and rewarding profession.

“Young brokers need to be diligent in their investigation discoveries when putting a loan application together and must never take any shortcuts,” White says. “Compliance with the Best Interests Duty is paramount and must be mastered. Once done, it becomes second nature.”

White also emphasises the importance of mastering the art of dealing with clients and their needs and emotions, while balancing the requirements of lending to ensure everyone wins in the end.

MPA invited the country’s leading mortgage companies to nominate standout achievers under 35, who had written over $15 million in loans within a year and held no more than two years of broker accreditation.

Following a rigorous review of submissions and peer recommendations, the MPA team selected 50 Rising Stars for the 14th annual list, recognising their exceptional impact, determination and drive.

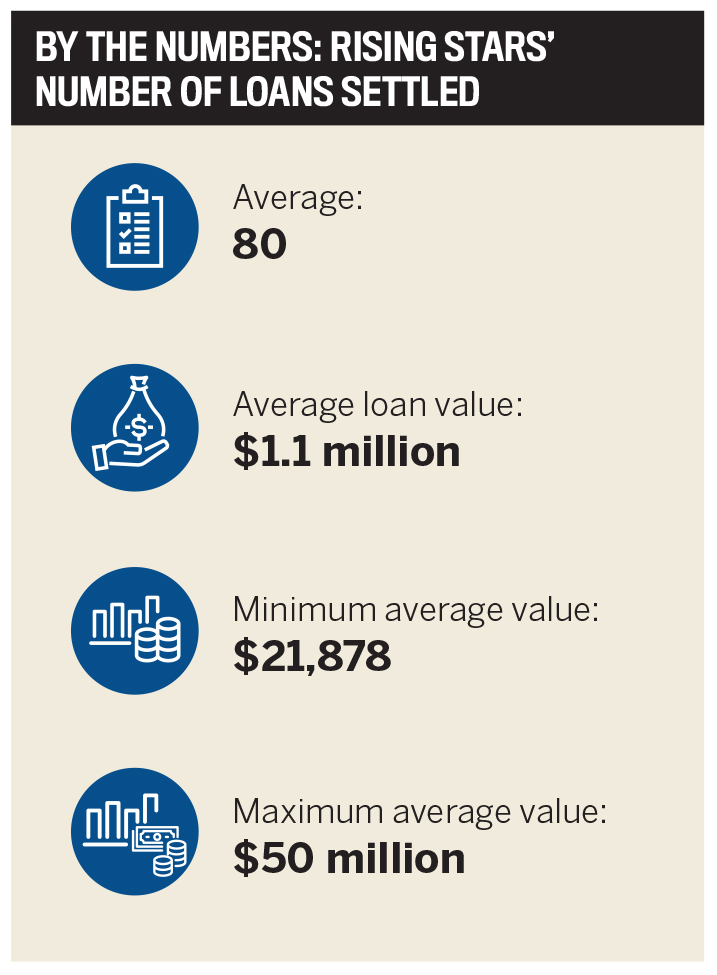

The value the Rising Stars bring to borrowers and lenders continues to ascend to new heights, according to the September 2024 quarter MFAA data:

The industry’s record-breaking growth shines a spotlight on the influence of the best mortgage brokers, who personify resilience, client-first innovation, leadership and far-reaching results, serving as role models for aspiring rising brokers.

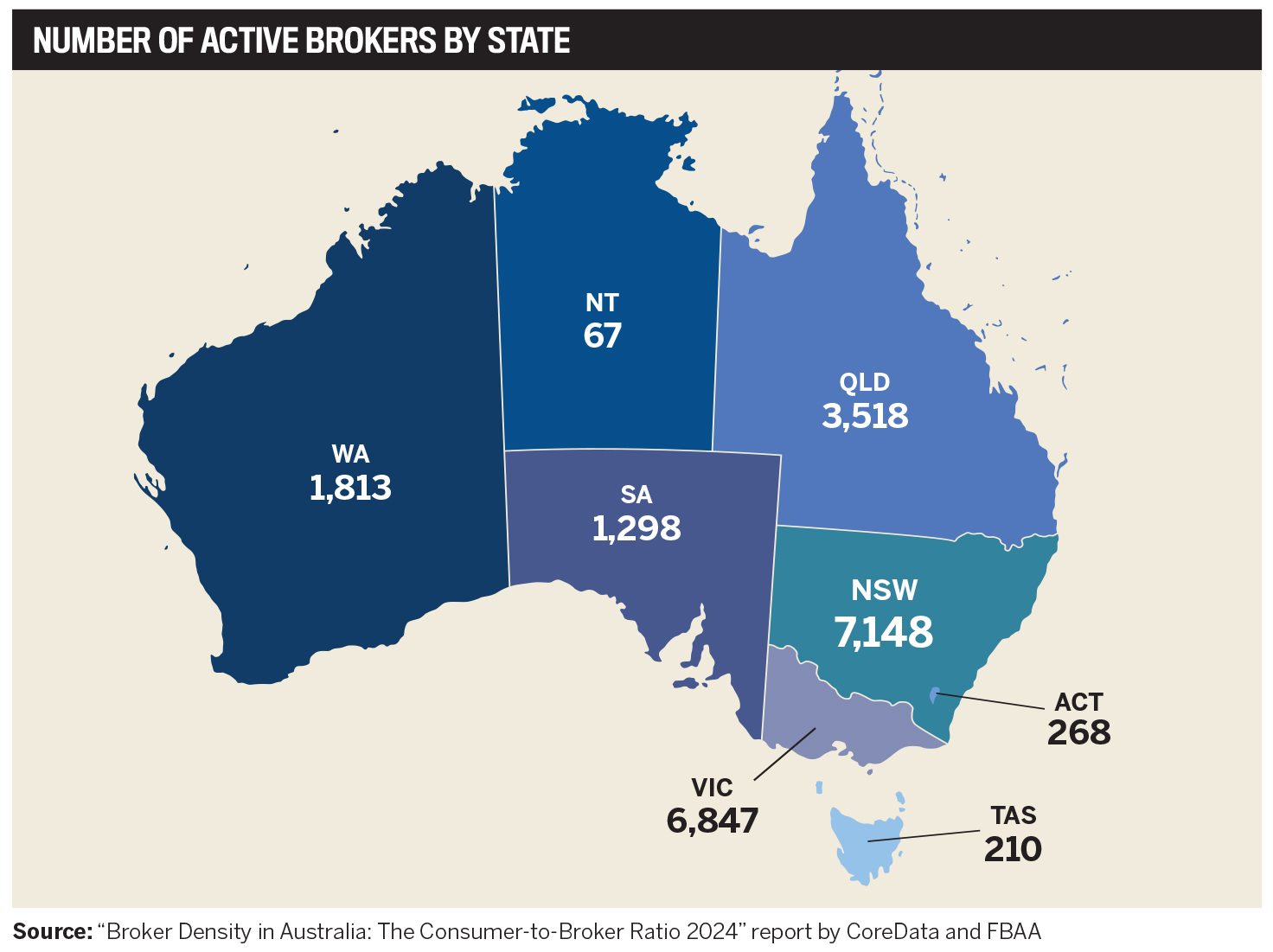

According to CoreData, consumer demand and interest in the broking profession are among the factors fuelling the industry’s growth. Australia’s national consumer-to-broker ratio is 10.7 per 10,000 adults, or one broker for every 931 adults, reflecting a 4.91% increase between 2018 and 2024.

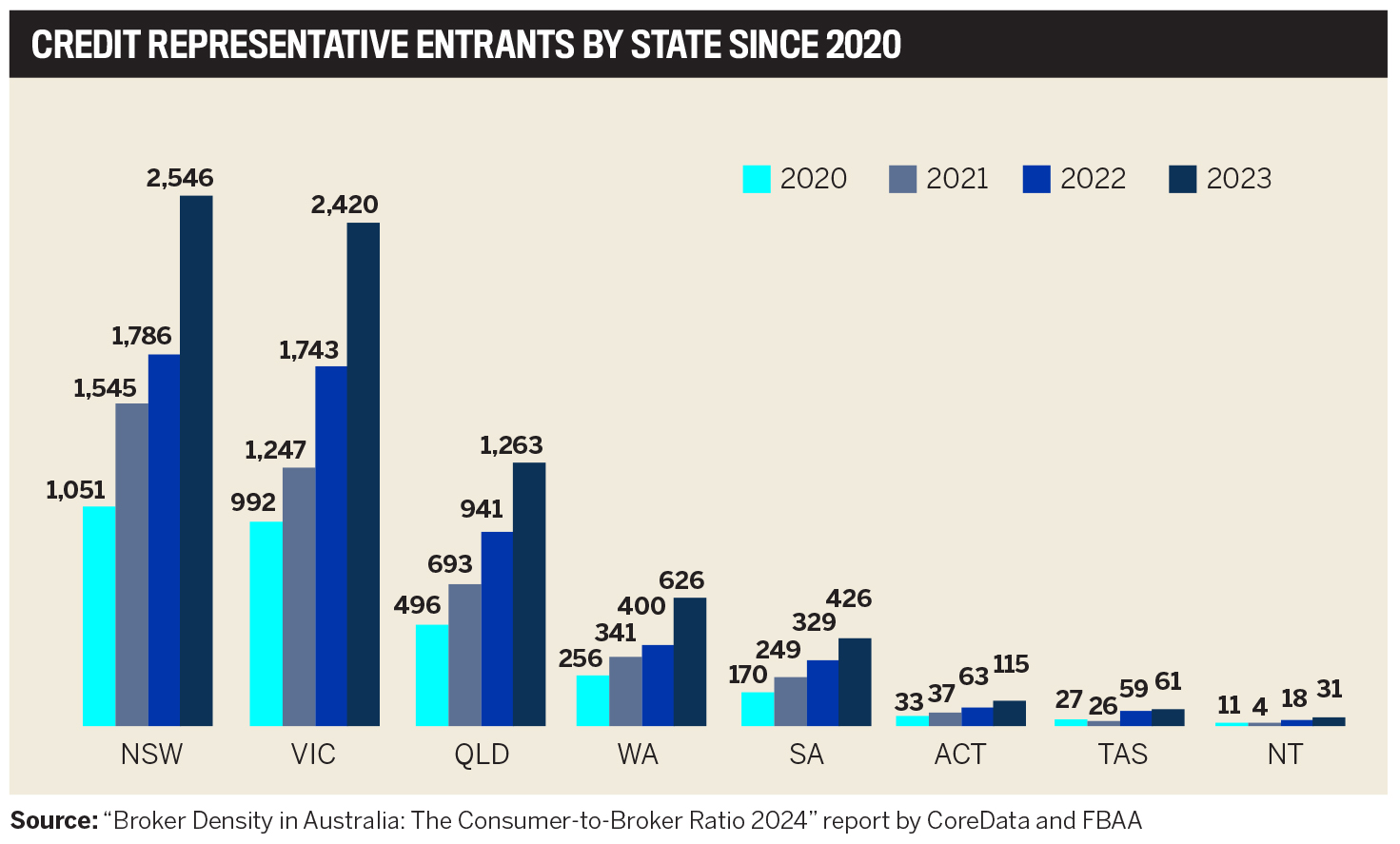

The number of people entering the broking industry has also surged over the past four years, more than doubling across all states and territories between 2020 and 2023. Additionally, 2023 was a peak year for new entrants across all states and territories, except Tasmania.

The most populous states, New South Wales and Victoria, saw the largest influx of new entrants across all years. They now have the highest number of brokers in the country, with 34% and 32% working there, respectively.

Regarding broker density, Victoria leads the way with 13.5 brokers per 10,000 adults, rendering it the most saturated broker market. In contrast, Tasmania and the Northern Territory are home to only 1% and 0.3% of Australia’s brokers and have the two lowest broker densities of any region, at 4.7 and 3.6, respectively.

Among Australia’s over 21,000-strong customer-facing mortgage brokers, this year’s Rising Stars possess the extraordinary potential to lead the country’s more than 10,700 businesses forward.

As MPA’s survey data shows, collectively, the Rising Stars have:

The five best mortgage brokers profiled here represent the country’s diverse rural and urban regions, specialties and unique achievements that have earned 2025’s Rising Stars this year’s prestigious recognition.

Sydney-based mortgage broker Salina Lam has honed a holistic approach to helping clients make informed financial decisions by explaining the ‘why’ and ‘how’ of lending. This transparency has enabled Lam to build trust and loyalty, creating a positive customer experience that has led to a robust referral base.

She works closely with multiple stakeholders, including clients, referral partners and lenders, and understands that proactive communication is essential in ensuring a smooth process.

“We often face pressure with settlement deadlines,” Lam says. “I proactively provide updates at each stage of the process, giving clients and referral partners confidence in my abilities and reassurance that everything is being actioned as planned.”

Her contributions to Insight Property Finance’s success are numerous, including:

Drawing on her experience as a corporate analyst at a Big Four bank, Lam takes pride in helping clients grow their wealth through home ownership. She has earned a reputation as a skilled broker who delivers exceptional value through personalised and comprehensive service and solutions.

After the deal closes, her commitment to clients continues to shine through. For instance, she is keen to negotiate better interest rates even after settlement. Among her notable achievements are:

As a young broker, Lam has counteracted perceptions about her limited experience by going above and beyond for every client, dedicating the time and attention needed to exceed their expectations and build up her book.

“Someone who has been in the industry for many years might have to manage hundreds of clients, which can sometimes make it harder to maintain that same level of personalised care,” she reflects.

Another hurdle Lam has conquered with ease involves staying on top of the vast number of lenders and their varying processes and credit policies. She emphasises the importance of understanding the unique requirements of each lender to deliver the best solutions for clients.

“I genuinely care about my clients and take the time to learn the specifics of each lender’s offerings, including reaching out to BDMs to workshop scenarios, asking the right questions, and, when necessary, relentlessly pushing for escalations to ensure the best possible outcome,” she says.

While managing his clients at the picturesque Brightwaters brokerage on the western shore of Lake Macquarie, head mortgage broker Steven Clark devotes considerable time to training junior brokers and support staff.

Clark also specialises in helping investors build and scale their property portfolios and working with first-home buyers. Most of the brokerage’s clients are low- to middle-income earners, highlighting his commitment to providing accurate information and well-informed advice to make wise decisions.

On the business front, he has helped grow the brokerage from a team of three to 15 and confidently handles referral and client relationship management. Clark assisted in implementing new technologies, including Broker Engine, Quickli and Spark, to enhance the brokerage’s operations. His customer-first approach has been key to achieving outstanding results and building trust and meaningful client and partner relationships.

“We focus on being as available and responsive as possible for our clients,” he says. “We’ve created a seamless experience by understanding their needs and proactively communicating.”

Within 48 months in the role, Clark has:

Juggling multiple demands while staying ahead of market trends can be challenging in competitive environments. To manage this, Clark focuses on strengthening his industry knowledge and leaning on more experienced colleagues for support and advice.

“I’ve focused on time management and also learned how to delegate tasks more effectively,” he says. “Building strong relationships with our BDMs has been key to getting the support and resources I need to stay on top of things and provide the best service to my clients.”

South Melbourne senior associate Mark Stutz has flourished since joining the mortgage industry, starting at Quattro Finance & Advisory as a credit analyst before quickly advancing to a top new business writer after earning his broker accreditation.

Stutz specialises in commercial and development finance, adeptly funding site acquisitions, running tender processes and assisting clients to get their projects up and running. The February 2024 settlement of a development finance transaction for 18 apartments in Caulfield North is among his most significant achievements to date. The project reflected the knowledge he has gained and reinforced his self-confidence.

“Quattro is an established business with a strong reputation and that’s certainly given me a decent leg-up,” Stutz explains. “Knowing the market well so you can have those technical conversations also gives clients confidence in you.”

Success came early for Stutz, who credits his ability to forge strong connections with clients and lenders as the backbone of his impressive results. Not one to sit by and wait for good things to happen, Stutz has earned a reputation for shifting gears with intensity and focus.

Some of the steps he has taken in the past 12 months to boost his skills and knowledge include attending numerous industry and networking events, such as the LMG Business Excellence Conference in Cairns and the MFAA Top Gun Commercial Workshop.

His strategies for overcoming the challenges faced by young brokers include:

The most rewarding transactions Stutz has dealt with involve finding niche solutions for clients with complex requirements.

In an industry that boasts a significant cohort of older, experienced brokers, gaining traction and recognition when starting out can be tough. Stutz has turned this to his advantage by seeking out mentors and industry insiders who want to pass on their knowledge.

Rachel Howlett’s lived experience of supporting younger siblings on a part-time job while completing her studies has taught the finance strategist the value of financial literacy and education. That first-hand knowledge has driven Howlett’s meteoric rise in the mortgage industry, where she plays a major role in delivering Infinity co-founder Graeme Holm’s Money Mentor masterclass education series from her home base in Varsity Lakes.

“Instead of pitching for business, we focus on educating people about managing their finances effectively,” she says. “This adds value before they commit to working with us and builds trust.”

This strategic approach to improving potential clients’ financial literacy paves the way for solutions that make a real difference. For example, Howlett recently assisted a client who had $350,000 in term deposits earning 4.8% interest, while at the same time paying 6.5% interest on their home loan. By reallocating those funds to reduce the home loan balance, she lowered their monthly repayments and freed up equity for future investments.

Chief among her numerous achievements are:

Howlett views her role beyond that of a standard mortgage broker. Instead, she prides herself on being a holistic financial educator, helping everyday Australians break the big banks’ stranglehold and the conventional approach that governs traditional mortgage broking approaches.

She also strives to establish a strong foundation for young people so they can take good money habits into adulthood. Being taken seriously as a young woman in a male-dominated industry was a challenge she met head-on by going the extra mile to prove her expertise, backed by the results she has achieved for clients.

“When I moved from events management to finance, a female CEO told me I wouldn’t make it in finance as a young-looking woman,” she reflects. “That stuck with me, and it motivated me to work even harder to prove her wrong. I take pride in inspiring other young women to believe they can succeed in this field.”

Within six months of launching his career, mortgage broker Steffan Bastians has emerged as a top performer whose dedication and expertise have garnered recognition as a Rising Star and a finalist for LMG’s 2024 Best New Broker award.

That success has been built on a foundation of strong referral partners, such as accountants, financial advisors, conveyancers and builders, ensuring clients receive a complete package of services tailored to their needs. His banking background instilled a passion for finance that has blossomed since joining the broking community, where he feels less restricted in serving clients.

Before starting as a broker, Bastians created a 12-month plan for himself, breaking down monthly goals with clear, measurable targets – all of which he has exceeded.

“I review and update the plan regularly to stay on track or adjust if needed. This approach has kept me focused and driven,” he says.

The guidance and mentorship of Brokerage and Co’s founder and CEO, Sergio Stefano, has been invaluable in Bastians’ development and confidence. Some of his accomplishments include:

Staying across the unique policies and niches of the country’s lenders remains challenging in a competitive market where change is the norm. Bastians tackles this by setting aside upward of three hours daily to study lender policies and creating a visual guide to reference key information quickly.

Building relationships with lender BDMs has also been essential.

“Their support makes a big difference when clarifying policies or working through tough deals,” he reflects. “I’ve learned not to put all my eggs in one basket and always have back-up options for lenders if something falls through.”

At ING Australia, we’re thrilled to once again sponsor MPA’s Rising Stars for 2025.

For a quarter of a century, brokers have worked with us to help more Australians achieve their home ownership dreams. Today, more than 90% of our home loans are sourced through the third-party channel. Supporting the next wave of talented brokers isn’t just important – it’s vital for the future of our industry and the customers we serve.

Fresh talent keeps the broker channel thriving, bringing innovation, energy and new perspectives. Rising Stars like those featured in this report exemplify the drive, resilience and customer-first mindset that define success in our ever-evolving market.

2025 is shaping up to be a year of change and opportunity. The Rising Stars will no doubt tackle challenges head on, helping the broker channel grow stronger than ever. ING is proud to champion their achievements and celebrate their journey.

Congratulations to this year’s nominees. We can’t wait to see what you’ll achieve next!

George Thompson

George Thompson

Head of Mortgages

ING

MPA invited the most impressive mortgage companies in the country to nominate high-performing achievers for the 14th annual Rising Stars list. All nominees had to be 35 years old or younger, had to have written more than $15 million in loans from 1 October 2023 to 30 September 2024, and worked as accredited brokers for no more than two years.

Brokers presented their submissions, detailing why each individual deserved to be considered, and recommendations were then taken from their peers to decide who made the final cut. After thoroughly reviewing all entries, the MPA team narrowed down the list to 50 Rising Stars who have made the most significant impact on the industry through their financial results, determination and drive.

The MPA Rising Stars report is proudly sponsored by ING.