Jump to winners | Jump to methodology

Building on the legacy of trailblazing female leaders, MPA’s Elite Women of 2024 are pioneering change and inspiring the next generation, as well as championing a rise in representation and recruitment across the sector.

Industry professionals from across the country were invited to nominate exceptional female leaders, and after a review of hundreds of nominees, the MPA team carefully selected 54 Elite Women who have made a positive professional impact on their organisations, communities and the industry by:

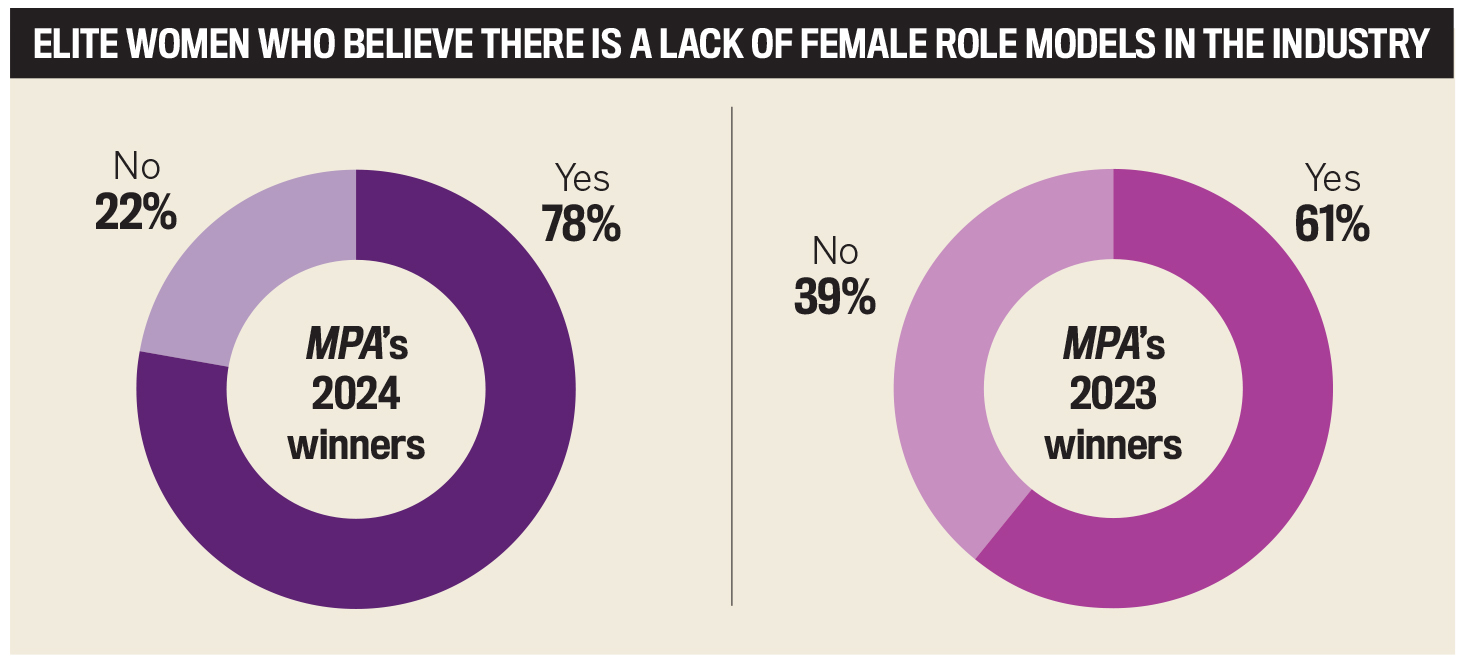

While MPA’s 2023–24 survey data shows a 17% rise in Elite Women who believe there is a dearth of female role models, this year’s awardees exemplify what leadership in action looks like and are leading the charge for women across the mortgage sector.

The industry’s professional bodies, the FBAA and the MFAA, have both long acknowledged the need to boost female representation.

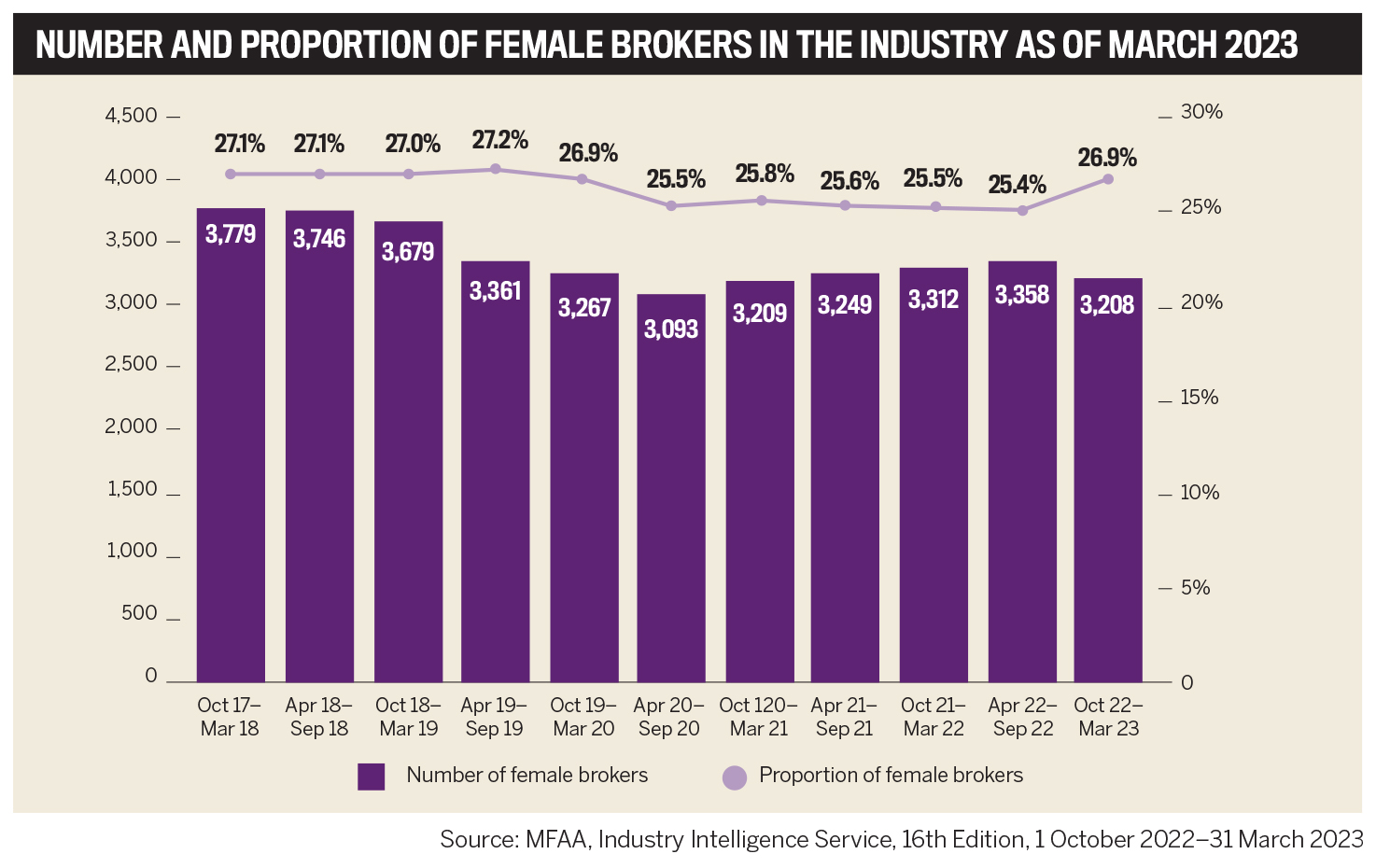

This is happening according to the MFAA’s data, as female brokers have increased their representation from a historic low of 25.4% in September 2022 to 26.9% as of March 2023.

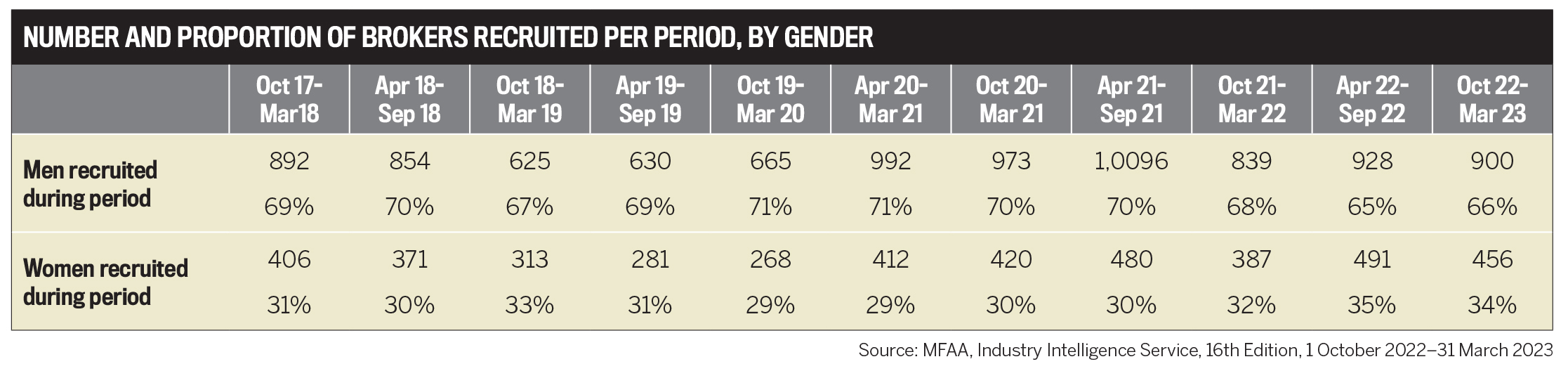

This positive development is coupled with women gaining the upper hand in recruitment. Comparing the most recent year-on-year growth (March 2022 to March 2023), male recruits rose by 7.27%, but women recorded more than double this ratio with 17.83%. These statistics showcase the strides made with MPA’s Elite Women at the forefront.

At the FBAA, 75% of staff are women, including those in senior and executive positions, notes the association’s managing director, Peter White, AM.

The FBAA’s membership division has generally been stable over the past decade, with the latest figures showing 12,335 members, split into 28% women and 72% men.

White says, “In my view, an Elite Woman in the Australian mortgage industry is a person who has developed a successful unique value proposition to their customers, which has led to excellence in providing their service to their customer base as well as showing excellence in their governance and obligations under law. But in all fairness, I see this is the case for women and men in our industry.”

Nicole Triandos – NAB

Head of partnerships and enablement

The values of respect, responsibility, passion and vision instilled by her parents have guided Nicole Triandos throughout her personal and professional life. She has built a thriving career underpinned by her unwavering dedication to nurturing relationships and a professional network based on mutual support:

“I remember being in the media room at 8 p.m. on the night the royal commission report was handed down, and it was a monumental period of change for NAB and the broader financial services industry, unlike anything I’ve experienced during my career since,” she says.

Over two decades of working in the third party channel, Triandos has excelled in marketing, relationship management and promoting diversity and inclusion in the workplace, particularly for underrepresented females.

When Triandos first took on her current role in 2016, no other women were in an equivalent position at other major banks. She was often the only woman in the room and learned to constantly speak up to ensure her voice was heard and work harder to secure and maintain her position.

Triandos says, “The quality of relationships I have built and will continue to build in the broker industry keeps me motivated every day. Working collaboratively with my colleagues and delivering great client results continues to inspire me. Many clients have become close friends as genuine care is at the heart of these connections.”

Stephanie Thomas – Loan Market Ignite

Managing director and senior mortgage broker

As a working mum with three children, Stephanie Thomas knows first-hand that an inclusive, collaborative and flexible work environment is paramount to reaching one’s full potential.

When she branched out in 2022 and launched a Loan Market franchise, she set out to create a workplace culture that prioritised her team’s wellbeing and clients’ needs. Her primary focus is inspiring her team to feel as passionate about caring for clients as she does.

“I am hugely proud of how hard we peddled and pushed and the effort we put in as a family to get here together,” she says.

When the former long-time business development manager took the leap of faith to open her own business, she developed a genuine appreciation of clients’ trust and confidence in her.

Using her experience, knowledge, compassion and empathy, Thomas has created an environment that helps clients achieve their goals, and she becomes a source of referrals.

She says, “When clients say I’ve done a great job and ask me to help somebody else, that tells me I’ve hit the nail and motivates me to continue striving for that. I also want to build something for my family that they’re proud of, particularly in the hope that my two daughters will join me and become mortgage brokers or work in the finance industry.”

Peta Siebert – Manage Your Loans

Chief executive officer

Seasoned industry leader Peta Siebert believes in constantly reinventing herself to stay ahead in the fast-moving industry.

She is known for her passion for empowering her team, developing innovative technology to streamline the loan process and creating a transparent, supportive and positive work culture. These qualities have helped her build loyal relationships over the past three decades.

“It’s beautiful when you have three team members: one has followed me through three different organisations, and two are brand new and individually nominated me for this award,” she says. “That’s the stuff that makes a big difference. You know you’re doing the right thing for your team and people in the industry.”

Based on her decades-long experience mentoring new brokers, Siebert is passionate about pushing for higher industry standards and believes formal education and other requirements are needed. Her experience guiding her teams and celebrating their successes underpins her goal of transforming mortgage broking into a profession recognised for its expertise and integrity, such as law and accounting.

She says, “I want the professionalism in our industry to improve, and that’s why I continue to strive for excellence. We handle massive amounts of volume, people’s income and responsibility, yet we’re not seen as a true professional industry.”

Larissa Barton – Mortgage Choice Peregian Beach and Noosaville

Mortgage broker and director

Larissa Barton’s caring leadership shines as she emphasises that providing her team with certainty, guidance and comfort is paramount, especially during challenging times.

She takes pride in attracting new people without financial experience and offering them opportunities to flourish through education, training and mentoring. Barton values her team and implemented a nine-day fortnight to give them more flexibility and work-life balance.

“It took three years for the rubber to hit the road – three years of grinding and lots of tears and wondering what we had done as we put everything on the line,” she says. “We had to succeed because we had no plan B. Now, we’re on the other side, and I feel it’s a huge accomplishment to have gone through that and become successful."

A sense that there’s always more to learn and achieve drives Barton’s desire to continue learning and developing. She has amassed extensive industry knowledge and experience over the past 20 years, including a decade-long stint as a mobile banker.

She says, “It took me years to get confidence in the great amount of knowledge I had and to know that I’m even more valuable to my clients now in getting them the best results. “I’m enjoying the flow I have in my work, and I’m excited to see the impact it will have on the growth of the business.”

MPA’s survey feedback suggests a desire for more initiatives to improve gender representation and support women in their career journeys, including these ideas from 2024’s Elite Women:

ANZ is a proud sponsor of the third annual MPA Elite Women list, dedicated to showcasing top women in the mortgage industry. We are delighted to collaborate with MPA once more to spotlight the valuable skills and talents of these outstanding female leaders in mortgage broking and finance and celebrate the Elite Women who have made their mark on the mortgage industry.

This prestigious list honours and acknowledges women’s contributions to helping Australians achieve their homeownership or business goals as brokers, aggregators or lender representatives. We remain committed to working better together with brokers, aggregators and industry partners to promote an inclusive culture and enrich the diversity of our industry.

Natalie Smith

Natalie Smith

General Manager

ANZ Retail Broker

In April of this year, MPA invited industry professionals from across the country to nominate exceptional female leaders for its Elite Women 2024 list. Nominees had to be working in a role that related to, interacted with, or in some way impacted the industry and should have demonstrated a clear passion for their work and have never previously been recognised as MPA Elite Women.

Nominators were asked to describe the nominee’s standout professional achievements over the past 12 months, initiatives and innovations, and contributions to the mortgage industry.

After a thorough review of all the nominations, the MPA team narrowed down the list to the final 54 Elite Women who have made their mark on the industry.

MPA’s Elite Women report is proudly sponsored by ANZ.