Jump to winners | Jump to methodology

Brokers continue to assert their influence in Australia’s mortgage market, shedding light on the dynamics of the third party distribution channel and the standout support aggregators provide amid ongoing market fluctuations.

MPA’s Brokers on Aggregators 2024 report uncovers that broker satisfaction levels have experienced a moderate decline, dropping seven points, despite being indispensable partners.

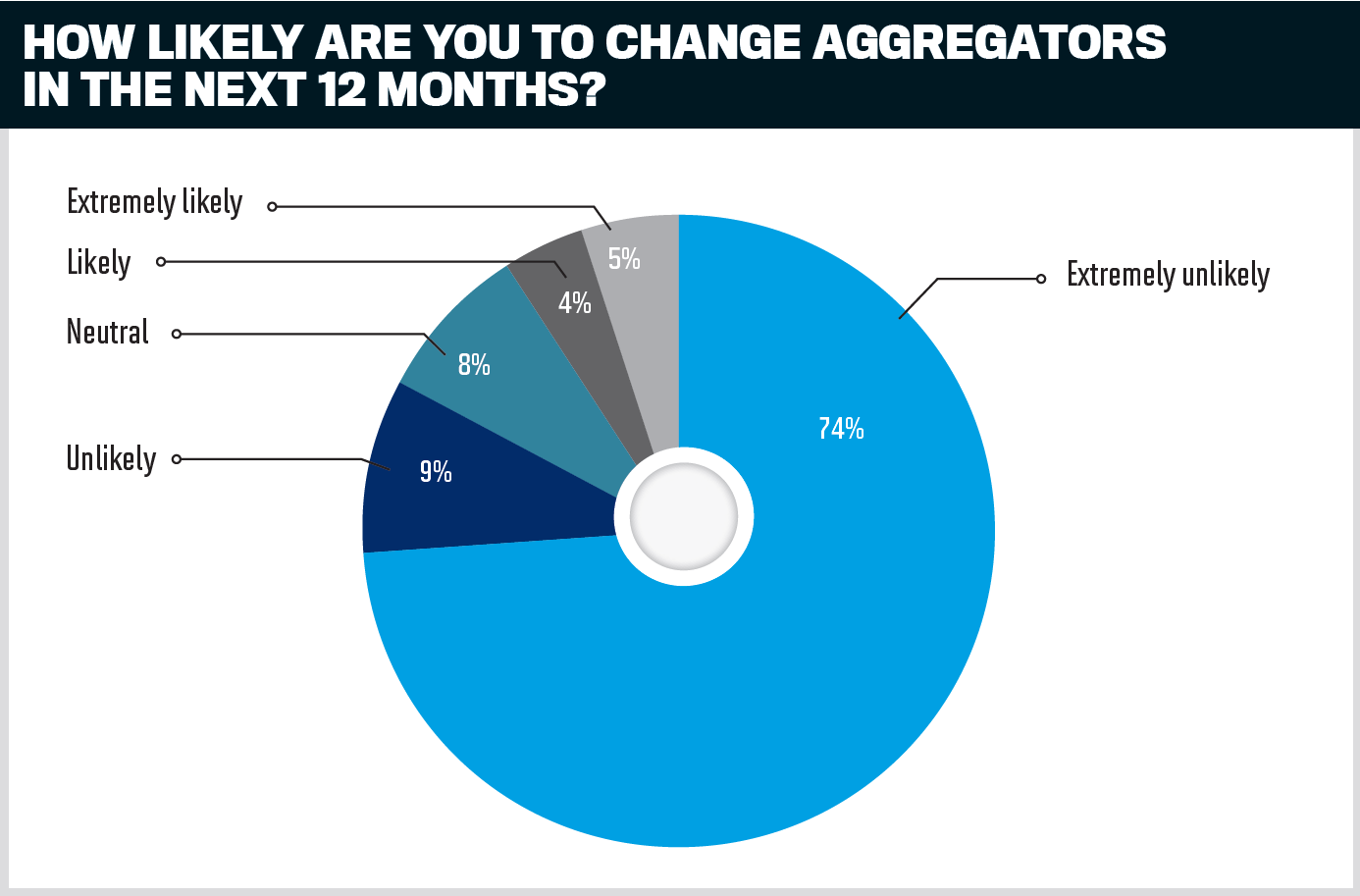

This shift in sentiment doesn’t mean the sky is falling, as aggregator loyalty remains deep, with 74% of brokers indicating they are extremely unlikely to take their business to a competitor.

This year’s top mortgage aggregators fiercely advocate for broker interests in a demanding consumer and lending market, providing key ingredients to ensure broker success.

“Successful aggregators treat brokers as more than just a number,” says Liberty chief distribution officer David Smith. “They understand and invest in their business at the grassroots level and maintain strong relationships with key lenders.”

He adds, “The aggregators that set themselves apart embrace technology with a progressive approach that goes beyond simple loan applications and CRM, using innovation to make the process easier for brokers and customers.”

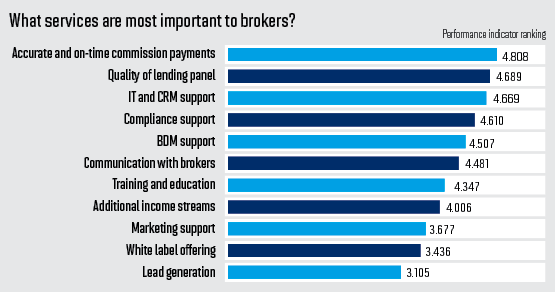

The top-ranked aggregators have surpassed expectations on trusted performance indicators, as demonstrated by these comments from respondents on the broking community’s three top priorities:

Timely commissions

“They allow us to access the commission before it is officially received, aiding cash flow”

Lending panel quality

“Continually adding new lenders to the panel provides brokers with more choice for loan products and better variation of lending policy”

IT and CRM support

“Improved technology helps reduce application time, helping with client refinance growth”

In the first quarter of 2024, the broker market share of residential home loans reached an all-time high of 74.1%, according to the MFAA.

This statistic bolsters the pivotal role aggregators play in the evolving mortgage market.

For award-winning non-bank lender Liberty, Smith asserts that technology is proving to be a challenge and an opportunity, underscoring the critical capability of an aggregator to engage with lenders in ensuring the best outcomes for brokers and customers.

“Customer care and retention will always be vital for brokers to nurture their existing business while attracting new borrowers and marketing for growth,” he explains. “Looking ahead, we believe the aggregator space will likely see further consolidation while smaller, boutique aggregators will strengthen competition.”

“We expect broking, generally, to face a steady increase in digital competitors, with limited property market supply, elevated interest rates, and living costs all contributing to make aggregators and brokers compete harder for customers,” he adds.

As Australia’s broking elite appear poised to expand their share of mortgage originations, the aggregators assisting them to weather the current storm stand out as essential allies.

Continue reading to explore detailed survey results and standout highlights.

Brokers re-evaluate loyalty, as they prioritise tech, service and support, with finances a persistent issue

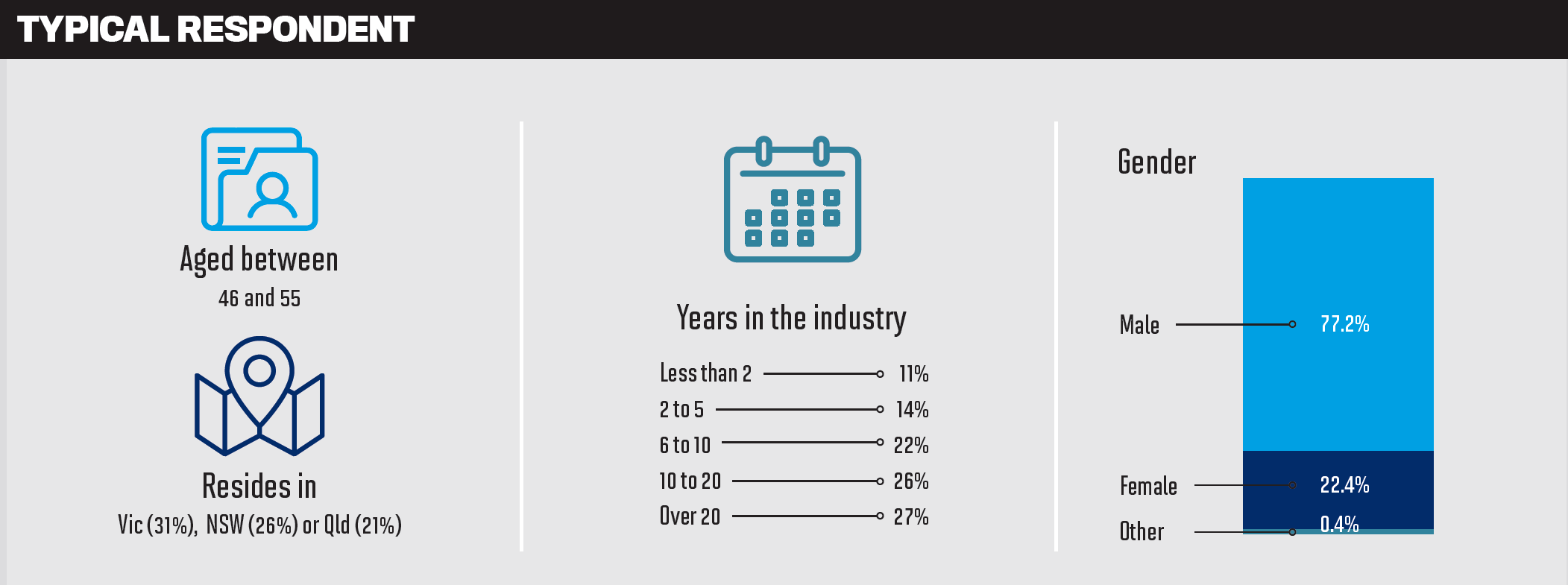

Survey respondents attributed the downward shift in aggregator loyalty, falling from 81% in 2023 to 74% in 2024, to various factors, including market conditions, service quality changes, and competitive offerings.

Still, a majority of brokers expressed strong allegiance to their current aggregators, with one broker noting, “They’ve given me great support over the years and are excellent to work with.”

Another said, “I’m very happy where I am, and I could do more myself to learn from them.”

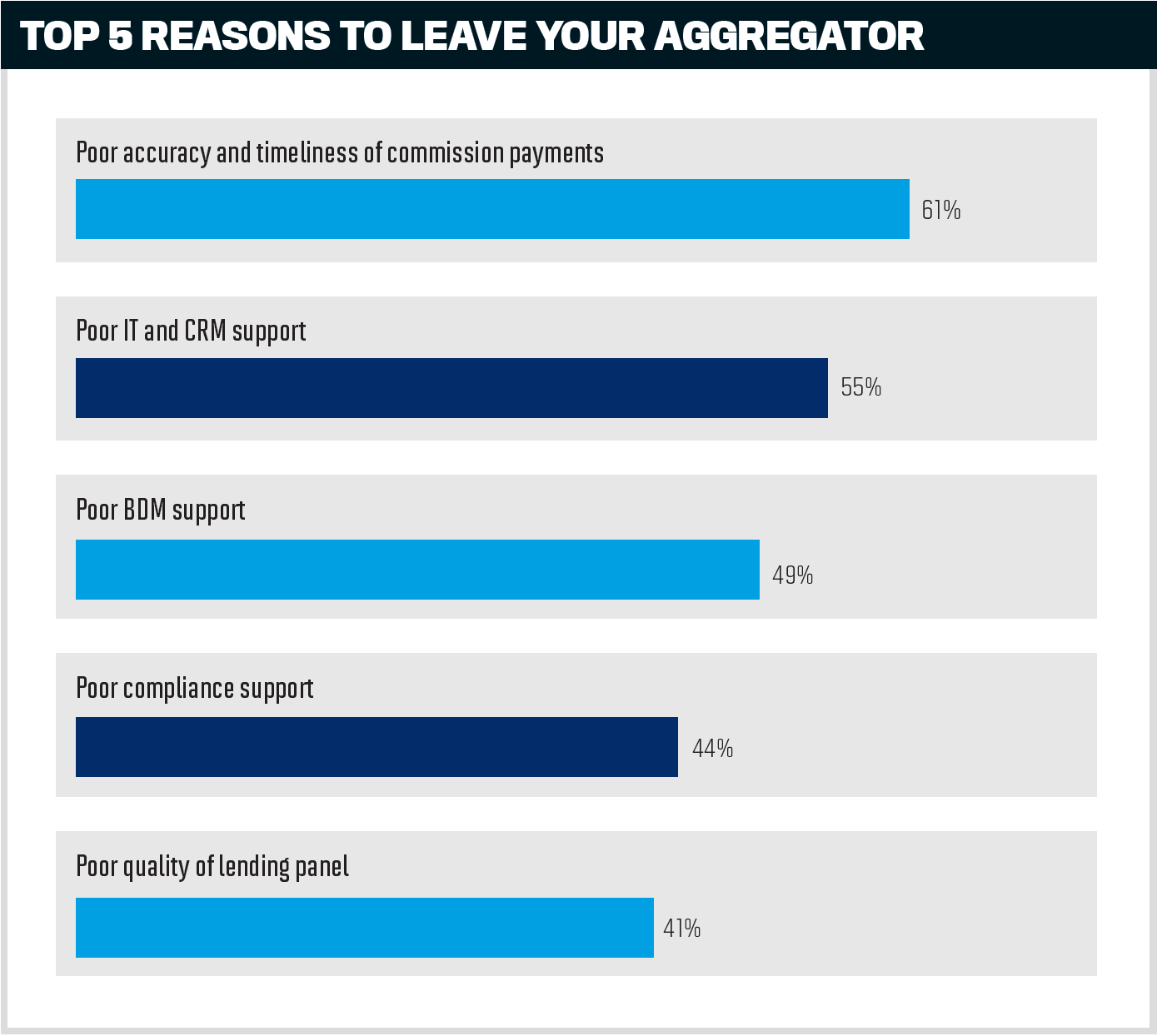

The top three reasons brokers reported for switching to a competitor have remained consistent since the 2021 report. They included subpar IT, CRM, and BDM support, as well as inaccuracies and commission payment delays.

For the fourth consecutive year, commission payments ranked as the predominant aggregator service, followed by lending panel quality and IT and CRM support.

The competition for accurate and timely payment of commissions in 2024 was fierce among aggregators with over 600 brokers. Finsure emerged as the gold-medal winner, claiming the top spot from last year’s champ, National Mortgage Brokers, who secured the bronze. Loan Market maintained its solid silver standing.

In the boutique aggregators group, MoneyQuest ascended to gold from its silver finish last year. Nectar Mortgages debuted with a silver win, and bronze went to Liberty Network Services, which claimed the gold last year.

Brokers were vocal about commissions, highlighting concerns and suggestions related to commission structures, clawbacks, and aggregators’ perceived processing methods:

“Better commission splits should be implemented once brokers reach a certain book value. Establish a target, and once achieved, the trail commission should increase”

“Fight harder against clawbacks”

“Commission processing should be stronger and more automated”

“Petition all lenders for higher commissions. Brokers are handling double the workload, and lenders should process these deals within minutes”

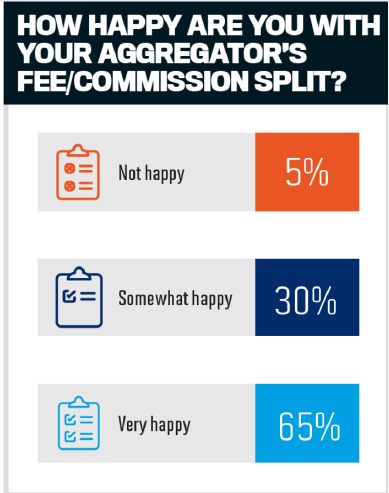

Brokers who indicated they were very happy with their aggregator’s fees and commission split also experienced a slight decrease in 2024, dropping from 68% last year to 65%.

A small but slightly higher margin of brokers expressed dissatisfaction, while just under one-third indicated mild satisfaction, resembling the previous year.

The specifics of brokers’ annual settlement values were roughly the same for the past two years, showcasing their resilience to persistent economic challenges and ability to work effectively with their aggregator partners to help clients achieve their goals.

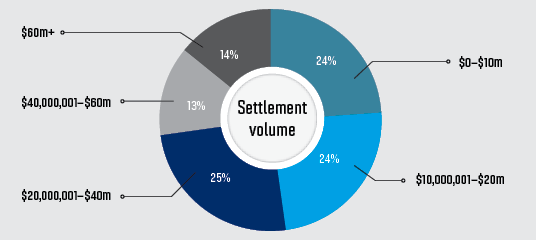

The 2024 brokers’ settlement values were:

24% $0-$10m (two points less than last year)

24% $10,000,001-$20m (one point higher than last year)

25% $20,000,001-$40m (one point higher than last year)

13% $40,000,001-$60m (one point higher than last year)

14% $60m+ (one point lower than last year)

Unsurprisingly, survey respondents’ top reasons for leaving their aggregator correlate to the core services they appreciate most: commission payments, IT, CRM, and BDM support.

Brokers pulled no punches in expressing their opinions on the issues, signalling the essentials the best mortgage aggregators need to retain their business:

Service and support: administrative and compliance assistance, as well as communication, transparency, and leadership from the top down

Technology and tools: user-friendly CRM systems, calculators, IT support, and investment in emerging tech stacks and solutions

Financial factors: competitive financial arrangements and incentives, diversification opportunities

Among aggregators with 600+ brokers, reigning champ outsource Financial retained its gold medal for IT and CRM support. Loan Market successfully battled back to take silver after scoring bronze last year, and Specialist Finance Group was third place in a tight race.

For boutique aggregators, MoneyQuest’s three-year gold reign continued, Nectar Mortgages took silver, and the bronze went to Liberty Network Services.

“Working with highly-rated aggregators ensures consistency and quality of applications, minimal back-and-forth, and a deep understanding of the regulatory environment,” Liberty’s Smith says.

Accurate and on-time commission payments

Aggregrators

Finsure

Loan Market

National Mortgage Brokers

Boutique aggregrators

MoneyQuest

Nectar Mortgages

Liberty Network Services

Additional income streams

Aggregrators

Finsure

National Mortgage Brokers

outsource Financial

Boutique aggregrators

Nectar Mortgages

MoneyQuest

Liberty Network Services

IT and CRM support

Aggregrators

outsource Financial

Loan Market

Specialist Finance Group

Boutique aggregrators

MoneyQuest

Nectar Mortgages

Liberty Network Services

Quality of lending panel

Aggregrators

Loan Market

outsource Financial

Specialist Finance Group

Boutique aggregrators

Nectar Mortgages

MoneyQuest

Purple Circle Financial Services

Compliance support

Aggregrators

outsource Financial

National Mortgage Brokers

Loan Market

Boutique aggregrators

MoneyQuest

Liberty Network Services

Nectar Mortgages

White label offering

Aggregrators

Connective

Finsure

Loan Market

Boutique aggregrators

MoneyQuest

Nectar Mortgages

Purple Circle Financial Services

Hopes and fears collide in a mix of clawbacks, lending panel diversity, and hidden costs

Brokers highly value the quality and diversity of an aggregator’s lending panel, as evidenced by its three-year run as No. 2 on their priority list.

Lending options significantly influence brokers’ decisions to jump to a competitor, consistently ranking among the top five reasons they would leave their aggregator.

Loan Market has clinched the gold medal by a commanding margin for its lending panel quality among aggregators with 600+ brokers for three consecutive years. outsource Financial netted silver, and Specialist Finance Group won bronze.

Among boutique aggregators, Nectar Mortgages won the gold medal, MoneyQuest nabbed silver, and Purple Circle Financial Services took the bronze.

The size and diversity of aggregators’ lending panels appear to coincide with overall broker satisfaction, as brokers often prioritise access to a wide range of lenders offering competitive rates and products, facilitating greater flexibility and opportunity for their clients’ needs.

MPA’s survey data suggests brokers are mainly satisfied with their aggregator’s lending panel, with some noting they would like to have:

“Greater access to lower tier lending solutions”

“A better comparison tool for commercial lending”

“More private lenders to assist with short-term funding”

“Improved panels with more non-banks and major banks”

When asked which lenders they would like added to their panel, long-standing favourites Liberty, HSBC, and Bank Australia were most mentioned.

Compliance support endures as a fourth-place broker priority, in tandem with a reason they might leave an aggregator. Some respondents, however, believe some aggregators have been slow to adapt to market changes, and concerns about clawbacks and fees draw the ire of many:

“The broker industry needs to apply pressure to the banks to keep their interest rates competitive, as well as reduce clawback terms extensively”

“They do not understand the franchise model and have made it harder for us to do the same thing we were doing before”

“Our aggregator is destroying the legacy and goodwill built by generations past”

“They have been too slow to change to a purchase market from a refinance market”

Other brokers offered kudos to their aggregators for their unwavering support in providing professional indemnity insurance coverage within their fee package and education on interest rates and compliance.

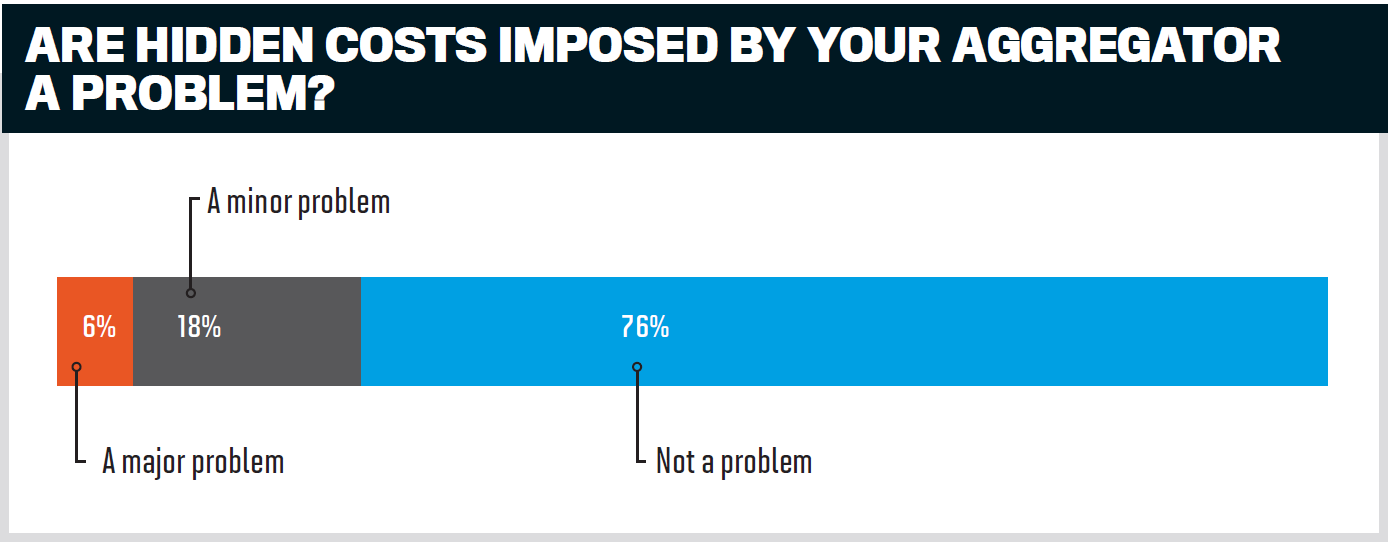

Another trend among brokers revealed an increasing concern about hidden costs imposed by their aggregators. Since the strong trust level of 90% was recorded in 2021 by brokers indicating it wasn’t a problem, this year’s data shows that the figure dropped to 76%, compared to 82% in both 2023 and 2022.

Those who stated it was either a minor or major problem also increased to 24% from 18% the previous year. Combined with an 8% bump in the 2021 data, this indicates a substantial rise, suggesting that broker confidence in their aggregator’s commitment to transparency has been eroding.

Brokers have highlighted this issue:

“From my perspective, they want to increase the fees generated per broker. I’m not sure how that assists brokers to reduce costs”

“Marketing costs are charged per deal, not per customer. That means if I settle three loans for one customer, I get charged three times”

“Every add-on costs money, so monthly fees end up being very high”

BDM support held strong in fifth place again this year with a marginally higher importance rating of 4.6 out of 5. This result suggests a continued emphasis on business development support focused on education, coaching, and proactive communication.

“Get the BDMs out of Sydney for the country brokers,” a respondent said.

Another broker noted, “There is a vast array of products and services available for a fee, and it is hard to know what to focus on.”

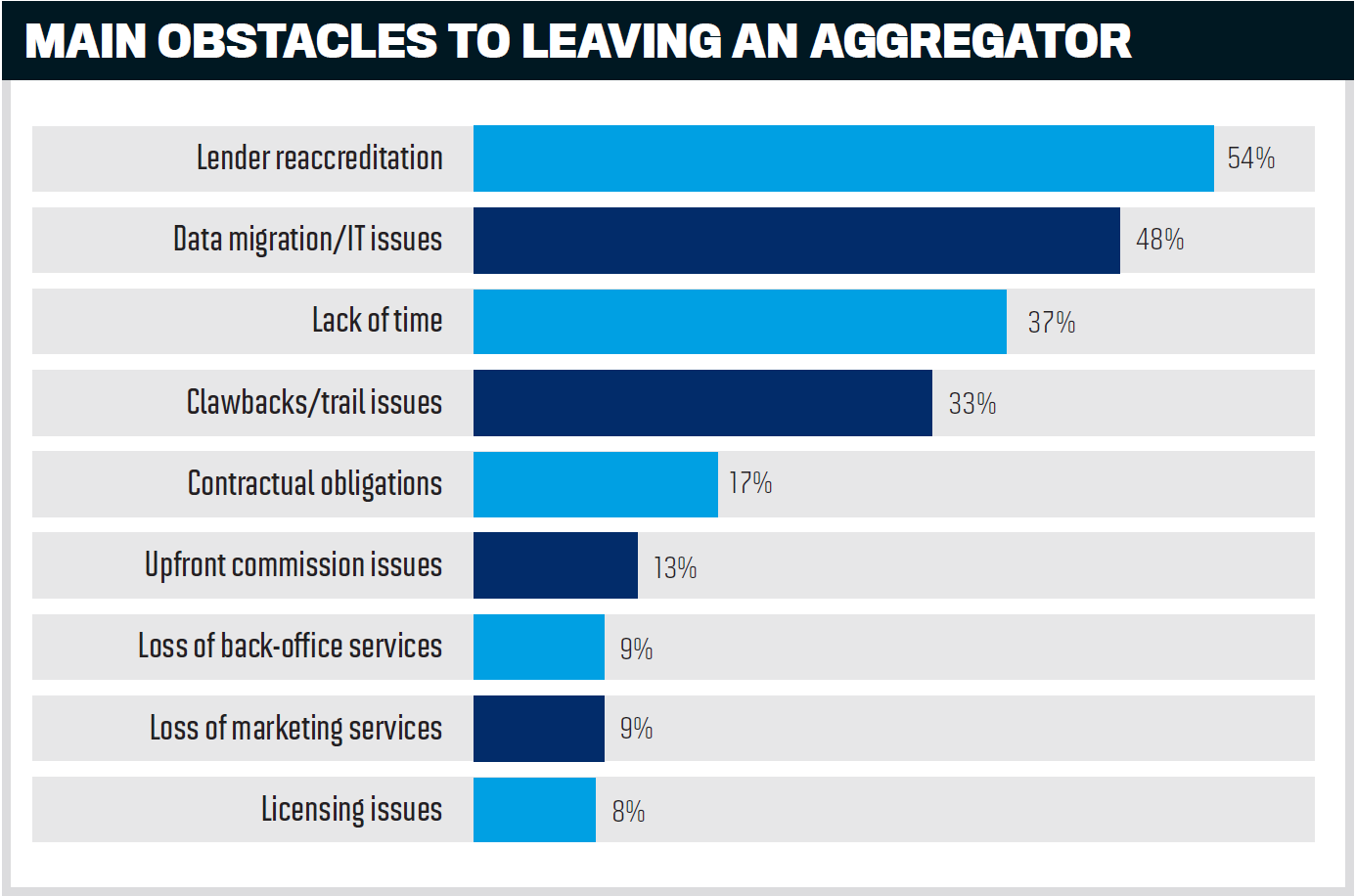

For the third consecutive year, over half of brokers cited the lender re-accreditation process as a stubborn obstacle to switching aggregators.

“Lenders and aggregators appear not to support a streamlined re-accreditation process across all parties,” one broker asserted.

Data migration and IT issues ranked as the second biggest issue two years running, with notably fewer brokers saying lack of time was a hurdle.

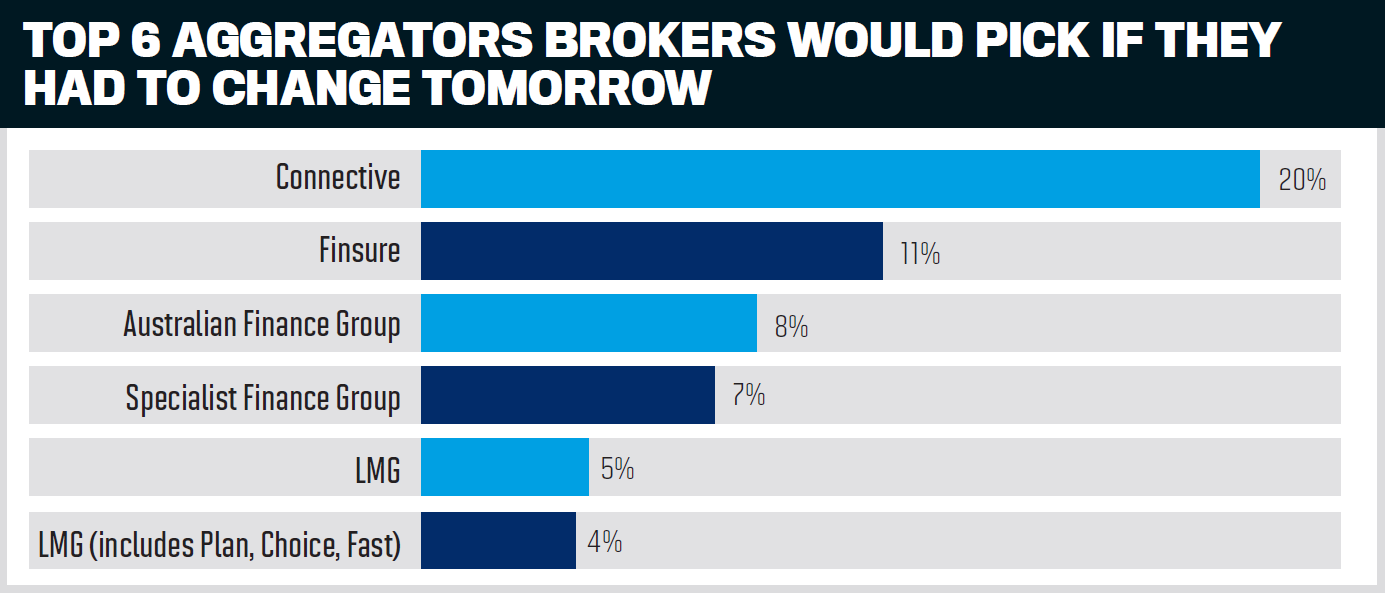

If brokers could change aggregators tomorrow, their favoured choice would be Connective at 20%, Finsure at 11%, and Australian Finance Group at 8%.

While Connective is down significantly as a top broker pick from 33% last year, brokers repeatedly lauded its flat-fee model and superior CRM, technology and tech tools.

“I have switched to Connective in the last six months; their commission splits are more reasonable, and the CRM and branding system is much more flexible,” one broker noted.

Brokers commented that Finsure has good IT and internal processes, compliance support, flexibility, a flat-fee model, and positive referrals.

Helping brokers adjust and thrive in a rapidly changing mortgage market with higher interest rates and inflation is a hallmark of the best mortgage aggregators.

This broker captured what places the industry leaders at the forefront: “I have been with my aggregator for over 10 years and will be with them for life. They are supportive in all areas of broker development.”

Lead generation

Aggregrators

Specialist Finance Group

National Mortgage Brokers

Loan Market

Boutique aggregrators

Nectar Mortgages

Liberty Network Services

MoneyQuest

Marketing support

Aggregrators

outsource Financial

National Mortgage Brokers

Loan Market

Boutique aggregrators

Nectar Mortgages

MoneyQuest

Liberty Network Services

Communication with brokers

Aggregrators

outsource Financial

National Mortgage Brokers

Finsure

Boutique aggregrators

MoneyQuest

Liberty Network Services

Purple Circle Financial Services

BDM support

Aggregrators

outsource Financial

Specialist Finance Group

National Mortgage Brokers

Boutique aggregrators

MoneyQuest

Nectar Mortgages

Liberty Network Services

Training and education

Aggregrators

outsource Financial

National Mortgage Brokers

Finsure

Boutique aggregrators

MoneyQuest

Liberty Network Services

Nectar Mortgages

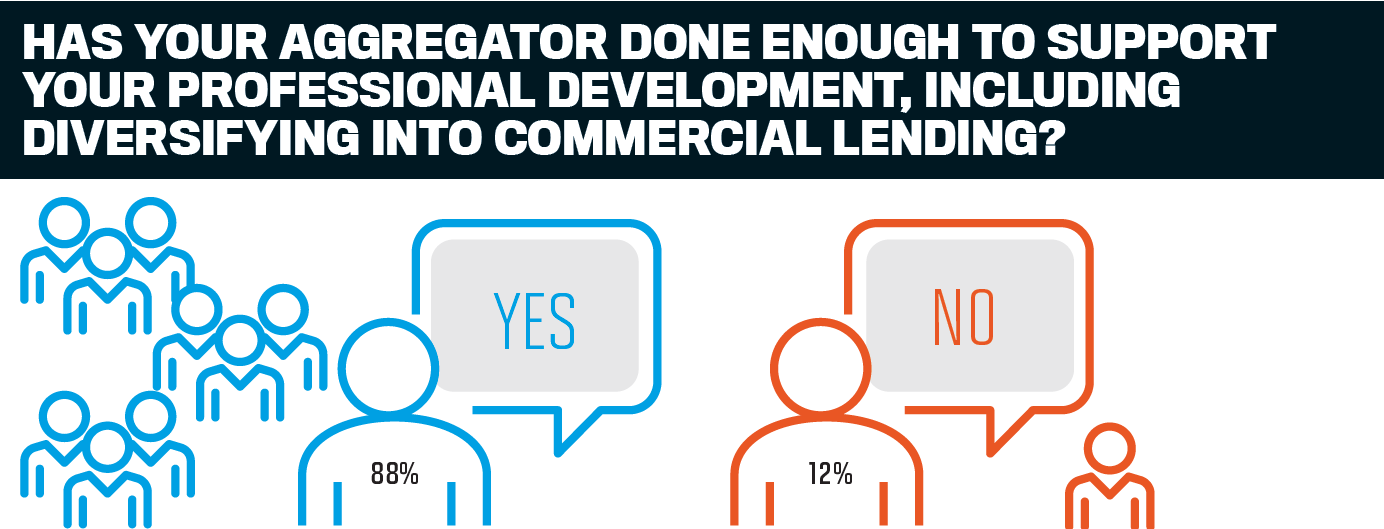

With broker market share of residential loans at more than 74%, MPA asked the broking community if their aggregator was doing enough to boost this share further, and what more they could do

MPA presents the final ranking of Australia’s top aggregators and boutique aggregators in 2024 based on brokers’ votes across 11 award categories.

In MPA's 14th annual Brokers on Aggregators survey, brokers were asked to rank their aggregators across 11 categories:

accurate and on-time commission payments

IT and CRM support

quality of lending panel

communication with brokers

BDM support

compliance support

training and education

additional income streams

marketing support

white label offering

lead generation

Brokers ranked their aggregator with a score from 1 to 5 in each category.

Due to the varying sizes of aggregator groups and the disparity in the number of respondents per aggregator, only those that achieved a response rate of at least 10% of brokers for each aggregator were included in the final list.

MPA also asked brokers a series of questions relating to their aggregator's service and other needs, but these did not affect the overall score.