Floify is mortgage software that is used to streamline the loan origination process for lenders and borrowers. Here is everything you need to know

Floify founder Dave Sims started his mortgage software company after he made a startling discovery: that mortgage document collection is a slow and arduous process.

That is why Sims, a software designer, created a solution that streamlined the process for a lender to make requests, send updates, and provide borrowers a secure portal to submit their documents and remain up to date with the status of their home loan.

In this article, you will learn everything you need to know about Floify, from what it is to its key features—and how it could benefit your mortgaging business.

What is Floify used for?

Floify is mortgage automation and point-of-sale (POS) software that is used to streamline and organize the loan origination process for both lenders and borrowers. Floify achieves this by providing a secure application, communication, and document portal between mortgage lenders, borrowers, and real estate and other mortgage stakeholders.

This digital POS provider is used by mortgage loan officers to gather and verify borrower documentation, track home loan progress, communicate with borrowers and real estate agents, and close home loans more quickly. Typically, Floify’s customers are loan originators and non-banking lenders.

What are Floify’s key features?

Floify offers numerous features to help streamline the mortgage loan origination process for both borrowers and lenders. Here are some of the key features you can expect to gain access to once you have signed up for Floify:

- Track back-office workflow tasks to limit last-minute rush to closing

- Keep borrowers and real estate agents up to date with easy-to-use email updates

- Automate the process of collecting loan documents from borrowers

- Archive loan files for fast, easy access at any time

- Gain 24/7 visibility into the status of your pipeline

What are the benefits of using Floify?

Floify is an optimal borrower portal that automates the process of collecting mortgage documents and sending updates. By automating the more time-consuming, error-filled steps in the mortgage lending process, Floify helps mortgage loan originators.

How? Floify’s simple interface guides your clients through each step of the process, allowing them to upload their documents directly into the system that tracks the progress of their home loan. And by keeping them informed with automated milestone updates, Floify increases referral partner retention.

Floify review: Technology

Floify also utilizes the most current technology to complete tasks in significantly less time than what is otherwise possible, freeing up you and your team to process more home loans and enjoy a better work-life balance.

Floify uses cloud technology to automate the gathering of home loan documentation from borrowers. It also establishes an intuitive portal for mortgage loan originators which allows them to track every loan file up to closing. Not only does this reduce the possibility of human error during the documentation process, but it enables originators the opportunity to spend more time working with clients and ultimately closing loans—it also increases their bottom line.

Floify review: Integration

Through its own research, Floify found that most of its clients were using DocuSign for their e-signatures, which is why Floify integrated the ease and security of DocuSign into its system. Users of Floify can now send document templates already set up in their DocuSign account directly.

Floify users can also send a one-time document that does not use pre-existing templates. Instead, you can design a template through a DocuSign user interface and send documents with pre-filled fields (as well as without). You also have the option to send mortgage documents that require a co-borrower's e-signature.

Is Floify free?

No, Floify is not free. Floify does, however, offer a free trial prior to getting a plan. With a per-user pricing model, Floify’s business plans start from $70 per month or $840 per year. For the team plan, you would have to pay $200 per month or $2,400 per year. If you are trying to decide which plan might work best for you and your operation, it is important to contact Floify to request enterprise plan pricing.

Who uses Floify?

Some 564 companies use Floify, most of which are in the US (85%) and in the financial services industry. Most commonly, Floify is used by organizations that have 1-10 employees and generate $1 million-$10 million in revenue.

Here is a brief look at the top industries that use Floify:

- Financial services 54%

- Real estate 16%

- Banking 11%

Here is a list of the distribution of companies that use Floify, based on number of employees:

- More than 50 employees (small) 64%

- Less than 1,000 employees (large) 6%

- Medium-sized companies 28%

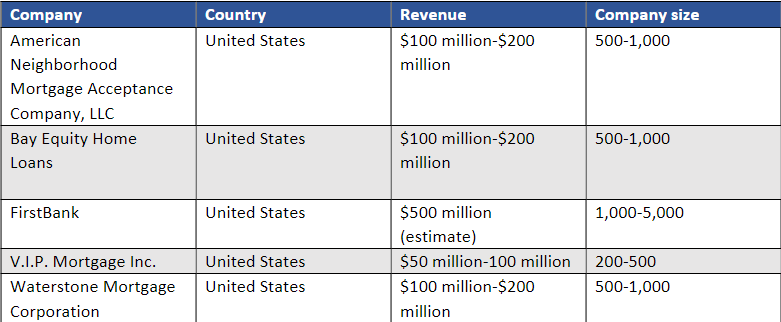

The following is a graph of some of the companies that use Floify:

What software is used in mortgage?

The best software that is used in the mortgage industry is mortgage and loan origination software solutions—such as Floify—which are the most effective in helping mortgage lenders, mortgage brokers, and loan officers save time. Mortgage and loan origination software achieves this by complying with regulations, increasing efficiencies, and converting more.

Mortgage software, which is also known as customer relationship management (CRM) software, helps mortgage professionals run their front-end operations more efficiently. Because it helps firms store customer data in a centralized database, CRM software is important for mortgage companies; the database is usually easily shared among all departments within any organization.

Mortgage software also automates most of a company's time-consuming marketing tasks such as follow-ups with prospects, leads, realtors, partners, and closed clients.

Here are some ways companies benefit from using mortgage software like Floify:

- Improves customer relationship management

- Promotes effective lead collection and engagement

- Improves prospecting

Floify: Company overview

Floify: Company overview

Headquarters: Boulder, Colorado

Number of employees: 10

Industry: Mortgage automation and point-of-sale (POS) software

Revenue: $10-100 million

Key people: Dave Sims, founder

Competitors

- FileInvite

- Shape Software

- LoanAssistant

- Help With My Loan

- Bryt Loan Management Software

- ABLE Origination

- Crowdsofts

- TurnKey Lender

Floify review: Will this CRM work for your company?

Floify is all about saving you time so that you can focus on your clients as well as the growth of your operation. It allows you to automate the process of collecting loan documents from borrowers and archive loan files for fast, easy access at any time, among many other key features. And the benefits are easy to see; you streamline communications and get more done.

Do you have experience using Floify? Do you think it is an effective tool to connect with your customers? Share your Floify review in our comments section below.