Refinancing properties might be an everyday deal for many mortgage brokers, but what about refinancing an investor's entire portfolio? Three lenders talk to MPA about the complexities involved and how they support brokers

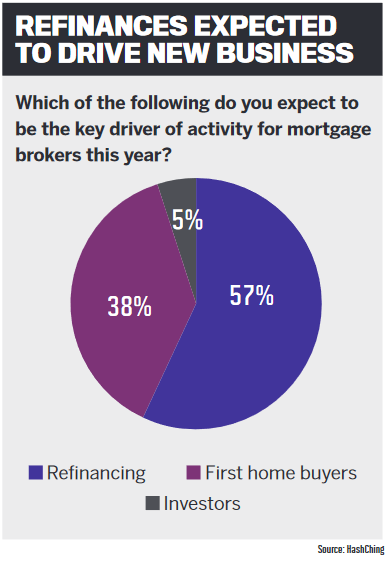

Since May 2020, refinancing deals have exceeded all expectations as borrowers seek to take advantage of low interest rates and secure their positions in the uncertain COVID-19 environment. Refinance enquiries are coming not just from owner-occupiers but property investors as well, who are looking to make the most of record-low rates.

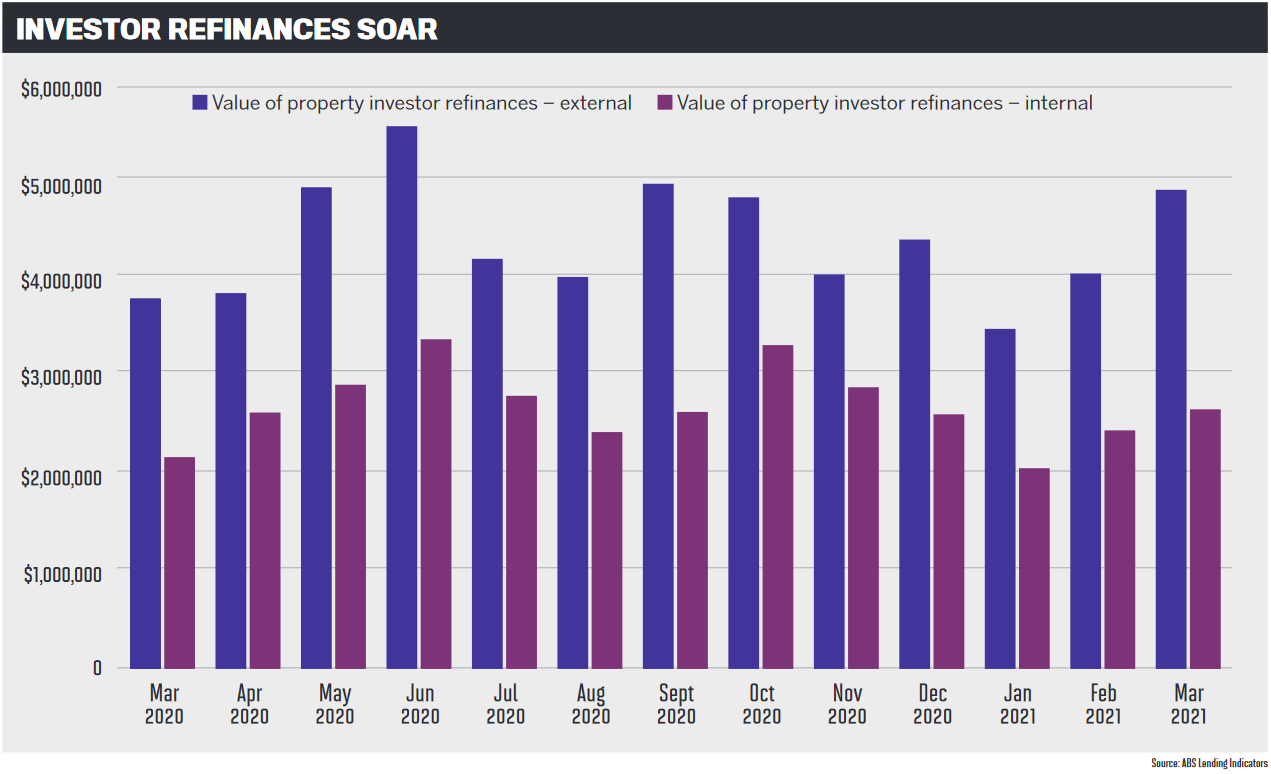

According to the ABS, in June 2020 there were $5.5bn worth of investor refinances to new lenders. In the same month, $3.3bn worth of investor loans were refinanced with existing lenders.

That was the highest-value month of the year, but even the most recently released figures for March 2021 show that $4.8bn in loans were refinanced externally and $2.6bn were refinanced internally.

For investors with portfolios comprising several properties, savings on interest rates can make a huge difference.

“These lower rates obviously reflect back to lower repayments, which give investors greater savings to reinvest into things like renovations or property upgrades,” says Melissa Christy, lending product lead at smartbank 86 400. “Lower repayments also mean a higher return on investments across the portfolio, which can allow for further investment down the line.”

The bank began offering loans towards the end of 2019 and has seen a “great response” from investors.

Refinancing multiple properties

Refinancing multiple properties

For investors with property portfolios, 86400 allows one single application for multiple properties, either as individual deals or with cross-securitisation.

If an investor has numerous properties and loan products with different banks, this gives them the ability to connect their external accounts via the app, which gives them a better view of their complete financial picture.

Christy says brokers need to determine the optimum way to structure a deal to the best benefit of the customer, and she advises them to look at what solutions a lender can offer for multiple properties.

For instance, 86400’s ‘Own’ home loan allows five separate loans for one annual fee, regardless of the number of security proper-ties or separate deals.

“Most lenders offer a solution for multiple properties,” Christy says. “The biggest challenge is finding the lender that will be able to provide a product which will suit the investor’s circumstances the best. That is where a broker can help and is often best suited to doing the legwork for the customer to find a solution which fits.”

On top of the low interest rates, one of the big drivers of refinance numbers over the last year was lenders’ cashback offers. ME, for instance, offers a $2,000 cashback incentive.

The bank works with property investors to help them “get ahead” and uses tax-free rent shaded to 80% in its serviceability calculations. It can also link applications to achieve aggregated pricing on interest rates for the total combined borrowing amount; offers up to 90% LVR, including lender’s mortgage insurance; and can accept the rental amount from a signed tenancy agreement, even if the rent assessment in a valuation differs.

“ME has some great options when it comes to refinancing or investing that can help property investors get ahead,” says Mathew Patterson, head of broker sales at ME.

The bank’s BDM team is on hand and committed to helping brokers navigate the best solutions for their clients. There are some potential obstacles that property investors need to look out for, however.

“With a heated property market and interest rates so low, one challenge could be getting the valuation you need or making sure your debt-to-income ratio stays lower than seven,” he says.

How brokers can help investors

When it comes to the risks and challenges that investors with property portfolios can face, Virgin Money’s state manager for WA and SA, James Davies, says there isn’t one perfect answer to suit all customer types.

Challenges to consider in refinancing could be around the localisation of properties and their value, how the loan product was originally set up, whether or not there was LMI at the time of acquisition, and whether there have been any capital improvements to the value of the properties to enable a refinance without incurring LMI again.

A mortgage broker is in a prime position to have those conversations with borrowers to work out what they need. Davies says it’s important that brokers look out for anything that might hold the transaction up down the road.

“We all have a responsibility to engage with the customer to uncover everything – to get a holistic view of the customer’s circumstances,” he says.

“It’s our responsibility to enable the brokers with the right information and help them with questions they may or may not have thought out with their customers. By helping brokers find the right information with their customers, we are enabling them to ensure there is a quick and seamless transition through the assessment process.”

Brokers will find that some investors with multiple properties will want to bulk all their properties together with one lender, and others will think it’s too risky to have all their eggs in one basket and instead will choose to hold various properties across various lenders.

Virgin Money allows borrowers to collateralise their properties to offset a better LVR position and get a better price point relative to the total borrowing.

In assessing a refinance application from an investor, particularly one heavily reliant on rental income, Virgin will look at their overall financial position to ensure the best servicing is on the table. But Davies says there can be a number of restrictions to the security types and the way the lending structure is set up.

“There can also be concentration risks if customers do own a number of properties that are concentrated within one development, or next door to each other in the same street,” he says, explaining that there are myriad ways these transactions can be facilitated.

In working with brokers, Davies says Virgin offers a real relationship benefit. While brokers may not find refinancing a property portfolio to be a daunting task, especially if they have done it before, many customers might.

“Customers want to have faith and trust in their broker. They also want to know their broker is being supported by their lender, giving them support throughout the transaction,” says Davies.

“We are there to foster those deep relationships to completely support what it is the customer is trying to achieve. We are empowering our brokers with our online tools to support their customers throughout all transactions and achieve their investment goals.”

Davies says brokers working with investors who have property portfolios should be aware that Virgin Money offers a high level of end-to-end support. Its process supports brokers from the moment they meet their customers for the first time right through to approval.

“The time and detail we provide is where our uniqueness sits. We understand that most brokers may need specialist attention, and we are here to help. Brokers can call on their business development manager to assist in providing investor options available for their customers,” he says.