In challenging times, leading aggregators step up to help their brokers adjust

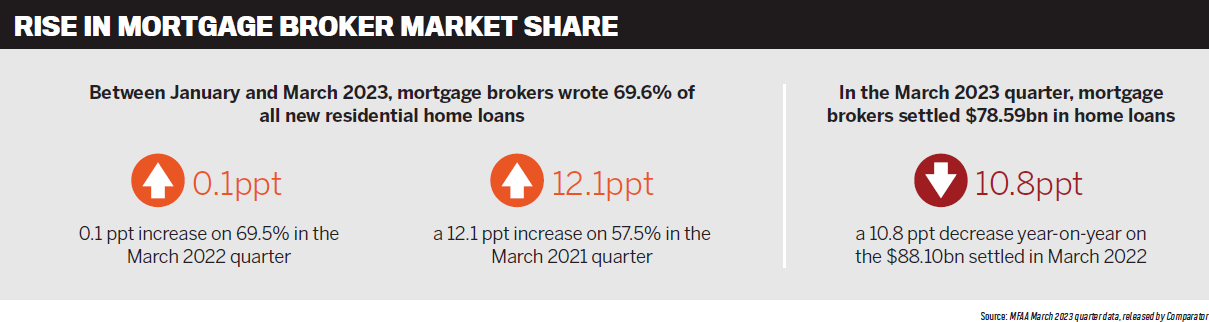

Despite a rising interest rate environment and home loan volumes dipping, brokers still enjoy an enviable position in Australia’s mortgage industry. Boasting a market share of almost 70% of all new residential loans, they are increasingly relied on by customers for their expertise and advice on how to navigate an economy hit by high inflation and 12 cash rate rises by June 2023.

But brokers are under the pump, working to help thousands of borrowers rolling off low fixed rates onto much higher amounts. Some clients are stuck with their current loans due to the 3% serviceability buffer, which means they are unable to refinance to a better deal.

Supporting brokers through these challenging times are the mortgage aggregators. MPA gathered some of the nation’s leading aggregators to discuss industry issues at an annual roundtable held at Silks at Crown Sydney. Participants included Blake Buchanan, general manager, Specialist Finance Group; Tanya Sale, CEO, outsource Financial; Gerald Foley, managing director, nMB; Chris Slater, head of sales and distribution, AFG; Brad Cramb, CEO distribution, Lendi Group; and Andrea McNaughton, group executive, LMG Residential.

Brokers Samantha Harvey, senior mobile mortgage broker at Aussie, and Ashik Rahman, head of lending at Landen, also joined the roundtable.

Q: The home loan market in 2023 looks very different to what it was 12 months ago. What are the main challenges aggregators and their broker members are dealing with? How have brokers responded to these challenges?

Starting the discussion, outsource Financial’s Sale said the difficulty was that nobody had expected the current challenges to emerge as they did. Brokers experienced boom times during COVID and after the pandemic.

“All of a sudden the interest rates rose out of the blue. None of us were predicting that; even the RBA wasn’t predicting it. They told us to expect rates to rise in 2024, and now all of a sudden we’ve had 12 rate rises since May 2022,” Sale said.

Panic set in as interest rates climbed, and the challenge for outsource Financial was assisting members to cope with the massive change. “It came down to assisting brokers with education. But we also had to assist brokers so they could educate the consumer and support the consumer; thereby a number of education pieces were rolled out to our brokers to guide them through these times.”

Sale (pictured below) said it was important to help brokers get on the front foot “and not wait for another interest rate rise” to talk to their customers.

Buchanan, from Specialist Finance Group, said brokers were affected by a combination of issues.

“Last year, brokers per quarter were nearing $100 billion in settlements, and this quarter we’re probably likely to see [figures up to the] high 70s, $80 billion,” he said.

“There’s been a volume drop-off, and you’re seeing really aggressive retention strategies across lenders and an increase in mortgage prisoners.”

Buchanan said brokers were working harder for fewer returns. Data also showed that medium-sized and large brokerages were losing less volume, “which means smaller brokers, they’re hurting more”.

The challenge for these brokerages was how to replace those volumes or open up to a greater section of the market. Buchanan said more and more one-person businesses were expanding, “joining forces with others” and becoming brokerages.

“I think this a good thing – to surround yourself with support and assistance and strategies that can grow your business,” he said. “Just because you’re an excellent broker doesn’t always necessarily mean that you’re an excellent business person. If you’re running a small brokerage, you need to be a great business person.”

Sale asked Buchanan why he thought single-broker operations were losing business.

Buchanan said there were a few reasons, including that in down markets, the psychology of consumers was to “go to bigger branches for safety”, which was why the big banks’ market share increased in troubled times.

“I think that medium or larger-size brokerages just have a better presence in the market, and people are looking for trust with their advisers more and more,” Buchanan said. “A larger presence implies trust.”

Single-person broker operations were less likely to invest in great websites and marketing strategies. Due to cashback offers for refinances, people were now “shopping brokers” more than ever, Buchanan said, and the larger brokers were winning a bigger share of the market due to superior marketing.

Sale said outsource Financial was not seeing this trend, and in fact the single-person broker operations were actually increasing their business, not losing it.

Foley (pictured below) from nMB said there were two factors when it came to home loan market challenges – one was the impact on the broker, and the other was how customers were coping.

“In a normal world, 90% or more of what brokers do is passing on good news,” he said. “This has gone to 90% dealing with tough situations, which they weren’t built or experienced to deal with – a lot of education was needed around that.”

Neither brokers nor customers and not even bank staff had experienced such a rapid increase in interest rates, so a different mindset was required, Foley said.

“I know some lenders didn’t have letters to write to customers to say your rate’s gone up. They had to create them; they hadn’t done it for so long. It was always ‘your rate’s gone down; keep your payment where it was; get ahead’. ”

Foley said aggregators worked with brokers on their mental health and “getting them match fit”. nMB brokers were also on the front foot with customers, encouraging them to increase their loan repayments as early as possible and build up a buffer.

“The March rate rise was a tough one. That’s where it really started to hurt people,” he said. “They’d been able to absorb a lot of the rate rises until then. Their offsets and redraw buffers started to get completely absorbed, and then they had to find a new payment.”

Sale commented that brokers’ strategy had to change when they realised that customers’ buffers that were built in the COVID era were not going to be enough. She said brokers, aggregators and consumers were facing a number of challenges, and it was all about planning for the worst-case scenario.

Foley said consumer media loved “a car crash” and were caught up in emotional language about mortgage stress and the fixed rate cliff. He said the increases in mortgage arrears weren’t as bad as some had predicted because people had always fought to keep their home loans by adjusting other spending. But the RBA had lifted the cash rate 12 times in 13 months, meaning interest rates were going up faster than mortgage holders could cut back their spending.

He said he liked the idea of the RBA meeting less frequently to make decisions on interest rates as “it would be better for people to be able to adjust and take some of the messaging on”.

At AFG, brokers had been reactive, Slater (pictured below) said. “We thought the COVID period was going to be quiet for brokers and it wasn’t, so we moved. Our brokers were incredibly busy, and they were exhausted. So when it dropped off a little bit they enjoyed the break.

“The unexpected and continuing rate rises meant brokers had gone from being reactive to being a lot more proactive,” he said. “Both our large and small brokers were seeing a slowing in activity from new purchases, but that has stabilised.”

Slater said the refinance market had been interesting due to cashbacks, “which was really distorting the picture”, with AFG brokers having to do a lot more on a loan file than they used to.

Because brokers were writing large loan volumes two to three years ago, Slater said there hadn’t been as much focus on retaining fixed rate customers, and now brokers had to be more proactive and look at the quality of their databases and ascertain which customers were rolling off fixed loans.

“We’ve had to work closely with some of our brokers to assist them with the way they’re thinking and prioritising and running their businesses day to day to help those customers in this position,” Slater said.

Brokers were also being encouraged to work hard on bringing in new revenue, including through diversification.

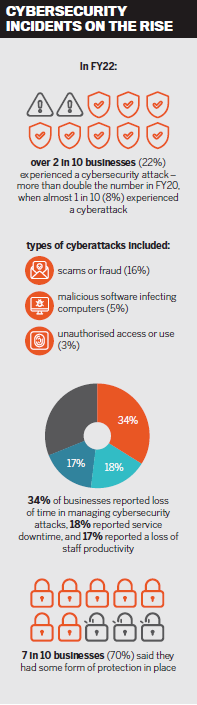

Slater said AFG had also been focusing on cybersecurity for brokers. “We’re spending a lot of time on making sure our data is really pliable and usable, but also continuing to work on making sure that the systems that brokers are using, the systems we’re using, are cyber resilient.”

Foley said there had been debate a few years back about the payment of trail commissions, but the current challenges showed how important these were for brokers. “You need that deferred payment of the value of bringing a customer to a bank, at times like this where maybe the front end is a bit down but the customer demand on a broker is greater than usual.

“It’s such an important part of the revenue model, because the obligations and expectation is for life of loan.”

Slater said cashbacks had been shortening the life of loans, “taking the inherent value out of the transaction”, which was “bad for the banks and bad for us”.

Cramb agreed with all the previous speakers but said the biggest challenge from his perspective was uncertainty, and this could be broken down into three areas.

The first was macroeconomic conditions, such as interest rates and inflation, which had moved far more quickly than anyone expected.

The second factor was the market, with structural changes driven by competitive pressures. “As people are responding to that market shift, there has been a decline in volumes.”

Cramb said that according to March data, around 50% of the market involved refinances, the highest figure that he had seen. This was leading to an uncertain market and intense competition, with both brokers and aggregators finding it difficult to respond.

The third part of the equation was the customer, with serviceability and capacity to borrow becoming an issue.

“It’s been some time since we’ve had to deal with that. It’s the velocity of that uncertainty and the velocity of change, which is creating the need to respond.”

Through its response to these market uncertainties, Lendi Group had been fortunate to grow market, Cramb said, citing the aggregator’s business model and the way it supported its broker network.

“It’s very hard for a new broker in these market conditions to find customers. So, how can you centralise or support a broker when it comes to customer acquisition?”

Cramb said moving from offline to online processes was key, particularly when brokers were working harder than ever.

“The final piece would be what I would call productising our response to the market, and one example is fixed rate,” he said. “We’ve created a fixed rate tracker for our brokers, which allows them to put a customer on a highly contextualised journey, but it’s automated in the background, making the broker look like a superhero but at the same time taking a lot of that work away from them.”

LMG Residential’s McNaughton (pictured below) said the broker played the role of the great educator, and it was important to help brokers spend time speaking to customers.

“We’ve invested a lot in technology to take time out of the file and make sure it’s compliant, but I think customers now need more advice,” McNaughton said. “Getting really good advice around structure I think shows the value of a broker, not just to customers but also referrers, including property groups and real estate agents.

“I think agents haven’t seen this kind of climate, let alone brokers; they are really busy, and leads have gone through the roof.”

Q: Thousands of mortgage holders will be rolling off their fixed rate loans in the near future. How are you pivoting to deal with this, and what advice and support are you offering brokers, especially in a competitive refinance market?

Buchanan (pictured below) said roughly $400bn in loans would be rolling off fixed rates this year. “So if every broker in the country was to stop what they were doing and just work on these loans, they’d have a year’s worth of work.”

However, Buchanan said fixed rate roll-offs did create some problems, and while “brokers know what they’re doing with customers”, aggregators needed to make them aware of certain matters.

He said the utilisation of HEM (the household expenditure measure) or below had increased across all the major banks. “That’s a concern, and it means brokers really need to verify and document clients’ living expenses to avoid compliance breaches.

“You combine that with the awareness, going through your databases; to your point, Brad, understanding who your clients are and having really good relationships with them, pre-empting the issue and talking to clients.”

Sale responded by saying that aggregators had to ensure their brokers were kept abreast of lender policies and process changes.

“With rising interest rates and the fixed rate cliff dominating the mortgage and finance broking landscape, we’ve got to really gear brokers towards a positive mindset; we can’t let them fall into negativity,” she said.

“We’ve got to assist brokers in identifying opportunities but focus on finding the solutions for their clients.”

And brokers would find solutions by being up to date with all the lender policy and process changes, because if they didn’t “it would end in tears for the consumer and broker”, Sale said.

“Chris commented on something that’s very, very important,” she added. “Brokers have to diversify their knowledge and expand their thinking, whether that be diversification within their business, as business owners, or diversification of the lender policies and the processes.”

Slater said brokers knew how to retain customers. They worked with existing lenders, knew when the customers were coming off their fixed rates, but it involved a lot of work.

‘Making it easy for them to do the work is half the battle,” Slater said.

Knowing their customers were coming off a fixed rate with a particular lender, brokers “would love to have a great conversation with that lender and say, we’ve retained them at a really market-leading rate”.

But brokers had a duty to make sure those customers were placed in the very best product for that customer, Slater said. “It’s a lot of work because you’re already getting the trail, you’ve already banked the upfront, and you’re now having to go and do the work all over again, ensuring that you’re across all the offers. And what if you can’t move the customer because they’re a [mortgage] prisoner?”

Lander’s Rahman (pictured below) said the process started three to four months before customers came off their fixed rates and often involved education about living expenses. He gave the example of visiting a customer in northwest Sydney, not to write a new loan but to retain that customer.

“I sat there with the customer, going through their living expenses, their budget, with a finetooth comb,” Rahman said. “They were on 1.89% interest rate and were about to roll off in three months’ time – ‘How am I going to afford the loan?’ ”

Rahman told the customer that they were facing interest rates of 5.5% and possibly higher, and they needed to consider what it meant for their loan repayments.

After two hours of looking at their finances, they identified $1,700 of additional funds not budgeted for in their monthly expenses; these were being spent on restaurant meals, takeouts and gym memberships that they could cut back on and redirect towards their mortgage.

Foley said the key factor was unemployment, which was sitting at about 3.5%. This meant that if people had jobs and an income, they could adjust their expenses to meet higher mortgage repayments.

“For borrowers, they realise I don’t need to eat out four times a week; once is enough. I don’t need Netflix, Stan and the other three; I just need one or two’, ” he said.

“If you’ve got an income, then lenders, particularly the incumbent lender, they’re not going to be calling people’s loans. You lose options of where you can go, but at worst, you’re going be able to stay where you’re at [with your current lender].”

Foley said some economists were now predicting two interest rate cuts next year. “So it’s about getting through the current environment, and I can’t see unemployment going too high.”

Aussie broker Harvey said most customer enquiries she dealt with were about fixed rate roll-offs and while it was a “huge opportunity”, brokers were doing so much extra work.

“The retention piece is so huge, because there’s no point getting them in the front door and then seeing your existing customers just go out the back door,” Harvey said. “It’s a real juggle as a broker to have the time to focus on the existing customer and then also have the time to focus on the new customers.”

Harvey said there were a small number of customers who faced the hardest situation – they had settled loans when interest rates were at record lows, at a time when the RBA was saying rates would remain low until 2024.

“They’re the ones that we’re having tough conversations with: ‘This is what your repayment will be reverting to in six months. Unfortunately, there is nothing we can do except price your existing lender’. ”

Sale asked the brokers at the roundtable if any of their clients had been forced to sell their homes.

Harvey said she didn’t have clients that fell into this category, but she had spoken to a customer who she was worried about. They had borrowed at the maximum borrowing capacity, and the loan was fully fixed, with one partner just having gone on maternity leave. “We’re doing our best as brokers to help out, and we’re having these discussions early.”

Rahman said one customer told him that they had listed their property to sell. “I went to the lender and showed proof that the property was on the market. I convinced them to convert the principal and interest loan to interest only for the next six months, giving the customer an avenue to cut back on expenses and sell. The idea was to sell first, then downsize.”

Cramb (pictured below) said this played to the strength of the broker proposition, and the current market conditions could only improve that. “It’s like a once-in-a-lifetime opportunity or market dynamic we’re probably not going to see again, which is why we tried to get ahead of it with our team.”

It was important for brokers to speak to their customers early on, Cramb said, and Lendi Group tackled this through automation, using its fixed rate tracker known as Flex or Plus. This gave brokers a choice: through Flex they could approach fixed rate customers themselves, or they could instead use Plus and have a trained central team contact customers on their behalf.

Sale said brokers had no control over property prices, and there was a danger that customers who were forced to sell would not get the price they had paid and would not be able to cover their mortgage.

Referring to the conversation about new brokers not being able to acquire customers, Rahman said brokers were becoming “more and more involved in customers’ lives – they’re not just a mortgage broker”.

He said, “Over the years I have built relationships with financial planners, solicitors, accountants and real estate agents and have found that, given the current financial climate, having these additional resources has been substantially beneficial when pulling together tailored short-term to long-term strategies for my customers.”

McNaughton said the value of brokers was evident during COVID when tenants, particularly in Victoria, didn’t have to pay rent.

“So the landlords, business owners and property managers finally understand the value that a broker can bring around refinancing,” she said. “I think existing experienced brokers are so busy, new brokers that are good, that are hungry, that are well supported, I think have a huge opportunity.”

McNaughton said that with rising broker market share the question was not so much “should I use a broker?” but “which broker?”

“All that work you’re doing is just generating more referrals.”

Slater said AFG had started with “three blokes that are still there after 29 years, and they did all the work that brokers are still doing today”.

“Our brokers at heart are entrepreneurs They know how to do that work, because if they don’t, someone else will step in and they’ll do it.”

Slater said he understood Lendi Group’s model, but under AFG’s model the team did not have conversations with customers on behalf of brokers. “We encourage our brokers to think how they are going to solve that problem, and we help them solve it.”

Cramb reiterated that Lendi Group’s brokers were offered a choice of talking to the customers themselves or allowing the team to do it, and 70% opted for the latter.

Rahman said he was not only educating customers; he was also educating real estate agents about how construction loans worked “because they want to be equipped and go out there and have that conversation with customers”.

“I may not win that customer then, but I’m definitely winning that customer two months down the track when that real estate agent brings the customer back.”

Slater asked Rahman how that worked with a lot of real estate conversations happening online. “You’re saying the whole human touch is so important in the transaction; with online you just can’t do that.”

Rahman said that from a broker’s point of view, facilitating conversations online was easier. “But from a customer, real estate agent or financial planner point of view, they still want to sit down with me and go, ‘Ash, what have you got for me?’ ”

Buchanan said what underpinned this issue was the regulator and the rate service.

“The RBA have failed; they failed to act quickly enough, particularly with the overseas learnings,” he said. “They didn’t move quickly enough. They set rate expectations at 2024 and beyond – how wrong that was.”

APRA had largely been “asleep at the wheel”, Buchanan said. “When rates are the lowest they’ve ever been, they reduce the buffer rate; now they’re at the highest they’re likely to be in Australia, they put the buffer rate up. It shows that the regulators are behind the eight ball; it should be the other way around.”

Brokers needed to get match fit for the fixed rate cliff, Buchanan said. “We know it’s coming; we haven’t felt it yet. The biggest of the cliff is in July, which means September, October is when you’re going to really start feeling that repayment hurt.”

Brokers had to “get in training” knowing they would have to show more empathy to their clients and work harder for less money because it would be tough times in the months ahead.

When it came to data on affordability, McNaughton said LMG was trying to ensure that the compliance team made it easier to refinance, adjusting settings on a simple refi.

Foley commented that interest-only loan options should be offered for six- or 12-month periods to soften the blow for those facing hardship because of large repayment increases when rolling off fixed rates.

“That’s where the lenders have to step up and show compassion,” Sale said, “if the brokers have the opportunity to say in advance, ‘We’ve looked at your whole situation, and if we can get you an interest-only loan for the next 12 months, we believe we can get you through this time’. ”

Buchanan said it would take regulatory intervention because brokers could not refinance deals by demonstrating serviceability, even though they could put clients in a better financial position.

He gave the example of a client who had held a loan for three years and had another 27 to run. “If they can get 0.8% or 1% reduction by going to another lender, they’re in the system, they’re making their repayments, they’re going to move to a cheaper repayment, why do they have to jump through the serviceability tests? If the lender accepts the risk in this circumstance, then why can’t the broker assist this client?”

Q: Brokers now facilitate almost 70% of all residential home loans. What market share do you think is achievable, and how can brokers get there?

McNaughton said a group of 40 Loan Market businesses had travelled to the UK and the Netherlands for a study tour. In the UK, broker market share was at 84%.

“Our plan by 2028 is to get to 80% … I think there’s a long way to go, but everyone’s pretty excited about it.”

In Australia, best interests duty “is our friend when it comes to why use a broker”, McNaughton said. “So there’s more opportunity to be pushing that this [BID] is why you use a broker not a bank. Our broker share will continue to grow, and we can drive that harder through NPS on brokers.”

Slater said he hoped broker market share would reach 80%, but “we all have to bring our A game” to do so.

Lenders said it was difficult for them to get “eyes on customer”, and while this made the broker proposition good, Slater said, “I don’t think they’re sitting around the boardrooms saying, ‘we’re going to let broker get to 80%’; they’re thinking, ‘how do we get back to 50/50?’ ”

Slater said there was a huge push for digital loans as lenders looked to deal with customers directly, and lots of companies were trying to solve that tech puzzle. “We need to make sure we’re equipping our brokers with the tools to still be able to compete in a digital world.”

Sale was not worried about digital loans. “The last few years have really pushed home the human touch in this industry, and quite frankly this is where mortgage brokers have the advantage.”

McNaughton said it was more to do with the quality of the advice brokers provided, combined with a digital process. “So you want a great customer experience which is end-to-end digital. No one wants to fill out forms. Make that bit easy, but you need good advice.”

She said brokers also worked hard to offer loans that were in clients’ interests, pushing their market share higher.

Slater pointed out that children today grew up with smartphones, bought clothes online, communicated with friends online, spent time in virtual environments. “We’ve now got this X factor of ChatGPT, so in the future it might be a broker or it might just be a robot.”

Foley said the next generation of customers, not brokers, would determine the digital future. “Digital is more of a threat for the direct-to-lender customer than broker because it plays to the person that wants to do it themselves anyway.”

He believed broker market share would go as high as 75%, but more importantly, it was about growing the 45% of commercial SME borrowers that used a broker. “So it’s about brokers growing their business and doing different things, not just growing more of what they’re doing now.”

Sale said, “I honestly think we’ll get to 80% because we’re equipping brokers to be able to offer the digital or the fintech component, as well as the human component.”

She said WebloanQ in Salestrekker was a great example of how outsource Financial allowed brokers to maintain their competitive edge against fintechs, along with being able to offer the consumer the mortgage broker experience – it then became the consumer’s choice. By adding these features into the Salestrekker software system, outsource Financial brokers could capture the “best of both worlds for the consumer”.

Buchanan said moving to 80% was realistic within five years, but it depended on a few things. He said the twentysomethings that Slater alluded to would be future borrowers, and this generation was increasingly self-serving. In the US, consumer direct-to-digital loans “had blown up”.

“Consumers are going online to a rate comparison site; they put in some detail, and they choose the cheapest one, and what they give themselves is faux validation,” Buchanan said.

Importantly, as experts, brokers offered advice and data validation; this was the same reason people used accountants to do their taxes, “because they know what they’re doing”.

“If the consumer is getting their own validation by going through a rate simulator online, well that’s concerning,” Buchanan said.

To grow market share, he said brokers needed to provide a new like-for-like experience of speed and confidence to yes, with expert validation layered on top. This could be done through systems that were digitally connected directly to lenders and their decisioning centres.

Cramb agreed and said this was the structural change that would lead to the growth everyone was talking about.

“It’s always good to have a broker in the front, but direct integrations into lenders, we’re building those direct integrations,” he said. “What tells me that this will continue to grow is the appetite from the lenders is there.”

“It’s always good to have a broker in the front, but direct integrations into lenders, we’re building those direct integrations,” he said. “What tells me that this will continue to grow is the appetite from the lenders is there.”

Buchanan said consumers would opt for those lenders with direct integrations if it provided a faster yes, which encouraged more lenders to invest in these systems.

McNaughton said that if aggregators possessed more data than a major lender about why a customer would choose a certain bank over another, “that’s going to be pretty powerful [motivation] for lenders, and brokers and aggregators”.

She said aggregators could advocate for more broker share because they had far more insights than lenders into what products brokers were recommending and customers were choosing.

Q: Broker question from Ashik Rahman: With all the rate rises in the last 12 months, borrowing capacity has reduced. Some desperate borrowers might be tempted to provide inaccurate or falsified documents to secure lending. How are aggregators supporting brokers in tackling and identifying potential fraud?

Buchanan said brokers needed awareness and accountability when it came to compliance. “So, verify, verify, verify, and if customers are presenting documents that aren’t real, you need to identify them to protect your business. There’s no point in helping a customer and earning $3,000 commission if it’s going to destroy your career.”

He said aggregators worked closely with industry bodies and regulators, such as APRA, on these issues to effect change. “Our role is to make sure that not only is the broker channel protected but their consumers’ availability of credit assistance is protected into the future. It’s a multipronged approach.”

Sale said eventually aggregators would make certain systems, such as bankstatements.com and Equifax’s facility, compulsory for brokers, to assist them in identifying documents and conducting due diligence.

“Brokers cannot be slack on this side,” she said. “They’re going to have to implement processes within their businesses to combat the fraud that’s happening out there.”

There had been increasing cases of fraud by consumers and referrers, and when it happened Sale urged all outsource Financial brokers to conduct business reviews. “[They] must review their systems and their processes to ensure that they have completed all due diligence to protect themselves and their livelihoods.”

Cramb said compliance by design was crucial – ID, verification, documents, e-consent or consent – and key to the process was brokers ensuring compliance. Lendi Group believed that having a central model and a standardised process covered both the broker business and the aggregator business. Brokers who opted into this model were assisted with a standard process or “compliance by design”.

“We’re aligning that with our lender partners to show them that 70% of our flow is now standardised, therefore we can identify fraud or any compliance issues with a more systematic approach,” Cramb said.

At AFG, Slater said brokers had two choices: to run their own licence or operate under the aggregator’s licence. “If you run under our licence, we have a procedure that you have to follow, but we’ve also built an infrastructure that flags bad actors in our system and provides additional protection.”

If brokers encountered customers who had been flagged by fraud departments at lenders or AFG, that information would be shared so brokers could put checks in place and seek further details.

“I’ve got compliance coaches that will come out and sit down with you, and they’ll go through your process,” Slater said. “Those brokers who embrace it, we will share intel with them around who they’re dealing with.”

Rahman said that while he was happy to assess everyone’s financial circumstances, if he picked up that a customer had been flagged, he would not risk his licence.

Q: Clawbacks, net of offset and cashbacks are all major issues for brokers. What are your views, and how can the industry work together to find better outcomes?

Buchanan said commissions based on net of offset were the most expensive issue for brokers and should be removed, considering brokers’ use of BID. He added that cashbacks were probably a breach of ASIC regulations but weren’t interpreted that way. “If you’ve got a lender with the consumer’s largest financial investment, and you’re paying them money to come to you, disregarding the best interest or not, that should not be allowed.”

Cashbacks were also an APRA and ACCC issue, Buchanan said. There was an IRRBB (interest rate risk in the banking book) for banks. “We know that banks pay brokers through a factor of marginalisation, so they borrow the upfront and they get repaid that upfront out of the loan over a period of two or three years and then their net interest margins go up after that.”

Buchanan said banks relied on that client staying with them for a long period. Before cashbacks it was about five years, but data suggested that had fallen to three and a half to four years. “So loan terms are shrinking, which means profitability – on a per-loan basis – is shrinking for lenders.”

Smaller lenders often didn’t have the capital to pay cashbacks, so they were losing loan volumes and were unable to compete with banks paying cashbacks, which lessened competition.

Outside of lifting rates, banks that wanted to maximise home loan profitability could only look at fees, which was quite taboo, or lower broker commissions, and this was a real risk, Buchanan said.

SFG had given a lot of attention to the matter. “It’s about getting the three regulators in a room to talk about these issues and reset the guidelines. Cashbacks should be abolished.”

At outsource Financial, Sale said brokers were concerned about loan churning, with clients wanting to refinance every one to two years to claim cashbacks. “The regulatory bodies are not doing anything about it, and they should be looking at this seriously.”

Slater said cashbacks squeezed out small lenders, took the economics out of a transaction and didn’t have the best interests of the customer at heart.

Buchanan said cashbacks had increased the number of clawbacks. “I’m not saying that it will happen, but there’s an argument to say that brokers are now churning their clients more. I think that’s very concerning.

“Clawback represents about less than 2% of commissions. Net of offset represents about 10% – between 8% and 12%. So your brokers with net of offset are earning 10% less, and with clawbacks it’s only 2%.”

Harvey (pictured below) said clawbacks were a major issue for brokers. “Why do clawbacks exist when we have BID? We’re acting in the best interests of our customers, and when we’ve got the compliance levels that we do now, why is it necessary?”

Buchanan said it was partly a competition issue – some lenders couldn’t afford to abolish clawbacks, while other lenders didn’t have clawbacks. “But the reality is for the second-and third-tier lenders, by factoring in marginalisation to pay a broker and earning back that upfront over two to three years, without clawback a lot would fail, and you’d have less competition.”

Cramb agreed, saying there was an economic sharing between brokers and lenders, and getting rid of clawbacks would “open a Pandora’s box”.

Foley said the disparity in net of offset policies created the problem they were trying to avoid. “The regulators were very clear at the time – we don’t want to see everyone coming out with the same model.”

Slater said the current property market had clouded the net of offset issue. The banking royal commission had claimed that brokers were deliberately inflating borrowers’ loan amounts so they could claim more upfront commission. For example, on a house worth $1m, where the borrower owed $200,000, the broker was encouraging them to borrow $800,000, and the $600,000 would sit there in offset and never be used.

Net of offset was designed so that mortgage holders would borrow what they needed and not a greater amount to satisfy the broker’s interests. “But now we’ve had 12 rate rises and property prices aren’t going up, I would suggest brokers wouldn’t even have an opportunity to claim more.”

Slater said the other frustrating thing for brokers was that some lenders’ net of offset commissions were paid every month, and with other lenders brokers had to wait a year.

With AFG loan products, as long as the loan stayed on the books for three months, brokers made some upfront and trail money and then it tailed down. “For other lenders, it’s really blunt: zero to 12 months you get nothing.”

Q: Broker question from Samantha Harvey: How as an industry are we looking to handle data breaches and security?

Sale said outsource Financial worked closely with its software providers. “They get audited regularly not only by us but by the lenders and EY, Deloitte, PWC, to name a few. Every aggregator in this room would have very tight security components within their software that the brokers are using.”

Buchanan said the weakest link would probably be unverified outsourced agents. “For example, you might give your data to someone in Manila that might be untested. You don’t know what security systems they’re using. The responsibility is for us to set good practices and policies, but also for brokers to have good business disciplines and adhere to them.”

Slater commented that everyone in the value chain needed to be alert. “Lenders are testing us; we are undertaking external penetrations testing and we share that with our brokers,” he said.

“I’ve got consumers now emailing, saying, ‘how do I know the data that I’m giving to your broker is safe?’ ”

Slater said he was very passionate about this issue. Security was about more than just the systems you used; it was about your staff too, and where your data was held. Brokers and AFG staff were educated about keeping data safe, and AFG staff were tested regularly for leaks and phishing.

Cramb said that like AFG, Lendi Group was also very strong on data security, and he agreed with Buchanan that sharing data with third parties posed a risk.

“We’re investing everything in the one IT stack right now, which is designed to future-proof the business for this because it’s the number one risk.”

McNaughton said aggregators needed to show leadership on this issue. “There is pressure on aggregators to let people use popular automated tech that relies on password sharing for repricing, and you need to say no, you can’t do that.”

She said the biggest lesson for brokers was that they should not attach bank statements to emails but use integrated solutions such as FileInvite, which meant the documents were embedded, not attached.