Review of open banking finds major failings in system

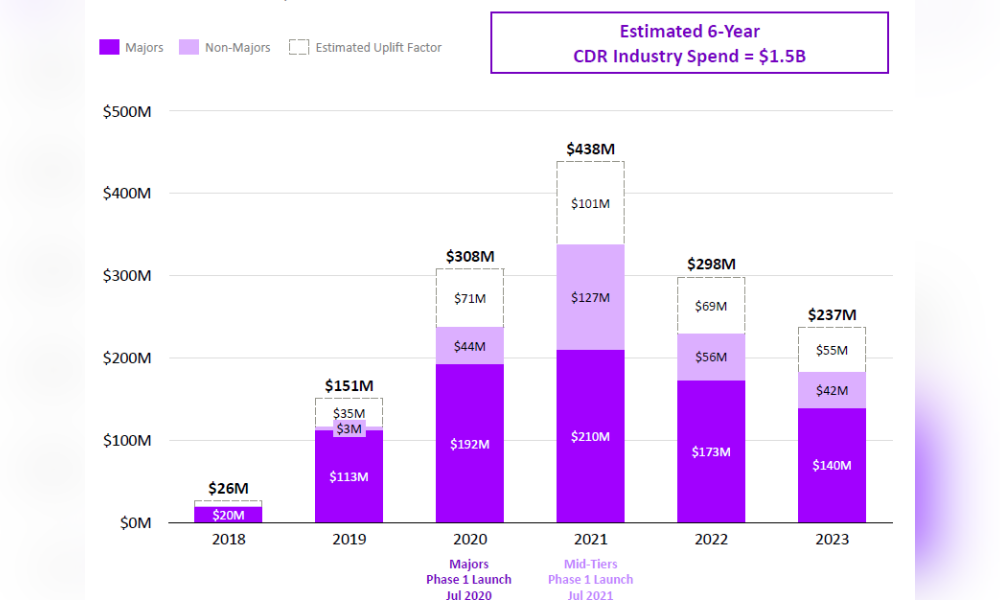

Banking leaders have criticised the Consumer Data Right regime in Australia, saying despite the $1.5 billion the banking industry has invested in open banking, it has failed to deliver benefits for customers or enhance competition.

The Australian Banking Association (ABA) and the Customer Owned Banking Association (COBA) said few customers were aware of open banking, let alone using it.

They also said disproportionately higher compliance costs for mid-tier and regional banks were badly affecting competition, forcing banks to put off investing in digital technology and scam prevention.

The associations were commenting following the release of the ABA’s strategic review of the roll-out of Australia’s CDR regime, which was carried out by IT company Accenture.

However, the MFAA and NextGen, the main technology provider to the mortgage lending industry, have defended the CDR.

While acknowledging the ABA’s and COBA’s concerns about the scale of investment required for open banking, they point to a greater uptake in broker-originated lending emanating from the CDR.

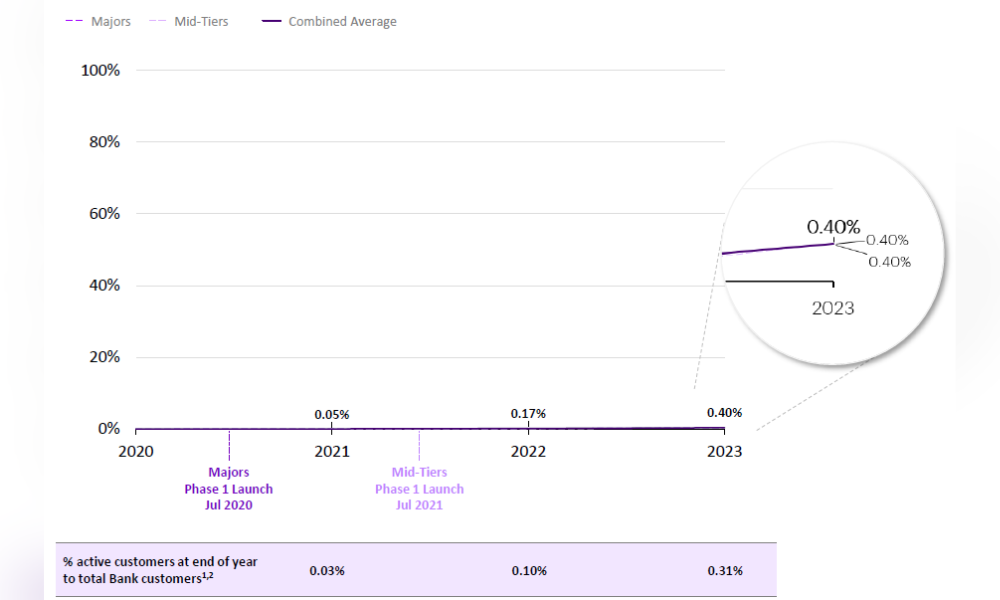

CDR, also referred to as open banking, came into effect for customers of major banks in July 2020, and for customers of other banks in July 2021.

Under open banking, financial institutions are required to share customer and product data on financial products and services from savings accounts to investment loans and retirement savings.

This allows customers to access and share their financial data with accredited third parties, at their own choice. Consumers also have full visibility of whom the data shared with, and the ability to nominate the time frame in which data will be shared and for what purpose.

ABA CEO Anna Bligh (pictured above left) said the banking industry had worked in partnership with the federal government to roll out the CDR, dedicating considerable resources into building data-sharing systems.

“Australian banks have invested heavily to secure the success of CDR,” Bligh said. “Despite the best efforts of government, regulators and industry, this review makes it clear that CDR has not realised its potential.”

Bligh said while Australians had enthusiastically embraced digital innovations in banking such as mobile wallets and PayID, uptake of the CDR had been comparatively low.

Accenture’s CDR strategic review showed that at the end of 2023, just 0.31% of bank customers had an active data-sharing arrangement, which compared unfavourably with consumer adoption of other banking digital innovations.

The report also pointed out the substantial investment from both government and industry participants into CDR, which “continues to incur significant ongoing costs”.

“The banking industry alone is estimated to have spent around $1.5bn since 2018,” the review stated.

“It’s time to go back to the drawing board,” Bligh said. “The current CDR regime isn’t delivering for customers or enhancing competition and a new pathway forward is needed.”

COBA CEO Michael Lawrence (pictured above, second from left) said customer-owned banks had collectively invested more than $100 million in CDR, with very little benefit to customers or competition.

“While we support the intent of the CDR to increase competition, it has actually made it more difficult for smaller banks to compete by tying up resources with little to no tangible return,” Lawrence said.

“Before smaller banks commit more resources, we ask for a clear roadmap to ensure the CDR delivers on its original intent to improve competition.”

Lawrence said forging ahead without addressing foundational issues would further erode competition and divert essential investment away from improving customer outcomes and supporting local communities.

MFAA’s views on the CDR

The MFAA has backed the open banking system since its introduction and CEO Anja Pannek (pictured above, second from right) said the peak industry body continued to support CDR “for the benefit of our members’ clients”.

“The entire premise of CDR is about giving consumers better control over their own data – which is something consumers should rightfully expect,” Pannek said.

“In noting comments around the ABA report – yes, we do acknowledge the change and investment required by lenders has not been insignificant. The key reason for this is that up until up until CDR, a consumer’s financial data has been held very tightly by ADIs.”

Pannek said the key to consumer adoption of CDR had been establishing the regulatory guardrails to give consumers confidence.

This meant they understood they could work with trusted advisers in the CDR regime, which importantly encompassed mortgage brokers as a result of the MFAA’s advocacy.

Pannek said the MFAA continued to work very closely with Treasury – and industry, not only through its more than 10 submissions on CDR but also more recently around the use cases for CDR.

“Mortgage broking is an excellent use case for open banking. In recently released research by FinTech Australia, lending use cases make up 40% of use cases, by far the biggest category of use cases.

Pannek said it had taken time to build the CDR infrastructure, which was an ongoing task in broking.

“Pleasingly, we’ve seen a noticeable uptick in development of CDR solutions and products for brokers over the last 12 months and expect this to further accelerate. This development is being led by both aggregators and other service providers bringing product solutions to market.

“We continue to urge industry to put united effort behind CDR and open banking, and accelerate its use for mortgage brokers and to do this before other technologies such as screen scraping become outdated.

“In summary, I think a good analogy for CDR is that we should liken this to a marathon – not a sprint – with a very worthy finish line: driving better outcomes for consumers.”

NextGen’s views about open banking

Tony Carn (pictured above, far right), the chief customer officer at NextGen, said the company acknowledged and agreed with the ABA – there had been a significant investment by the government and industry into CDR over the past four years.

“Investment has, however, also been from the whole ecosystem of private enterprises like NextGen, who have invested heavily into developing the solutions to provide lenders and brokers with a fast, safe and secure way to receive data from customers,” Carn said.

He said as CDR had matured over the past 12 months, NextGen had seen an acceleration in use for broker-originated lending as “we have worked with the industry bodies, aggregators and brokers on access, training and awareness”.

“We are now also seeing lenders we work with, investing in CDR to drive compliance and cost efficiencies in their own lending practices. The opportunity to drive a return on the investment in CDR, is to increase access, training and awareness, which needs to be driven by all stakeholders in the CDR ecosystem.”

CDR strategic review highlights problems

The review detailed a number of problems with the CDR, including low customer update, high expenditure due to investing in compliance with the CDR, prescriptive standards and changes to the scheme creating extra layers of complexity, and adverse competition outcomes due to the bigger impact of the CDR on smaller banks.

Low customer uptake

The review showed new CDR customers for 2023 represented 0.40% of total banking customers (see table below), while active customers at the end of 2023 represented 0.31% of total banking customers.

“Penetration of CDR amongst bank customers remains insignificant, in large part due to limited stickiness of arrangements – increasing growth in new customer acquisitions is required to grow the active customer base,” the report said.

“Customer uptake is particularly low when considering mobile wallets in Australia which reached 10% user adoption in 2019 (three years since Apple Pay entered in end of 2015), and continued to accelerate in growth to 36% user adoption in 2022.”

CDR customer uptake

Source: Consumer Data Right Strategic Review, July 224, ABA and Accenture

The high cost of CDR

According to the report, between 2018 and 2023 surveyed banks reported a total expenditure of $1.1bn, with 75% ($847m) incurred by majors and 25% ($273m) by mid-tiers.

Between 2021 and 2023, CDR costs had been disproportionately higher for mid-tier banks, with indicative percentage CDR spend to operating revenue being 0.2% for majors, and 0.7% for mid-tiers.

Indicative percentage CDR spend to operating costs was 0.4% for major banks and 1.1% for mid-tier banks.

“Persistently high compliance spend will continue to limit the capacity of data holders to invest in strategic CDR initiatives, impacting the overall availability and appeal of ADR functionality for consumers,” the review stated.

Total CDR expenditure – major banks vs mid-tier banks

Source: Consumer Data Right Strategic Review, July 224, ABA and Accenture

What do you think of CDR (open banking)? Are your clients aware of it? Comment below