Unit price growth decelerates significantly

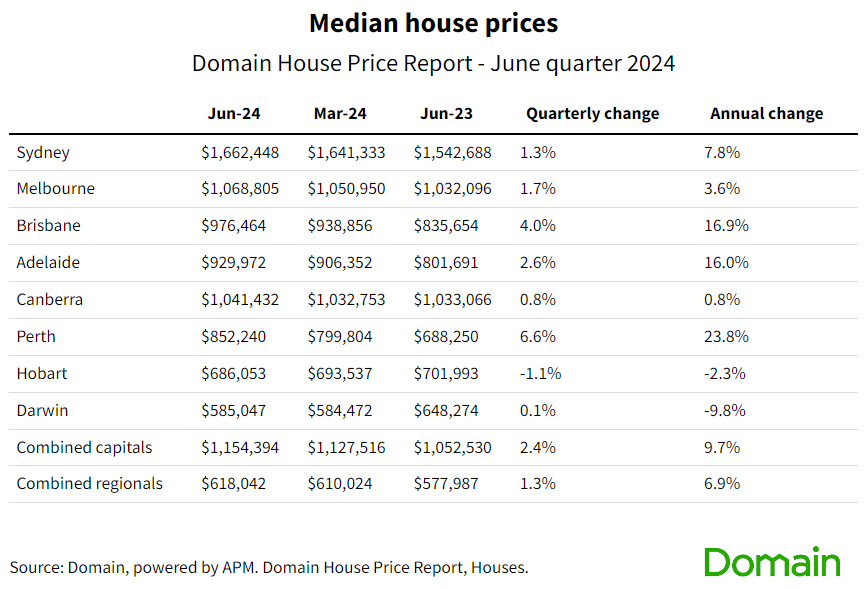

House prices across Australia’s combined capitals have risen for the sixth consecutive quarter, maintaining the same pace as the previous quarter, though slowing compared to 2023’s quarterly gains, real estate giant Domain has reported.

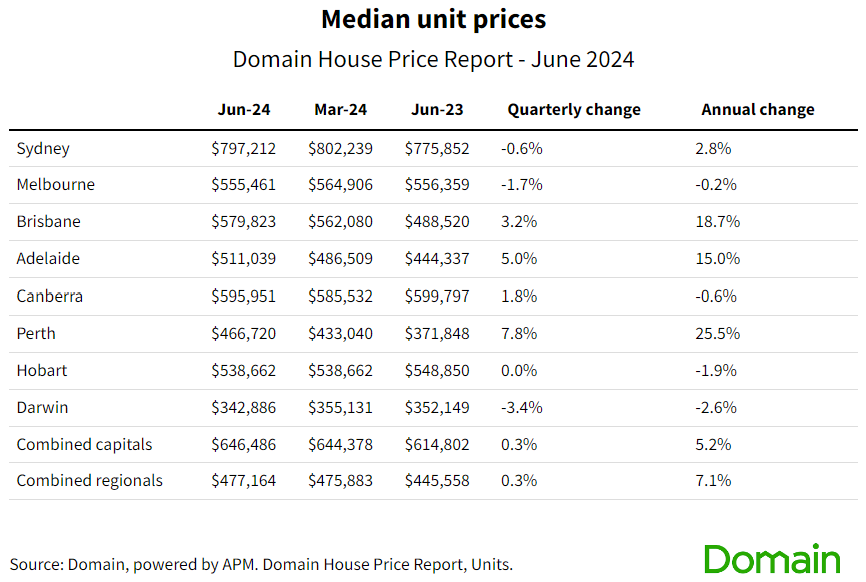

Unit price growth has decelerated significantly, marking the weakest quarterly outcome since early 2023, growing at a rate four times slower than the previous quarter. This slowdown has led to a deceleration in annual gains for both combined capital house and unit prices for the first time in this growth cycle.

Domain’s latest House Price Report also showed new record prices in Sydney, Brisbane, Adelaide, and Perth for houses, and in Brisbane, Adelaide, and Perth for units. However, Sydney and Adelaide saw their quarterly house price gains roughly halved compared to the previous quarter.

In Sydney, house prices rose by £11,000 (1.3%) over the June quarter, reaching a record high of £870,000, while unit prices fell for the first time in 1.5 years. Melbourne achieved its strongest house price gain in 2.5 years, rising by £9,500 (1.7%) over the June quarter.

Brisbane is on track to surpass £523,000 for house prices next quarter, with units experiencing the longest stretch of growth since 2005-08. Adelaide's unit prices surpassed £261,000, with strong quarterly and annual gains.

In Canberra, both house and unit prices moved into recovery, showing positive quarterly gains. Perth continued to be a top performer with house prices surpassing £418,000, rising by £235 per day over the past year — the steepest rise in the city’s history — and unit prices achieving record highs.

Hobart experienced a decline in house prices, reaching a three-year low, while Darwin saw house prices flatline and unit prices decline for the second consecutive quarter.

Domain said the varied growth trends across cities are influenced by different supply and affordability constraints. A 7% annual increase in homes on the market and a 9% increase in new listings indicate restored vendor confidence due to sustained price rises. However, stretched affordability appears to be increasing the time it takes to sell across some cities.

“The housing market remains resilient despite low consumer sentiment, economic pressures, and high interest rates,” said Nicola Powell (pictured above), chief of research and economics at Domain. “Supply still remains constrained overall, weighed against a surge in demand from strong population growth and a tight rental market.

“Demand is also being sustained by rising investor activity which may inevitably shift focus to units. It is likely that current demand is being propped up both by existing leverage from the property market and the bank of mum and dad — factors likely to become stronger due to ongoing price growth.

“Given that building approvals across the country have been on a declining trend since 2021 — an indicator of constrained supply — the price growth trend is unlikely to reverse itself. However, the persistent price growth trend may be tempered by higher cash rates and inflation in the long run, so there might be some relief in store for those looking to enter the market.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.