For the third year in a row, Macquarie Bank takes the No.1 spot in Brokers on Banks

An unwavering commitment to developing strong and enduring relationships with broker partners continues to pay dividends for Macquarie Bank.

The major bank has been named winner of MPA’s Brokers on Banks for 2024, the third consecutive year it has won the coveted title.

To gain an understanding of the findings of the Brokers on Banks report, the areas Macquarie Bank excelled in, how the bank responds to the needs of brokers, and its ongoing investment in technology, MPA caught up with Macquarie Bank head of broker sales Wendy Brown.

“Brokers are at the heart of our home loans business, so we’re incredibly proud to be named the winner of the Brokers on Banks award for the third year running,” says Brown.

“As a committed partner to the broker industry, this award is wonderful recognition of all our teams that work hard to deliver a best-in-class service and experience to brokers and their clients.”

Brown says Macquarie Bank’s teams spend a lot of time listening to feedback and getting to the heart of what brokers tell them they need, including where they can enhance their offering.

Brown says Macquarie Bank’s teams spend a lot of time listening to feedback and getting to the heart of what brokers tell them they need, including where they can enhance their offering.

“To receive this award for the third year in a row is a great testament to those teams, and we’re delighted that our offering continues to resonate with the broker community across Australia.”

More than 90% of Macquarie Bank’s home loans were sourced via brokers over the last 12 months.

“This channel is extremely important to our business,” says Brown. “We take a relationship-focused approach, meaning our market-facing teams are committed to building deep and lasting connections with brokers, understanding what matters most to their businesses.”

Broker feedback is fundamental to how Macquarie Bank reviews and evolves its offering, says Brown. “We take an ‘always-on’ approach to the feedback that brokers have about their engagement and experience with Macquarie. We do this in a number of ways, such as via surveys and through direct conversations with Macquarie’s BDM teams.”

The feedback is captured and shared internally and is essential to prioritising what the bank works on next, ensuring that “we’re acting on what brokers tell us matters most to them and their clients”.

As an example, Brown says brokers have told Macquarie that giving support staff access to the Broker Portal would significantly improve the running of their businesses. “So we’ve evolved our portal to include access for support teams, which is driving meaningful efficiencies for broker businesses across Australia.

“In addition, we’ve also combined our broker channels across home, commercial and car loans as one team, which allows us to diversify our offerings to meet more client needs and drive efficiencies.”

Brown says Macquarie Bank BDMs are also highly experienced and knowledgeable, providing brokers with confidence and guidance every step of the way.

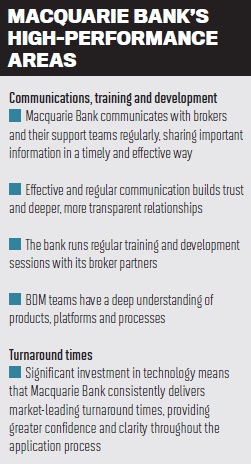

In this year’s Brokers on Banks survey, the bank ranked first in three categories: communications, training and development; interest rates; and turnaround times.

Macquarie Bank’s strong feedback mechanism for brokers has been instrumental to “how we do business and to our ability to innovate”, Brown says.

“We also use a range of data insights to gain a deeper understanding of our clients and brokers, delving into their needs and wants.

“We communicate regularly with brokers and their support staff in a variety of ways to provide them with regular updates, news, and give them the confidence that they have everything they need to support their clients.”

To further support broker partners, Macquarie Bank offers:

- direct access to specialised support teams (BDMs, Broker Support, credit team, etc)

- BDMs who are credit specialists who can help brokers through any scenario to find the fit for their clients

- a clear and transparent rates and credit policy

- weekly SLAs – consistent and transparent messaging across the business

- proactive communication on product, service and business changes

Brown says Macquarie Bank recognises that control, transparency and confidence are fundamental throughout the home loan application journey for both brokers and their clients.

“We know this from the conversations we’ve with brokers day in and day out, and we apply this understanding to all of our touchpoints across our home loan offering.”

Brokers are given information on a weekly basis, including current turnaround times, updates to credit policy and interest rates, and details on new features and functionality.

Brown says effective and regular communication with broker partners and their support teams builds trust and deeper, more transparent relationships.

Macquarie Bank runs regular training and development sessions with brokers.

Its BDM teams have a deep understanding of the products, platforms and processes the bank offers, as well as broader marketplace trends.

“They are supported by the wider Macquarie home loan ecosystem, which includes our operational and support functions which we’ve continued to invest in and grow,” says Brown.

Credit teams also work closely with BDMs to share updates and changes on credit policies to ensure brokers have easy access to the information they need.

Brown says turnaround times are one of the most important factors for brokers and their clients. “Because of the significant investments we’ve made over several years in our technology platforms, we consistently deliver market-leading turnaround times. This provides greater confidence and clarity throughout the application process.”

Brokers also voted Macquarie Bank the No. 1 preferred bank for property investors. Browns says its lending products and banking solutions have been engineered to support investors.

Within a single Macquarie Bank loan facility, she says customers can set up multiple loan accounts, and each of those accounts can have different repayment types and interest types.

Within a single Macquarie Bank loan facility, she says customers can set up multiple loan accounts, and each of those accounts can have different repayment types and interest types.

“For example, within a single facility you may decide to have one loan account that’s got a fixed rate principal and interest repayment, and another loan account that has a variable rate interest-only repayment.”

Technology and innovation are a key focus at Macquarie Bank. Brown says empowering brokers and clients with faster, simpler and more secure technology gives them the tools to carry out their work.

“Often, we find it’s the everyday improvements that our brokers respond best to. For example, our portal allows brokers to see their clients’ loan details, interest rates, fixed rate loan expiration and much more, all at their fingertips.”

Brown says this helps brokers navigate discussions and questions from their clients quickly and easily and support clients through crucial moments.

“These enhancements were brought to light through broker feedback.”

In 2024, Macquarie Bank has a range of new and exciting initiatives underway to improve efficiency, productivity and, “most of all, improve brokers’ experience with us”, Brown says.

“We are working on some enhanced security features, real-time platform support, in addition to continuing to improve the functionality within Broker Portal even more, and we look forward to communicating these enhancements with our brokers throughout the year.”