Key stakeholders work with brokers to help first home buyers

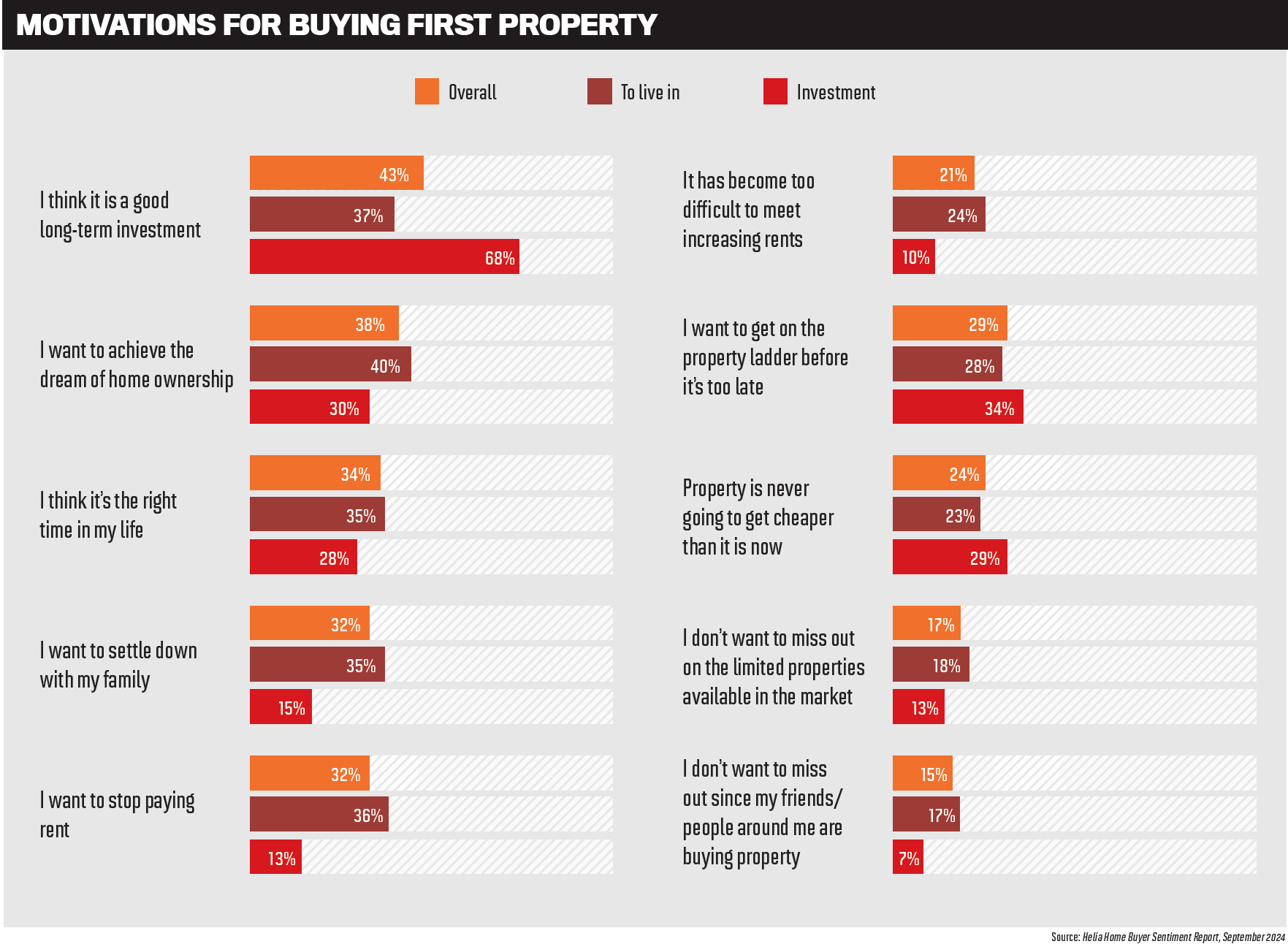

While many feel that achieving the ultimate Aussie dream of homeownership is slipping further away from their grasp, the majority still believe it’s a good time to buy and that the investment is worth it.

There’s no doubt it’s harder for first home buyers after 13 successive interest rate rises, slow wages growth, a cost of living crisis and rising property prices.

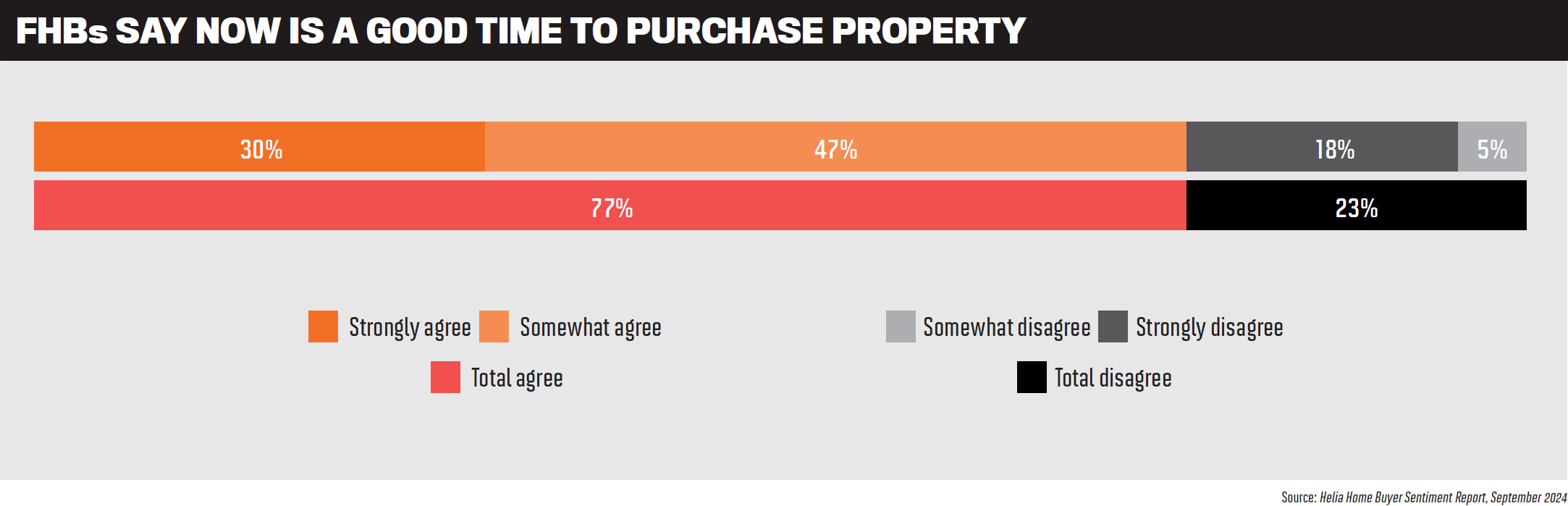

The time it takes to save for a 20% deposit on an entry-level house ranges from just three years and seven months in Darwin to six years and eight months in Sydney, according to Domain. But Helia’s latest 2024 Home Buyer Sentiment Report shows the majority of first home buyers remain hopeful – 77% agreed it was a good time to buy.

To understand what’s happening in Australia’s first home buyer lending market and how mortgage brokers can get involved, MPA spoke to Greg McAweeney (pictured above centre), chief commercial officer at lenders mortgage insurance provider Helia; Blake Buchanan (pictured above left), general manager of aggregator Specialist Finance Group (SFG); and Ian Rakhit (pictured above right), general manager third party at Bankwest. Property Council of Australia group executive, policy and advocacy, Matthew Kandelaars also provided his insights.

First home buyer trends

Kandelaars says it’s encouraging to have seen new loan commitments to first home buyers rise marginally in recent months, with one in three first home buyers supported by the federal government’s Home Guarantee Scheme in 2023–24.

“It is sadly evident that purchasing a first home is increasingly challenging,” he says. “In Sydney, the average age of a first-time buyer has risen to 37, while in Melbourne it’s now 36.”

As it becomes harder for first home buyers to enter the market, it’s crucial to support and empower them to achieve the home-ownership dream.

“We need to ensure that mortgages are more accessible to young first-time home- buyers, giving them a better opportunity to secure housing,” Kandelaars says.

The Property Council believes government taxes are a large barrier for first home buyers, with data indicating that 30–40% of the cost of buying a new home in some jurisdictions is made up of taxes, fees and charges.

Kandelaars says the price thresholds for first home buyer stamp duty exemptions need to be pegged to the changing median house price to give buyers greater choice.

“Underpinning this is a concerted effort to increase housing supply across the nation,” Kandelaars says.

“If there were a stronger, more sustainable pipeline of new housing, more Australians would be able to afford their ideal home.”

Commenting on trends in the first home buyer market, Buchanan says there’s recently been an increase in pre-approvals across the board as property growth slows.

“Whilst affordability, particularly for first home buyers, is tight generally, there is more affordability in units when compared to houses, which is spurring activity in this segment,” he says.

Buchanan notes that there has been an uptick in first home buyers using the ‘bank of mum and dad’ to achieve their home- ownership goals, and he says this is likely to continue.

“There has also been a growing number of first home buyers who have reset their goals and accept that their first home is not necessarily their forever home or could be an investment to get onto the property ladder,” he says.

McAweeney says that in the past 12 months first home buyers have faced rising property prices and increased living costs, impacting their ability to save a 20% deposit. “Despite this, Helia’s latest Home Buyer Sentiment Report 2024 reveals that FHBs remain opti- mistic, with 77% agreeing that now is a good time to buy.”

Several other key first home buyer trends were identified in the report. These include:

- difficulty saving: rising living costs have surpassed housing unaffordability as a key barrier to saving a 20% deposit

- alternative strategies: FHBs are exploring alternative pathways to purchasing a home sooner, including the use of LMI, with 77% of prospective FHBs likely to use LMI in 2024 (up from 59% in 2023)

- seeking guidance: FHBs are looking for support from mortgage brokers, with 91% of FHBs likely to use a mortgage broker to obtain a home loan

“It’s encouraging to see that, despite the current market, first home buyers aren’t giving up on their homeownership dream,” says McAweeney.

“Helia develops resources designed to empower mortgage brokers to have more confident conversations with FHBs,” he adds. Rakhit agrees that, despite cost of living pressures, the dream of homeownership for younger Australians is still very much alive.

Bankwest’s Home Truths research found that homeownership is still important to younger Australians (64% of Gen Z); and those planning to buy in the next five years are willing to sacrifice property features, such as a pool or a deck (38%) and property size (35%), to get on the property ladder.

“We consistently see homeownership as important to Australians, regardless of the property market or economic conditions at any given time, and what changes is how aspiring homebuyers adapt to those situa- tions,” Rakhit says.

Working with mortgage brokers

Helia conducts regular market research to understand the challenges faced by mortgage brokers, and develops educational resources, tools and estimators to support them, says McAweeney.

“Our resource library includes videos, factsheets, infographics and case studies to help homebuyers understand how LMI can support their homeownership goals. Our LMI fact sheet and infographics are also available in a range of languages, including Arabic, Punjabi and Simplified Chinese.”

“We have also commenced discussions with aggregators with a view to provide training and resources to better support mortgage brokers,” says McAweeney.

Rakhit notes that brokers play a vital role in helping first home buyers navigate the complexities of homeownership, and in finding the best solutions for their customers’ circumstances.

“Bankwest strives to be the best bank for brokers in the country, and we pride ourselves on the collaborative relationship we have with brokers to ensure we continue to deliver the tools and processes offering the best possible experience for them and their customers.

“On average, we help over 300 first home buyers into a new home every month.”

Rakhit says the bank is committed to supporting brokers and ensuring it meets their needs and expectations. This support ranges “from our passionate, award-winning BDMs and broker chat to our world-class broker portal and self-serve education resources”.

“We’re also committed to engaging brokers and making sure they feel empowered through face-to-face events and our regular direct communications.”

At SFG, Buchanan says most brokers offer their services to a range of client types, including first home buyers. “So it’s impor- tant that the market stays on top of the state or federal offers for FHBs, along with lender offers and policies for this segment.”

This education is made available to SFG members through multiple avenues, including face-to-face learning, SFGlearn and digital content, as well as more personalised learning sessions.

“I think that there is broadly great content availability at call should a broker need it, which is something that’s very pleasing to see over time,” Buchanan says.

SFG is fortunate to have many younger professional brokers who have grown up in an era of first home buyer schemes and policies. “This has given them real and personal experience with this segment, and there is nothing quite like experience.”

Value of technology

Rakhit says Bankwest is focused on simplicity and speed and has continued to invest in innovative digital solutions. This includes working with brokers to build a world-class broker portal that enables brokers to quickly access information and tools that help them find the best solutions for their customers, fast and efficiently.

The bank is also investing in DocBox, its secure document transfer solution. This allows brokers to transfer documents securely to Bankwest through its broker portal.

Digital signing also helps to speed up the process and ensures that, following unconditional approval, documents are already on the way to the broker and customer, with a built-in four-hour delay to give brokers time to congratulate their customers.

The Bankwest Simple Home Loan was introduced to meet the needs of customers such as first home buyers who are looking for a basic product with fewer fees and less

fuss. It has no application fees, no extra costs to redraw, the ability to make extra repayments at any time, and an optional 100% offset facility.

Buchanan says SFGconnect is a SalesTrekker-based platform with a number of cool features that are directly relatable to the newer generations and their expectations for digital experiences and speed of responses.

“Whilst the age of FHBs has been increasing, the majority are still millennials and Gen Zers who are more inclined to seek responses online, compare themselves and research their provider through online reviews,” he says.

This is where SFGconnect comes in to automate and digitise the experience, giving them comfort and validation around their choice of broker, says Buchanan.

Looking to the future

Over the next 12 to 18 months, McAweeney expects FHBs to continue to be savvy in looking for ways to make their homeownership dream a reality. “Mortgage brokers will continue to act as a trusted guide for FHBs navigating the complex homebuying process. Helia is well positioned to support both FHBs and mortgage brokers.”

Helia provides flexible LMI solutions such as monthly LMI and family assistance.

McAweeney says with rising living costs, some homebuyers can’t pay for the LMI premium up front. To help, Helia’s Monthly LMI offering allows homebuyers to pay the LMI fee monthly until their loan has been paid down to below the LVR determined by their lender, or until the loan is discharged.

Helia’s family assistance offers a 15% reduction on LMI when parents or family pay the LMI premium up front at loan settlement.

Looking ahead, Buchanan says he sees more favourable conditions when it comes to interest rates, but he expects home prices to remain high as demand still exceeds supply in many regions. “Our role is to give the tips and tools available to our members for use and to put into practice. There is still a large cohort of people who think homeownership is beyond them when it might not be.

At Bankwest, Rakhit says the focus is on certainty and speed of approval and settlement. This will support “our brokers [to] help first home buyers realise their dream of homeownership”.

“We’ve been really clear in our strategy, prioritising investment in the digital and broker channels our customers are increasingly preferring, and we will continue to innovate and work with brokers to deliver solutions as their needs – and those of their customers – evolve.”