Another major lender adjusts RBA cash rate forecast

RateCity reported a mix of interest rate reductions and increases for new customer variable rates among Australian banks, with several lenders adjusting their offerings to attract new borrowers.

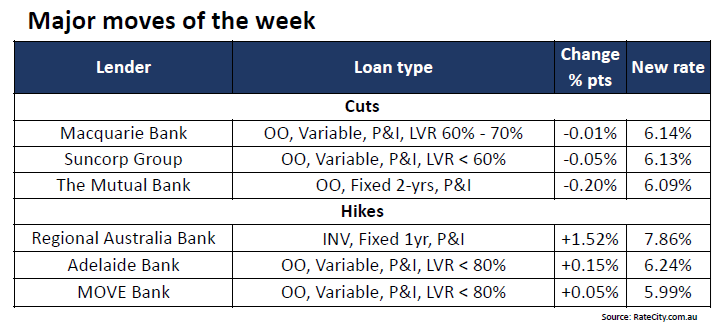

Macquarie Bank reduced select rates by up to 0.10 percentage points for both owner-occupier and investor loans, setting its lowest advertised variable rate at 6.14%. Suncorp also lowered its rates for owner-occupier loans by 0.05 percentage points, achieving a slightly lower rate of 6.13%.

In contrast, Adelaide Bank raised its owner-occupier variable rates by 0.15 percentage points, pushing its lowest rate to 6.24%.

On the fixed rate front, only minor changes were reported, with a few smaller lenders cutting two- and three-year fixed rates. Regional Australia Bank increased select fixed rates across all loan terms.

“The upcoming RBA meeting will almost certainly result in a hold to the cash rate at 4.35%,” said Sally Tindall (pictured), research director at RateCity.com.au. “However, there will be even greater focus than usual on how the central bank responds to the stickier than expected inflation results, and whether it opts to revert back to a tightening bias.”

Australia’s largest bank, Commonwealth Bank of Australia (CBA), has adjusted its forecast for the RBA cash rate, now predicting only one cut of 0.25 percentage points in November 2024.

Westpac’s economic team also revised its forecast last week, also reducing its prediction from two cuts to just one.

With these updates, all of Australia’s “big four” banks — CommBank, Westpac, NAB, and ANZ — now anticipate a single reduction in the RBA’s cash rate in November 2024.

“What these cash rate forecasts tell us is that no one, not even the RBA knows what its next move is,” Tindall said. “While we’ve made excellent progress bringing down inflation, there’s every chance this next leg of the battle could be the hardest.

“The RBA is not going to revert back to hiking the cash rate without plenty of data on its side, and plenty of warning to borrowers. However, if you’ve got a mortgage, it’s prudent to plan for a hike just to be on the safe side.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.