What's in store for the property sector?

Having watched inflation spike and central banks raise rates at record speed in 2022, experts have placed their bets on yet another tough year ahead of investors in 2023 – with a further 25-basis-point interest rate hike by the Reserve Bank to start off.

CommSec and Commonwealth Bank Group’s economic insights have been summarised in a newly released report, Tough 2022: And it’s not going to get much easier. In it, the group’s economists revealed their expectations for Australia’s economic growth to slow from 3.5% in 2022 to 1.1% in 2023 – more than a full percentage point below what is considered ‘normal’ growth (2.25%) – and the RBA to announce another 0.25% interest rate hike in February 2023 for a peak rate of 3.35%.

Commonwealth Bank Group experts also predicted mild recessions in the near future for the likes of the US, UK, Europe, and Japan, which CommSec described as industrialised economies.

Read more: Will Australia dodge recession?

CommSec economists forecast a slightly brighter future for the Australian sharemarket, with 2022’s 5.5% drop easing into a lift of 4% to 7% over the coming 12 months, depending on factors such as interest rate changes by major central banks and China’s economic recovery.

“High levels of inflation, continued uncertainty about interest rates, tight labour markets, high energy prices, the war in Ukraine, and the re-opening of the Chinese economy pose both risks and opportunities for investors,” said chief equities economist Craig James. “While the coming year certainly won’t be without its challenges, we are tipping a modest gain for the benchmark S&P/ASX 200 index in 2023.”

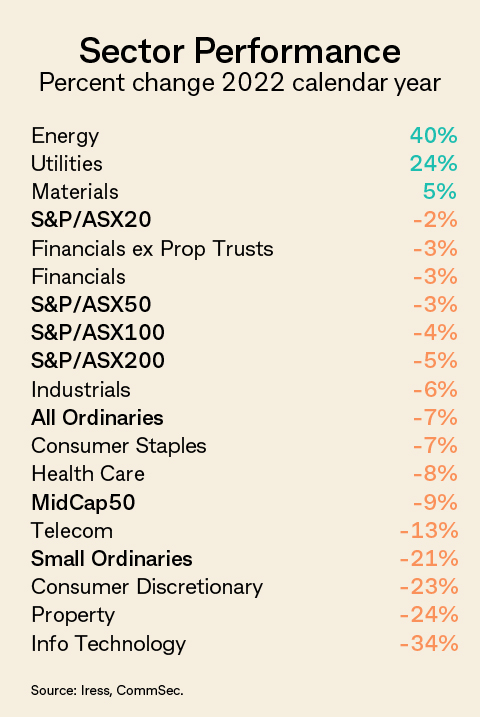

The CommSec report also analysed sector performance across the Australian sharemarket in 2022 and found that growth sectors such as real estate – or those that relied on stable economic conditions and low interest rates for profit growth and business expansion – led the yearly declines. Property trusts fell by 24%, ‘outperformed’ only by fellow growth sector information technology, which fell by 34%.

The financials sector, excluding property trusts, suffered a milder downtick of 3%.

The global economic environment in 2023 would not be conducive for growth-focused sectors, the CommSec report concluded. Still, more forward-looking investors could expect a much better 2024, buoyed by interest rate cuts expected later this year. Smaller companies and the consumer discretionary, IT, and property sectors, in particular, could benefit from the second half of 2023. By contrast, 2022’s top-performing energy and material sectors, which had flourished in response to 2022’s high oil, coal, and gas prices, were more likely to face challenges for the rest of the coming year.

Read next: As Australia employment surges, are more rate increases coming?

Amid the gloomy insights, the CommSec report noted one bright spot in 2022 – the Australian sharemarket had outperformed global peers in 2022.

“There’s no doubt that Aussie sharemarket investors had a tough year in 2022,” James said. “But the good news is that Australian share indexes held up better than in most other advanced markets due to an outperforming economy.”

Do you agree with CommSec’s outlook for 2023? Let us know in the comments below.