Sliding scale reduces commission clawback after broker feedback

In a move that’s sure to be welcomed by the mortgage broking industry, NAB has changed its clawback commission structure, introducing a sliding scale that means less money is taken out of broker’s pockets.

NAB executive broker distribution Adam Brown (pictured above) has sent an update to the major bank’s broker partners informing them of the changes to clawback on broker upfront commissions involving NAB residential home loans, which came into effect on September 1.

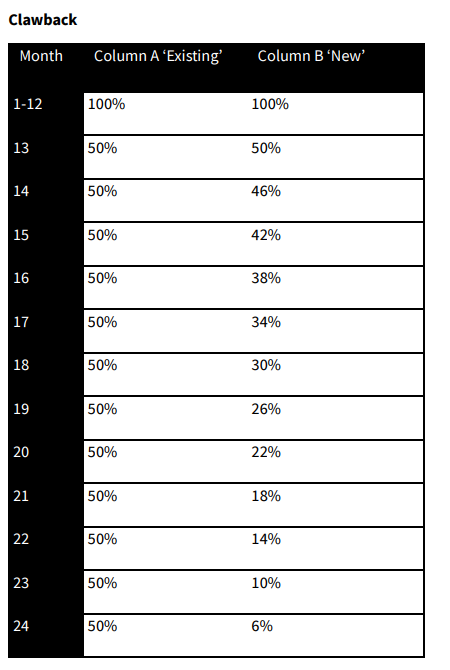

Under the changes, broker clawback will be lowered on a sliding scale, starting at month 14, where it will reduce from 50% clawback to 46% clawback and then continue reducing in the following months, until it reaches just 6% in month 24.

Previously 50% clawback was in place for NAB home loans from month 13 to 24.

In the email to brokers, NAB explained that Column A referred to the ‘existing’ structure and Column B referred to the ‘new’ structure effective September 1, 2024:

- For residential home loans, the new rates detailed in Column B will apply to all home loans where the loan is fully repaid or discharged within two years from September 1, 2024.

- That is, if the broker customer’s home loan was drawn down on October 31, 2022, and they discharged their home loan on September 1, 2024, then the proportion of the upfront commission that will be clawed back will be the ‘new’ rate of 10% rather than today’s ‘existing’ rate of 50%.

Updated NAB broker commission clawback structure

Source: NAB

Source: NAB

Brown told brokers NAB had updated its clawback commission structure after listening to feedback from its broker community.

“The changes will fix a real pain point for brokers by improving the clawback structure and the refreshed, stepped commission rate will better align NAB’s products in market,” said Brown.

“These changes came into effect from 1 September 2024 and will apply to new residential loans settled after that time.”

Brown said he been in his current role for almost a year now and was “loving the role and what we do for brokers and customers”.

“I’ve met with many brokers across the country, listened to feedback and acted to improve the experience working with NAB.”

He also said he was extremely proud of NAB’s team of highly skilled NAB BDMs, relationship managers and relationship associates that support brokers every day.

“The home loan market remains highly competitive. We recognise the role that brokers play in the home loan market, and we value our long-term partnerships.

“Balancing returns and growth in this dynamic market will remain important. The economic environment, including persistent inflationary pressures, is challenging for our customers and we are here to help.”

NAB continues to invest in the broker channel to make it easier for brokers and customers by simplifying and digitising the home lending experience, said Brown.

“Look out for more exciting things to land around policy and product in the coming months.”

Brown also encouraged brokers to continue to provide their feedback to NAB to help improve the broker experience.

What do you think of NAB's clawback changes? Share your views below.