New CoreLogic report also indicates ongoing affordability challenges as house prices continue to rise across the country

The number of Australian suburbs with median house or unit values exceeding $1 million hit a new high in August, according to property data services provider CoreLogic.

The latest CoreLogic Million-Dollar Markets report revealed that 29.3% of the 4,772 suburbs analysed had a median value at or above $1 million, up from 21.7% in January 2023, when property values bottomed out after the start of the rate-tightening cycle. The current figure surpasses the previous market peak of 26.9% in April 2022.

Despite the rise in million-dollar suburbs, affordability has worsened. CoreLogic’s analysis has revealed that to service a loan on a $1 million property with an $800,000 loan balance and a 6.28% variable mortgage rate, a household now needs an annual income close to $200,000 — up from around $125,000 before the interest rate hikes.

“At the onset of COVID, just 14.3% of house and unit markets had a median value at or above $1 million,” said CoreLogic economist Kaytlin Ezzy (pictured above). “With almost 30% of suburbs now posting a seven-figure median, the increase is a natural consequence of rising values and worsening affordability.”

The new CoreLogic report showed the number of million-dollar markets grew by 18.5% — or 218 suburbs — over the past year. In August 2022, 1,057 suburbs had a median house value of at least $1 million, while 122 unit markets reached that level. Those numbers have risen to 1,257 and 140, respectively, in the past year.

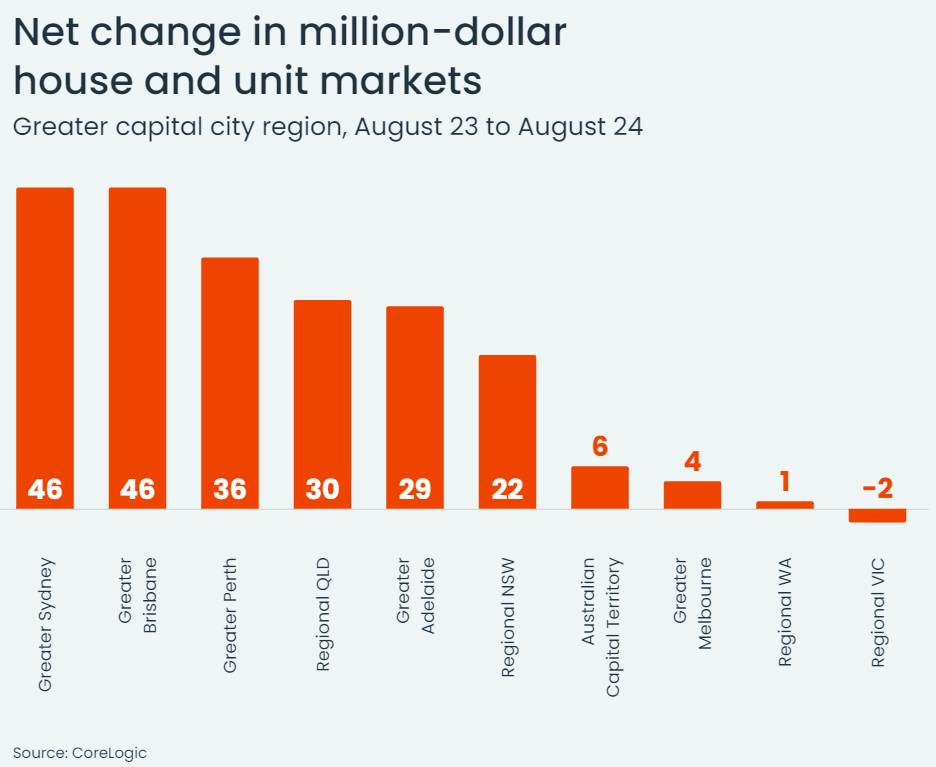

While the increase has been spread across the country, Sydney continued to lead with a median house value of over $1.18 million and the highest net rise in million-dollar suburbs, adding 46 over the past year. Brisbane also recorded a net increase of 46 million-dollar markets, with property values climbing 15% over the year.

“The positive flow of interstate migration, coupled with a continued undersupply of advertised listings and newly built housing stock, has seen Brisbane values rise 65.1% since the onset of COVID,” Ezzy said. “This has eroded much of the city’s previous affordability advantage, making Brisbane the second most expensive capital with a median dwelling value of $875,040.”

Perth added 35 new entrants to the million-dollar club, driven by the highest annual rise in dwelling values across Australia. However, Perth’s lower starting point meant it saw fewer new seven-figure suburbs than Sydney and Brisbane.

On the other hand, Melbourne and regional Victoria experienced a decline in property values, with a 1% drop over the year.

“An unfavourable investment taxation environment, a higher level of new housing completions, and an above-average supply of advertised properties have put downward pressure on values in these areas,” Ezzy said.

At the national level, the pace of growth has slowed, with a 1.3% increase in property values over the three months to August, down from a 2% rise in the three months to April.

“While growth is slowing, and market conditions vary across regions, it’s unlikely we’ve reached the peak in million-dollar markets,” Ezzy said.

Currently, 24 suburbs are within reach of the $1 million mark, with positive value growth in the last quarter.

“It’s likely we’ll see a number of these markets cross the million-dollar threshold within the next few months,” Ezzy said.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.