Average price of an Aussie home climbs to $959,300

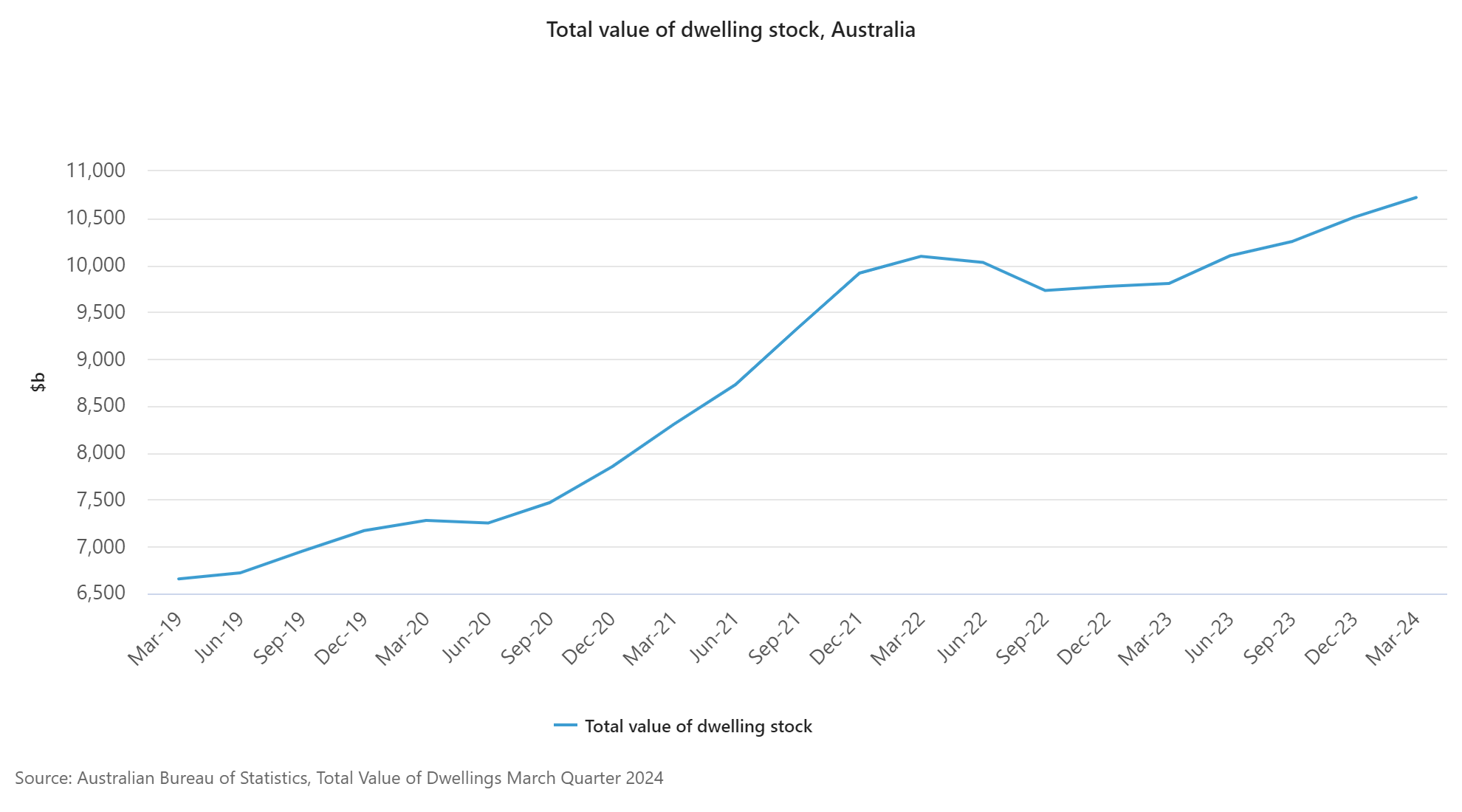

The total value of residential dwellings in Australia reached $10.7 trillion in the March quarter of 2024, a $209.4 billion increase from $10.5 billion in the December quarter of 2023, according to preliminary estimates of the Australian Bureau of Statistics (ABS).

Households owned $10.3 trillion of the total value of residential dwellings, with the total value of residential dwellings increasing across all states and territories in the March quarter of 2024.

The latest ABS Total Value of Dwellings data also showed the number of residential dwellings in Australia rose by 52,700 to 11.2 million, and the mean price of residential dwellings increased by $14,300 to $959,300 this quarter.

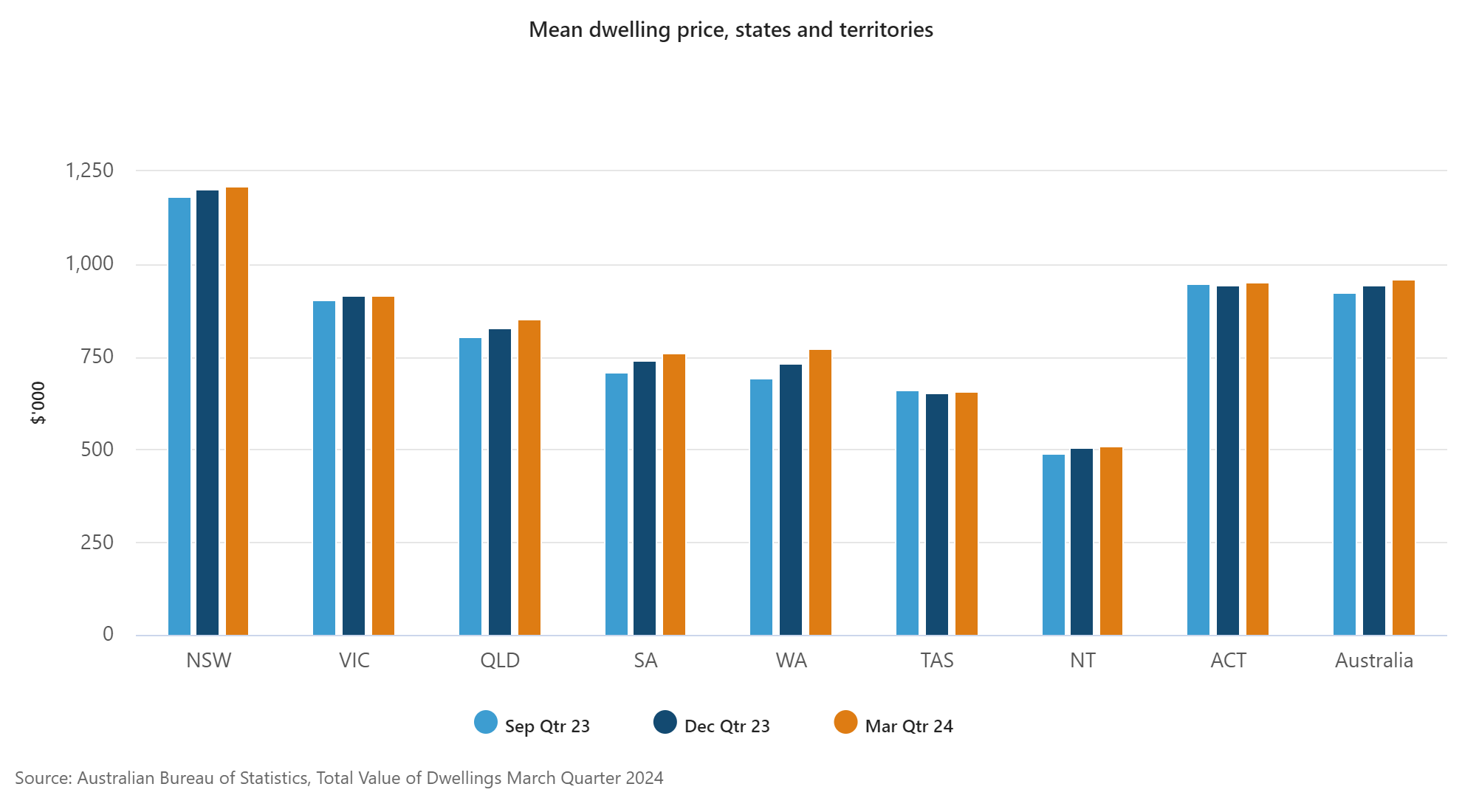

New South Wales had the highest mean price for residential dwellings at $1.2 million, followed by the Australian Capital Territory at $950,500 and Victoria at $914,300. The Northern Territory had the lowest mean price at $511,400.

“The property market remains vulnerable to higher interest rates and rising unemployment in the second half of 2024, moving into 2025,” said Robert Baharian (pictured above), co-founder and director of Ekam Capital. “We’re already seeing slowing growth in house prices in capital cities, primarily in Sydney and in Melbourne, as high levels of debt and the cost-of-living weigh on households.

“As a nation, Australia’s household sector is among the most indebted in the world, which means rising rates will eventually hurt households’ ability to take on more debt, especially if we see a jump in the employment rate towards 5%.”

Baharian projected that interest rates might remain unchanged until at least September 2024, with a potential cut not expected until April 2025.

“If rates rise in June, it will be six months from peak rates to a cut, on par with the third shortest period in duration before the RBA cuts rates,” he said.

Over the past 50 years, the average duration between a peak in interest rates and subsequent cuts in Australia has been about 10 months. The shortest duration was in 2008 during the onset of the global financial crisis, and the longest was from 1995 to 1996 as inflation improved after peaking at 5.1% in 1995.

“Households may have to buckle in for higher interest rates for many months more as it may not be until 2025 when they see their mortgage costs fall with official interest rates,” Baharian said.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.