2015’s key regulatory and market developments will also characterise the year ahead. MPA editor Sam Richardson explains why brokers should start planning now

2015 was a year of surprises; APRA’s restrictions on investment lending, out-of-cycle rate rises and China’s economic slowdown. 2016 will be equally as volatile; the difference is that we are already aware of many of the developments that will take place.

If anything, brokers have too much information about the year ahead, with daily reports on house prices and regulator interference. This is MPA’s attempt to separate the wheat from the chaff, asking the industry’s leaders what’s relevant for you and your business over the next 12 months.

Lukewarm cooling

Take the housing market itself. In Sydney and Melbourne, the current discourse centres on a coming ‘correction of house prices’; i.e. that prices will fall in these cities, mainly based on week-by-week clearance rates and other short-term data.

on week-by-week clearance rates and other short-term data.

A better measure is QBE’s Housing Outlook report, released in October, which suggests that in 2016, growth will simply slow in these cities; from 22.3% YOY in Sydney to 7.3%; and from 15.7% to 4.9% in Melbourne. Corrections won’t occur until 2017 and 2018. Similarly, prices in Perth and Darwin will continue to fall, as they’ve done this year, and Adelaide and Hobart’s prices will remain relatively stagnant. The only unusual development in 2016 will be an upturn in Brisbane’s house prices, from a growth of 2.9% to 5.4% next year.

Therefore, when it comes to the housing market, 2016 will be a ‘relatively robust year’, as Mortgage Choice John Flavell told MPA. Clear trends allow brokers to plan ahead, whether based in Perth or Sydney and as Flavell points out, “the majority of Australians still believe now is a great time to buy and own property.”

For Aussie Home Loans’ CEO James Symond, the slowing of growth on the east coast “is a good and important thing and necessary for the sustainability of property affordability, especially in areas like Sydney and Melbourne where they got a little out of hand, in my opinion.” He doesn’t see any imminent correction of prices, but rather the market becoming more sustainable.

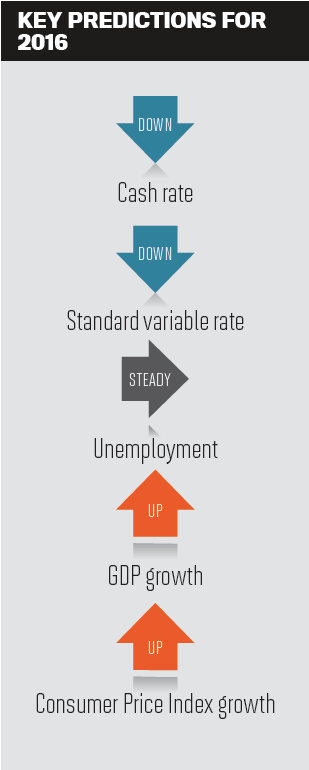

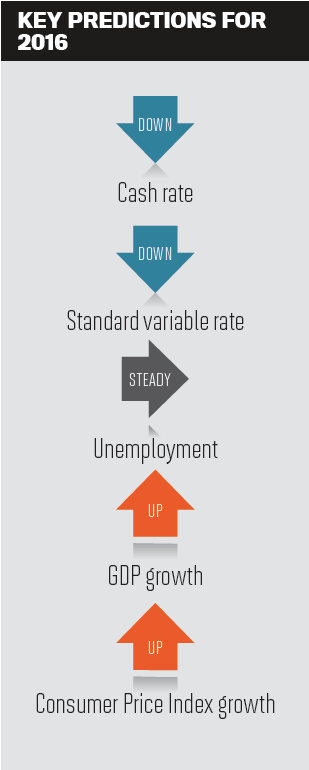

The joker in the pack here is interest rate rises and falls; however, the RBA’s monthly proclamations have lost much of the lustre they held in 2014. Saddled with a stagnant economy, the RBA has essentially subcontracted management of the exuberant housing market to APRA, who has succeeded in slowing investor demand.

As we suggest in our 2015 Hotlist, APRA chairman Wayne Byres may have more influence than Glenn Stevens over the direction in which lenders’ interest rates move in the year ahead.

March of the regulators

Indeed, the major developments which will shape 2016 will be spearheaded by organisations whose names start with the letter ‘a’. APRA and ASIC have been steadily handed more responsibility by the RBA and federal government; most prominently in the government’s response to the Financial System Inquiry. You might not recall the FSI, which issued its final report in late 2014, but the coming year will see it move from a state of recommendation to one of implementation, so it’s worth reacquainting yourself with the key points.

Most relevant to brokers is a planned review of mortgage brokers’ remuneration structures, which ASIC will conduct in late 2016. According to the Treasury, this review will help with “reducing and improving the disclosure of conflicted remuneration in life insurance, stockbroking and mortgage broking.” For MFAA CEO Siobhan Hayden, the review “really is an opportunity for us to educate APRA, the Treasury, and lobbyists”, and tackle public and regulator ignorance which was evident several times in 2015. “I don’t think it’s going to go anywhere,” she said.

FBAA CEO Peter White told MPA “the transparency under the NCCP, especially with the latest out from the FSI; I don’t see that there’s any reasonable call to change the way things are.” The industry is open to feefor- service models, he added.

are.” The industry is open to feefor- service models, he added.

A second development, which will directly eat into brokers’ pockets, are discussions over a user-pays model for the regulators; in practical terms, the cost of an Australian Credit Licence could significantly increase, in order to pay for ASIC and APRA.

“At the moment, the way they’re proposing the pricing model doesn’t fly at all,” MFAA’s Hayden argued. “They’ve done the easiest cut, based on volume. The licensing amount would be

about $500 for a broker, but if you go to $20 million in lodged loans, it increases to $26,000.”

The MFAA and FBAA are opposing this approach, and so discussions will likely extend through most of 2016, and Hayden added: “seeing [user-pays] happen in a 12-month window would be ambitious… if they do come out of further discussions, it would be in 2017.” Part of the reason for this is it will have to go through a parliamentary process, White noted. “We can’t completely stop it,” he concluded. “What we can do is make it fairer for the majority.”

More still could emerge from the FSI. The recommendation that originally captured brokers’ attention – that they disclose ownership structures to clients – is already being implemented by some broking groups and requires, according to Hayden, “a simple inclusion to a credit guide or similar”.

Another change, highlighted by Flavell, was ASIC’s increased powers to ban harmful financial products, which he broadly supported by saying: “so long as ASIC’s intervention does not stifle innovation, then we support the idea. ASIC is, after all, the industry watchdog and they should be given the necessary powers to govern this industry appropriately.”

Evidently, regulators are changing and becoming more powerful. It’s possible that could rub off on mortgage broking’s industry bodies, as negotiating new regulations gives them a sense of purpose they’ve not had in years. “Our engagement with regulators keeps on increasing,” White told MPA. “We’re constantly in front of regulators and federal ministers; it’s my job and it’s what I do, and it occupies 70% or more of my time.”

When MPA talked to the MFAA, they were already preparing plans for lobbyists in Canberra. Of course, lobbying isn’t cheap, nor is it guaranteed to sway a result; and brokers will be expecting those results as regulation begins to bite. With aggregators providing training and banks no longer requiring MFAA or FBAA membership, brokers have been questioning the value of industry bodies for years. Depending on the concessions they can extract from regulators, 2016 could be a turning point in the relationships between brokers and their representatives.

Broker vs broker

When predicting changes within the industry, it’s traditional to pick out a particularly huge corporation and claim they are planning a move into broking; this time last year it was supermarkets, and recent suggestions have involved accountants and even Google. The reality is slightly less exotic, if nevertheless still relevant; whilst they’ll be fewer new players in the market, there’ll be more brokers fighting for business.

Existing groups will grow, of course. Mark Bouris’ Yellow Brick Road group had an active year and further acquisitions in 2016 are not out of the question. Connective’s new iConnect Financial retail aggregation model will officially launch in April but will still be relatively small: Connective’s Steven Heavey told MPA that they were aiming for 100 brokers by September. Aussie is planning a major recruitment drive, aiming for 25 more purpose-built stores by July and 300 extra loan writers, bringing their total to 1,500.

Financial retail aggregation model will officially launch in April but will still be relatively small: Connective’s Steven Heavey told MPA that they were aiming for 100 brokers by September. Aussie is planning a major recruitment drive, aiming for 25 more purpose-built stores by July and 300 extra loan writers, bringing their total to 1,500.

We may see more lenders enter the channel; a number of former mutual banks entered the channel this year, such as Bank Australia, although their small size will limit their impact. With regard to accountants entering broking, MPA investigated the trend back in its issue 15.10 and found it was limited to individuals; although CPA Australia has applied for an ACL it was more directed at financial planning. In fact, mortgage broking organisations are the ones who are conquering new territories, with the MFAA reportedly considering expanding into New Zealand.

Brokers are faced with two choices, illustrated by the strategies of the Mortgage Choice and Aussie franchises. At their annual general meeting, Mortgage Choice’s Flavell identified the main challenge as “our ability to keep pace with market growth… we couldn’t keep pace with a market that was growing 12–14%.”

Interestingly, MPA’s Top 100 Brokers also struggled to keep pace with rising house prices, despite their combined loans

total increasing 7% from last year.

Mortgage Choice has made diversification top priority, aiming to better integrate and increase the return from the franchise’s financial planning arm, noted in both their 2016 plan and their 2020 long-term strategy. “Customers are increasingly looking to deal with professionals who can handle all of their financial needs,” Flavell told MPA.

“They don’t want to share their private financial information with various different companies; they want to deal with a onestop shop.”

MPA asked Aussie CEO Symond if he was also planning to offer more diversified services. Aussie had previously tried all types of diversification, he noted, even including selling alarm systems, but “we’ve found that home loans are certainly the heart of what we do; it’s the river that runs through it.” Cross-selling was not off the menu, Symond explained; Aussie also sells insurance and personal loans, but the new stores being planned were primarily focused on home loans.

Instead, Aussie would try and distinguish themselves through improved customer service, beginning with bringing their call centre not just in-house but into their Sydney head office, “literally 20m from the CEO’s office”, Symond boasts. He believes customer service has become far more important in recent years. “With mortgage brokers being in excess of 50% of mortgage flows in Australia, the likely competitor to one mortgage broker is another mortgage broker. And that’s something we haven’t really seen materially before.”

With similar lender panels, pricing and credit criteria, a broker’s service proposition becomes the key differentiating factor, Symond explained, even more so than the Aussie brand: “the brand does a stunning job in making the phones ring… however, once the broker speaks to the customer, it’s then up to them; they become the brand. It’s their service, it’s their skill it’s their care which ensures the customer makes it to the finish line.” He also added that follow-up service fell into this category: “if they don’t have an existing customer management plan, someone else will.”

Mortgage Choice and Aussie’s strategies are not incompatible, of course; many consider a full-spectrum diversified proposition as the best way to service and keep a customer. The key point is that brokers, not branches, supermarkets, or overzealous regulators, will be your main competitors over the year ahead; the traditional broker proposition is still attractive, but no longer distinguishes you from the competition. Therefore,

successfully reinventing that proposition will be the key challenge for brokers in 2016 and beyond.

If anything, brokers have too much information about the year ahead, with daily reports on house prices and regulator interference. This is MPA’s attempt to separate the wheat from the chaff, asking the industry’s leaders what’s relevant for you and your business over the next 12 months.

Lukewarm cooling

Take the housing market itself. In Sydney and Melbourne, the current discourse centres on a coming ‘correction of house prices’; i.e. that prices will fall in these cities, mainly based

on week-by-week clearance rates and other short-term data.

on week-by-week clearance rates and other short-term data.A better measure is QBE’s Housing Outlook report, released in October, which suggests that in 2016, growth will simply slow in these cities; from 22.3% YOY in Sydney to 7.3%; and from 15.7% to 4.9% in Melbourne. Corrections won’t occur until 2017 and 2018. Similarly, prices in Perth and Darwin will continue to fall, as they’ve done this year, and Adelaide and Hobart’s prices will remain relatively stagnant. The only unusual development in 2016 will be an upturn in Brisbane’s house prices, from a growth of 2.9% to 5.4% next year.

Therefore, when it comes to the housing market, 2016 will be a ‘relatively robust year’, as Mortgage Choice John Flavell told MPA. Clear trends allow brokers to plan ahead, whether based in Perth or Sydney and as Flavell points out, “the majority of Australians still believe now is a great time to buy and own property.”

For Aussie Home Loans’ CEO James Symond, the slowing of growth on the east coast “is a good and important thing and necessary for the sustainability of property affordability, especially in areas like Sydney and Melbourne where they got a little out of hand, in my opinion.” He doesn’t see any imminent correction of prices, but rather the market becoming more sustainable.

The joker in the pack here is interest rate rises and falls; however, the RBA’s monthly proclamations have lost much of the lustre they held in 2014. Saddled with a stagnant economy, the RBA has essentially subcontracted management of the exuberant housing market to APRA, who has succeeded in slowing investor demand.

As we suggest in our 2015 Hotlist, APRA chairman Wayne Byres may have more influence than Glenn Stevens over the direction in which lenders’ interest rates move in the year ahead.

March of the regulators

Indeed, the major developments which will shape 2016 will be spearheaded by organisations whose names start with the letter ‘a’. APRA and ASIC have been steadily handed more responsibility by the RBA and federal government; most prominently in the government’s response to the Financial System Inquiry. You might not recall the FSI, which issued its final report in late 2014, but the coming year will see it move from a state of recommendation to one of implementation, so it’s worth reacquainting yourself with the key points.

Most relevant to brokers is a planned review of mortgage brokers’ remuneration structures, which ASIC will conduct in late 2016. According to the Treasury, this review will help with “reducing and improving the disclosure of conflicted remuneration in life insurance, stockbroking and mortgage broking.” For MFAA CEO Siobhan Hayden, the review “really is an opportunity for us to educate APRA, the Treasury, and lobbyists”, and tackle public and regulator ignorance which was evident several times in 2015. “I don’t think it’s going to go anywhere,” she said.

FBAA CEO Peter White told MPA “the transparency under the NCCP, especially with the latest out from the FSI; I don’t see that there’s any reasonable call to change the way things

are.” The industry is open to feefor- service models, he added.

are.” The industry is open to feefor- service models, he added.A second development, which will directly eat into brokers’ pockets, are discussions over a user-pays model for the regulators; in practical terms, the cost of an Australian Credit Licence could significantly increase, in order to pay for ASIC and APRA.

“At the moment, the way they’re proposing the pricing model doesn’t fly at all,” MFAA’s Hayden argued. “They’ve done the easiest cut, based on volume. The licensing amount would be

about $500 for a broker, but if you go to $20 million in lodged loans, it increases to $26,000.”

The MFAA and FBAA are opposing this approach, and so discussions will likely extend through most of 2016, and Hayden added: “seeing [user-pays] happen in a 12-month window would be ambitious… if they do come out of further discussions, it would be in 2017.” Part of the reason for this is it will have to go through a parliamentary process, White noted. “We can’t completely stop it,” he concluded. “What we can do is make it fairer for the majority.”

More still could emerge from the FSI. The recommendation that originally captured brokers’ attention – that they disclose ownership structures to clients – is already being implemented by some broking groups and requires, according to Hayden, “a simple inclusion to a credit guide or similar”.

Another change, highlighted by Flavell, was ASIC’s increased powers to ban harmful financial products, which he broadly supported by saying: “so long as ASIC’s intervention does not stifle innovation, then we support the idea. ASIC is, after all, the industry watchdog and they should be given the necessary powers to govern this industry appropriately.”

Evidently, regulators are changing and becoming more powerful. It’s possible that could rub off on mortgage broking’s industry bodies, as negotiating new regulations gives them a sense of purpose they’ve not had in years. “Our engagement with regulators keeps on increasing,” White told MPA. “We’re constantly in front of regulators and federal ministers; it’s my job and it’s what I do, and it occupies 70% or more of my time.”

When MPA talked to the MFAA, they were already preparing plans for lobbyists in Canberra. Of course, lobbying isn’t cheap, nor is it guaranteed to sway a result; and brokers will be expecting those results as regulation begins to bite. With aggregators providing training and banks no longer requiring MFAA or FBAA membership, brokers have been questioning the value of industry bodies for years. Depending on the concessions they can extract from regulators, 2016 could be a turning point in the relationships between brokers and their representatives.

Broker vs broker

When predicting changes within the industry, it’s traditional to pick out a particularly huge corporation and claim they are planning a move into broking; this time last year it was supermarkets, and recent suggestions have involved accountants and even Google. The reality is slightly less exotic, if nevertheless still relevant; whilst they’ll be fewer new players in the market, there’ll be more brokers fighting for business.

Existing groups will grow, of course. Mark Bouris’ Yellow Brick Road group had an active year and further acquisitions in 2016 are not out of the question. Connective’s new iConnect

Financial retail aggregation model will officially launch in April but will still be relatively small: Connective’s Steven Heavey told MPA that they were aiming for 100 brokers by September. Aussie is planning a major recruitment drive, aiming for 25 more purpose-built stores by July and 300 extra loan writers, bringing their total to 1,500.

Financial retail aggregation model will officially launch in April but will still be relatively small: Connective’s Steven Heavey told MPA that they were aiming for 100 brokers by September. Aussie is planning a major recruitment drive, aiming for 25 more purpose-built stores by July and 300 extra loan writers, bringing their total to 1,500.We may see more lenders enter the channel; a number of former mutual banks entered the channel this year, such as Bank Australia, although their small size will limit their impact. With regard to accountants entering broking, MPA investigated the trend back in its issue 15.10 and found it was limited to individuals; although CPA Australia has applied for an ACL it was more directed at financial planning. In fact, mortgage broking organisations are the ones who are conquering new territories, with the MFAA reportedly considering expanding into New Zealand.

Brokers are faced with two choices, illustrated by the strategies of the Mortgage Choice and Aussie franchises. At their annual general meeting, Mortgage Choice’s Flavell identified the main challenge as “our ability to keep pace with market growth… we couldn’t keep pace with a market that was growing 12–14%.”

Interestingly, MPA’s Top 100 Brokers also struggled to keep pace with rising house prices, despite their combined loans

total increasing 7% from last year.

Mortgage Choice has made diversification top priority, aiming to better integrate and increase the return from the franchise’s financial planning arm, noted in both their 2016 plan and their 2020 long-term strategy. “Customers are increasingly looking to deal with professionals who can handle all of their financial needs,” Flavell told MPA.

“They don’t want to share their private financial information with various different companies; they want to deal with a onestop shop.”

MPA asked Aussie CEO Symond if he was also planning to offer more diversified services. Aussie had previously tried all types of diversification, he noted, even including selling alarm systems, but “we’ve found that home loans are certainly the heart of what we do; it’s the river that runs through it.” Cross-selling was not off the menu, Symond explained; Aussie also sells insurance and personal loans, but the new stores being planned were primarily focused on home loans.

Instead, Aussie would try and distinguish themselves through improved customer service, beginning with bringing their call centre not just in-house but into their Sydney head office, “literally 20m from the CEO’s office”, Symond boasts. He believes customer service has become far more important in recent years. “With mortgage brokers being in excess of 50% of mortgage flows in Australia, the likely competitor to one mortgage broker is another mortgage broker. And that’s something we haven’t really seen materially before.”

With similar lender panels, pricing and credit criteria, a broker’s service proposition becomes the key differentiating factor, Symond explained, even more so than the Aussie brand: “the brand does a stunning job in making the phones ring… however, once the broker speaks to the customer, it’s then up to them; they become the brand. It’s their service, it’s their skill it’s their care which ensures the customer makes it to the finish line.” He also added that follow-up service fell into this category: “if they don’t have an existing customer management plan, someone else will.”

Mortgage Choice and Aussie’s strategies are not incompatible, of course; many consider a full-spectrum diversified proposition as the best way to service and keep a customer. The key point is that brokers, not branches, supermarkets, or overzealous regulators, will be your main competitors over the year ahead; the traditional broker proposition is still attractive, but no longer distinguishes you from the competition. Therefore,

successfully reinventing that proposition will be the key challenge for brokers in 2016 and beyond.