New data shows that the main reason Australians haven’t switched their home loans is that they are happy with their current lenders. A broker who specialises in refinancing reveals a few quick questions that will soon change a borrower’s mind.

Aussies are not rushing to switch home loans. About two in five mortgage holders (39%) have stayed put with their loans over the past decade (about 1.17 million households), according to a survey by comparison website Finder.com.au.

This reluctance among households translates to a potentially wasted combined $27.4m per month, $328.2m per year, or a staggering $9.9bn over 30 years.

Of the 1,351 respondents surveyed, only 6% were currently considering a switch, while just 21% have switched to a better deal within the last fi ve years.

NSW Loan Market finance broker Renee Robins told MPA why refinancing loans was big business for brokers, despite the recent data showing reluctance among borrowers to switch.

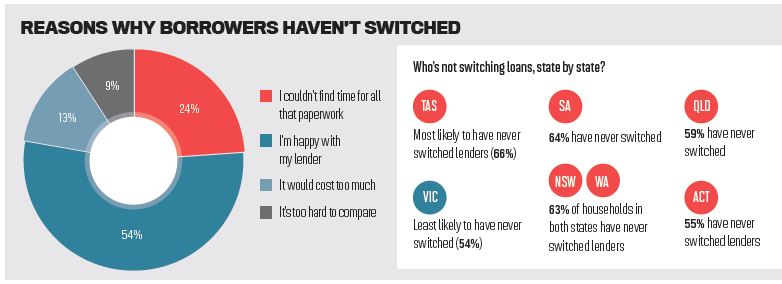

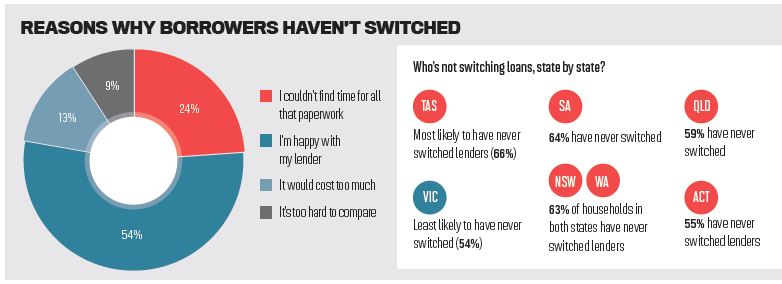

The major reason respondents said they hadn’t switched was that they were content with their lenders (54%), but Robins says it’s more a case that they don’t know what they’re missing out on.

“I am amazed how often I sit down with clients who are paying 5% or 6% or higher and are happy with that,” says Robins. “They do not realise they are paying so much more than what is currently on offer. That money is better spent on paying off their mortgage, not giving it to the lender.”

The majority of Robins’ business is refinancing loans, and she agrees with the Finder pie chart (see boxout) on the four reasons given by consumers for not switching their loans. But she says a few quick questions will soon change their minds.

She asks her clients who are hesitant about refinancing questions such as: “What are the features of your loan and do you use them all? If you are not using this feature why do you keep paying for it in your annual fee? Are you aware your current interest rate is higher than what other lenders are currently offering and it is higher than what your lender is currently offering new customers.”

She says she makes the refinancing process as easy as possible for clients, collecting all documents in one go and then the signature on application.

“Lenders want customers to be confused with their choices,” says Robins. “One of the greatest tools available for consumers looking for loans is the comparison rate. Most clients I see do not know what the comparison rate is. Lenders keep this a secret. If everyone was aware of this tool they would be challenging their lender for better rates.”

Even though it is more affordable now to switch lenders since the banning of excessive exit fees to variable home loans in 2012, Robins says clients aren’t aware that these exit fees no longer exist.

“No lender tells their customers what the fees are to get out of a product. When I advise them they only really have an administration fee and some small government charges, they are very surprised.

“Refinancing is such a great source of business for brokers as the lenders are making it way too easy for clients to get better service from a broker. The market has never been so competitive; brokers have more options than any one lender can off er – we are in a position to educate our clients whilst giving them fantastic service and saving them money. This is a win-win situation that will generate clients for life.”

This reluctance among households translates to a potentially wasted combined $27.4m per month, $328.2m per year, or a staggering $9.9bn over 30 years.

Of the 1,351 respondents surveyed, only 6% were currently considering a switch, while just 21% have switched to a better deal within the last fi ve years.

NSW Loan Market finance broker Renee Robins told MPA why refinancing loans was big business for brokers, despite the recent data showing reluctance among borrowers to switch.

The major reason respondents said they hadn’t switched was that they were content with their lenders (54%), but Robins says it’s more a case that they don’t know what they’re missing out on.

“I am amazed how often I sit down with clients who are paying 5% or 6% or higher and are happy with that,” says Robins. “They do not realise they are paying so much more than what is currently on offer. That money is better spent on paying off their mortgage, not giving it to the lender.”

The majority of Robins’ business is refinancing loans, and she agrees with the Finder pie chart (see boxout) on the four reasons given by consumers for not switching their loans. But she says a few quick questions will soon change their minds.

She asks her clients who are hesitant about refinancing questions such as: “What are the features of your loan and do you use them all? If you are not using this feature why do you keep paying for it in your annual fee? Are you aware your current interest rate is higher than what other lenders are currently offering and it is higher than what your lender is currently offering new customers.”

She says she makes the refinancing process as easy as possible for clients, collecting all documents in one go and then the signature on application.

“Lenders want customers to be confused with their choices,” says Robins. “One of the greatest tools available for consumers looking for loans is the comparison rate. Most clients I see do not know what the comparison rate is. Lenders keep this a secret. If everyone was aware of this tool they would be challenging their lender for better rates.”

Even though it is more affordable now to switch lenders since the banning of excessive exit fees to variable home loans in 2012, Robins says clients aren’t aware that these exit fees no longer exist.

“No lender tells their customers what the fees are to get out of a product. When I advise them they only really have an administration fee and some small government charges, they are very surprised.

“Refinancing is such a great source of business for brokers as the lenders are making it way too easy for clients to get better service from a broker. The market has never been so competitive; brokers have more options than any one lender can off er – we are in a position to educate our clients whilst giving them fantastic service and saving them money. This is a win-win situation that will generate clients for life.”