Over 370,000 complaints resolved since 2018

AFCA experienced its busiest year in its five-year history, reflecting increased financial stress within the community, a persistent problem with scams, and ongoing issues related to insurer claims handling delays lasting for more than 12 months.

AFCA’s Annual Review 2022-2023 revealed that there were a record-breaking 96,987 complaints lodged by consumers and small businesses with the financial industry ombudsman between July 1, 2022, and June 30, 2023, marking an unprecedented 34% spike from the previous year.

“It is less than five years since AFCA started on 1 November 2018, and we have already resolved over 370,000 complaints,” said David Locke (pictured above), AFCA CEO and chief ombudsman. “This work has resulted in $1.15 billion in compensation awarded to consumers and small businesses (as of September 2023).”

Over the 2022-23 year, AFCA resolved 86,185 complaints, a 21% rise compared to the previous year, leading to $253.8 million in compensation and refunds for successful complainants.

AFCA’s systemic efforts, meanwhile, prompted firms to provide $100,528,522 in remediation to 378,830 individuals.

Complaints lodged by small businesses with AFCA in 2022-23 numbered 3,807 (4%).

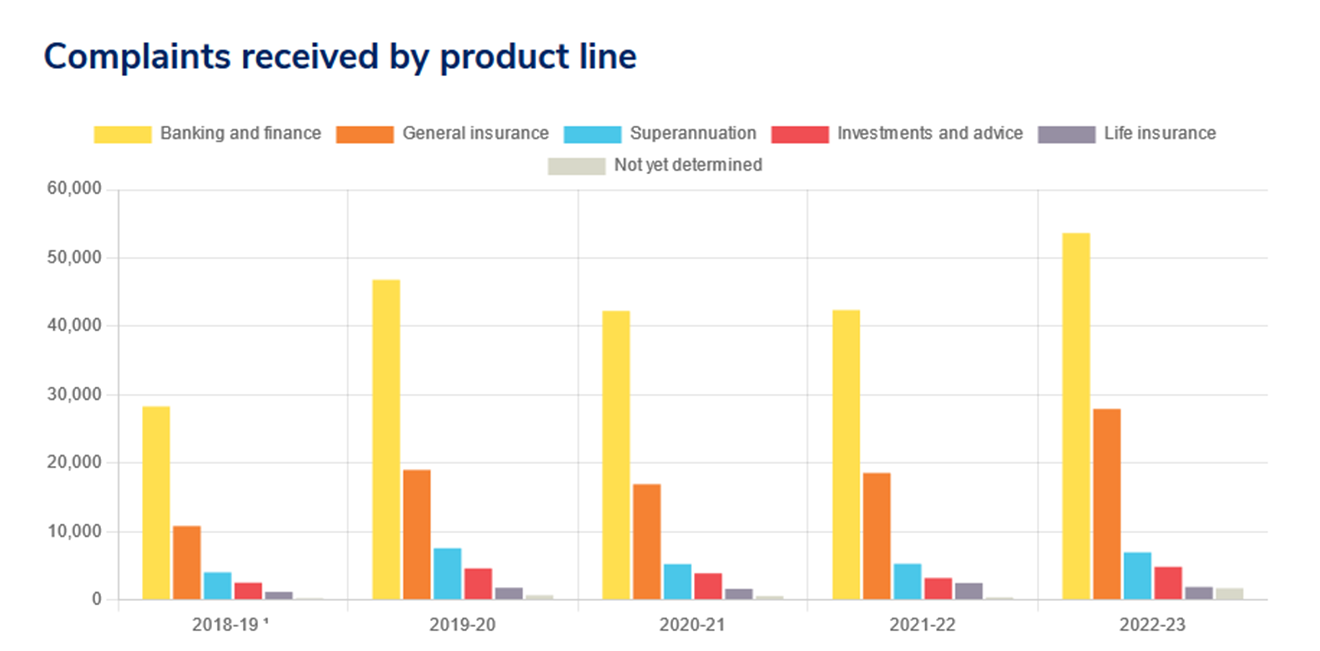

Complaints by category

In the banking and finance sector, complaints increased by 27% to 53,638 during 2022–23.

This category saw a 9% rise in financial difficulty-related complaints over the year, with a massive 31% increase in the June quarter when compared to the same period in the previous year. Complaints related to home loans and credit cards also experienced notable increases in the closing months of the financial year.

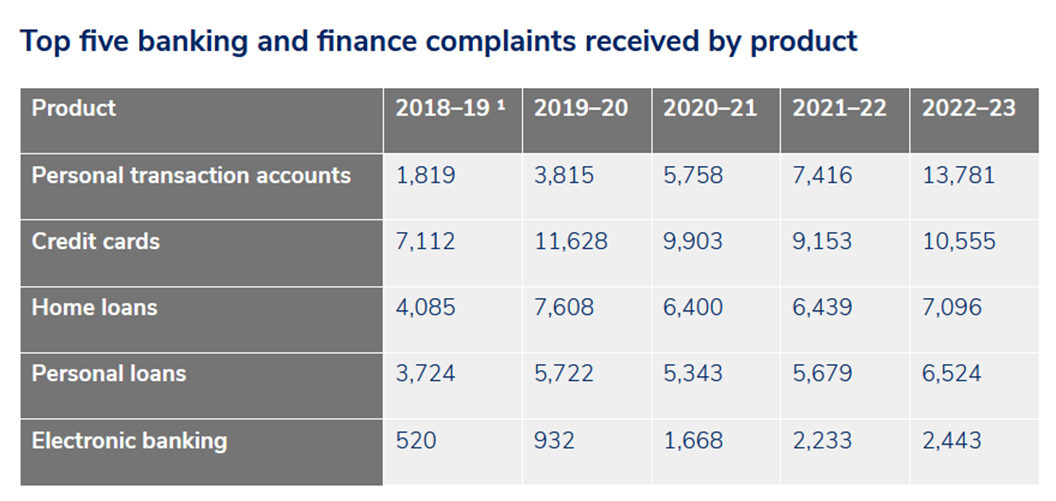

Over the same year, personal transaction accounts became the most complained-about product, surpassing credit cards for the first time since AFCA’s establishment. Disputes related to personal transaction accounts increased by 86%, partly due to a 46% rise in scam-related complaints, which reached a total of 6,048.

Within general insurance, the primary concern was the delay in claim handling by insurers, which was up 66%. General insurance complaints, in general, surged by more than 50%, growing from 18,563 to 27,924.

“AFCA acknowledges the challenges insurers have faced in recent years,” Locke said. “However, the sustained increase in complaints and issues with delays is of great concern. AFCA is working closely with insurers to reduce complaints requiring an AFCA investigation.”

Superannuation-related complaints surged 32% in 2022–23, with a particularly sharp rise of 136% in complaints related to delays in claims, including the payment of death benefits.

Complaints related to buy now, pay later (BNPL) services spiked 57%, possibly driven by a growing number of consumers seeking alternative forms of credit due to rising interest rates and increased cost-of-living pressures.

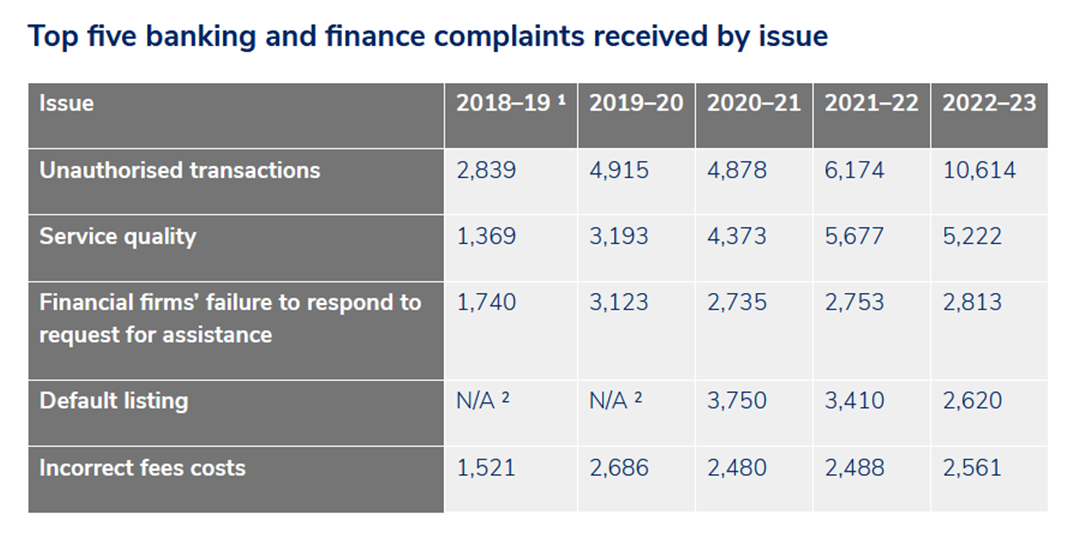

See the tables below for the top five banking and financial complaints by product and issue:

Who complained?

Across states and territories, New South Wales registered the largest number of complaints, at 31%, followed by Victoria (27%) and Queensland (18%). Western Australia comprised 8% of the complaints, South Australia, 6%, and ACT, 2%. Tasmania and Northern Territory both received 1% of total complaints.

Of the complainants, the majority were aged 40-59 (42%). This was followed by those aged 60 and over (24%), and 30- to 39-year-olds (21%).

“Throughout 2023–24, AFCA will continue to encourage banks and other finance providers to take active steps to identify and support customers experiencing financial hardship,” Locke said.

Access and read AFCA’s Annual Review 2022-2023.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.