Reviews by ASIC and others are forcing aggregators to step up, and brokers are happy with their response

For MPA’s 2016 Brokers on Aggregators survey, we introduced new questions related to ASIC’s remuneration review. The regulators are looking to aggregators for data and to gain an understanding of the broker market; brokers want to know exactly what’s going on and what it means for their business.

Reviews by ASIC and others are forcing aggregators to step up, and brokers are happy with their response

A distinctive feature of aggregators – and another way they differ from banks – is that their business model is nearly entirely dependent on brokers. If brokers disappeared, then aggregators would need to radically alter their business model to survive. That might sound extreme, but the outcomes of ASIC’s remuneration review – not to mention another review by the ABA – could spell chaos for brokers and therefore for aggregators.

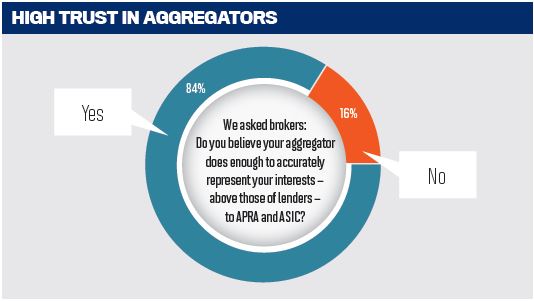

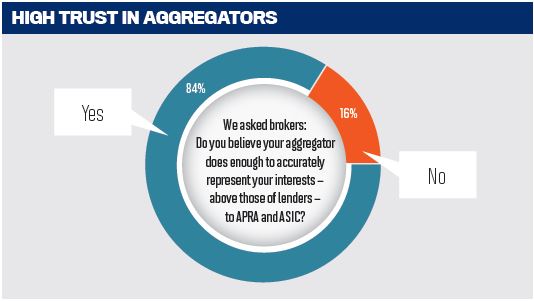

Despite all of this, it’s unclear whether advocating for brokers in the public space is necessarily part of an aggregator’s job. It’s certainly a big ask, given most aggregators have close to zero public profile or lobbying resources, and some are owned or heavily reliant on banks, whose stance in the commission review has been (perhaps deliberately) difficult to ascertain. Nevertheless, ASIC has reached out to aggregators – through data requests, roundtables and meetings – so brokers are dependent on aggregators to represent their interests and keep them informed.

What’s clear is that the vast majority of brokers trust their aggregators – 84% believe their aggregator will represent their interests above those of lenders. AFG and Outsource received particular praise from their brokers for their public advocacy of brokers. One AFG broker commented that “their advocacy for brokers during the ASIC review has been immense. Keep up the fantastic work”. An Outsource broker noted that “Tanya Sale always has her Mortgage Advisors as her top priority especially when she fights the banks on her behalf or ASIC for that matter. You always know they are on your side and you are working for the same cause”.

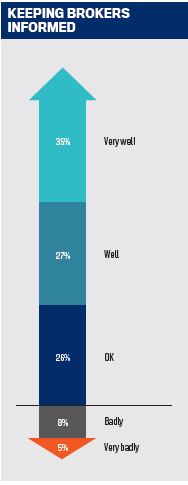

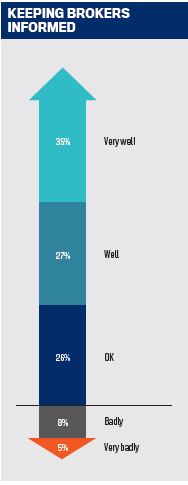

Through their vocal commentary both within and outside the industry, AFG and Outsource have made it clear that they back brokers, and brokers have noticed. Other aggregators were celebrated for keeping their brokers updated behind the scenes about the review and other new regulations: FAST were endorsed by one of their brokers for their “continual updates in the changing market – paying particular attention to ASIC and APRA regulations and guidelines – they make life simpler for the broker”. With some considerable exceptions in the comments, the numbers suggest that brokers are satisfied that their aggregators are keeping them informed about ASIC’s review.

There are some suggestions that the current regulatory pressures will have long-term consequences for brokers and aggregators.

Our ranking of aggregator services (see p42) shows that compliance support has jumped up the rankings from sixth most important service in 2015 to third this year. While compliance is most important at the lower end of the volume scale, even the most high-performing brokers gave it an average importance rating of 4.04 (4 corresponds to ‘important’).

Compliance support brings in a number of other services, most obviously an aggregator’s competence in training and education. The comments in this survey suggest that most brokers view compliance support as an aggregator helping them to stay safe while taking the minimum time out of their business. As one eChoice broker put it, “eChoice provide an excellent compliance system making it almost impossible to not meet NCCP requirements. All documentation is provided with a fail-safe check system, making me confident that I have not missed anything. This allows me to spend more time on customers and their needs”.

While future surveys will be needed to confirm any long-term changes, this year’s survey suggests that 2016’s regulatory changes are having an effect on what brokers want from their aggregators. Some aggregators have chosen to go public with their views, and their reputation has improved accordingly. Other aggregators have successfully stepped up their compliance support and communication to their brokers (not all, however). Compliance support, it appears, is becoming much more than an issue for junior brokers; it’s essential for every brokerage.

Reviews by ASIC and others are forcing aggregators to step up, and brokers are happy with their response

A distinctive feature of aggregators – and another way they differ from banks – is that their business model is nearly entirely dependent on brokers. If brokers disappeared, then aggregators would need to radically alter their business model to survive. That might sound extreme, but the outcomes of ASIC’s remuneration review – not to mention another review by the ABA – could spell chaos for brokers and therefore for aggregators.

Despite all of this, it’s unclear whether advocating for brokers in the public space is necessarily part of an aggregator’s job. It’s certainly a big ask, given most aggregators have close to zero public profile or lobbying resources, and some are owned or heavily reliant on banks, whose stance in the commission review has been (perhaps deliberately) difficult to ascertain. Nevertheless, ASIC has reached out to aggregators – through data requests, roundtables and meetings – so brokers are dependent on aggregators to represent their interests and keep them informed.

What’s clear is that the vast majority of brokers trust their aggregators – 84% believe their aggregator will represent their interests above those of lenders. AFG and Outsource received particular praise from their brokers for their public advocacy of brokers. One AFG broker commented that “their advocacy for brokers during the ASIC review has been immense. Keep up the fantastic work”. An Outsource broker noted that “Tanya Sale always has her Mortgage Advisors as her top priority especially when she fights the banks on her behalf or ASIC for that matter. You always know they are on your side and you are working for the same cause”.

Through their vocal commentary both within and outside the industry, AFG and Outsource have made it clear that they back brokers, and brokers have noticed. Other aggregators were celebrated for keeping their brokers updated behind the scenes about the review and other new regulations: FAST were endorsed by one of their brokers for their “continual updates in the changing market – paying particular attention to ASIC and APRA regulations and guidelines – they make life simpler for the broker”. With some considerable exceptions in the comments, the numbers suggest that brokers are satisfied that their aggregators are keeping them informed about ASIC’s review.

There are some suggestions that the current regulatory pressures will have long-term consequences for brokers and aggregators.

Our ranking of aggregator services (see p42) shows that compliance support has jumped up the rankings from sixth most important service in 2015 to third this year. While compliance is most important at the lower end of the volume scale, even the most high-performing brokers gave it an average importance rating of 4.04 (4 corresponds to ‘important’).

Compliance support brings in a number of other services, most obviously an aggregator’s competence in training and education. The comments in this survey suggest that most brokers view compliance support as an aggregator helping them to stay safe while taking the minimum time out of their business. As one eChoice broker put it, “eChoice provide an excellent compliance system making it almost impossible to not meet NCCP requirements. All documentation is provided with a fail-safe check system, making me confident that I have not missed anything. This allows me to spend more time on customers and their needs”.

While future surveys will be needed to confirm any long-term changes, this year’s survey suggests that 2016’s regulatory changes are having an effect on what brokers want from their aggregators. Some aggregators have chosen to go public with their views, and their reputation has improved accordingly. Other aggregators have successfully stepped up their compliance support and communication to their brokers (not all, however). Compliance support, it appears, is becoming much more than an issue for junior brokers; it’s essential for every brokerage.