More homeowners are turning to side hustles and family support to maintain financial stability

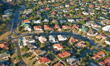

Australians are exploring new financial strategies to cope with ongoing cost-of-living pressures while keeping homeownership within reach, according to new research from Great Southern Bank.

Despite 64% of Australians reporting that their financial plans have been delayed by at least 12 months due to economic challenges, many remain optimistic about their long-term financial security.

The bank’s “No Place Like Home” report revealed that 62% of Australians feel their financial security is the same or better than it was two years ago, while 40% of homeowners remain confident in achieving their long-term financial goals.

A growing number of Australians, particularly younger generations, are turning to additional sources of income to manage mortgage repayments and stay on track financially.

The report found that 67% of homeowners have either started or are considering starting a side hustle, hobby business, or second job to supplement their income. This trend is especially strong among millennials, with 40% of millennial homeowners planning to start a side hustle, 21% considering a second job, and 11% eyeing small business opportunities.

“The third phase of our ‘No Place Like Home’ report shows continued hope and resilience among Australian homeowners, despite current financial and economic pressures,” said Megan Keleher (pictured above), chief customer officer at Great Southern Bank. “It’s encouraging to see that they are using their entrepreneurial spirit to think about ways to boost their incomes and stay focused on paying off their home.”

In addition to finding new income sources, the report also found that many Australians are turning to family for support. Nearly four in 10 or 39% of Baby Boomers who have adult children living at home are happy for them to stay indefinitely, while 7% of Australians have either moved back in with family or had adult children return home in the past two years.

Parents are also helping the next generation achieve homeownership. Fifty-eight percent of parents with children at home believe their children will be able to buy a home between the ages of 26 and 35. Additionally, 10% of homeowners are considering downsizing to contribute to their children's home deposit.

“More than before, we’re seeing would-be homeowners looking for ways to save money and achieve their financial goals, even if it means taking a longer-term view,” Keleher said. “Our research confirms many homeowners also want to be in a position to help their family members have the long-term financial security that homeownership brings.

“Irrespective of whether your parents are able to help, there are many pathways to homeownership. We are passionate about helping all Australians own a home and that means being here to help guide customers through the options – from state government homebuyer incentives to the Australian government’s Home Guarantee Scheme or shared equity programs to buy with a smaller deposit.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.