Lending stays strong despite 13 interest rate hikes since 2022

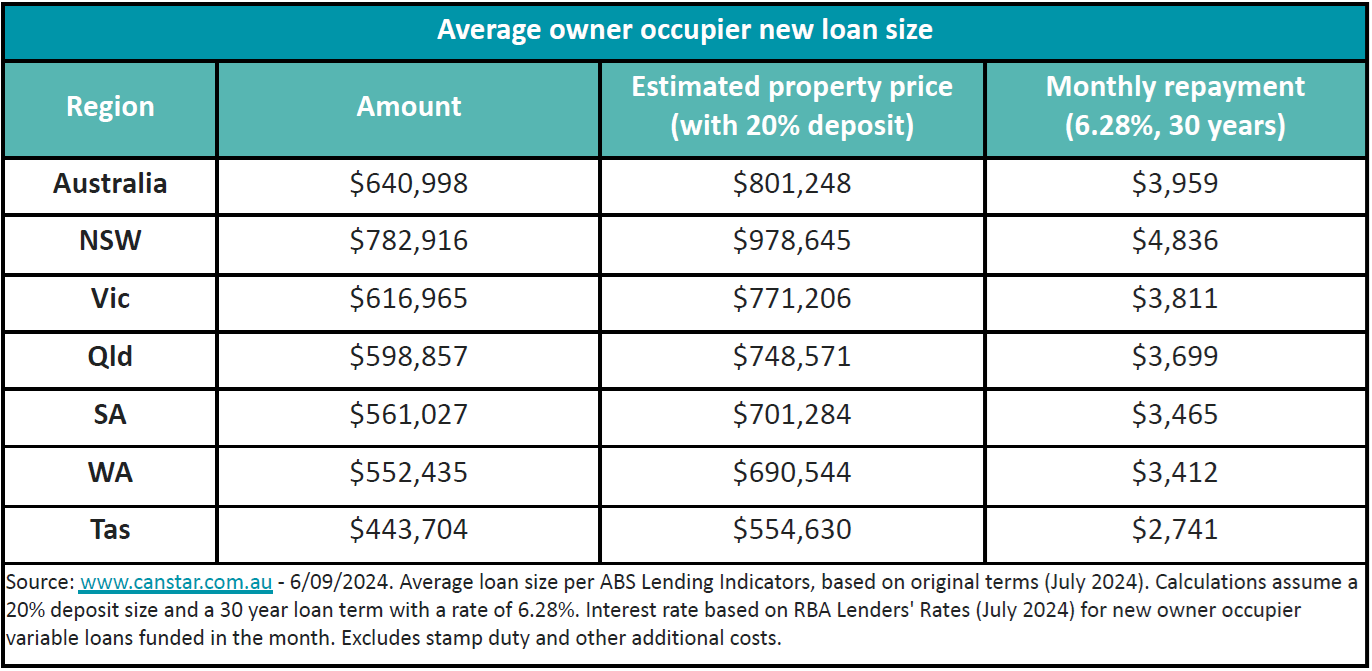

The average loan size for owner-occupiers in Australia has reached a record high of $640,998, according to new data from the Australian Bureau of Statistics (ABS).

This represents an 8.1% increase from the $593,213 average in July 2023, despite the Reserve Bank of Australia (RBA) holding firm on interest rates.

Canstar’s analysis indicates that an owner-occupier with a 20% deposit is now likely purchasing a property worth approximately $801,248, excluding stamp duty and other costs.

“The average new owner-occupier loan size just hit another record high as borrowers continue to dig a little bit deeper to get in that winning bid,” said Sally Tindall (pictured above), data insights director at Canstar, commenting on the latest ABS lending indicators report.

“This data suggests across the country, the average owner-occupier with a 20% deposit is now shelling out over $800,000 for a property and committing to an estimated repayment that’s almost $4,000 a month.”

In addition to rising loan sizes, market activity has increased across all sectors. The total number of owner-occupiers and investors rose 6.8% in July from the previous month and 26.2% year-over-year. In total, 53,899 new buyers entered the market during the month, pushing total lending to $30.58 billion, the highest level since May 2022, when interest rate hikes first began.

Investors are leading the surge, with their numbers growing 5.2% month-on-month and 35.4% annually. The value of loans to investors rose by similar figures, according to seasonally adjusted data. Meanwhile, lending to first home buyers grew by just 0.8% in July, indicating slower progress in this segment of the market.

“Thirteen rate hikes later and Australia’s home loan market is still thriving with almost $30.6 billion in new loans settled in just one month,” Tindall said.

“Investors, in particular, have dominated the market in recent months, with the value of new loans recording its sixth consecutive rise, up a staggering 35% compared to the previous year.”

While first home buyer activity remains subdued, with around 10,000 loans settled in recent months, Tindall noted that the influx of properties coming onto the market during Spring could offer opportunities. However, she suggested that some first home buyers may need to explore alternative strategies, such as investing in lower-priced markets, to enter the property ladder.

ABS data shows that only 7% of first home buyers in July were investors, with just 795 loan commitments made by first-time buyers seeking investment properties.

“If you’re priced out of the market you live in, it could be time to think of a plan B,” Tindall said.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.