"It's never been a better time to do a stocktake on your home loan"

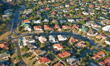

With autumn approaching, Bendigo Bank has encouraged Australians to examine the suitability of their home loan for the current economic conditions.

Richard Fennell (pictured), chief customer officer of consumer banking at Bendigo and Adelaide Bank, emphasised the timing opportunity presented by the seasonal change for Australian households to review their finances.

“With cost of living presenting challenges for many Australians, it’s never been a better time to do a stocktake on your home loan,” Fennell said. “At Bendigo Bank, we have a variety of different options to suit your needs and a long list of mobile lenders and in branch lending specialists to help you save money along the way.”

Aiming to assist Australians in evaluating their financial situation and exploring potential savings by switching lenders, the bank now offers a complimentary home loan health check.

“A home loan health check is where we go through all the customers current loans and accounts with other banks, and we figure out the best option going forward for what it is they need,” said Amanda Flemming, mobile lending manager at Bendigo Bank.

Flemming also shared how a couple, Penny and Ross Norris, upon her recommendation, were able to reduce their monthly repayments by approximately $481 and saved $5,772 in their first year of their home loan.

“We pride ourselves on feeding into the prosperity of our customers and communities, not off them – so you can rest easy knowing your bank is helping the communities in which they operate at the same time as receiving fantastic products and services,” Fennell said.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.