The customer-owned banks enjoy their moment in the spotlight as they showcase to brokers what sets them apart from traditional lenders

The customer-owned banks enjoy their moment in the spotlight as they showcase to brokers what sets them apart from traditional lenders

THE ROYAL COMMISSION’S interim report found that the mainstream banks’ emphasis on selling and generating a profit trumped honesty, good judgment and diligent leadership, allowing customers’ best interests and needs to go neglected.

Most will agree that 2018 was not a good year for the banks.

Their reputations and brands were damaged, customers and shareholders were angered, and cracks were exposed between executives and board members as bonuses, private conversations, decisions and practices were scrutinised in public. The findings cast a dark shadow over the entire banking sector, except for one small, little-known portion of it: the customer-owned banks. Just the name alone demonstrates something different – that customers are top of mind.

The customer-owned banking industry, which encompasses mutual banks, credit unions and building societies, is different from regular for-profit banks.

Customer-Owned Banking Association (COBA) explains it, profi ts are not paid to external shareholders but are put back into better products and services for customer members and the local community.

.jpg) Customer-owned banks are in the business of putting people before profits, which they regularly demonstrate through their investments in community and conservation projects.

Customer-owned banks are in the business of putting people before profits, which they regularly demonstrate through their investments in community and conservation projects.

“With the customer-owned model, 100% of profits are used to benefit the customers. Our sector is profit-making but not profit-maximising. We’re not trying to squeeze our customers to please shareholders. We’re not perfect, but we are not conflicted about who we are working for,” said Mike Lawrence, CEO of COBA.

So, while most banks faced some degree of public discontent last year, the customer-owned banks’ profiles and books grew as customers sought out better alternatives.

Residential lending in the mutual sector increased by 6.6% in 2018 to $89.5bn, according to the KPMG Mutuals Industry Review.

The customer-owned banks’ total assets grew to almost $116bn from $113bn, according to APRA’s September 2018 quarterly banking figures.

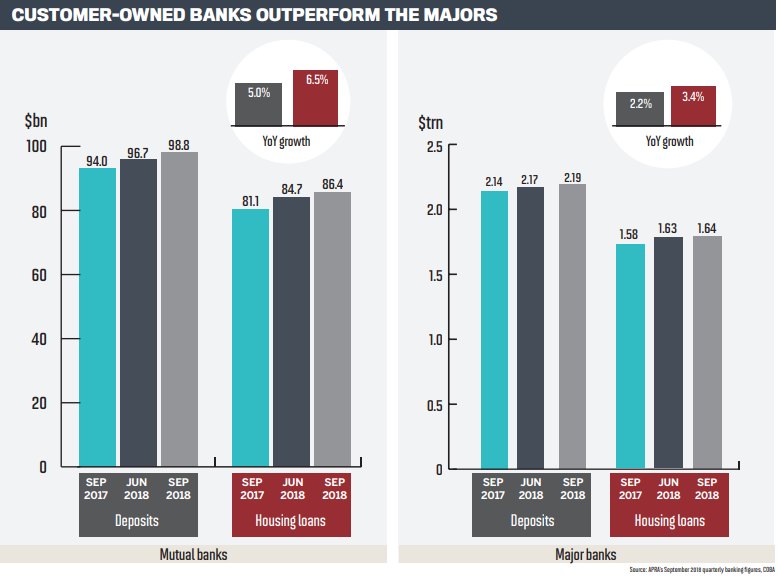

On top of that, the sector’s deposit and housing loan growth outperformed the major banks and system on both an annual and quarterly basis.

As customer-owned banks build on this momentum in the coming years, they will no longer be “the best-kept secret” but will instead see themselves working alongside brokers to drive competition and good consumer outcomes in a lending landscape that urgently needs professionals with high moral and ethical codes.

Broker heads from Bank Australia, Heritage Bank, Beyond Bank Australia and Teachers Mutual Bank discussed all this and more at MPA’s inaugural Customer-owned Banks Roundtable held in January. Read on to find out more.

Q: What reforms do you think are most needed to improve the broker sector and broker remuneration?

“For me, a lot of the heavy lifting is done,” said Vincent Lewis, partnerships manager at Bank Australia, who kicked o the conversation by commending the work of the Combined Industry Forum. Many of the major and second-tier banks have now removed bonus and soft-dollar incentives and based upfront commission on the funds drawn down net of offset.

“Those were the key issues I saw that were the bugbear of everybody, and certainly [Commissioner] Hayne has focused greatly on that.

I don’t think we should be looking at the flat-fee structure.

I don’t think there is any relevance to that, but we’ll wait and see,” Lewis said.

“We’re seeing and hearing that people want a change from their bank because of the behaviour demonstrated during the royal commission” Mark Middleton, Teachers Mutual Bank

As for trail, he thinks that’s a topic that deserves more discussion.

“Trail should continue, but I think there probably is a good argument to say trail should be continued based on the commitment to review it annually or biannually to justify it.

We all know it’s justifiable, but the market out there is saying there is concern.

Just refuse that argument by having a process around it, which I think they have been doing in the financial planning environment for some time,” Lewis said.

Mark Middleton, head of third party distribution at Teachers Mutual Bank, which includes UniBank and Firefighters Mutual Bank, said, “One of the issues [that might arise] post-royal commission is that we are focusing on the need for more changes to the broker sector.

Whilst this is important, we’re of the view that we need to appreciate what’s just been completed by the CIF.

“I believe if there are any changes to come, we’d want to see brokers appropriately remunerated for their hard work,” Middleton said.

“They are an essential part of the home loan industry.” Not only would a flat-fee model affect brokers directly, but it would have consequences for various other industries and consumer choice. “There are 27,000 people employed in this sector. You don’t want to have 27,000 unemployed people,” he said.

Brokers have played a huge part in growing the footprint of Teachers Mutual Bank, which entered the broking sector in late 2013.

“Without brokers, our sector would not have the same level of brand awareness, and our ability to grow would be inhibited.”

Stewart Saunders, head of broker distribution at Heritage Bank, said that while it was important to recognise the headway the CIF had made, it was equally important to remember that the work was not over.

“It’s about continuing to evolve. What we did as an industry 12 months ago is very different to what we’re doing now, and we are continuing to provide better customer outcomes, and we need to constantly focus on that,” Saunders said.

“Whatever comes out in February from the royal commission will be further changes, and we’ll look at driving those outcomes, but it doesn’t stop next year once they’re implemented.

We need to continue to ensure that the industry is moving forward and is driving better outcomes and is really delivering for customers.”

While some of this can be done through self-regulation, other matters that drive different competitive interests will need to be regulated by the government, he said.

“And hopefully there aren’t any unintended consequences.” As for trail, that’s something that would be very difficult to change without legislation, Saunders said.

“I think all of us around the table would agree that there is nothing fundamentally wrong about the current model, and there are alternative models that could potentially work.

It is a big change that would need to be looked at holistically.”

Darren McLeod, head of third party at Beyond Bank, said that what the CIF had been able to achieve in such a short period of time compared to other industries was remarkable.

“If you look at all the statistics, especially the ones that the MFAA has come out with around complaints in the broker sector compared to retail, there is so much evidence to say that [the broker model] is not broken,” McLeod said.

“I don’t think the broker sector directly needs any more reforms.”

However, he noted that whatever changes the royal commission recommended to lenders around responsible lending and living expenses would be passed down to all distribution channels, including brokers.

If a fee-for-service model was introduced, it would reduce the overall flow through brokers, which mutual banks were reliant on.

“This will have a negative impact on our organisations’ flows and threatens to stunt our growth objectives,” McLeod said.

As lenders have tightened up on credit requirements, brokers have already seen the impact on their bottom line.

Broker loan volume dropped by 3% from $51.7bn to $50.1bn between the September 2017 and September 2018 quarters, according to data from the MFAA and Comparator.

CoreLogic’s Pain and Gain Report showed that, during the September 2018 quarter, 11.1% of properties across the country resold for less than their purchase price, making this the weakest quarter for profitable resales since 2013.

.jpg)

Q: How have these changes affected you as brokers, and how are you handling the increased workload that comes with it?

Gio Migheli, principal at Astute Financial in North Sydney, said that since all brokers under the Astute aggregation group had been looking at living expenses and getting three months’ worth of bank statements from customers for some time, it wasn’t a big adjustment for them.

“It is getting a little tougher as some of the banks drill down into those statements more and more … that’s taking more time now, whereas before you accepted what they had and if it was roughly around HEM you would lodge it,” he said.

Over the last 12 months, with the major banks tightening their purse strings and lead times stretching out to two weeks, Migheli has started looking elsewhere for funding.

“We’ve used Bank Australia a bit in the last 12 months because I’ve found them to be very easy, with good products and great rates, and I’m looking at the other mutuals.”

He estimated that about 70% of his loans were now going to banks other than the big four.

Q: What challenges and/or opportunities do you think the royal commission’s recommendations will present for customer-owned banks?

A recurring theme at the roundtable was the alignment between the philosophy and principles of customer-owned banks – which are beholden to their customer members, not shareholders – and good consumer outcomes.

The roundtable participants representing banks said that since their organisations were not driven by increasing profit margins they were able to deliver better customer outcomes as a result. Customer-owned banks have an opportunity in the post-royal commission climate to showcase what a great alternative to the for-profit banks they are, Saunders said.

“That doesn’t generate the headlines that some of the scandals have, but I think you need to look at what the fundamental difference is for customers in the customer-owned sector where you don’t have that favour of profit over everything else.”

The royal commission showed that much of the banks’ poor behaviour and misconduct was driven by greed.

.jpg)

Generating more money for shareholders was put before customers’ interests. Patrick Sheppard, principal adviser at Appian Way Financial Services, said, “For me as a broker, it’s about philosophy and culture, and about how you treat your partners in business and your customers.

You never want to put a client that you’ve got a good relationship with a lender that’s going to treat them poorly, because that will reflect poorly on you.”

Sheppard has found that the customer-owned banks generally provide brokers with better service. “It’s less ‘computer says no’ and more ‘pick up the phone and ask them what’s going on and what’s outside the square and let’s find the solution’.”

Middleton said Teachers Mutual’s service was about taking people’s feedback on board and doing something about it.

“We ring back and say, ‘We’ve addressed that; here’s the outcome’, and they’re surprised that someone has actually listened to them.

This is not the experience at other banks,” he said.

Lewis was frank about the value that customer-owned banks provide.

“We are the best-kept secret,” he said.

He explained that the difference between customer-owned banks and the big four was who they were responsible to (members/ customers); the type of lending they engaged in (responsible lending; companies that do no harm); and their underlying values that prioritised giving back and helping the community.

.jpg)

“That’s not well known, but once people do discover that they’ll come to us in droves,” Lewis said. While customer-owned banks still face competition from other second-tier and non-major lenders, as well as neo banks and fintechs, Lewis doesn’t believe these lenders can provide the same high level of customer service and good consumer outcomes that customer-owned banks are known for.

Q: Have you received more business from brokers this past year?

Over the last year customer-owned banks have seen an increase in business, which is partly due to brokers seeking more ethical and sustainable options for their clients, Middleton said.

“There probably is a good argument to say trail should be continued based on the commitment to review it annually or biannually” Vincent Lewis, Bank Australia

Teachers Mutual Bank had its biggest 12 months on record.

“As an industry, the brokers have been very supportive of the new opportunities as mutuals have come in.

We’re very thankful that brokers have taken to us,” Middleton said.

“Constantly, we’re seeing and hearing that people wanted a change from their bank because of the behaviour that had been highlighted during the royal commission, and they wanted out.”

“There are winners and losers out of every change that’s made, and we need to be very careful of the unintended consequences” Stewart Saunders, Heritage Bank

In the last three to four months, Lewis said Bank Australia had seen a massive uptick in business. In November the bank received more than 500 loans when it usually received around 250.

What brokers appreciate most about Bank Australia is that it keeps them in the loop.

“Our scenarios team doesn’t just say no,” Lewis said.

“We talk about how we can structure it. … We’re constantly communicating [with the broker].” However, customer-owned banks are facing some challenges of their own.

The royal commission’s recommendations mean there are many unknowns ahead for the smaller lenders.

“The concern is how the findings will impact the customer-owned banking sector and that we have to bear the sins of the majors as well,” Saunders said.

“Being smaller organisations, increased regulation has a disproportionate impact on us. There have been no negative findings for customer-owned banks, yet we will have to bear the same regulatory pressure as the major banks.

“There are winners and losers out of every change that’s made, and we need to be very careful of the unintended consequences of those changes.”

That one-size-fits-all approach to regulation disadvantages smaller lenders, as do capital requirements, McLeod added.

“We got really heavily penalised [by the APRA investor and interest-only caps], and our business really suffered as a result.”

McLeod said the cost of implementing the new systems and processes designed to deal with the changes is another barrier.

“Obviously, money and resources are not as easily accessible as they are for the big four – smaller mutuals especially will find it tough to keep up with what’s required and compete at the same time,” he said. “Competition is tough and fierce at the moment.

Beyond Bank Australia is entering new markets, and brand awareness and the cost of marketing is a real challenge for a mutual our size.”

Looking forward, though, the pros seem to outweigh the cons for customer-owned banks, which are seeing a shift in what the new generation of bank customers are looking for – companies that act ethically and sustainably and abide by the values they espouse.