Lack of supply boosts demand

Buyer interest in apartments on the Gold Coast has skyrocketed with a lack of supply helping propel interest.

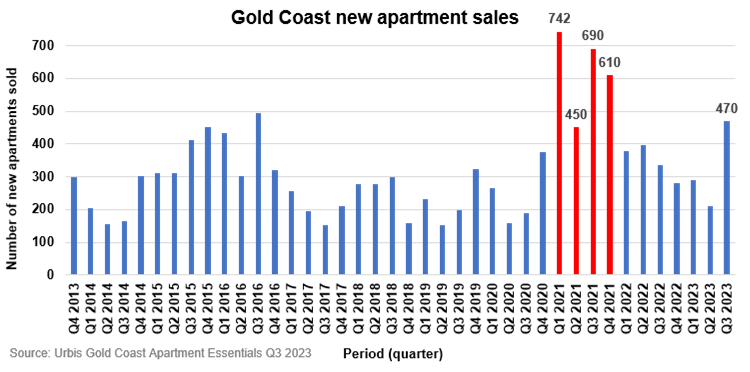

New data from town planning experts Urbis revealed there had been a significant increase in apartment sales in recent months, which are up 470 in the last quarter, more than double what they were in the previous quarter when they sat at 200.

Urbis director Paul Riga (above left) said the majority of sales were centred around the traditional apartment precincts of Surfers Paradise, Broadbeach and Main Beach, with the remainder of sales along the Gold Coast limited by the lack of new projects.

Build-to-sell apartment projects on rise in Gold Coast

He said in a significant new trend, a number of projects that were constructed to be used as build-to-rent projects had been switched to build-to-sell projects instead, signifying developers’ desire to capture sales in a constrained supply environment.

“What the data tells us quite simply is that the demand for apartments has remained strong, with new developments harnessing the purchasers,” said Mr Riga.

“This is great for the property market, it underpins property prices but creates further problems with supply – meaning if new projects don’t get underway the supply will continue to diminish.”

The data also showed of the 1,770 apartments remaining for sale at the end of September – 82% were in Surfers Paradise, Main Beach and Broadbeach.

The areas of North Shore, Coastal Fringe and Southern Beaches Precincts all have a limited supply with just 264 apartments remaining for sale across all three precincts and of the five new project launches during Q3 2023 – four are in Broadbeach and Main Beach.

Buyers look for lower-cost entry into Gold Coast apartment market

Gold Coast-based Mortgage Choice franchise owner Deslie Taylor (pictured above centre) said she too has seen increased demand for apartments on the Gold Coast.

Taylor said as a result of conversations and research conducted by her team, buyers are looking for a lower-cost entry into the Gold Coast hotspots thanks to the great lifestyle on offer without the hefty price tag that may come with a stand-alone house.

She said as a result of a lack of stock, some buyers – ranging from locals to interstate and international investors – were broadening their scope to invest in a diverse range of properties.

“Our clients are no longer feeling the need to remain locked into a specific type of property and or location due to lack of stock on the market. They are diversifying their approach to ensure they can get into the market.”

According to Taylor, most clients closer to retirement age look to sell and downsize into a unit along the water.

“However certainly the investor is keen to grab an apartment for their portfolio with most planning on the holiday rental option for as high a yield as possible.”

Taylor said investors also see value-for-money in Gold Coast properties when compared to the Sunshine Coast and the southern states of Australia.

“Given the Gold Coast is such a large area we are aware that some locations have a better overall return than others, it’s a case of ensuring all research on property choice is completed before entering into the market.”

Taylor said many buyers are also excited about the future of south eastern Queensland and the Gold Coast area thanks in part to the pending Olympic Games in 2032 and the great lifestyle and career opportunities it offered.

Gold Coast property investment market remains resilient

Highland CEO David Highland (pictured above right) said the Urbis data underpinned the resilience of the market.

His Sydney-based company has expanded its operations to the Gold Coast and is marketing the Sammut Group’s Coast apartments under construction on Garfield Terrace at Surfers Paradise.

“What this shows us is that demand for the Gold Coast has not diminished since the boom times brought about after the COVID pandemic,” Highland said.

“We are still seeing very strong interest from Sydneysiders keen to either move to the Gold Coast or at least take a stake in the Gold Coast’s future by purchasing an apartment here.

“The problem is that unless construction costs stabilise there may not be the stock required to meet demand.”

Despite a drop in population growth, according to a recent report from real estate firm Colliers, the Gold Coast’s property market continues to prosper.

Colliers research also reveals that office space on the Gold Coast is in hot demand with supply set to dry up in 2024 and 2025.

What makes the Gold Coast such an appealing place for property developers? Share your thoughts below