"They can help bridge the knowledge gap by providing a clear explanation of LMI"

Mortgage brokers play a pivotal role in guiding prospective home buyers through the complexities of lenders mortgage insurance (LMI), according to a recent survey.

Conducted jointly by Helia and the Mortgage & Finance Association of Australia (MFAA), the research delved into mortgage broker perceptions of LMI, their communication about LMI with clients, and the current level of understanding among home buyers regarding LMI.

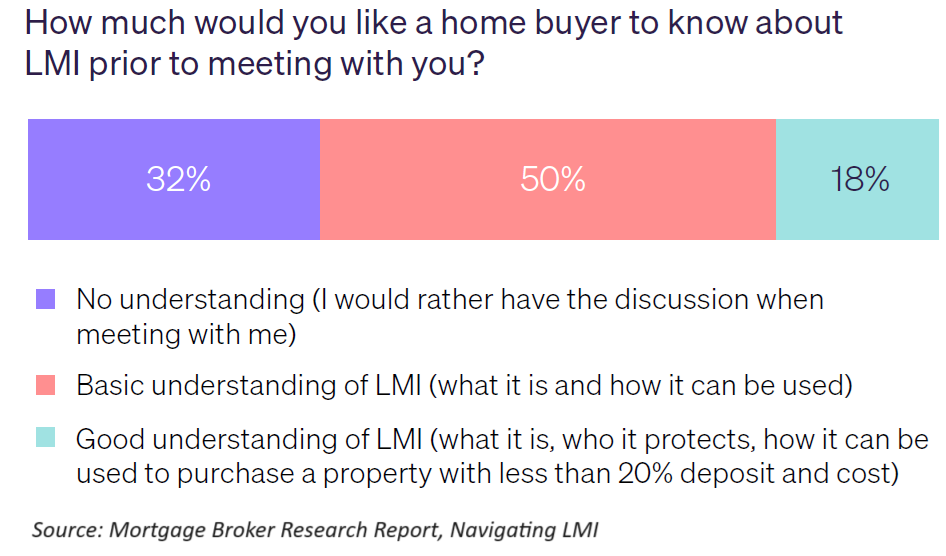

LMI serves as an avenue for home buyers with less than a 20% deposit to meet the requirements for a home loan. The survey, which garnered responses from over 250 mortgage brokers, revealed that half of them prefer clients to possess a basic knowledge of LMI prior to their initial interaction with a broker.

Greg McAweeney (pictured left), chief commercial officer at Helia, underscored the indispensable role of mortgage brokers in explaining LMI to home buyers.

“As trusted advisors, mortgage brokers can help bridge the knowledge gap by providing a clear explanation of LMI and how it can benefit home buyers to get into their home sooner,” McAweeney said.

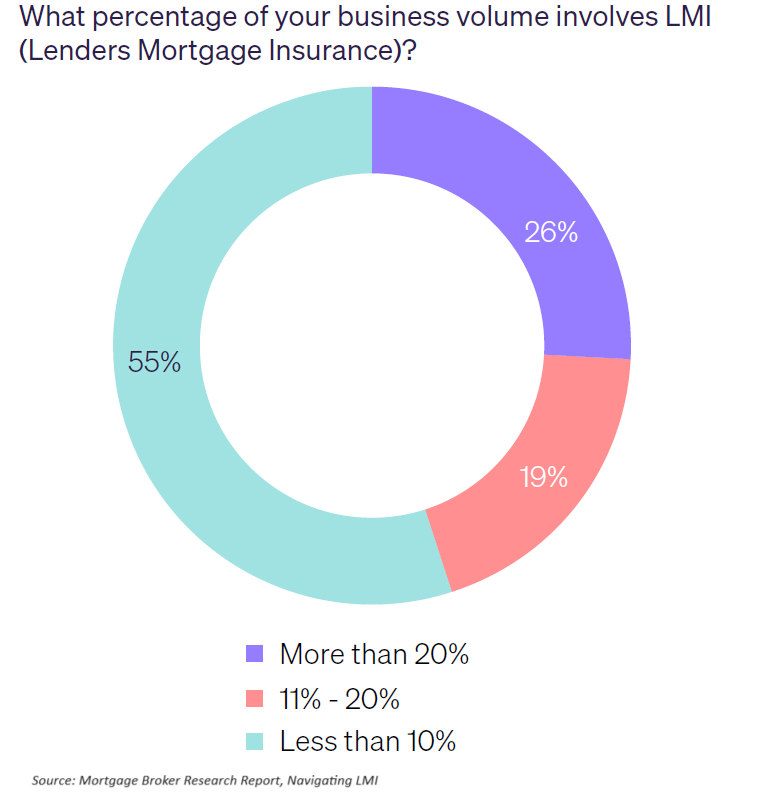

According to the survey, the primary challenge faced by clients in navigating LMI is comprehending its cost-benefit dynamics. Despite LMI’s potential to expedite home purchases, it is not frequently recommended by mortgage brokers, with 74% of respondents indicating that less than 20% of their business volume involves LMI transactions.

Commenting on the research, Anja Pannek (pictured right), chief executive at the MFAA, highlighted the significance of mortgage brokers in enhancing market choice and competition by determining products tailored to clients’ needs, including LMI.

“Mortgage brokers are a trusted source of information for home buyers and are in a position to explain how LMI works as they do all options for buying a home,” Pannek said.

“We know that mortgage and finance brokers increase both competition and choice for home buyers through identifying products that meet their specific needs. The research highlights that LMI could be part of this choice Australians have when it comes to securing a home loan, and it’s something they should know about.”

The insights gleaned from the research will support the development of resources aimed at educating both mortgage brokers and clients about LMI, enabling them to make informed decisions regarding their home buying options. These resources, which include case studies and a seven-point small deposit health check provided by Helia, aim to empower stakeholders in navigating the intricacies of LMI.

The upcoming Looking Ahead 2024 event next week will also highlight these findings and other insights from the report, offering stakeholders an opportunity to delve deeper into the implications for the mortgage industry.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.