What you need to know about construction finance

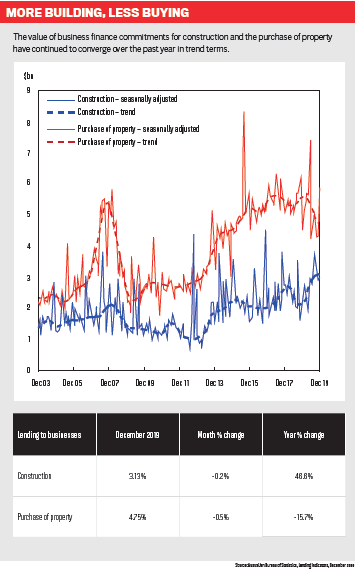

IT’S NO secret that the banks have pulled back from lending in a number of areas over the last couple of years. One sector that has been especially affected, thanks to restrictions imposed by APRA, the changing property market and the scrutiny facing the finance sector, is construction lending. But instead of leaving holes in the ground, brokers have been turning to one solution in particular: private funders and non-bank lenders.

After APRA introduced regulations limiting banks’ growth in investor lending to 10% and requiring a 30% cap on new interest-only loans, banks began increasing interest rates, constricting their loan-tovalue ratios and increasing presales hurdles, which made it more difficult for investors and developers to get loans.

As a result, brokers say they have had to turn more and more to private funders to get the loans approved.

One such lender, Supra Capital, says it has noticed a shift in brokers bringing more business to the company since the banking restrictions came into play, as the bigger banks don’t have the benefit of being flexible and tailoring individual deals to someone’s commercial merits.

The non-bank started out in real estate in the 1990s, and managing director Adriana Zuccala says there are benefits to be gained from the group’s experience.

“Being property developers historically, we understand the risks of construction funding at a practical level and can mitigate those risks in a way that’s very different to, or possibly won’t be permitted by, the inflexible criteria and regulation of the traditional banks,” she says.

“Being property developers historically, we understand the risks of construction funding at a practical level and can mitigate those risks in a way that’s very different” Adriana Zuccala, managing director, Supra Capital

So, what is construction finance and what trends are we seeing?

One of the biggest obstacles in securing construction lending from more traditional lenders is often the requirement to achieve significant presales, frequently as much as 100%, before finance will be given.

In the changing landscape, securing this high proportion of presales is often not only difficult but also undesirable.

“The difficulty of presales has been one of the bigger trends in the last couple of years, and this has been for a number of reasons,” says Zuccala.

“The limitations regarding interest-only loans have discouraged purchasers; overseas restrictions and additional taxes on foreign buyers have led to a drop in foreign investors; and changes to stamp duty concessions have removed incentives to buy off the plan.”

Further, Zuccala notes that there is a growing trend of younger Australians preferring to rent instead of buying a new home. As a result, developers are often keen to hold the developed product. In such cases, this requires developers to provide further equity to maintain LVRs.

“Those lower LVRs mean developers are not using their equity as well as they could or should,” adds Zuccala.

By contrast, Supra Capital can not only offer less stringent presales requirements and higher LVRs but will also consider the experience and track records of the developer and project teams, other asset positions and the proposed exit strategies.

Supra Capital may also provide mezzanine debt behind a bank as financing that the developer would otherwise need to chip in, thereby reducing the potentially onerous LVR requirements imposed by the traditional banks.

Andrew Samios, the director of ADS Property Finance Pty Ltd, deals with high-networth developers and has been no stranger to the struggles of acquiring construction finance from the banks over the last few years.

He says that, particularly in this space, banks will change their appetites frequently, and that is why he has turned more to nonbanks and private funders, working with the likes of Supra Capital. “What happens with the banks is they just put the brakes on, and they stop lending overnight,” he says.

How can non-bank lenders assist brokers?

For the non-bank lenders that can provide alternatives for borrowers, brokers are usually their main referral source. Supra Capital is no different and procures many of its financing opportunities directly from the broker channel.

Zuccala considers the relationship between non-banks and their brokers to be of the utmost importance, saying it is one of mutual collaboration and cooperation, comprising of complementary knowledge and expertise, with both parties focused on solutions, customer service and choice.

“Understanding the property market in the area of construction is vitally important to enable the proper assessment of risk,” says Zuccala.

“The speed at which we can analyse a deal and provide funding is faster than the major banks, because we’re more bespoke and our processes are less complex as a result of the lack of complexity of our organisation and regulatory framework, as opposed to the banks who do need to go through multiple layers of processes,” she adds.

This means that brokers are not only able to provide their clients with a more flexible approach to their construction lending requirements, but also a more timely one.

Samios has seen first-hand that the slowing of presales in the construction market has meant banks are harder to borrow from, and this is where he has benefited from turning to a private lender.

“In the private market we can negotiate with little or no presales,” he says. “That suits the developers, especially the experienced ones. They’re more than happy building in a market like Melbourne or Sydney, because that’s where people want to be, and where people want to be, they want to buy.”

What do brokers need to know about construction finance?

For brokers who are new to construction lending or have never worked in the space before, Zuccala recommends partnering with a broker who already has experience in the sector, and then partnering with a lender like Supra.

“We’re happy to work with brokers who have not necessarily worked in the space so we can explain to them what it is we need from the outset so that they can ensure they look after their client in the best possible way,” she says.

As a piece of advice, Zuccala says it can be good to start the process of getting funding two to three months before the client needs the finance to ensure enough time to arrange the various reports a funder will need, such as valuation reports and an initial report from a quantity surveyor.