Payment defaults also surge to record high

The rate of business failures in Australia has reached its highest level since January 2021, during the peak of the COVID-19 pandemic.

This was revealed in CreditorWatch’s August Business Risk Index (BRI), which showed business failure rate hitting 4.95% – a 17.3% increase since the beginning of the year.

The credit reporting bureau projects the rate to rise further, reaching 5.20% over the next 12 months.

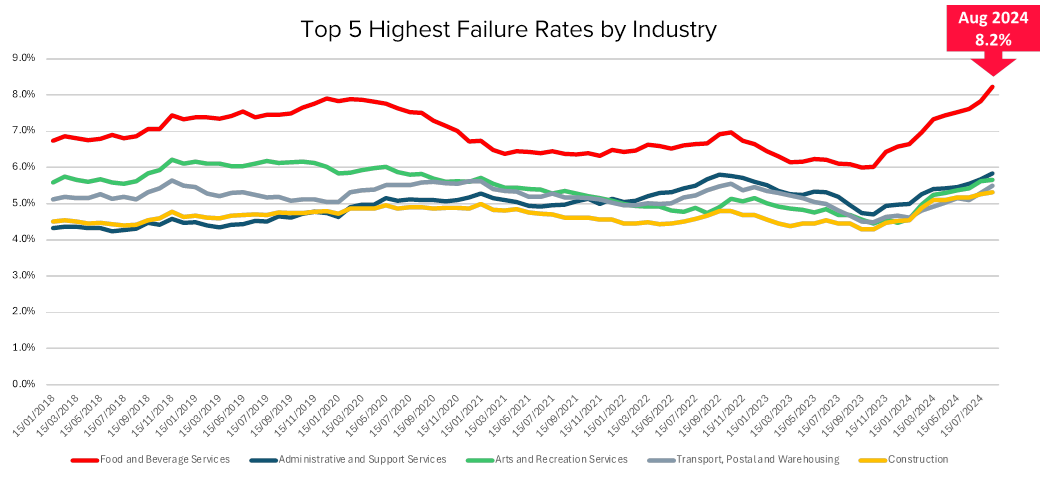

The increase in business failures has been attributed to weak consumer spending, high inflation, and rising interest rates. The food and beverage services sector is the hardest hit, with an 8.2% failure rate in August, followed by the administrative and support services sector at 5.8%. On the other end, the agriculture, forestry, and fishing sector recorded a lower failure rate of 3.3%.

The food and beverage sector is particularly under pressure due to rising costs and declining demand. Many businesses in this industry also face tax collection efforts from the Australian Tax Office (ATO) and are burdened by high rents in prime retail areas, making it difficult for them to relocate to lower-cost premises.

See LinkedIn post here.

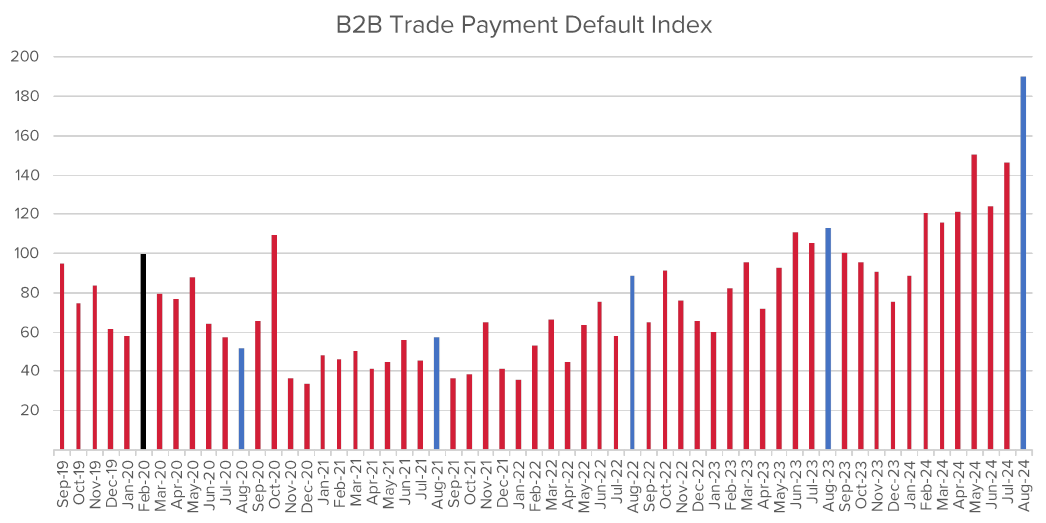

CreditorWatch’s data also shows a significant rise in business payment defaults, which have surged 68.1% in the past year, reaching record levels. This suggests that more businesses are struggling to pay their suppliers, further increasing stress in the business sector.

There is a strong correlation between payment defaults and business failures, with businesses facing one default having a 28% chance of closure within a year. This likelihood rises to 74% for businesses with four or more defaults.

Patrick Coghlan (pictured above left), chief executive of CreditorWatch, noted that the rising business failure rate highlights the need for interest rate relief.

“One of the biggest contributing factors to this increase in our business failure rate is the lack of consumer demand,” he said. “This is reflected in the ABS household spending and Westpac consumer sentiment numbers.

“Consumers won’t be inclined to open their wallets in any significant way until they get a reduction in their mortgage payments. A couple of rate cuts would also mean that credit becomes more affordable for businesses, and they are able to get back on the growth track as well.”

“Our data, consistently and for some time now, indicates that Australian businesses are operating under extremely challenging conditions,” said Anneke Thompson (pictured above right), chief economist at CreditorWatch.

“We don’t expect businesses to feel more confident until there have been at least two or three cuts to the cash rate. Unfortunately, this means it is likely things will get worse before they get better.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.