Expected Christmas trading surge fails to materialize

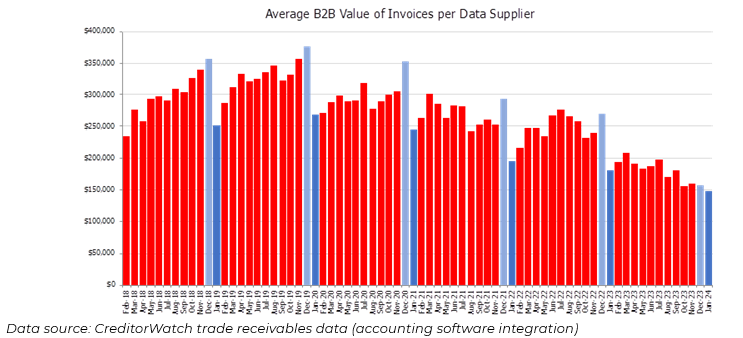

The average value of B2B invoices fell to a record low, indicating a continued decrease in business activity, according to the latest CreditorWatch Business Risk Index.

The anticipated increase in trade during December – a common occurrence in previous years – did not materialise and instead posted a 19% reduction in invoice value compared to January 2023, signalling potential difficulties for businesses that depend on a pre-Christmas boost.

CreditorWatch anticipates that trading conditions will worsen throughout 2024, as business and consumer confidence remains low and input costs stay high. This forecast aligns with the recent slump in Christmas retail sales, which fell by 2.7% from November to December, highlighting the impact of cost-of-living pressures on consumer spending.

Department stores and the hospitality sector, including cafés and restaurants, experienced a downturn in trade, deviating from the expected seasonal uplift.

Additionally, the rate of business failures increased in January, with external administrations surpassing pre-COVID levels.

“The retail trade numbers for December clearly showed that interest rate increases and high inflation are now exerting a huge amount of pressure on households, which translate to lower demand for goods and services,” said Patrick Coghlan, chief executive at CreditorWatch. “Our hope is that interest rate relief arrives sooner rather than later to ease cost-of-living pressures and stimulate demand.”

Anneke Thompson (pictured above), chief economist at CreditorWatch, added that the January 2024 Business Risk Index data reflects ongoing low consumer and business sentiment.

“It is looking increasingly likely that the first half of 2024 will be some of the most challenging operating conditions many businesses will have ever experienced,” she said.

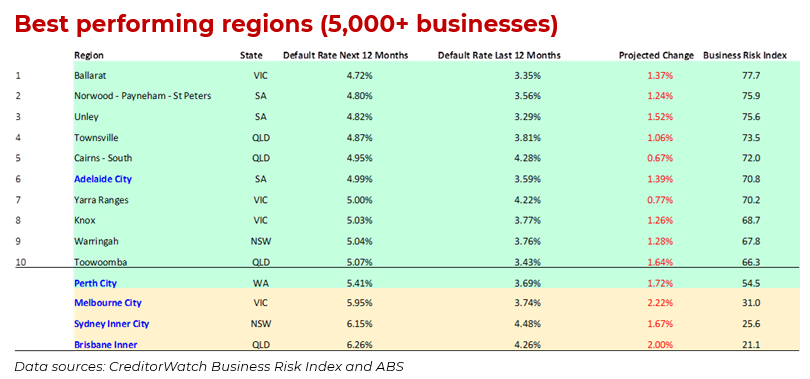

The report also outlines the regions with the lowest levels of business insolvencies, often associated with older populations and established businesses with lower debt levels. Conversely, areas with younger populations are experiencing higher insolvency rates, impacted by rising interest rates.

Predictions for business failure rates over the next 12 months identify the food and beverage services, public administration and safety, and accommodation sectors as having the highest risk.

The report suggests that the federal government’s policies affecting population growth, such as the reduction in student visas, will have mixed effects on the economy, potentially easing rental inflation but negatively impacting sectors reliant on population growth and overseas students for labour.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.