RateCity.com.au has the latest

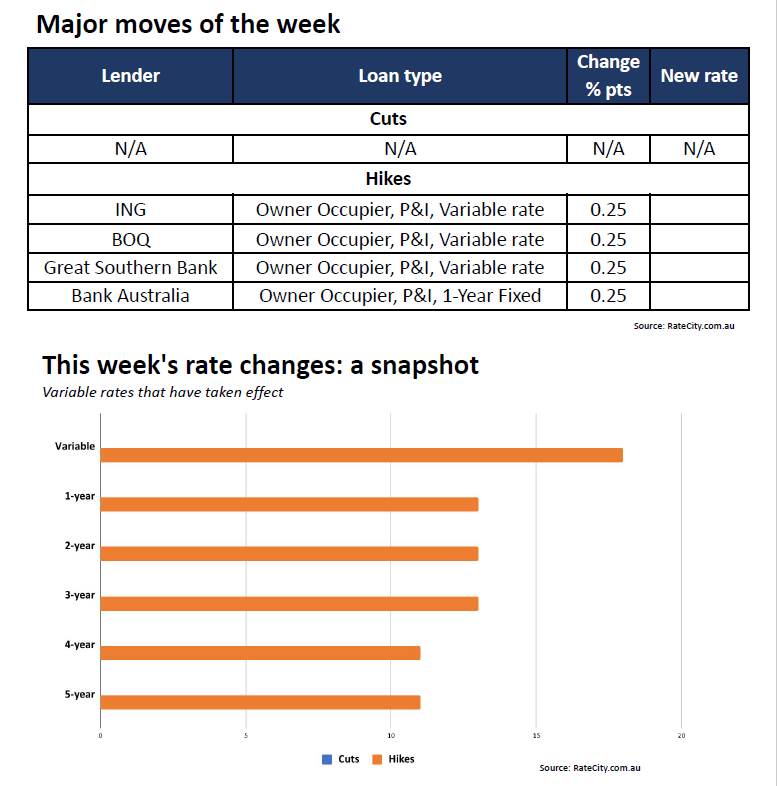

The mortgage market has been abuzz with activity this week, following Reserve Bank’s decision to raise the cash rate by 0.25 percentage points, according to RateCity.com.au.

Variable rate increases

During the week from Nov. 8-14, a majority of lenders promptly reacted to the RBA’s latest rate hike, passing on the entire 0.25 ppt increase to their variable mortgage rates – a move, Sally Tindall (pictured above), RateCity.com.au research director, said came as no surprise.

The exception, so far, is Transport Mutual, which announced that it will only pass on a 0.15 ppt increase to its existing customers.

Three of the big four banks are set to implement their rate increases this Friday, with Westpac following suit next Tuesday.

See table below for the latest mortgage rate changes, and the graph for a snapshot of last week’s variable rate changes.

Fixed rate changes

Within the fixed-rate space, lenders are responding to the elevated costs of wholesale funding against a backdrop of uncertainty, with Commonwealth Bank the latest to announce fixed-rate hikes, with its three-year fixed rate slated to increase this Friday.

“The fixed rate increases are, however, a moot point for many customers, as the majority of borrowers are opting to stay on variable until the dust settles,” Tindall said.

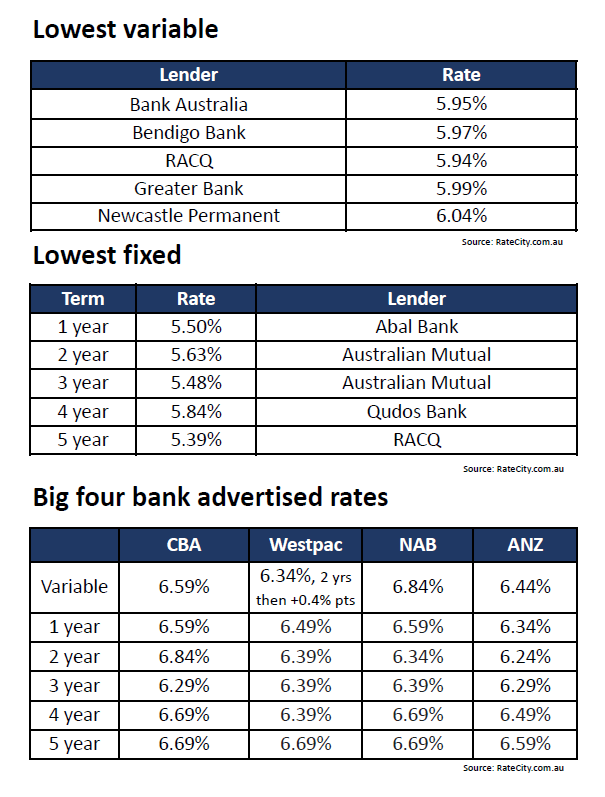

Updated rates

See the first two tables below for the lowest variable and fixed rates. And for the latest big four advertised rates, refer to the third table.

To learn about the rate changes the prior week, read "Latest mortgage rate changes revealed".

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.