Award-winning broker Marshall Condon has a bold vision to educate his generation, Gen Y, through his new brokerage and enable them to live the lifestyle they dream of sooner

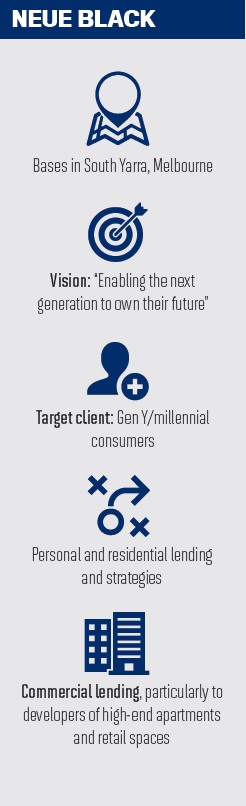

A year ago, one of the industry’s top brokers had a vision to launch his own brokerage, and soon it will become a reality when it officially launches at the end of March as Neue Black.

The brokerage will target millennials and serve as a ‘private bank’, catering for all their finance needs.

“We wanted our brand to be unique and to reflect our values,” says Neue Black’s founder and CEO Marshall Condon. “We’re a premium brand, for people that want a premium service and a level of sophistication. So far we’ve found everyone has responded very positively – we’re really happy about that.”

After four months working together with a branding company to create the look and feel of the brand, they settled on the name.

Part of the offering will be options for clients to put their equity in different asset classes, Condon says, and the wealth management side will involve platforms that offer different investment products that traditionally have been out of reach for many millennials.

.jpg)

The impetus for Neue Black started with Condon’s background in broking. Part of the industry since he left school, he got his broking start at Mortgage Choice and gained his Bachelor of Business in Economics and Financial Planning alongside his career. He then explored management in the banking world for a time before returning to the franchise and running his own branch in South Yarra for the past three years.

During this time he has been repeatedly recognised for excellence as a broker and carved a successful niche in the industry, providing an end-to-end service for property developers and their off-the-plan apartment buyers.

“I have always wanted to build my own brand and business,” says Condon. “It gives me a great feeling of satisfaction knowing I have built a great company with great people, delivering a worthy cause: enabling the next generation to own their future.”

Creating a brand

The biggest difference between a franchise model and starting your own brand is the support you receive to help you get up and running.

“The franchise model works really well when you’re starting out – they can be very supportive. When you venture out on your own you’re starting from scratch,” says Condon, as leaving the franchise also meant leaving behind his existing residential client base. But he says it is really a positive as it enables him to build the business the way he wants to and focus on targeting the Gen Y demographic. “The grass is definitely greener on the other side. Our marketing strategy focuses on generating in excess of 20,000 visits to our website in the first 12 months.”

Condon’s business-to-business focus on commercial loans is quite a different ball game to targeting millennials for residential mortgages but is an area he is still heavily involved in.

“We have a strong pipeline in the commercial channel, and that’s still a large part of the business. We’ve recently added another commercial broker. The rebrand complements the commercial side; however, we’re putting more resources into promoting our message for our residential clients throughout the launch campaign,” he says.

When MPA spoke to Condon for our Top 10 Commercial Brokers report in 2015, he said he had chosen to target the construction and development space because it was a growing area. “To mitigate the market risk, we have relationships with long-standing developers, and their site locations and product are of such quality that they will continue to develop when the market is not as buoyant,” he said.

Condon also made our Top 10 Commercial list in 2014 and said his time in banking had helped in the way he deals with lenders. “I quickly learnt that when you’re on the other side of the fence it is about the bank first rather than the customer – it was a fair mind-shift for me, coming from broking. One thing I’ve really worked hard on is to form relationships with bankers, so my relationship with the client is protected…they realise there are other deals to come.”

Condon and his team of four create a young, energetic work culture at Neue Black, based in South Yarra. They all came on board late last year and filled the roles of operations manager, head of commercial, and sales, marketing and administration support. Their backgrounds include banking and commercial, and one team member is also fluent in Mandarin.

“We love working in South Yarra. It’s close to the city and has a bohemian feel that our clients really enjoy. A lot of our clients live around the South Yarra area so our office location is convenient,” says Condon.

“Building a team with great people where attitudes and values align makes this a great place to work and has been personally rewarding for me. I really enjoy spending time with my team. We’ll keep growing by focusing on attitude and values.

“People will get to know us as a brand that understands people want sophistication, elegance, wealth and to still maintain a lifestyle. We’ve stayed true to this and we believe our values resonate through the brand and the customer experience.”

Educating a generation for financial success

When asked why he had decided to focus on Gen Y as his residential clientele, Condon revealed where his passion for his work comes from and how the brokerage was part of a larger vision: to contribute to making his generation more fi nancially savvy.

“Fundamentally, we’re enabling people to take control of a signifi cant part of their life. Whether it’s their fi rst home or fi nance for different assets, we believe it’s important to make the right decisions and have the right long-term strategy that will, essentially, set them up to have a secure future,” says Condon.

“Sometimes I think millennials leave it too late to look at fi nance or investing or even saving – we’re very much a spending generation, focused on living a comfortable lifestyle instead of focusing on balancing long-term wealth and lifestyle. We believe both are achievable.

“I think the millennials need to spend some time thinking about what the economic climate will look like at retirement age. Let’s say the resources boom will have ended by 2040; add to that an ageing population and then add population growth ahead of estimates.

“Will our generation have access to an age pension that covers infl ation and population growth? I believe our generation needs to take action and build a secure future, starting with ourselves.

“If Neue Black can start creating change within a generation, to start people thinking about it earlier and to get them planning for their future, we’ve fulfilled our purpose.”

He has a target number in mind of Gen Y clients he wants to help in a certain time, and once the brand is launched he looks forward to focusing on the educational side of things.

Condon says the brokerage will be utilising various media outlets to do this.

“One of our core values is education. We work very hard on this aspect throughout the client experience. We’re often surprised by our clients’ knowledge of the options available to build wealth effectively and still maintain a flexible lifestyle.”

He adds: “We believe that the millennial generation will outspend Gen X over the next five to 10 years, and we’re positioned really well to address the needs of the next generation.”

Condon told MPA back in 2015 that he presents himself to clients as a partner in the project and ultimately as a source of finance.

“I will show them different structured options to consider and let them make an informed decision. I find that by being seen as part of their team and another resource for their business, I have a deeper relationship with my customers.”

Using technology to grow

Condon intends to incorporate robo-advice into the wealth side of his business and doesn’t see it as a threat but more of an add-on, using technology to assist growth rather than hinder it.

“What we’re offering will not cancel out fi nancial planning – there’s always going to be people who need to have a face-to-face conversation with their trusted adviser. We know this.

“We’re currently working on incorporating a wealth management offering into the Neue Black experience – in a non-traditional way but staying true to the traditional values of face-to-face advice and maintaining that personal touch. We can deliver sophisticated products and structures in a way that suits the preferences and cost tolerances of our generation.”

At the time of writing, the official brand launch of Neue Black is set for the end of March and will be marketed heavily via diverse media.

“We’re really excited to formally launch the brand in March,” says Condon. “We’ve been working on the rebrand for quite some time, making sure we get the positioning right. We received really positive feedback from our clients and partners during the concept and testing phases. We’re investing in a successful launch and we’re defi nitely looking forward to the market’s response.”