Comprehensive credit reporting has finally arrived in Australia and promises to reveal all when it comes to your clients, writes MPA editor Sam Richardson

Comprehensive credit reporting has finally arrived in Australia and promises to reveal all when it comes to your clients, writes MPA editor Sam Richardson

Sometimes, very occasionally, the industry really is transformed overnight. When Treasurer Scott Morrison stepped up to the lectern at Melbourne’s Intersekt festival, most of the audience of fintech entrepreneurs expected more of the usual lip service to innovation: better regulation; more lavish start-up hubs and the like. Instead they got a game changer: the Government will force the major banks to share customer data, starting just eight months from now.

By making comprehensive credit reporting mandatory, Morrison has ended a fight that has lasted for more than three years. The Financial Systems Inquiry of 2014 recommended that lenders share not only negative but all data about borrowers, to help smaller and data-driven lenders make smarter decisions. The major banks, which hold most client data, have done their best to delay the process, and the Australian Bankers’ Association has finally committing to sharing customer transaction data within two years.

The ABA was too late, and it appears that the Government’s patience has run out. Less than 1% of customer data is currently being shared, Morrison observed. By July the major banks will need to share 50% of their data.

That will increase to 100% by July 2019, with non-major banks and potentially non-bank lenders being added shortly after. CCR will have huge consequences, Morrison predicted. “For borrowers, this regime should lead to one thing – a better deal on your mortgage, your personal loan or business loan.”

The benefits of baring all

Morrison’s promise could be the one commitment the Coalition can actually keep. Lenders in the US have shared data since the 1970s, while the UK government is currently pushing through CCR, so Australia is not entering the unknown. For established lenders, access to more data has two potential benefits, Suncorp’s CEO of banking and wealth, David Carter, told MPA. “We should be able to make the origination process quicker, and at some point we should be able to offer differentiated pricing.”

Lenders already offer differentiated pricing, hence the higher rates on interest-only loans that are deemed to be more risky, for example. Tailoring pricing to an individual borrower’s risk profile – rather than just a category of borrowers – could be “a great thing for brokers and their customers”, according to John Flavell, CEO of Mortgage Choice. “Some [customers] will definitely notice a difference, and others may not. It all depends on their unique financial situation.”

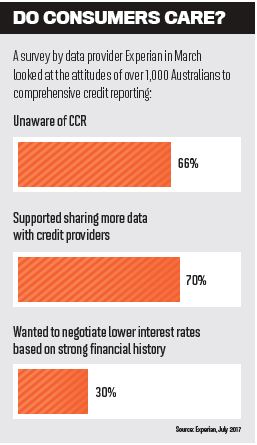

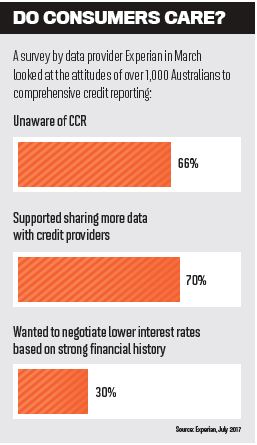

It’s possible that the introduction of CCR in 2018 and 2019 could prompt a one-off refinancing boom. Data from Experian suggests that many customers would like to renegotiate lower interest rates based on strong financial history (see boxout). Brokers have the client databases and knowledge to target the borrowers who could gain most, at the right time.

It’s possible that the introduction of CCR in 2018 and 2019 could prompt a one-off refinancing boom. Data from Experian suggests that many customers would like to renegotiate lower interest rates based on strong financial history (see boxout). Brokers have the client databases and knowledge to target the borrowers who could gain most, at the right time.

Over the longer term, Flavell explains, “the introduction of comprehensive credit reporting will more than likely increase the level of competition between Australia’s lenders”. Non-major lenders have been calling for CCR’s introduction for a number of years.

CCR could even give birth to new lenders, as Morrison acknowledged in his speech. The UK has seen a wave of online-only banks, such as Starling Bank and Monzo, giving borrowers new options in recent years. In Australia, business lenders, including Prospa and SocietyOne, indicate that data-driven lending can be particularly profitable. Six-year-old Prospa has lent over $400m, while SocietyOne began sharing data in November.

Nowhere to hide

For Australian borrowers and their brokers, CCR is an opportunity but also a challenge. As the Consumer Action Law Centre puts it, “the flip side to lower fees and interest rates for some is that costs will increase for others. These ‘others’ will undoubtedly be Australia’s most vulnerable, disadvantaged and financially stressed households”.

Lenders will be able to “profile for profit”, the Consumer Action Law Centre explains, raising rates not only for genuinely risky borrowers but for any they consider undesirable. Consequently, as Suncorp boss Carter says, “all borrowers won’t be equal; they’ll be less equal under comprehensive credit reporting”.

Profiling could nevertheless benefit brokers, although brokers may have to change the way they work. Today, interest rates are widely advertised and easy to explain; under CCR they could go the way of insurance, Carter predicts. “My premium will be different to your premium, even if we live next to each other, because my house and the characteristics of my risk are slightly different to yours.”

Most worryingly for consumers is the prospect of interest rates increasing because of incorrect information. At present, 20–30% of client credit data is inaccurate, lawyer Joe Trimarchi of Trimarchi & Associates told MPA sister title Australian Broker. With the Privacy Act currently unable to enforce correct reporting, this will be another challenge for the government. The ABA has also raised concerns about borrowers being penalised for natural disasters or small business cash flow issues.

Finally, CCR doesn’t just make borrowers less equal; it could exacerbate differences between lenders. Suncorp’s Carter is sceptical that CCR can improve competition, because capital requirements for banks still allow major banks and Macquarie to hold less capital than non-majors. In practice, this gives the major banks the ability (if not necessarily the will) to offer cheaper rates to clients.

With borrowers chasing personalised rates, the pricing differences between major and non-major banks could become particularly apparent, Carter says. “What would be good for competition is more of a level playing field on that best-quality risk … if you want to get the true benefits of comprehensive credit reporting into the market.”

For brokers, concerns over competition or increasing interest rates may be a moot point. CCR, as Mortgage Choice’s Flavell explains, will “make the mortgage market more complex and confusing than ever before – which will help to further enhance the broker proposition.”

Sometimes, very occasionally, the industry really is transformed overnight. When Treasurer Scott Morrison stepped up to the lectern at Melbourne’s Intersekt festival, most of the audience of fintech entrepreneurs expected more of the usual lip service to innovation: better regulation; more lavish start-up hubs and the like. Instead they got a game changer: the Government will force the major banks to share customer data, starting just eight months from now.

By making comprehensive credit reporting mandatory, Morrison has ended a fight that has lasted for more than three years. The Financial Systems Inquiry of 2014 recommended that lenders share not only negative but all data about borrowers, to help smaller and data-driven lenders make smarter decisions. The major banks, which hold most client data, have done their best to delay the process, and the Australian Bankers’ Association has finally committing to sharing customer transaction data within two years.

The ABA was too late, and it appears that the Government’s patience has run out. Less than 1% of customer data is currently being shared, Morrison observed. By July the major banks will need to share 50% of their data.

That will increase to 100% by July 2019, with non-major banks and potentially non-bank lenders being added shortly after. CCR will have huge consequences, Morrison predicted. “For borrowers, this regime should lead to one thing – a better deal on your mortgage, your personal loan or business loan.”

The benefits of baring all

Morrison’s promise could be the one commitment the Coalition can actually keep. Lenders in the US have shared data since the 1970s, while the UK government is currently pushing through CCR, so Australia is not entering the unknown. For established lenders, access to more data has two potential benefits, Suncorp’s CEO of banking and wealth, David Carter, told MPA. “We should be able to make the origination process quicker, and at some point we should be able to offer differentiated pricing.”

“This regime should lead to one thing – a better deal on your mortgage, your personal loan or business loan” - Scott Morrison

Lenders already offer differentiated pricing, hence the higher rates on interest-only loans that are deemed to be more risky, for example. Tailoring pricing to an individual borrower’s risk profile – rather than just a category of borrowers – could be “a great thing for brokers and their customers”, according to John Flavell, CEO of Mortgage Choice. “Some [customers] will definitely notice a difference, and others may not. It all depends on their unique financial situation.”

It’s possible that the introduction of CCR in 2018 and 2019 could prompt a one-off refinancing boom. Data from Experian suggests that many customers would like to renegotiate lower interest rates based on strong financial history (see boxout). Brokers have the client databases and knowledge to target the borrowers who could gain most, at the right time.

It’s possible that the introduction of CCR in 2018 and 2019 could prompt a one-off refinancing boom. Data from Experian suggests that many customers would like to renegotiate lower interest rates based on strong financial history (see boxout). Brokers have the client databases and knowledge to target the borrowers who could gain most, at the right time.Over the longer term, Flavell explains, “the introduction of comprehensive credit reporting will more than likely increase the level of competition between Australia’s lenders”. Non-major lenders have been calling for CCR’s introduction for a number of years.

CCR could even give birth to new lenders, as Morrison acknowledged in his speech. The UK has seen a wave of online-only banks, such as Starling Bank and Monzo, giving borrowers new options in recent years. In Australia, business lenders, including Prospa and SocietyOne, indicate that data-driven lending can be particularly profitable. Six-year-old Prospa has lent over $400m, while SocietyOne began sharing data in November.

Nowhere to hide

For Australian borrowers and their brokers, CCR is an opportunity but also a challenge. As the Consumer Action Law Centre puts it, “the flip side to lower fees and interest rates for some is that costs will increase for others. These ‘others’ will undoubtedly be Australia’s most vulnerable, disadvantaged and financially stressed households”.

Lenders will be able to “profile for profit”, the Consumer Action Law Centre explains, raising rates not only for genuinely risky borrowers but for any they consider undesirable. Consequently, as Suncorp boss Carter says, “all borrowers won’t be equal; they’ll be less equal under comprehensive credit reporting”.

Profiling could nevertheless benefit brokers, although brokers may have to change the way they work. Today, interest rates are widely advertised and easy to explain; under CCR they could go the way of insurance, Carter predicts. “My premium will be different to your premium, even if we live next to each other, because my house and the characteristics of my risk are slightly different to yours.”

Most worryingly for consumers is the prospect of interest rates increasing because of incorrect information. At present, 20–30% of client credit data is inaccurate, lawyer Joe Trimarchi of Trimarchi & Associates told MPA sister title Australian Broker. With the Privacy Act currently unable to enforce correct reporting, this will be another challenge for the government. The ABA has also raised concerns about borrowers being penalised for natural disasters or small business cash flow issues.

“All borrowers won’t be equal; they’ll be less equal under comprehensive credit reporting” - David Carter, Suncorp

Finally, CCR doesn’t just make borrowers less equal; it could exacerbate differences between lenders. Suncorp’s Carter is sceptical that CCR can improve competition, because capital requirements for banks still allow major banks and Macquarie to hold less capital than non-majors. In practice, this gives the major banks the ability (if not necessarily the will) to offer cheaper rates to clients.

With borrowers chasing personalised rates, the pricing differences between major and non-major banks could become particularly apparent, Carter says. “What would be good for competition is more of a level playing field on that best-quality risk … if you want to get the true benefits of comprehensive credit reporting into the market.”

For brokers, concerns over competition or increasing interest rates may be a moot point. CCR, as Mortgage Choice’s Flavell explains, will “make the mortgage market more complex and confusing than ever before – which will help to further enhance the broker proposition.”