Figures from our Consumers on Brokers report suggest the market for fee-for-service brokers could be larger than is currently assumed.

In our Consumers on Brokers report for the second year running, we get real consumer opinions, good and bad, to the people who really need them – brokers. Our survey ran for five weeks on Key Media’s consumer-facing yourmortgage.com.au comparison website, and on the website of Your Investment Property magazine. These databases are closely monitored. Furthermore, we made sure all our respondents had actually used a broker – this survey is about real experiences, not just perceptions.

Our survey is, admittedly, not as big as those of the banks, but unlike the banks we don’t have a message or product to push. Instead, our questions have focused on current issues, namely ASIC’s remuneration review and the rate rises for new and existing customers introduced by banks in 2015. We’ve also included a number of practical questions to help brokers with their marketing and after-settlement service, and distinguished between different income and borrower groups where appropriate.

PAYING THE BILL

As ASIC reviews brokers’ remuneration structures, our respondents say they’re comfortable with commission, and almost half are open to paying their broker We couldn't run a report about consumers without talking about this year’s biggest consumer issue – ASIC’s review into mortgage brokers’ remuneration.

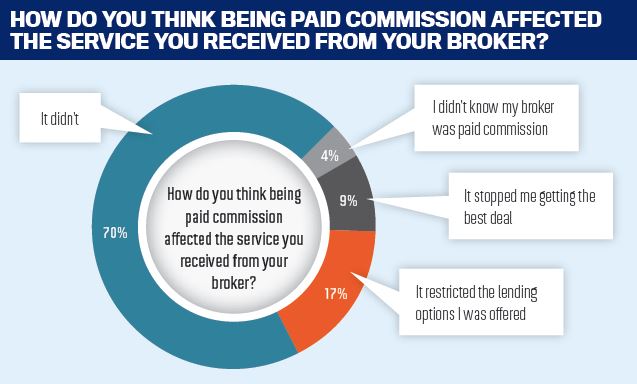

ASIC are concerned that commissions could act as a form of ‘conflicted remuneration’, producing worse results for consumers. We therefore asked our respondents how they thought commission aff ected their experience with a broker – and whether they were aware brokers were paid commission at all.

The headline figure is that 70% of our respondents didn’t think being paid commission affected the service they received from their broker. We asked respondents to give us their thoughts on commission, and the comments were encouraging for brokers. In one typical comment, the respondent said they had “no problem [with commission]. He... tells me the commissions he receives from each bank. I do not feel it has an impact on the decision I make, and it saves me paying him.” Another respondent who had no problem with broker commission wrote that “they provide a service that none of my banks ever did”.

Breaking down the results by type of borrowers helps explain borrower attitudes. Investors and those switching properties – those who’d experienced the application before – are more comfortable with commission, whilst only 60% of first time buyers believe it didn’t affect service. Worryingly, 11% of fi rst-time buyer respondents said they weren’t aware their broker was paid commission. Moreover, one in five of all respondents saw commission as restricting the lending options they were offered, although only one in ten believes commission prevented them from getting the best deal.

Given that brokers are supposed to clearly disclose commission, a significant number of our respondents appeared to be confused as to how commissions work. The biggest misapprehension was that all lenders pay the same level of commission, with one respondent writing, “Even though they get the same commission from different lenders, I believe lenders can find other ways to encourage brokers to recommend that lender.” Another respondent suggested that brokers should disclose the commission levels of the lenders on their panel.

Additionally, a number of respondents who were comfortable with upfront commission cast doubt on the need for trail commission. “I expect them to be paid but feel it’s not appropriate to be paid for the life of the loan,” wrote one respondent. “I’ve never had follow-up service from my fi rst broker I used over 10 years ago and, in fact, he complained when I went back to him as he specialised for a certain target audience.” As you may have noticed, in our section on After-Settlement Service, 40% of our respondents have never been contacted by their broker since settling the loan. It’s therefore far from surprising these clients have a negative perception of trail.

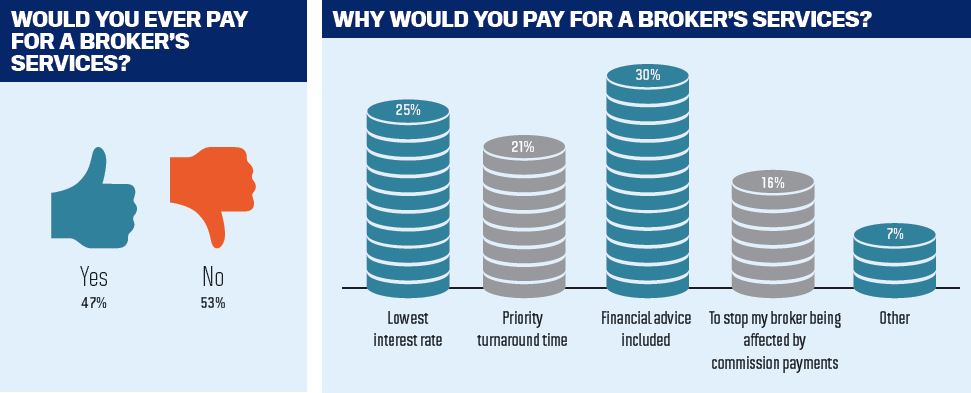

ASIC are investigating all remuneration structures, including fee-for-service. Responses by industry players, particularly AFG, have questioned the viability and consumer appetite for fee-for-service. We asked our respondents whether they’d ever pay for a broker’s services, and if so, what they’d expect.

Almost half of respondents (47%) said they would consider paying their broker. Whilst this also means 53% of respondents wouldn’t consider fee-for-service, these findings certainly suggest the market for fee-for-service brokers could be larger than is currently assumed.

We split the results down by income bracket and found that high income borrowers ($180,000+) were the most willing to pay their broker (57%), and that openness to fee-for-service decreased with wealth. However, even amongst the lowest income bracket (less than $37,000), 38% of respondents would still consider paying their broker. There was no pronounced difference in the willingness of different types of clients – FHBs, investors, upgraders – to pay their broker.

Given almost all lenders currently do pay commission it’s natural that consumers would expect additional value from a fee-for-service broker. This year and in 2015, we asked respondents who were open to fee-for-service which additional services they would expect. ‘Financial advice included’ continues to be top option (30%), followed by the lowest interest rate (25%) and priority turnaround time (21%) – you can read more about this in our section on Choosing a Broker.

This year, we also included another potential response for this question: ‘To stop my broker being affected by commission payments’. We introduced this to gauge whether respondents were so concerned about the negative effects of commission that they would pay to avoid it. The response rate – just 16% of respondents – suggests the majority of consumers would not contemplate taking this approach.

We had some interesting comments on the subject of why a consumer would pay a broker. “If it ensures the right loan structure with consideration to all other loans and future plans,” explained one comment, “then it is well worth it.” Several comments mentioned the importance of structuring with a view to a long-term relationship and portfolio building. Added to the abovementioned appetite for financial advice, this suggests that wealth-orientated brokerages are best placed to offer fee-for-service options, and indeed some already do.

Our survey is, admittedly, not as big as those of the banks, but unlike the banks we don’t have a message or product to push. Instead, our questions have focused on current issues, namely ASIC’s remuneration review and the rate rises for new and existing customers introduced by banks in 2015. We’ve also included a number of practical questions to help brokers with their marketing and after-settlement service, and distinguished between different income and borrower groups where appropriate.

PAYING THE BILL

As ASIC reviews brokers’ remuneration structures, our respondents say they’re comfortable with commission, and almost half are open to paying their broker We couldn't run a report about consumers without talking about this year’s biggest consumer issue – ASIC’s review into mortgage brokers’ remuneration.

ASIC are concerned that commissions could act as a form of ‘conflicted remuneration’, producing worse results for consumers. We therefore asked our respondents how they thought commission aff ected their experience with a broker – and whether they were aware brokers were paid commission at all.

The headline figure is that 70% of our respondents didn’t think being paid commission affected the service they received from their broker. We asked respondents to give us their thoughts on commission, and the comments were encouraging for brokers. In one typical comment, the respondent said they had “no problem [with commission]. He... tells me the commissions he receives from each bank. I do not feel it has an impact on the decision I make, and it saves me paying him.” Another respondent who had no problem with broker commission wrote that “they provide a service that none of my banks ever did”.

Breaking down the results by type of borrowers helps explain borrower attitudes. Investors and those switching properties – those who’d experienced the application before – are more comfortable with commission, whilst only 60% of first time buyers believe it didn’t affect service. Worryingly, 11% of fi rst-time buyer respondents said they weren’t aware their broker was paid commission. Moreover, one in five of all respondents saw commission as restricting the lending options they were offered, although only one in ten believes commission prevented them from getting the best deal.

Given that brokers are supposed to clearly disclose commission, a significant number of our respondents appeared to be confused as to how commissions work. The biggest misapprehension was that all lenders pay the same level of commission, with one respondent writing, “Even though they get the same commission from different lenders, I believe lenders can find other ways to encourage brokers to recommend that lender.” Another respondent suggested that brokers should disclose the commission levels of the lenders on their panel.

Additionally, a number of respondents who were comfortable with upfront commission cast doubt on the need for trail commission. “I expect them to be paid but feel it’s not appropriate to be paid for the life of the loan,” wrote one respondent. “I’ve never had follow-up service from my fi rst broker I used over 10 years ago and, in fact, he complained when I went back to him as he specialised for a certain target audience.” As you may have noticed, in our section on After-Settlement Service, 40% of our respondents have never been contacted by their broker since settling the loan. It’s therefore far from surprising these clients have a negative perception of trail.

ASIC are investigating all remuneration structures, including fee-for-service. Responses by industry players, particularly AFG, have questioned the viability and consumer appetite for fee-for-service. We asked our respondents whether they’d ever pay for a broker’s services, and if so, what they’d expect.

Almost half of respondents (47%) said they would consider paying their broker. Whilst this also means 53% of respondents wouldn’t consider fee-for-service, these findings certainly suggest the market for fee-for-service brokers could be larger than is currently assumed.

We split the results down by income bracket and found that high income borrowers ($180,000+) were the most willing to pay their broker (57%), and that openness to fee-for-service decreased with wealth. However, even amongst the lowest income bracket (less than $37,000), 38% of respondents would still consider paying their broker. There was no pronounced difference in the willingness of different types of clients – FHBs, investors, upgraders – to pay their broker.

Given almost all lenders currently do pay commission it’s natural that consumers would expect additional value from a fee-for-service broker. This year and in 2015, we asked respondents who were open to fee-for-service which additional services they would expect. ‘Financial advice included’ continues to be top option (30%), followed by the lowest interest rate (25%) and priority turnaround time (21%) – you can read more about this in our section on Choosing a Broker.

This year, we also included another potential response for this question: ‘To stop my broker being affected by commission payments’. We introduced this to gauge whether respondents were so concerned about the negative effects of commission that they would pay to avoid it. The response rate – just 16% of respondents – suggests the majority of consumers would not contemplate taking this approach.

We had some interesting comments on the subject of why a consumer would pay a broker. “If it ensures the right loan structure with consideration to all other loans and future plans,” explained one comment, “then it is well worth it.” Several comments mentioned the importance of structuring with a view to a long-term relationship and portfolio building. Added to the abovementioned appetite for financial advice, this suggests that wealth-orientated brokerages are best placed to offer fee-for-service options, and indeed some already do.

A MESSAGE FROM OUR SPONSOR

Information is powerful. Understanding your customer’s needs, financial goals and what led them to you in

the first place will play a defining role in shaping your service proposition. At Suncorp Bank, we recognise the importance of putting the customer at the heart of every decision.

We know customers are increasingly engaging with brokers for their home and investment lending needs. The value lies in knowing why. With this in mind, Suncorp Bank is proud to partner with MPA to bring you the Consumers on Brokers survey, proving valuable insights into consumer behaviour.

Brokers are looking for more than a mortgage broker °– they are looking for a trusted partner. At Suncorp Bank, we see our service as an extension of yours.

Our proposition is built around supporting the broker-customer relationship. Exceptional service is central to this, with our national team of Business Development Managers and local call centre sta˛ ed with lending experts providing on-the-ground, dedicated support.

Suncorp Bank aims to support brokers to do this by providing access to decision makers and other crucial information through the loan process. Transparency is a key part of this, allowing brokers to set and manage expectations with their customers.

Feedback is one of the most powerful tools available to our industry. We hope that the Consumers on Brokers survey provides valuable insights, information and intelligence to support you to enhance your customer service proposition, as we seek to continue to elevate our own for brokers.

Steven Degetto

Head of intermediaries

Suncorp Bank

Information is powerful. Understanding your customer’s needs, financial goals and what led them to you in

the first place will play a defining role in shaping your service proposition. At Suncorp Bank, we recognise the importance of putting the customer at the heart of every decision.

We know customers are increasingly engaging with brokers for their home and investment lending needs. The value lies in knowing why. With this in mind, Suncorp Bank is proud to partner with MPA to bring you the Consumers on Brokers survey, proving valuable insights into consumer behaviour.

Brokers are looking for more than a mortgage broker °– they are looking for a trusted partner. At Suncorp Bank, we see our service as an extension of yours.

Our proposition is built around supporting the broker-customer relationship. Exceptional service is central to this, with our national team of Business Development Managers and local call centre sta˛ ed with lending experts providing on-the-ground, dedicated support.

Suncorp Bank aims to support brokers to do this by providing access to decision makers and other crucial information through the loan process. Transparency is a key part of this, allowing brokers to set and manage expectations with their customers.

Feedback is one of the most powerful tools available to our industry. We hope that the Consumers on Brokers survey provides valuable insights, information and intelligence to support you to enhance your customer service proposition, as we seek to continue to elevate our own for brokers.

Steven Degetto

Head of intermediaries

Suncorp Bank