Refinancing hit record highs this month

In a widely expected move, the Reserve Bank has maintained the official cash rate at 4.1% for the third month running, raising hopes that Australia may have reached the peak of the current rate-rising cycle, while new data from PEXA showed loan refinances reached record highs this month, but still no mortgage cliff in sight.

Andy Kerr (pictured above left), homeownership executive at NAB, said a third straight month of steady rates gave homeowners some much-needed stability in their repayments and provided certainty to borrowers with fixed-rate home loans as they roll off onto more solid ground.

“Customers have used the last three months to catch their breath, but they’ve also continued to make considered changes to their spending through this steadier rate environment,” Kerr said. “More customers are now taking the opportunity of three rate pauses to look at how they can manage their finances to contend with rising living costs, set savings goals, or begin to rebuild a financial buffer.”

Julie Toth (pictured above right), PEXA chief economist, said the RBA’s latest move will be welcome news for existing and potential mortgage holders, who are still adjusting to previous interest rate hikes.

“Australia’s housing markets stabilised in early 2023 and have been recovering since around March, with a gentle lift in prices and sales volumes across most locations,” Toth said. “Today’s extended pause in monetary policy tightening will help foster greater confidence in the housing outlook, particularly among most buyers who rely on mortgages to finance their homes.”

But despite the much-hyped threat of a mortgage cliff from some 800,000 fixed-rate borrowers, Toth said this has so far failed to materialise this year. Instead, the firm has seen record-high refinance activity, as borrowers adjust to the “new normal” of higher mortgage costs.

ABS figures showed around 3.8 million Australian households (35%) are currently paying off a mortgage on their own home. Up to a third were on fixed rates on all or some of their debt in recent years, while many others have fixed-rate mortgages to fund investment or rental properties.

“PEXA’s latest data shows Australians are actively refinancing their loans at record rates which is helping to cushion the majority of Aussie mortgage holders from the recent rate hikes and reducing their likelihood of falling behind in repayments, as they make lifestyle adjustments,” Toth said.

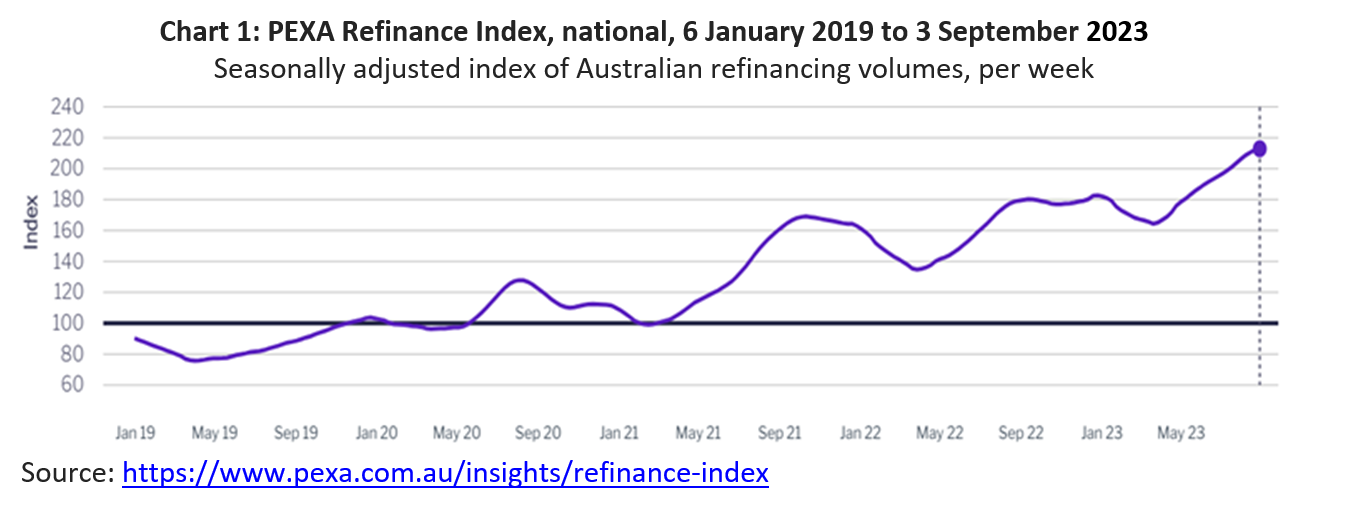

“PEXA’s Refinance Index shows loan refinancing volumes hit a new record high in the first week of September, with the Index reaching 212.2 points in the week ending Sept. 3 (seasonally adjusted). The Index confirms refinancing volumes are up by 3.2% from one month earlier and up by 18.8% from the same week in 2022.”

To put this into context, refinancing activity now was more than double compared to the lowest periods during the time of the pandemic in April-May 2020 and Feb-March 2021.

“Subsiding inflationary pressure for other goods and services are also helping households across the nation in meeting their loan commitments,” Toth said. “All of this helps to explain why mortgage arrears rates ticked up only slightly from very low levels in FY23 – according to S&P, it’s estimated just 1% to 1.5% of east-coast mortgagees were more than 30 days behind in their repayments in June 2023, with slightly higher rates in WA and NT.”

While interest rates were on hold this month, Kerr noted that the cost of petrol, groceries, and energy bills is still increasing.

RBA’s latest decision “is welcome news for around a third of Australians with a mortgage but we know rising living costs are still a cause of concern for many more and there’ll be some people who are worried about their financial situation. Anyone in that position should get in touch with their bank - we're here to help,” Kerr said.

Toth said that while Australia’s domestic economy might not require further rate hikes to tame inflation, international events such as developments in China and the ongoing Russia-Ukraine conflict may impact the Australian dollar and impact the domestic outlook.

Use the comment section below to tell us how you felt about this.