MPA takes an in-depth look at why and how brokers should expand into debtor finance.

Commercial broker Kevin Wheatley is no stranger to the value of debtor finance. After all, it was what saved his family’s storage and distribution business back in the late 1980s. “I factored $5m a year in those days to grow our business on a number of fronts,” he says.

As CFO at the time, Wheatley was having trouble with one of the mainstream banks, which had called in the business’s overdraft despite evidence of growth in large B2B contracts. Thanks to this bank “bullying”, the business was forced to sell equipment to pay off its overdraft.

“Growing our business on the back of the overdraft was never going to work – once your overdraft is exposed, banks are not very comfortable about extending the facility.”

That’s when Wheatley put invoice finance to work. With cash advanced against its receivables, the business invested in facilities like a warehouse and pallet racking. “It allowed us to grow from a $15m to a $28m business over an 18-month period.”

Wheatley has since become a strong advocate of debtor finance for the right SME through his finance business Bayside Commercial Mortgages, and he even mentors brokers looking to add debtor finance to their businesses. Wheatley says it gives them an edge.

“It’s an integral part of demonstrating a point of difference,” Wheatley says. “Financial pressure is the worst pressure any SME can experience. It makes a huge difference if they have a good adviser that can come on board, who can say, ‘Yes, I know you have a problem, but I’ve also got a solution to that problem’. It definitely adds a string to your bow as a broker, and ensures that brokers are perceived as professionals and that people listen to them.”

Knowing the ‘why’

Knowing the ‘why’

Expanding into debtor finance may seem daunting for residential mortgage brokers, but experts argue the transition is a genuine and relatively easy option for beginners. Scottish Pacific CEO Peter Langham says that, while commercial brokers are still the more common players in the market, that doesn’t rule out interested residential brokers. “It’s important to remember that commercial brokers didn’t all start out as commercial brokers. There’s nothing stopping a residential broker from expanding by moving into debtor finance,” Langham says.

Westpac national head of commercial introducers Janelle Pearce says there is a strong crossover between residential broker businesses and debtor finance because their clients are often business owners or self-employed. “Because residential brokers interact with business-owner clients, they are well positioned to add value by assisting these clients with their cash flow management and liquidity concerns in the day-to-day running of their business,” she says.

Peter Langham agrees. “A high proportion of home loan brokers will already be dealing with self-employed people who don’t get a payslip every fortnight. Those brokers are seeing the financials of those businesses, and it’s fairly easy for them to identify what assets are there on that balance sheet that could be leveraged to increase cash flow.”

Adding debtor finance capabilities can also be relatively simple. In many cases, brokers are able to hand off their clients to debtor finance providers once they have done the initial pre-qualification, meaning the level of commercial knowledge required is not prohibitively high. “It’s certainly wise to talk to a couple of debtor finance specialists to understand the product a bit more, but it really isn’t rocket science,” says Langham.

CVG Finance broker Paul Lambess, who does debtor finance deals, says sales are made easier by lenders that are not only broker-friendly but also actually pro-broker. “They really want to support your business and get as much as they can to get the deal set,” he says. This often translates to less work. “The workload you put in is much less, because they really want to help,” Lambess says.

Wheatley says debtor finance can be lucrative, depending on the facility size. Bayside facilitates around $50m per annum in debtor invoice facilities. Usually, a broker will pocket 50% of the establishment cost, which on a $3m facility could work out to between $20,000 and $25,000. As well as the upfront payment, there is an additional trail payment of approximately 15 and 20 basis points, depending on the provider. “That is very lucrative when it comes to picking up some additional revenue in your brokerage,” Wheatley says.

Westpac’s Pearce says it can add value to a broker’s business. “Brokers can use debtor finance as a solution that can differentiate them in the market, allowing them to off er a broader, diversified product suite. This is also a great retention strategy with clients.”

Debtor finance players agree there is potential demand in the SME market, should brokers wish to tap into it. Scottish Pacific’s latest SME Growth Index found that only 4.8% of SMEs actively keep an eye out for credit facilities that fi t best with their business. Meanwhile, 50% of SMEs don’t get around to reviewing their primary bank relationship and only 20% review this regularly. These statistics are met by a growth in openness to the idea of experimenting. “We’ve noted the increase in growth in SMEs willing to borrow from another bank or specialist non-bank lender,” Langham says. “This increase is even greater amongst SMEs who see themselves as declining or with unchanged growth – the number of these businesses looking beyond their main bank for funds has almost tripled in the last year from 6.9% to 18.2%.”

PAUL LAMBESS: USING DEBTOR FINANCE TO BUILD BUSINESS INCOME

PAUL LAMBESS: USING DEBTOR FINANCE TO BUILD BUSINESS INCOME

Debtor finance has been an important part of Newcastle-based Paul Lambess’s product offering at CVG Finance for the last five years. Because he services both residential and commercial clients, Lambess has a good idea of the value debtor finance can add.

“It’s a great tool to be able to use when talking to clients – it’s a bit of a niche,” Lambess says.

“Anyone can walk in and talk about a home loan, or a commercial loan, but debtor finance is a niche product and we’ve been able to use it to provide value to clients and referrers.”

There are some challenges brokers face when offering the product. With business clients often being close to their accountants, bad perceptions of the product can see them turned away.

“There is a perception – particularly among accountants – that it is an expensive product, that it’s a lender of last resort and something you would do only if you are really desperate,” Lambess says. “Potentially, you can get all the way through talking to a client about the advantages, but their accountant will can it because of their perception of the product.”

Then there’s a lack of awareness. For example, Lambess recently had a client who was still waiting two months after asking their bank for a $50,000 overdraft to help fund their business. In a week, he was able to get a $250,000 debtor finance facility turned around.

“The client and the accountant were blown away by the solution. With no property security they were able to get a facility five times that of a bank. They had known the overdraft wasn’t going to be enough, but had thought it would be better than nothing,” Lambess says.

When brokers are able to get around these problems through experience and knowledge, Lambess argues the advantages for their businesses can be great. One of the reasons for this is the nature of debtor finance, which can be a growing, rather than shrinking, asset.

“I think it is probably two or three times more rewarding to write debtor finance than a home loan,” Lambess says. “It pays a little bit more than a home loan, but it is also a growing facility – instead of being a loan that people pay off , it often grows, or appreciates rather than depreciates, earning brokers more as time goes on rather than less,” he says.

Executing the ‘how’

Debtor finance is easier than most commercial beginners think because brokers are able to scale their involvement up or down depending on their knowledge and experience. For example, Westpac says more experienced brokers will provide a full financial summary of their client to the bank. However, brokers need to realise that any transition will take some time, and some work. “The key is not trying to be an expert on day one,” Lambess says. “We can preach all day about diversification and extra income streams, but the trap is trying to be an expert on everything from day one. You need to build up your knowledge and experience.”

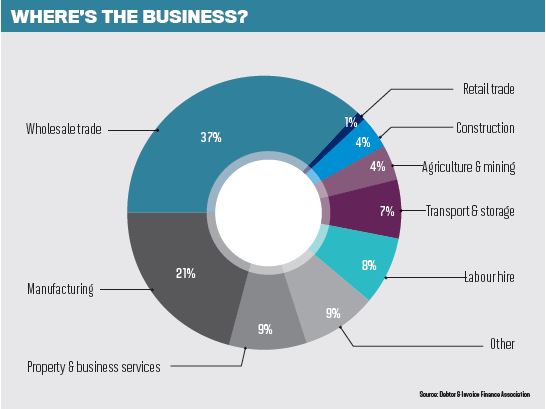

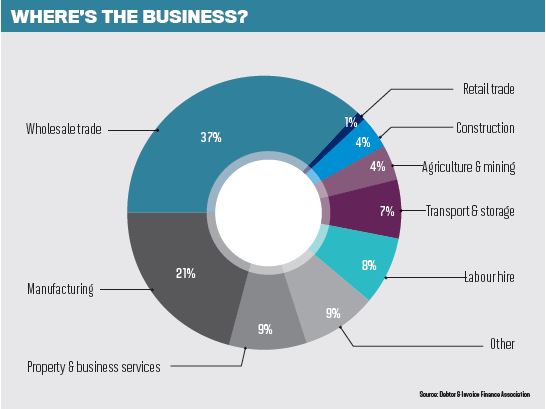

Debtor finance suits SME businesses selling to other businesses or government bodies on credit. This means manufacturing, wholesale, labour hire, business services, transport and logistics, and agriculture and mining services are the highest users. Because these businesses offer trade credit terms, they often need to wait for payments for extended periods of time, putting pressure on cash flow. The latest Dun & Bradstreet Trade Payments Analysis, for example, puts current average payment times at 44.1 days. Construction is one sector that is typically shunned by debtor finance funders, being a notoriously messy sector for payments, while retail businesses are excluded because they sell direct to consumers.

FactorONE’s Greg Charlwood says brokers need to be able to ask – and understand – two basic questions to pre-qualify debtor finance clients. The first is establishing if a client sells B2B on credit. The second is finding out if they are having problems with cash flow. To do this, brokers can benefit from basic experience in inspecting a business’s debtors and creditors ledger, to establish their overall cash fl ow position. It also helps to understand a balance sheet so they can assess the overall financial position of a business.

“The first bit of advice I give to brokers is to try and understand the individual’s business,” Kevin Wheatley says. “After going in to look at the debtors and creditors ledger, if the ratio of debtors to creditors is higher than, say, a 70/30 split, you can advise the client that you can arrange a facility to improve their cash fl ow to balance out that split.” With a basic understanding of how a debtor finance facility works, along with some knowledge of the company’s position, Wheatley says brokers can put forward the suggestion and handle basic questions.

Know your partners

Know your partners

There are a range of partner-ships that can help brokers get started in recommending debtor fi nance. For example, specialist product providers like Scottish Pacifi c, pitched at larger SMEs, and FactorONE, geared towards smaller businesses, are willing to support brokers by talking them through how the product works, giving them information resources they can use, and helping them build the knowledge and expertise they need to get confident about pre-qualifying and recommending debtor finance products. This includes taking the majority of legwork off the broker – with the broker’s consent – after the initial pre-qualification is done.

“Our product specialists work with brokers to help brokers understand key principles and details,” Westpac’s Pearce says. “We also educate brokers on the product, and most importantly provide them with product communication and training presentations assisting them to spot opportunities. Having the right banker contact point to direct any enquiries to so as to provide an optimal experience for clients is critical,” she says.

Brokers can also team up with senior commercial brokers like Wheatley or Lambess who are able to mentor them and off er commission-splitting arrangements while they increase their commercial knowledge. For interested brokers, the Debtor and Invoice Finance Association (DIFA) also runs an online factoring course in conjunction with the Australian Institute of Credit Management, which teaches the basics of factoring.

FactorONE’s Greg Charlwood says brokers can get a start in the area by data mining their existing book for self-employed clients and then contacting them to talk about their business and funding position, to establish if they are having any problems with cash fl ow. Or they can start keeping an eye out for SME clients who walk through the door for a home loan. Charlwood says brokers will be surprised once they move into debtor finance just how many deals they have been missing out on in their day-to-day business. “It’s amazing the number of times I get in contact with a broker I haven’t spoken to in a while, and while we are just chewing the fat they realise they actually have got a debtor finance deal,” he says.

However, Charlwood says debtor finance is different to selling home loans, and requires brokers who are willing to be proactive in selling, rather than reactive. “People do wake up in the morning thinking that they want a new house or a new mortgage, but they don’t wake up thinking they need an invoice finance facility,” he says. “They don’t just come and present themselves and say, ‘I want invoice finance’, so being proactive is key.

Bayside’s Wheatley says brokers all want the industry to stand out as professional, to ensure the channel continues to grow and thrive. “Right now we are doing 52% of referred business, and we need to keep growing that,” he says.

Debtor finance can play a key role in that mission. Scottish Pacific’s Langham says while the product is able to build broker business income streams, it also builds deeper relation ships with clients, rather than just “doing a home loan and then forgetting about it”.

“I think brokers should be positioning themselves as a client’s personal banker. They’ve got the perfect opportunity to do that, because their clients are not as aware as they should be of the solutions to their problems that are available out there in the market,” Langham says.

DIFA chairman Wayne Thomason agrees that debtor fi nance represents an opportunity for residential brokers, particularly if they are considering diversification as both a differentiator and income generator in the current market.

“In a market where diversification is increasingly important, debtor finance can represent the relatively painless addition of another income stream looking after the borrowing needs of SMEs, and could help them transition to other areas of commercial lending in future.”

CVG Finance’s Lambess says brokers can build on their professional image by having a batch of funders to work with, and gaining knowledge from experienced finance brokers.

“As brokers, clients are coming to you for choice, not as an agent of one provider,” he says. “So, while you absolutely should have funders that will walk the journey with you, and reward them with sending them deals back, you have to remember you are not an agent for one lender. Good brokers will support clients by telling them what the banks won’t,” he says.

Next steps

Look at the business clients in your database: are they within one of the target industries, or do they off er trade credit terms? Have they had problems with cash fl ow in the past? Then pre-qualify the client – look at the debtors and creditors ledger – and get in touch with a debtor fi nance lender to see how they can help. You may also wish to develop links with experienced brokers in the space to build your own expertise. Finally, look at the other articles in this supplement if your client is interested in commercial property, extra equipment or is self-employed.

THE OFFSET ADVANTAGE

The fi rst thing Bayside Commercial Mortgages’ Kevin Wheatley does when he is seeing potential SME debtor finance clients is go straight to the debtors and creditors ledger.

THE OFFSET ADVANTAGE

The fi rst thing Bayside Commercial Mortgages’ Kevin Wheatley does when he is seeing potential SME debtor finance clients is go straight to the debtors and creditors ledger.

“Provided the business is not insolvent, and all they are experiencing is cash flow issues, debtor finance can potentially improve not only their cash flow problem, but it can also improve their purchasing power from their suppliers at the same time,” Wheatley says.

Businesses getting their cash flow in the door more quickly through debtor finance can pay suppliers faster, and use this to negotiate payment discounts. For example, a client able to guarantee payment within 14 days might be able to negotiate a 5% discount.

“What that allows them to do is offset the savings from the supplier to the cost of the debtor invoice facility,” he says. “Because of the competitive price of debtor finance today it can be cheaper than the cost of an overdraft, and if you can then

offset some of the cost of that facility it becomes much cheaper than a fixed priced overdraft,” he says.

NEED MORE INFORMATION?

We’ve asked a few of our Top 10 Commercial Brokers what advice they have for a new broker entering the sector. Here’s what they told us.

JASON ARNOLD, QUATTRO COMMERCIAL PROPERTY FINANCE (9TH)

“Align yourself with a well-respected mentor and continually expand lender database and product knowledge.”

MARK CHURCHILL, ALLFIN FINANCE (8TH)

“I think specialisation has been a big piece in making our business a success. If you look close enough at the Australian market there have to be business segments which are looking for commercial brokers to become specialists. By specialising you can spend less time and money on marketing; you can concentrate your impact through industry bodies and also gain a reputation with the lenders, which makes it easier to place finance. It does limit your market, but at the end of the day once you master one segment it can be used as a stepping stone to associated segments.”

JAMIE GILES, GREEN FINANCE GROUP (6TH)

“The best piece of advice that I could give would be that it’s not only important to have a network but it’s important for you to be able to leverage off that network and make it a commercially viable proposition.”

DANIEL GREEN, GREEN FINANCE GROUP (5TH)

“Do your research. The transition from residential to commercial is hard work … Find a mentor, a broker with a proven track record in the space, someone who is willing to help you develop your understanding. If you decide to go your own way, pick a speciality area or industry and focus, focus, focus. You can always diversify later. Pay attention to building relationships with other professionals working in the same industry – ie accountants, solicitors, quantity surveyors, business brokers – and develop your networks with a view to being able to off er your clients a better service.”

MARSHALL CONDON(4TH)

“My advice would be the same for anyone entering into any new market. Take time to broker with a proven track record in the space, someone who is willing to help you develop your understanding. If you decide to go your own way, pick a speciality area or industry and focus, focus, focus. You can always diversify later. Pay attention to building relationships with other professionals working in the same industry – ie accountants, solicitors, quantity surveyors, business brokers – and develop your networks with a view to being able to off er your clients a better service.”

MARSHALL CONDON (4TH)

“My advice would be the same for anyone entering into any new market. Take time to understand the market. Develop relationships with the right people who know the market (such as bankers), and speak with people that are already in the space (brokers). I have found that brokers are happy to share their knowledge and feedback with others, and that will be the quickest way to get up to speed …”

Joshua Vecchio (2ND)

“If you’re going to do it, make sure you do it properly. Learn the products, make the contacts in the banks and understand the various asset classes/financial structures/lease requirements, etc, because you aren’t going to be able to give your clients the service they require if you try and do it in halves.”

SOURCES OF COMMERCIAL LENDING NEWS

mpamagazine.com.au

Visit our website and sign up to our regular newsletters covering business news, lender updates, lead generation, and reports from the magazine. Also read the regular articles by Top 10 Commercial Broker Joshua Vecchio.

MPA Business Strategy supplement

Published in late May with MPA 16.7, our annual Business Strategy supplement is dedicated to long-term business development. Topics for this year include benchmarking staff , franchising and alternative finance.

brokernews.com.au

Australian Broker magazine’s website sends out a daily newsletter and has breaking news as it arrives, plus a range of polls on current industry issues.

www.thinktank.net.au

Thinktank has a monthly market focus freely available on its website which analyses trends in commercial

real estate.

NAB business reports

National Australia Bank produces monthly and quarterly reports on a range of business sectors, with dedicated reports for SMEs.

CommSec

Commonwealth Bank’s investment division produces regular economic insight papers analysing current economic trends.

As CFO at the time, Wheatley was having trouble with one of the mainstream banks, which had called in the business’s overdraft despite evidence of growth in large B2B contracts. Thanks to this bank “bullying”, the business was forced to sell equipment to pay off its overdraft.

“Growing our business on the back of the overdraft was never going to work – once your overdraft is exposed, banks are not very comfortable about extending the facility.”

That’s when Wheatley put invoice finance to work. With cash advanced against its receivables, the business invested in facilities like a warehouse and pallet racking. “It allowed us to grow from a $15m to a $28m business over an 18-month period.”

Wheatley has since become a strong advocate of debtor finance for the right SME through his finance business Bayside Commercial Mortgages, and he even mentors brokers looking to add debtor finance to their businesses. Wheatley says it gives them an edge.

“It’s an integral part of demonstrating a point of difference,” Wheatley says. “Financial pressure is the worst pressure any SME can experience. It makes a huge difference if they have a good adviser that can come on board, who can say, ‘Yes, I know you have a problem, but I’ve also got a solution to that problem’. It definitely adds a string to your bow as a broker, and ensures that brokers are perceived as professionals and that people listen to them.”

Knowing the ‘why’

Knowing the ‘why’ Expanding into debtor finance may seem daunting for residential mortgage brokers, but experts argue the transition is a genuine and relatively easy option for beginners. Scottish Pacific CEO Peter Langham says that, while commercial brokers are still the more common players in the market, that doesn’t rule out interested residential brokers. “It’s important to remember that commercial brokers didn’t all start out as commercial brokers. There’s nothing stopping a residential broker from expanding by moving into debtor finance,” Langham says.

Westpac national head of commercial introducers Janelle Pearce says there is a strong crossover between residential broker businesses and debtor finance because their clients are often business owners or self-employed. “Because residential brokers interact with business-owner clients, they are well positioned to add value by assisting these clients with their cash flow management and liquidity concerns in the day-to-day running of their business,” she says.

Peter Langham agrees. “A high proportion of home loan brokers will already be dealing with self-employed people who don’t get a payslip every fortnight. Those brokers are seeing the financials of those businesses, and it’s fairly easy for them to identify what assets are there on that balance sheet that could be leveraged to increase cash flow.”

Adding debtor finance capabilities can also be relatively simple. In many cases, brokers are able to hand off their clients to debtor finance providers once they have done the initial pre-qualification, meaning the level of commercial knowledge required is not prohibitively high. “It’s certainly wise to talk to a couple of debtor finance specialists to understand the product a bit more, but it really isn’t rocket science,” says Langham.

CVG Finance broker Paul Lambess, who does debtor finance deals, says sales are made easier by lenders that are not only broker-friendly but also actually pro-broker. “They really want to support your business and get as much as they can to get the deal set,” he says. This often translates to less work. “The workload you put in is much less, because they really want to help,” Lambess says.

Wheatley says debtor finance can be lucrative, depending on the facility size. Bayside facilitates around $50m per annum in debtor invoice facilities. Usually, a broker will pocket 50% of the establishment cost, which on a $3m facility could work out to between $20,000 and $25,000. As well as the upfront payment, there is an additional trail payment of approximately 15 and 20 basis points, depending on the provider. “That is very lucrative when it comes to picking up some additional revenue in your brokerage,” Wheatley says.

Westpac’s Pearce says it can add value to a broker’s business. “Brokers can use debtor finance as a solution that can differentiate them in the market, allowing them to off er a broader, diversified product suite. This is also a great retention strategy with clients.”

Debtor finance players agree there is potential demand in the SME market, should brokers wish to tap into it. Scottish Pacific’s latest SME Growth Index found that only 4.8% of SMEs actively keep an eye out for credit facilities that fi t best with their business. Meanwhile, 50% of SMEs don’t get around to reviewing their primary bank relationship and only 20% review this regularly. These statistics are met by a growth in openness to the idea of experimenting. “We’ve noted the increase in growth in SMEs willing to borrow from another bank or specialist non-bank lender,” Langham says. “This increase is even greater amongst SMEs who see themselves as declining or with unchanged growth – the number of these businesses looking beyond their main bank for funds has almost tripled in the last year from 6.9% to 18.2%.”

PAUL LAMBESS: USING DEBTOR FINANCE TO BUILD BUSINESS INCOME

PAUL LAMBESS: USING DEBTOR FINANCE TO BUILD BUSINESS INCOMEDebtor finance has been an important part of Newcastle-based Paul Lambess’s product offering at CVG Finance for the last five years. Because he services both residential and commercial clients, Lambess has a good idea of the value debtor finance can add.

“It’s a great tool to be able to use when talking to clients – it’s a bit of a niche,” Lambess says.

“Anyone can walk in and talk about a home loan, or a commercial loan, but debtor finance is a niche product and we’ve been able to use it to provide value to clients and referrers.”

There are some challenges brokers face when offering the product. With business clients often being close to their accountants, bad perceptions of the product can see them turned away.

“There is a perception – particularly among accountants – that it is an expensive product, that it’s a lender of last resort and something you would do only if you are really desperate,” Lambess says. “Potentially, you can get all the way through talking to a client about the advantages, but their accountant will can it because of their perception of the product.”

Then there’s a lack of awareness. For example, Lambess recently had a client who was still waiting two months after asking their bank for a $50,000 overdraft to help fund their business. In a week, he was able to get a $250,000 debtor finance facility turned around.

“The client and the accountant were blown away by the solution. With no property security they were able to get a facility five times that of a bank. They had known the overdraft wasn’t going to be enough, but had thought it would be better than nothing,” Lambess says.

When brokers are able to get around these problems through experience and knowledge, Lambess argues the advantages for their businesses can be great. One of the reasons for this is the nature of debtor finance, which can be a growing, rather than shrinking, asset.

“I think it is probably two or three times more rewarding to write debtor finance than a home loan,” Lambess says. “It pays a little bit more than a home loan, but it is also a growing facility – instead of being a loan that people pay off , it often grows, or appreciates rather than depreciates, earning brokers more as time goes on rather than less,” he says.

Executing the ‘how’

Debtor finance is easier than most commercial beginners think because brokers are able to scale their involvement up or down depending on their knowledge and experience. For example, Westpac says more experienced brokers will provide a full financial summary of their client to the bank. However, brokers need to realise that any transition will take some time, and some work. “The key is not trying to be an expert on day one,” Lambess says. “We can preach all day about diversification and extra income streams, but the trap is trying to be an expert on everything from day one. You need to build up your knowledge and experience.”

Debtor finance suits SME businesses selling to other businesses or government bodies on credit. This means manufacturing, wholesale, labour hire, business services, transport and logistics, and agriculture and mining services are the highest users. Because these businesses offer trade credit terms, they often need to wait for payments for extended periods of time, putting pressure on cash flow. The latest Dun & Bradstreet Trade Payments Analysis, for example, puts current average payment times at 44.1 days. Construction is one sector that is typically shunned by debtor finance funders, being a notoriously messy sector for payments, while retail businesses are excluded because they sell direct to consumers.

FactorONE’s Greg Charlwood says brokers need to be able to ask – and understand – two basic questions to pre-qualify debtor finance clients. The first is establishing if a client sells B2B on credit. The second is finding out if they are having problems with cash flow. To do this, brokers can benefit from basic experience in inspecting a business’s debtors and creditors ledger, to establish their overall cash fl ow position. It also helps to understand a balance sheet so they can assess the overall financial position of a business.

“The first bit of advice I give to brokers is to try and understand the individual’s business,” Kevin Wheatley says. “After going in to look at the debtors and creditors ledger, if the ratio of debtors to creditors is higher than, say, a 70/30 split, you can advise the client that you can arrange a facility to improve their cash fl ow to balance out that split.” With a basic understanding of how a debtor finance facility works, along with some knowledge of the company’s position, Wheatley says brokers can put forward the suggestion and handle basic questions.

Know your partners

Know your partnersThere are a range of partner-ships that can help brokers get started in recommending debtor fi nance. For example, specialist product providers like Scottish Pacifi c, pitched at larger SMEs, and FactorONE, geared towards smaller businesses, are willing to support brokers by talking them through how the product works, giving them information resources they can use, and helping them build the knowledge and expertise they need to get confident about pre-qualifying and recommending debtor finance products. This includes taking the majority of legwork off the broker – with the broker’s consent – after the initial pre-qualification is done.

“Our product specialists work with brokers to help brokers understand key principles and details,” Westpac’s Pearce says. “We also educate brokers on the product, and most importantly provide them with product communication and training presentations assisting them to spot opportunities. Having the right banker contact point to direct any enquiries to so as to provide an optimal experience for clients is critical,” she says.

Brokers can also team up with senior commercial brokers like Wheatley or Lambess who are able to mentor them and off er commission-splitting arrangements while they increase their commercial knowledge. For interested brokers, the Debtor and Invoice Finance Association (DIFA) also runs an online factoring course in conjunction with the Australian Institute of Credit Management, which teaches the basics of factoring.

FactorONE’s Greg Charlwood says brokers can get a start in the area by data mining their existing book for self-employed clients and then contacting them to talk about their business and funding position, to establish if they are having any problems with cash fl ow. Or they can start keeping an eye out for SME clients who walk through the door for a home loan. Charlwood says brokers will be surprised once they move into debtor finance just how many deals they have been missing out on in their day-to-day business. “It’s amazing the number of times I get in contact with a broker I haven’t spoken to in a while, and while we are just chewing the fat they realise they actually have got a debtor finance deal,” he says.

However, Charlwood says debtor finance is different to selling home loans, and requires brokers who are willing to be proactive in selling, rather than reactive. “People do wake up in the morning thinking that they want a new house or a new mortgage, but they don’t wake up thinking they need an invoice finance facility,” he says. “They don’t just come and present themselves and say, ‘I want invoice finance’, so being proactive is key.

Bayside’s Wheatley says brokers all want the industry to stand out as professional, to ensure the channel continues to grow and thrive. “Right now we are doing 52% of referred business, and we need to keep growing that,” he says.

Debtor finance can play a key role in that mission. Scottish Pacific’s Langham says while the product is able to build broker business income streams, it also builds deeper relation ships with clients, rather than just “doing a home loan and then forgetting about it”.

“I think brokers should be positioning themselves as a client’s personal banker. They’ve got the perfect opportunity to do that, because their clients are not as aware as they should be of the solutions to their problems that are available out there in the market,” Langham says.

DIFA chairman Wayne Thomason agrees that debtor fi nance represents an opportunity for residential brokers, particularly if they are considering diversification as both a differentiator and income generator in the current market.

“In a market where diversification is increasingly important, debtor finance can represent the relatively painless addition of another income stream looking after the borrowing needs of SMEs, and could help them transition to other areas of commercial lending in future.”

CVG Finance’s Lambess says brokers can build on their professional image by having a batch of funders to work with, and gaining knowledge from experienced finance brokers.

“As brokers, clients are coming to you for choice, not as an agent of one provider,” he says. “So, while you absolutely should have funders that will walk the journey with you, and reward them with sending them deals back, you have to remember you are not an agent for one lender. Good brokers will support clients by telling them what the banks won’t,” he says.

Next steps

Look at the business clients in your database: are they within one of the target industries, or do they off er trade credit terms? Have they had problems with cash fl ow in the past? Then pre-qualify the client – look at the debtors and creditors ledger – and get in touch with a debtor fi nance lender to see how they can help. You may also wish to develop links with experienced brokers in the space to build your own expertise. Finally, look at the other articles in this supplement if your client is interested in commercial property, extra equipment or is self-employed.

THE OFFSET ADVANTAGE

THE OFFSET ADVANTAGE“Provided the business is not insolvent, and all they are experiencing is cash flow issues, debtor finance can potentially improve not only their cash flow problem, but it can also improve their purchasing power from their suppliers at the same time,” Wheatley says.

Businesses getting their cash flow in the door more quickly through debtor finance can pay suppliers faster, and use this to negotiate payment discounts. For example, a client able to guarantee payment within 14 days might be able to negotiate a 5% discount.

“What that allows them to do is offset the savings from the supplier to the cost of the debtor invoice facility,” he says. “Because of the competitive price of debtor finance today it can be cheaper than the cost of an overdraft, and if you can then

offset some of the cost of that facility it becomes much cheaper than a fixed priced overdraft,” he says.

NEED MORE INFORMATION?

We’ve asked a few of our Top 10 Commercial Brokers what advice they have for a new broker entering the sector. Here’s what they told us.

JASON ARNOLD, QUATTRO COMMERCIAL PROPERTY FINANCE (9TH)

“Align yourself with a well-respected mentor and continually expand lender database and product knowledge.”

MARK CHURCHILL, ALLFIN FINANCE (8TH)

“I think specialisation has been a big piece in making our business a success. If you look close enough at the Australian market there have to be business segments which are looking for commercial brokers to become specialists. By specialising you can spend less time and money on marketing; you can concentrate your impact through industry bodies and also gain a reputation with the lenders, which makes it easier to place finance. It does limit your market, but at the end of the day once you master one segment it can be used as a stepping stone to associated segments.”

JAMIE GILES, GREEN FINANCE GROUP (6TH)

“The best piece of advice that I could give would be that it’s not only important to have a network but it’s important for you to be able to leverage off that network and make it a commercially viable proposition.”

DANIEL GREEN, GREEN FINANCE GROUP (5TH)

“Do your research. The transition from residential to commercial is hard work … Find a mentor, a broker with a proven track record in the space, someone who is willing to help you develop your understanding. If you decide to go your own way, pick a speciality area or industry and focus, focus, focus. You can always diversify later. Pay attention to building relationships with other professionals working in the same industry – ie accountants, solicitors, quantity surveyors, business brokers – and develop your networks with a view to being able to off er your clients a better service.”

MARSHALL CONDON(4TH)

“My advice would be the same for anyone entering into any new market. Take time to broker with a proven track record in the space, someone who is willing to help you develop your understanding. If you decide to go your own way, pick a speciality area or industry and focus, focus, focus. You can always diversify later. Pay attention to building relationships with other professionals working in the same industry – ie accountants, solicitors, quantity surveyors, business brokers – and develop your networks with a view to being able to off er your clients a better service.”

MARSHALL CONDON (4TH)

“My advice would be the same for anyone entering into any new market. Take time to understand the market. Develop relationships with the right people who know the market (such as bankers), and speak with people that are already in the space (brokers). I have found that brokers are happy to share their knowledge and feedback with others, and that will be the quickest way to get up to speed …”

Joshua Vecchio (2ND)

“If you’re going to do it, make sure you do it properly. Learn the products, make the contacts in the banks and understand the various asset classes/financial structures/lease requirements, etc, because you aren’t going to be able to give your clients the service they require if you try and do it in halves.”

SOURCES OF COMMERCIAL LENDING NEWS

mpamagazine.com.au

Visit our website and sign up to our regular newsletters covering business news, lender updates, lead generation, and reports from the magazine. Also read the regular articles by Top 10 Commercial Broker Joshua Vecchio.

MPA Business Strategy supplement

Published in late May with MPA 16.7, our annual Business Strategy supplement is dedicated to long-term business development. Topics for this year include benchmarking staff , franchising and alternative finance.

brokernews.com.au

Australian Broker magazine’s website sends out a daily newsletter and has breaking news as it arrives, plus a range of polls on current industry issues.

www.thinktank.net.au

Thinktank has a monthly market focus freely available on its website which analyses trends in commercial

real estate.

NAB business reports

National Australia Bank produces monthly and quarterly reports on a range of business sectors, with dedicated reports for SMEs.

CommSec

Commonwealth Bank’s investment division produces regular economic insight papers analysing current economic trends.