The moderator of Finance and Coffee is in a powerful position: he has to promote conversation and police it

The moderator of Finance and Coffee is in a powerful position: he has to promote conversation and police it

Like any good Melbournian, Dien Le drinks a lot of coffee – soy lattes, to be exact. That’s worth knowing, because at some point you’ll probably encounter him at a coffee meeting. He usually schedules about three per day.

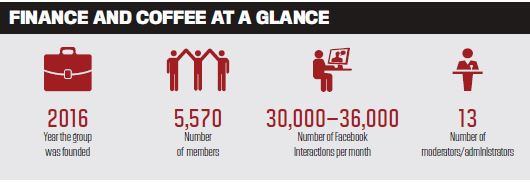

Le is the founder of Finance and Coffee, an online Facebook community that he began in February 2016 as a way of staying in touch with his broker and banking contacts in Victoria while he made the transition from lender to broker. The group quickly expanded beyond Le’s contacts to become a forum for all brokers across Australia.

It was initially intended as a conduit to face-to- face coffee meetings, where sole operators could meet in person, talk about the industry, and workshop deals and discuss challenges, but it’s since established an even larger presence online. Today it has more than 5,500 members, the majority of whom are brokers.

“A lot of them are one-man bands. The online community allows the person in their home office to reach out to a bigger family,” Le says.

“When you have some sort of knowledge or familiarity with someone whose name you see pop up on the forum that you look at every day, it’s a nice thing to catch up with them in person.”

Managing, moderating and expanding Finance and Coffee has since become Le’s full-time job. Membership is free for brokers. When they register, they are given the option to subscribe for more content and to access group discounts for the price of a coffee ($5) per month.

One thing he quickly realised was that all communities, even online ones, need rules of engagement. He asked for 12 volunteer moderators, spread across every state and representing different aggregators and associations, to help him keep the page on track so it wouldn’t become another venue for ranting and bank bashing.

“We need to be everybody’s friend, because at the end of the day we’re in one industry. Brokers can easily be divided … but there’s no place where brokers can talk to each other”

“I selected [the moderators] to ensure the page was agnostic and had a fair view of the industry so you don’t get one person touting one industry body or one aggregator over another,” he said.

“As a moderator, you’ve got quite a powerful voice. You can delete, you can remove comments as well as people, so the guys I selected did a fantastic job.”

Despite Finance and Coffee being a strongly rooted online community, Le is very hands-on. One of the challenges is juggling the many personalities that chime in. But if they don’t follow the rules, the moderators have no hesitation in expelling them.

The administration team has kicked 1,000 people out of the group so far. Not everyone agrees with this modus operandi, and some have parted ways to start their own groups elsewhere. But Le has come to accept that this is part of building the community he has envisioned: one in which learning and sharing is the mutual goal.

He’s made the rules more rigorous as a result. Prospective members now have to register on the Finance and Coffee website where they’re required to answer a series of questions and provide their credit rep numbers. This also ensures the group is closed to the public, and open only to those who play in the third party space. This, in theory, should provide brokers with peace of mind when workshopping challenging deals, as well as allowing other allied businesses, such as loan processors, private funders and other lenders, to engage with brokers.

“I’ve seen communities being built overnight, and they can also die overnight because those communities didn’t have rules, so anyone can post anything. It wasn’t well moderated, and when you do that you quickly lose the audience,” he says.

“We’ve got an audience that is very highly engaged in the conversations that we have, and without strict rules we would potentially lose that.”

Facebook data shows that there are more than 30,000 interactions on the Finance and Coffee page every month, which Le says proves the rules in place work.

With lenders changing their credit policies so rapidly these days, many brokers have come to see the page as a resource enabling them to talk through scenarios, especially if their BDMs are busy. The broker can start sourcing some suggestions and tips from the group while they wait, and members have shown they’re eager to help in any way they can, Le says. Some BDMs are also active on the group and respond to questions too.

But there are some conversations the group doesn’t permit, such as talk that pits aggregators and industry bodies against each other. More recent topics, such as the royal commission, have also been quashed.

“The brokers have their aggregators, and their respective associations, for that purpose and it’s their job to lobby for your existence as a broker. All associations and aggregators do massive work behind the scenes as well as publicly. Those are the ones that their questions and concerns should be directed to, not Finance and Coffee. Finance and Coffee is a platform for learning and sharing, not scaremongering.”

In an industry that’s been forced to contend with heightened scrutiny and polarisation, Finance and Coffee is trying to strike a balance between keeping the group active and engaged, and also controlling the conversations so people don’t feel alienated.

“We need to be everybody’s friend, because at the end of the day we’re in one industry. Brokers can easily be divided between aggregators or industry bodies, but there’s no place where brokers from across these groups can talk to each other. For some reason, I’ve managed to do that. We’re a friend to everyone.”

Title: Founder

Company: Finance and Coffee

Years in the industry: 12

Career highlight: “Creating the Finance and Coffee community. It is not often that you manage to create something that a large percentage of the industry is using and, most importantly, is talking about. At the start of 2016, had I told you that you could qualify for CPD points from a social media group, you would probably have laughed at the notion. ... Both the FBAA and MFAA now allow us to issue five CPD points if we can prove member activity on the group. “With a hive mind of over 5,500 members in every state, someone, somewhere, can answer your question quicker than calling a lender BDM or going through multiple lender policy booklets/PDFs. While answers provided by another member need to be doublechecked, it is a great way to start your search for potential lenders.”

Career lowlight: “The GFC. Multiple restructures, and the possibility of the lender I was employed with at the time closing business altogether, took a massive toll on me. While it all worked out in the end, what I learnt was that, as an employee, I did not have control of whether I had a job the next day or not. The seed to go out and start a business was planted, but it took many years and two more roles at two different lenders for me to actually have the courage to take the plunge into self-employment. I could not have done so without the blessing of a supportive wife.”