Mortgage Choice’s John Flavell walks MPA through his plans to take the franchise in a new and diversified direction

Mortgage Choice’s CEO might be new to the job, but he’s certainly not new to the industry.

MPA: What are your plans for Mortgage Choice over these first 12 months?

JOHN FLAVELL: There are five stakeholders that I’ve focused on in the first 26 days. The first is consumers, making sure we’ve got a proposition that delivers value to them, and I’ve certainly spent a lot of time looking at the data we’ve got from our mystery shopping and understanding where things work and where we might improve.

The second group is shareholders, as we’re a publicly listed entity, and making sure that our institutional investors, funds managers and analysts understand me, the business, and what our plans are, and are supportive of that.

We have a very competent board that’s there to make sure the management team is making prudent decisions about growing a productive business, and in addition to that, we have lender partners … I’ve spent a lot of time with lender partners.

And finally, but certainly not least, is the team within head office. I’ve spent a lot of the time in the field with our franchisees one-to-one, and also smaller groups, getting feedback from them in terms of what’s really urgent, what’s important and where there are opportunities for the future. And that’s really enabled me to get some clarity on where our focus should be, and where our broader strategic opportunities will be.

MPA: Are there any plans to expand Mortgage Choice’s loan writer numbers, and what is your proposition to potential members?

JF: I think as far as quality and quantity are concerned, we’ll never compromise quality for absolute quantity. So we’re very focused on being able to meet the needs of mortgagees consistently, and that can come through providing efficiency gains to the network, allowing them to get in front of more people and be more productive when they’re there, and also through growing out the size of the network as well.

Yes, we expect to increase the number of loan writers and the number of franchisees in the network, but we’re not going to compromise the quality to get there. You put one and one together, and you get something more than two – so profitable, sustainable market share growth, and delivering really strong customer outcomes.

MPA: So are you aiming for a similar growth in broker numbers to last year?

JF: No, I’d say not. If you look at what we do, only two out of three things we do are mortgages; the remainder is broader diversified financial services. The proportion of our activity in diversified services will be increased as the year goes on. The other thing is that the market’s grown pretty significantly from a mortgagee’s perspective, from a protection perspective and from an investment perspective, so it’s not really good enough for us to hold market share; we want to do more than that.

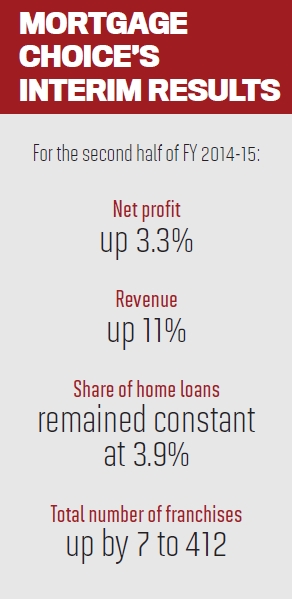

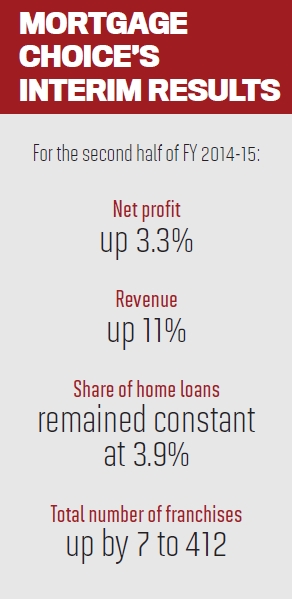

MPA: Diversified services only made up 11% of revenue in your interim results – isn’t that a very small proportion?

JF: The proportion of revenue that’ll be generated from diversified services will increase over time, I have no doubt. And then if you have a look at it, what is the basic nature of the services we’re providing? There are really basic additional services such as personal loans, car loans, insurance, commercial lending and then, obviously, what we do in terms of financial advice – meeting people’s needs in terms of protection, and their investment needs as well. So that proportion will increase over a while.

The revenue you might generate from a personal loan or a general insurance policy relative to a mortgage is obviously [smaller]. If you meet 100% of customers’ needs 100% of the time, the proportion of revenue that’d come from those diversified services is still smaller than what would come from the mortgage space. I think the focus for us is actually on saying, ‘How do we make sure all of our customers’ needs are met every single time?’ Every conversation we have is about everything from debt to protection to investments to whatever their needs are, because we’ve got some great solutions from them.

MPA: How are you going to drive diversification through the network – particularly for less willing brokerages?

JF: I don’t think it’s about willingness; it’s about people saying, ‘How can we make a really robust process?’, so every time I talk to a customer in terms of their debt needs, I have a conversation about protection, general insurance, credit. So it’s about getting that conversation out there and letting people know that we offer so much more than just mortgages. We’ve been at it for 23-odd years in mortgages, but as far as diversified services, it’s only been a very short period of time. We didn’t have financial planning three years ago, as the business was started from scratch, and now we’ve got almost 40 financial planners out there, which is wonderful, and it’s great we can meet more of our customers’ needs.

MPA: So is there support out there for brokerages that do want to diversify?

MPA: What are your plans for Mortgage Choice over these first 12 months?

JOHN FLAVELL: There are five stakeholders that I’ve focused on in the first 26 days. The first is consumers, making sure we’ve got a proposition that delivers value to them, and I’ve certainly spent a lot of time looking at the data we’ve got from our mystery shopping and understanding where things work and where we might improve.

The second group is shareholders, as we’re a publicly listed entity, and making sure that our institutional investors, funds managers and analysts understand me, the business, and what our plans are, and are supportive of that.

We have a very competent board that’s there to make sure the management team is making prudent decisions about growing a productive business, and in addition to that, we have lender partners … I’ve spent a lot of time with lender partners.

And finally, but certainly not least, is the team within head office. I’ve spent a lot of the time in the field with our franchisees one-to-one, and also smaller groups, getting feedback from them in terms of what’s really urgent, what’s important and where there are opportunities for the future. And that’s really enabled me to get some clarity on where our focus should be, and where our broader strategic opportunities will be.

MPA: Are there any plans to expand Mortgage Choice’s loan writer numbers, and what is your proposition to potential members?

JF: I think as far as quality and quantity are concerned, we’ll never compromise quality for absolute quantity. So we’re very focused on being able to meet the needs of mortgagees consistently, and that can come through providing efficiency gains to the network, allowing them to get in front of more people and be more productive when they’re there, and also through growing out the size of the network as well.

Yes, we expect to increase the number of loan writers and the number of franchisees in the network, but we’re not going to compromise the quality to get there. You put one and one together, and you get something more than two – so profitable, sustainable market share growth, and delivering really strong customer outcomes.

MPA: So are you aiming for a similar growth in broker numbers to last year?

JF: No, I’d say not. If you look at what we do, only two out of three things we do are mortgages; the remainder is broader diversified financial services. The proportion of our activity in diversified services will be increased as the year goes on. The other thing is that the market’s grown pretty significantly from a mortgagee’s perspective, from a protection perspective and from an investment perspective, so it’s not really good enough for us to hold market share; we want to do more than that.

MPA: Diversified services only made up 11% of revenue in your interim results – isn’t that a very small proportion?

JF: The proportion of revenue that’ll be generated from diversified services will increase over time, I have no doubt. And then if you have a look at it, what is the basic nature of the services we’re providing? There are really basic additional services such as personal loans, car loans, insurance, commercial lending and then, obviously, what we do in terms of financial advice – meeting people’s needs in terms of protection, and their investment needs as well. So that proportion will increase over a while.

The revenue you might generate from a personal loan or a general insurance policy relative to a mortgage is obviously [smaller]. If you meet 100% of customers’ needs 100% of the time, the proportion of revenue that’d come from those diversified services is still smaller than what would come from the mortgage space. I think the focus for us is actually on saying, ‘How do we make sure all of our customers’ needs are met every single time?’ Every conversation we have is about everything from debt to protection to investments to whatever their needs are, because we’ve got some great solutions from them.

MPA: How are you going to drive diversification through the network – particularly for less willing brokerages?

JF: I don’t think it’s about willingness; it’s about people saying, ‘How can we make a really robust process?’, so every time I talk to a customer in terms of their debt needs, I have a conversation about protection, general insurance, credit. So it’s about getting that conversation out there and letting people know that we offer so much more than just mortgages. We’ve been at it for 23-odd years in mortgages, but as far as diversified services, it’s only been a very short period of time. We didn’t have financial planning three years ago, as the business was started from scratch, and now we’ve got almost 40 financial planners out there, which is wonderful, and it’s great we can meet more of our customers’ needs.

MPA: So is there support out there for brokerages that do want to diversify?

JF: Sure, but having said that, the approach we take in relation to financial planning and mortgage broking in particular is they’re both highly specialised areas, and they’re highly specialised skill sets, so we have loan writers and we have financial planners, and we don’t have people trying to do both. The value that we can deliver to customers by having specialists in their chosen field speaks for itself in terms of the outcomes we’re giving to customers.

MPA: What is the Project One CRM system, and how will it help your brokers?

JF: We’ve been re-platforming the entire operation over the last three years, and we’ve developed Phase 1, which will be completed by May, and by November this year, we’ll deliver the second phase. And what that will do is give the network the ability to have an integrated single view of all our customers across all our services. It’ll deliver an efficiency dividend to the network, which means they can deliver quality outcomes to their customers, seeing their customers more and being more productive.

And it’ll give us the ability to turn around and say, ‘I have a complete view of you from a debt perspective, from a wealth perspective, and as your needs change over your life cycle, I’ve got a comprehensive and complete view and can anticipate and work with those needs.’ It’s one comprehensive view, and it’s about having data, then you pull that data together and create knowledge, and then with some insight, you can start to anticipate people’s needs and work with them to deliver a fantastic value proposition over their entire financial life.

Whatever your needs, whatever channel you want to use – online, on the phone, with an adviser face-to-face, whatever the case – then having a system that sees you as one customer is wonderful, as opposed to a fractured relationship.

MPA: Are there going to be any changes to Mortgage Choice’s marketing to consumers, particularly in the message you want to convey?

JF: If you have a look at the opportunities for an enterprise like Mortgage Choice to let consumers know what we do, then there are more options now than ever before. There are more places to make contact and put our message out to consumers. And like any enterprise, we’ve got to make sure we optimise that and get the best outcomes we can for the resources we have.

As far as our proposition is concerned, Mortgage Choice has been around for 23 years, and it comes back to delivering a good, strong value to consumers, and in more recent times about saying, ‘Mortgages are at the core of what we’ve done, but we’re taking that same principle and value and expanding it across a broader range of financial solutions.’ So, yes, it’s mortgages, but it’s more than mortgages. It’s Mortgage Choice, but there are more choices than ever before.

MPA: Where would you like Mortgage Choice to be in 12 months?

JF: I think from a directional perspective, continuing to increase our capability to meet the broader financial needs of more customers. And so I suppose that is growth in market share, growth in share of wallet, and developing and delivering more value to customers, which means building a more profitable franchisee network, which means delivering better outcomes to our lender partners, which means we’re delivering really strong positive outcomes to our shareholders as well.

MPA: What is the Project One CRM system, and how will it help your brokers?

JF: We’ve been re-platforming the entire operation over the last three years, and we’ve developed Phase 1, which will be completed by May, and by November this year, we’ll deliver the second phase. And what that will do is give the network the ability to have an integrated single view of all our customers across all our services. It’ll deliver an efficiency dividend to the network, which means they can deliver quality outcomes to their customers, seeing their customers more and being more productive.

And it’ll give us the ability to turn around and say, ‘I have a complete view of you from a debt perspective, from a wealth perspective, and as your needs change over your life cycle, I’ve got a comprehensive and complete view and can anticipate and work with those needs.’ It’s one comprehensive view, and it’s about having data, then you pull that data together and create knowledge, and then with some insight, you can start to anticipate people’s needs and work with them to deliver a fantastic value proposition over their entire financial life.

Whatever your needs, whatever channel you want to use – online, on the phone, with an adviser face-to-face, whatever the case – then having a system that sees you as one customer is wonderful, as opposed to a fractured relationship.

MPA: Are there going to be any changes to Mortgage Choice’s marketing to consumers, particularly in the message you want to convey?

JF: If you have a look at the opportunities for an enterprise like Mortgage Choice to let consumers know what we do, then there are more options now than ever before. There are more places to make contact and put our message out to consumers. And like any enterprise, we’ve got to make sure we optimise that and get the best outcomes we can for the resources we have.

As far as our proposition is concerned, Mortgage Choice has been around for 23 years, and it comes back to delivering a good, strong value to consumers, and in more recent times about saying, ‘Mortgages are at the core of what we’ve done, but we’re taking that same principle and value and expanding it across a broader range of financial solutions.’ So, yes, it’s mortgages, but it’s more than mortgages. It’s Mortgage Choice, but there are more choices than ever before.

MPA: Where would you like Mortgage Choice to be in 12 months?

JF: I think from a directional perspective, continuing to increase our capability to meet the broader financial needs of more customers. And so I suppose that is growth in market share, growth in share of wallet, and developing and delivering more value to customers, which means building a more profitable franchisee network, which means delivering better outcomes to our lender partners, which means we’re delivering really strong positive outcomes to our shareholders as well.