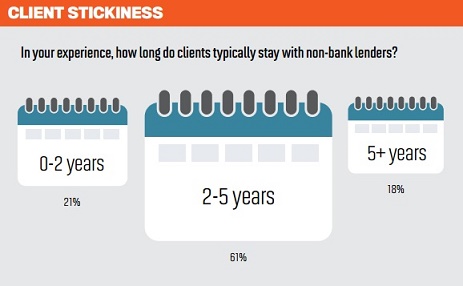

Borrowers are willing to consider non-banks, but why do the majority stay on with these lenders for only 2-5 years?

Brokers play a crucial role for non-banks, providing the overwhelming majority of their business, playing the intermediary between non-banks and the consumer.

Rather than just talk about the broker/non-bank relationship, we wanted to draw on brokers’ experience with consumers to explore what their customers think about non-banks and what this means for brokers.

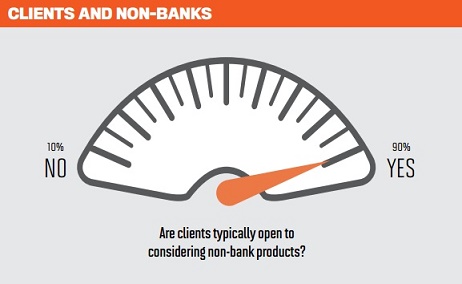

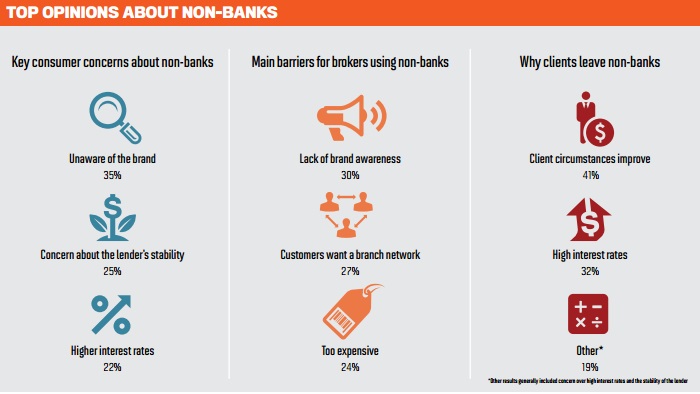

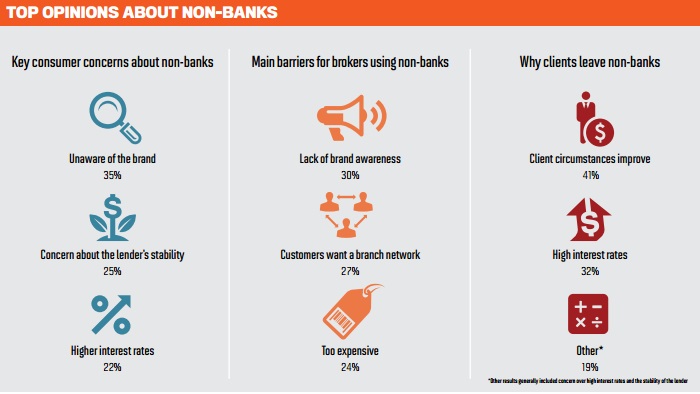

Consumers are relatively ignorant about the non-bank sector, but largely are still prepared to deal with non-banks, our results suggest. We asked brokers what clients’ main concerns were about dealing with non-banks, and ‘lack of awareness of the brand’ was number one, by some margin. However, when we asked brokers, “Are clients typically open to considering non-bank products?”, the overwhelming majority said their clients would.

Of course, saying consumers are prepared to consider non-banks doesn’t mean that lack of brand awareness isn’t a problem in the longer term. When we asked brokers to name their main obstacle to putting more business through non-bank lenders, ‘lack of brand awareness’ was the number-one barrier, although other factors such as ‘lack of a branch network’ and ‘high interest’ rates were almost as important.

Rather than just talk about the broker/non-bank relationship, we wanted to draw on brokers’ experience with consumers to explore what their customers think about non-banks and what this means for brokers.

Consumers are relatively ignorant about the non-bank sector, but largely are still prepared to deal with non-banks, our results suggest. We asked brokers what clients’ main concerns were about dealing with non-banks, and ‘lack of awareness of the brand’ was number one, by some margin. However, when we asked brokers, “Are clients typically open to considering non-bank products?”, the overwhelming majority said their clients would.

Of course, saying consumers are prepared to consider non-banks doesn’t mean that lack of brand awareness isn’t a problem in the longer term. When we asked brokers to name their main obstacle to putting more business through non-bank lenders, ‘lack of brand awareness’ was the number-one barrier, although other factors such as ‘lack of a branch network’ and ‘high interest’ rates were almost as important.

Price plays an important role in the consumer/non-bank relationship, and it goes a long way to explaining why consumers avoid non-bank lenders. It is a key concern of clients, and therefore a barrier to selling a non-bank product. Perhaps more important, it is a prime reason for non-banks losing their existing customers – both in the literal sense, but also because high interest rates may factor into perceptions that non-banks are a temporary solution.

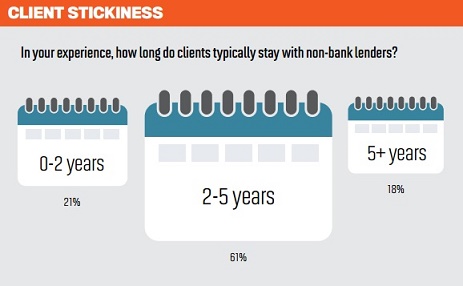

Please note our use of ‘may’ – as poor service isn’t an issue (given as a reason for just 9% of clients leaving), we assume it’s high prices that encourage consumers to move. Clients stay with non-bank lenders for an average of two to five years, suggesting that non-banks have trouble holding onto consumers – although many have previously told MPA this is their desired positioning in the market. In fact, many pride themselves on helping non-conforming clients rebuild their finances, and so won’t be concerned that ‘client circumstances improve’ is the main reason for borrowers leaving the sector.

One serious concern for non-banks, and for the brokers selling their products, may be the considerable level of consumer concern about non-banks’ stability, several years after the global financial crisis. Some non-banks now have the resources to mount their own consumer awareness and public relations campaigns, as Pepper did with their ‘Absolutely Positively Pepper’ campaign earlier this year. However, smaller non-banks will have to depend on brokers to properly educate consumers on non-banks’ financial backing and regulatory standards.

MPA's 2015 Brokers on Non-Banks proudly sponsored by Advantedge Distribution

One serious concern for non-banks, and for the brokers selling their products, may be the considerable level of consumer concern about non-banks’ stability, several years after the global financial crisis. Some non-banks now have the resources to mount their own consumer awareness and public relations campaigns, as Pepper did with their ‘Absolutely Positively Pepper’ campaign earlier this year. However, smaller non-banks will have to depend on brokers to properly educate consumers on non-banks’ financial backing and regulatory standards.

MPA's 2015 Brokers on Non-Banks proudly sponsored by Advantedge Distribution