Urges RBA to raise rates aggressively

Deutsche Bank economist, Phil O’Donaghoe, recently announced that he sees three more interest rate hikes (four including yesterday’s) by the Reserve Bank of Australia (RBA), based on his research utilizing the Taylor Rule (see below).

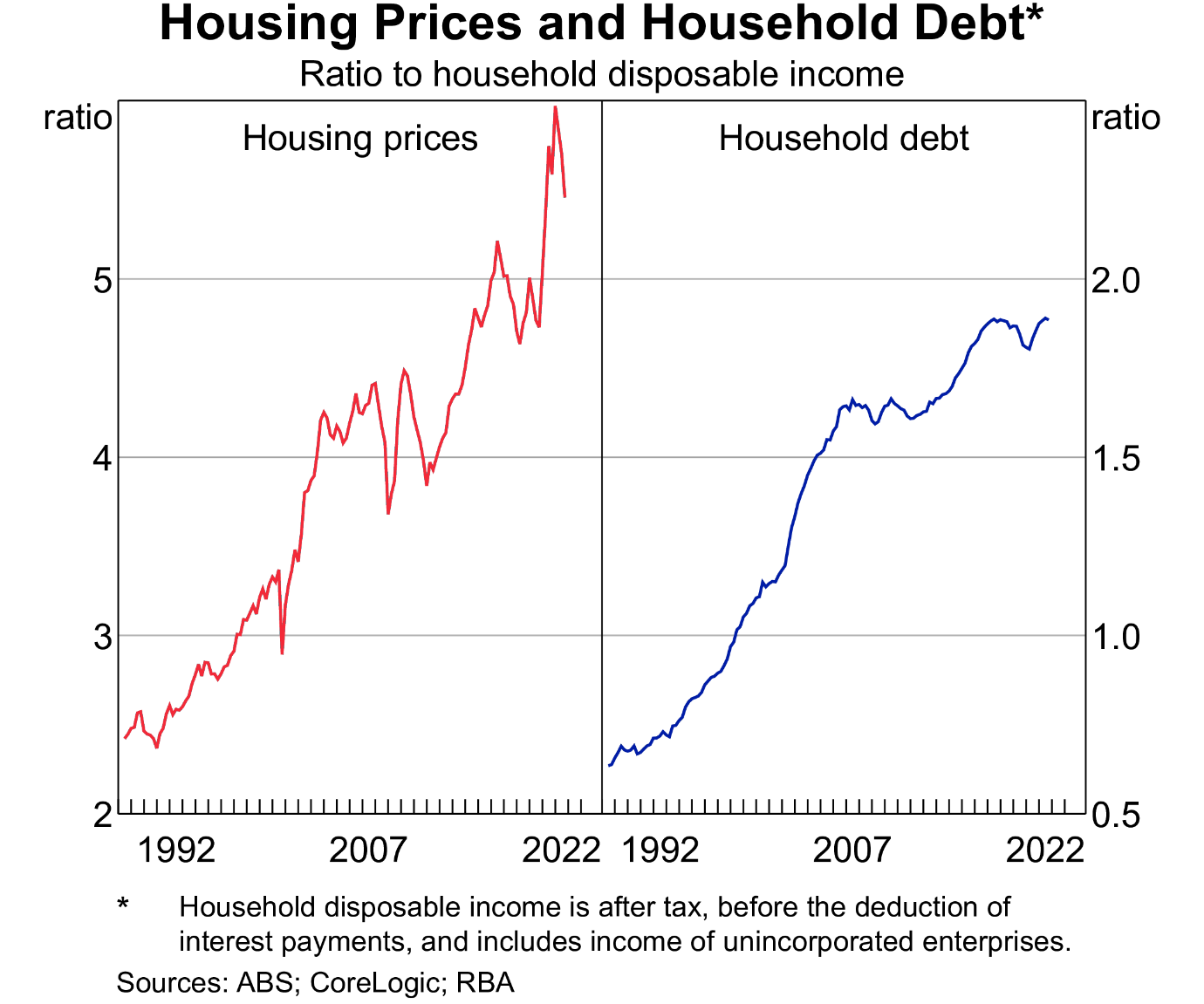

This would take the cash rate to a “terminal”, or final, rate of 4.1%. According to O’Donaghoe, this will make Australian households more sensitive to RBA policy as mortgage interest rates in the country are directly linked to the cash rate. Deutsche Bank indicated late last year that it saw a double digit fall in house prices as rates climbed.

Data from the Australian Bureau of Statistics (ABS) showed that average household debt was $261,492 in 2021-22, which is among the highest in the world. O’Donaghoe hopes that economists’ commentary can play a role in limiting the aggressiveness of the RBA’s interest rate hikes.

However, the ABS recently published new data showing a drop in retail sales of 3.9% in December, indicating that households have started tightening their purse strings.

Despite this, O’Donaghoe still believes the best course of action for the RBA is to hike aggressively over the next six months to ensure inflation returns to the target band of 2-3%.

On the other hand, AMP’s chief economist, Shane Oliver, does not believe that the RBA’s cash rate will peak above 3.6%. He believes that with the already slowing consumer confidence, housing indicators, retail sales, and jobs market, as well as peaking global and local inflationary pressures, the RBA may pause its rate hikes.

The Taylor rule is a monetary policy rule named after economist John Taylor, who first described it in 1993. The rule provides a simple formula that central banks can use to set interest rates, based on the current state of the economy.

The standard Taylor rule formula is:

i = r* + πe + 0.5(πe - π*) + 0.5y*

where: i is the target interest rate r* is the central bank’s long-term interest rate target πe is the current inflation rate π* is the central bank’s target inflation rate y* is the difference between the actual output gap and the potential output gap of the economy.

The Taylor rule provides a general guideline for central banks on how to adjust interest rates in response to changes in inflation and the level of economic activity.