Most experts think softening inflation will not hasten rate cuts

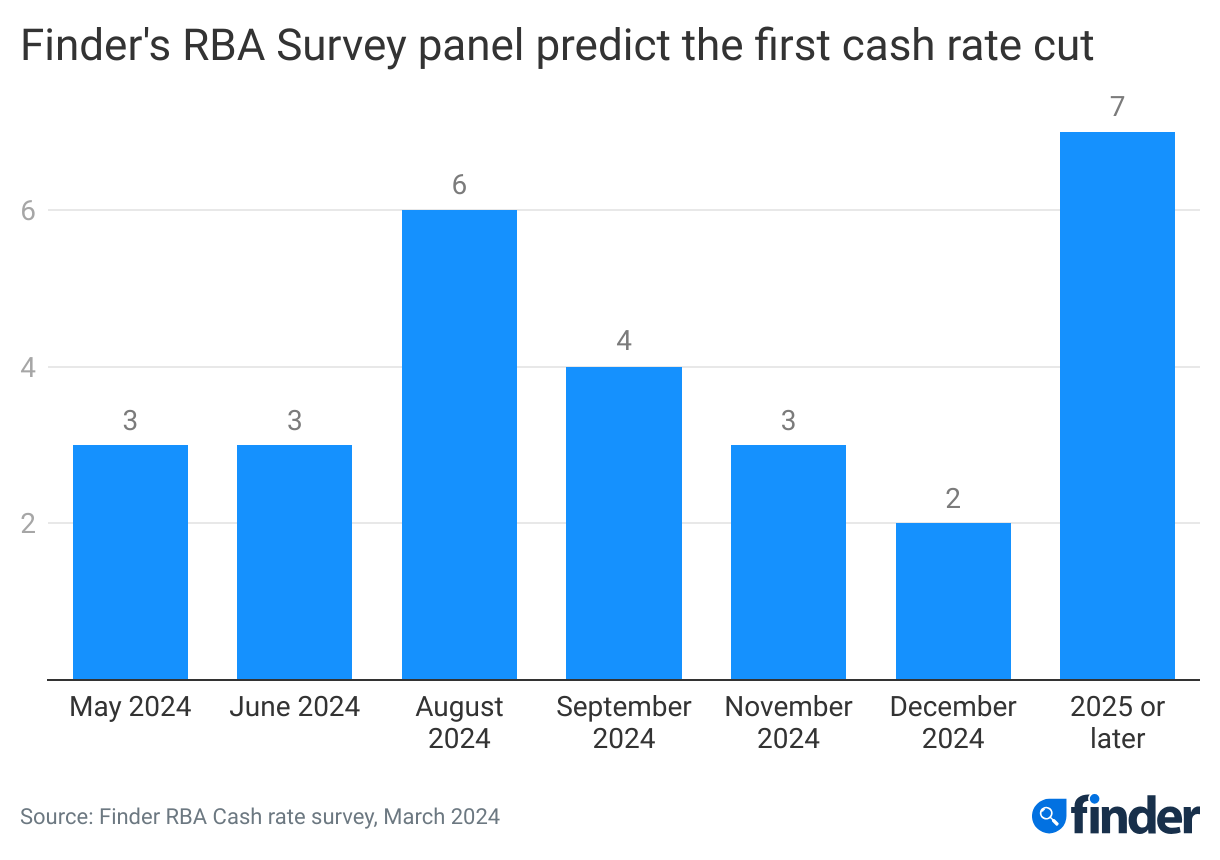

Economists have forecasted that there would be no interest rate cuts until at least September, despite inflation figures coming in lower than anticipated, a recent Finder RBA Cash Rate Survey has revealed.

The survey, which gathered insights from 41 experts and economists, suggested the Reserve Bank of Australia (RBA) would maintain the cash rate at 4.35% in March, amid signs that the cost-of-living crisis may be abating.

“With inflation continuing to reduce, it seems the RBA’s rate hikes are having the desired effect,” Graham Cooke, head of consumer research at Finder. “The question now is not if the RBA will cut rates – but when?”

Despite the softening inflation, a significant portion of surveyed experts (71%) did not foresee these developments hastening cash rate cuts, with a quarter of respondents expecting rate reductions to commence in 2025.

Shane Oliver (pictured above left) of AMP and David Robertson (pictured above centre) from Bendigo Bank both said further progress in core inflation was needed before any rate cuts were considered, with Harry Murphy Cruise of Moody’s Analytics suggesting that policy loosening is unlikely before September.

The survey also touched on the influence of potential US Federal Reserve rate cuts, with a majority of experts doubting immediate follow-up actions by the RBA.

Saul Eslake from Corinna Economic Advisory noted the RBA’s cautious approach to both rate hikes and cuts, suggesting a willingness to accept above-target inflation for longer periods compared to other central banks.

The possibility of the US Federal Reserve reducing rates three times in 2024 was also acknowledged, though experts like Cooke (pictured below) speculated on the limited immediate impact such moves would have on Australian policy.

Despite concerns over economic stimulation and consumer spending, 73% of the respondents believe these cuts will not significantly impact inflation levels.

Nicholas Frappell of ABC Refinery suggested that the short-term effects of the tax cuts could alleviate some cost-of-living pressures without substantially altering household financial conditions. Both Peter Munckton (pictured above right) from the Bank of Queensland and Mark Crosby of Monash University echoed the sentiment that the tax cuts would have a modest effect on economic growth.

Some experts, however, warned of the potential for inflation to rise due to increased consumer spending. Noel Whittaker, an adjunct professor at QUT Business School, pointed out that more disposable income could lead to higher expenditure. Similarly, Nicholas Gruen from Lateral Economics said that significant tax reductions might fuel inflation unless balanced with other policy measures.

Robertson viewed the tax cuts as an important step towards broader tax reform, suggesting they could provide a modest fiscal boost without derailing plans for rate cuts in 2025.

According to Cooke, the government seemed to have hit the nail on the head with its tax cuts.

“The stage 3 cuts have proven popular with many voters, and more importantly, don’t appear to risk re-energising inflation, according to the majority of our economists,” he said. “With savings accounts offering sky-high interest rates, Aussies would be best advised to put any tax money in their savings account.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.