However, income gaps and rising debt could present challenges

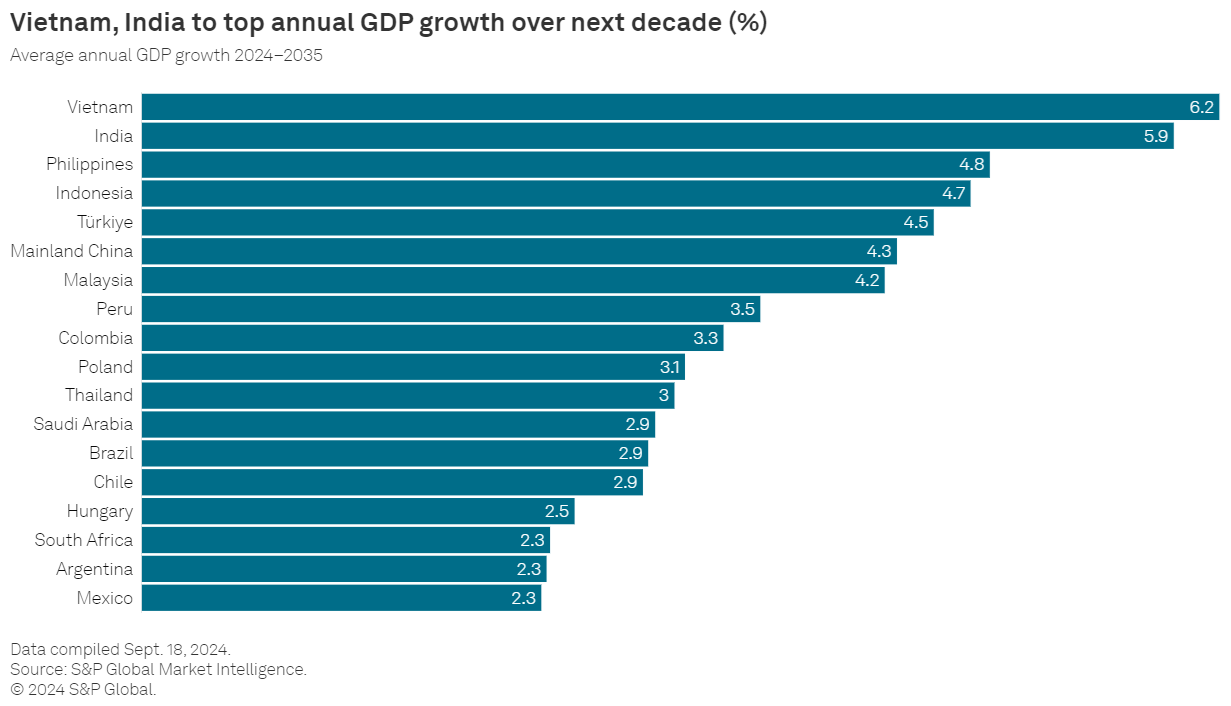

Emerging markets are poised to drive a significant portion of global economic growth in the coming years, according to a new report from S&P Global.

The report, titled “Look Forward,” forecasts that emerging economies will contribute roughly 65% of global economic growth by 2035, with nine of these markets expected to rank among the world’s 20 largest economies.

Policymakers in emerging markets have set ambitious goals for the next decade, focusing on economic diversification, infrastructure development, and skills advancement. However, limitations on trade, restricted capital flows, and a shortage of skilled labour could pose challenges to their growth plans.

The S&P Global report highlights the divergent paths of various emerging economies. While countries like Brazil, Indonesia, and India are positioned for strong growth, others, including Mexico and China, are facing setbacks. In South Africa, growth potential is promising but unlikely to meet the country's 2030 objectives. Saudi Arabia’s growth hinges on political reforms and attracting foreign investment, while Malaysia’s economic prospects depend on improving labour skills to enhance competitiveness.

However, the report also notes that despite their growth potential, per capita income in these markets is likely to remain well below that of advanced economies. Productivity improvements, supported by favourable demographics and technological advances, will be key to accelerating economic growth in these regions.

The energy transition and the relocation of global supply chains present significant opportunities for emerging markets. These economies are well-positioned to capitalise on their natural resources, large workforces, and manufacturing capabilities. However, geopolitical challenges, including conflicts and disruptions in global trade, will create hurdles.

Despite the growth outlook, income convergence with developed economies remains slow. By 2030, per capita income in the 10 largest emerging markets is projected to be only about a third of that in the 10 largest developed markets.

The pace of productivity growth will determine which emerging markets are able to close this income gap. Experts believe that countries that embrace global structural shifts, such as energy transition and supply chain changes, are expected to perform better in terms of income growth. In contrast, those that lag behind may face increased social and political instability, especially in regions like sub-Saharan Africa, where productivity growth is particularly weak.

S&P Global Ratings also warns of rising government debt in many emerging markets through 2030, although these debts are expected to remain manageable compared to those of developed nations. Improved external positions, higher reserve buffers, and more effective monetary policies have made many of these economies more resilient to global financial shocks.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.