Many Australians fall in love with property, and fall even more in love with the idea of giving up their day job to live off their real estate profits indefinitely. But what steps are required to actually make this happen? Brendan Kelly lays it on the line

Many Australians fall in love with property, and fall even more in love with the idea of giving up their day job to live off their real estate profits indefinitely. But what steps are required to actually make this happen? Brendan Kelly lays it on the line

How many properties do you need to own before you can comfortably live off the returns, and is it ever really safe to quit your day job and become a full-time investor?

There persists a romantic notion about ‘chucking in’ the day job, moving to a tropical beach and living out your days in paradise. Needless to say, the facts of life tend to tarnish those romantic notions and replace them with a certain pragmatic necessity to be around our families, friends, great medical care, services, conveniences and familiarity.

Nonetheless, the dream of being able to retire early, or at the very least retire comfortably, continues to drive thousands of people into investing in property.

The question remains, however: Is it ever really safe to quit our day job and become a full-time property investor? When it comes to our day job, more often than not, there is a very real feeling of comfort we get to enjoy when we stick with ‘the devil we know’. It’s fair to assume that if we have been successfully employed for some time and if we do our job well, then we can surely feel secure about our ability to put food on the table and keep a roof over our heads. Isn’t it?

Employment, however, offers no guarantee and tends to mask a fundamental flaw in relying on earned income.

If we think about it a little, we begin to see that employment is simply the act of exchanging our time for money. In its simplest form, this act of exchange occurs on an hourly basis. If we offer our time and skill to serve the company for an hour, we’ll get financially compensated. If we don’t work the hour, we won’t get the money.

Of course, the more skill you can apply for your employer, the more valuable you are to the organisation, and therefore the more they will compensate you for every hour you work, in order to encourage you to stay.

It is important to notice here, though, that you need to work the hour before you get paid – and therein we find the flaw. If for some reason you are no longer able to invest that hour into your job, you are then unable to hold up your end of the agreement and your ability to earn an income evaporates.

Owning an asset base big enough to generate an income to live off is more durable and reliable for generating an income than working harder at staying employed and relying on blood and bone!

The point: not only is it safe to quit your day job to become a full-time property investor (when your alternative income is in place), but it is safer to do that than it is to rely on remaining employed to secure your financial future.

Income and yield

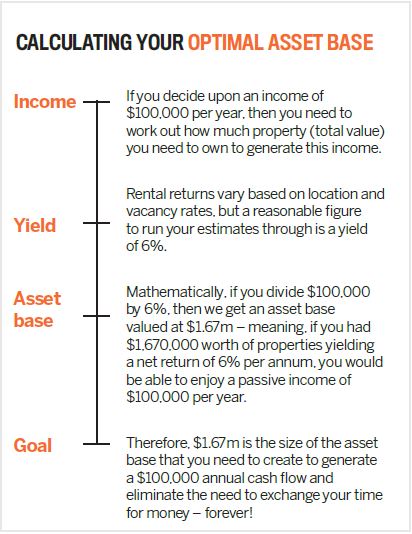

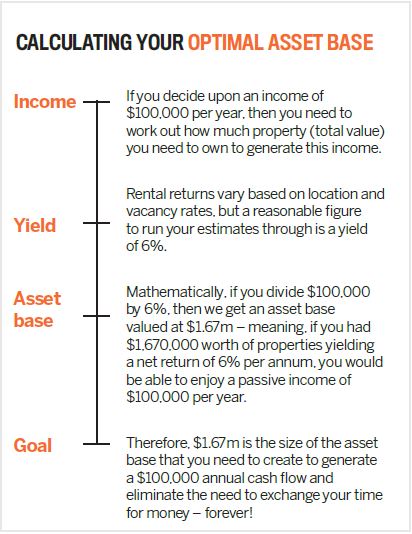

In order to get a grip on how to create an alternative income, we need to be clear on how much

income is enough, and what might be the rate of return we can expect from our investments.

When the question around ‘how much’ gets asked among people who talk about living the dream, a general consensus begins to emerge, suggesting that about $100,000 per annum would be enough. Realistically, such a measure is a very personal thing and it would be wise to invest some time to try to determine the cost of the life you want to live very clearly for yourself. However, let’s go with $100,000 as being a great starting point for our alternative income.

We also need to consider the rate of return we believe we can achieve from our investing.

If we owned residential houses in major CBDs, we might expect a gross rental yield of about 2.5–5%. If we held residential property in more regional areas, we might expect a gross rental yield to the tune of about 4–7%. Of course, if we owned high-yielding commercial properties or properties in selected mining towns or rural locations, we might be able to generate gross rental yields in the order of 6–14%. So knowing this, what might be a fair and reasonable net rental yield?

If we decide to own a mixed portfolio of properties in different areas without debt, let’s say, we might be able to average a net rental yield somewhere in the vicinity of 6%. Using this rate of return, we can now determine the size of the asset base we require to live the life we want without being employed (see box on p37 for how we calculated a value of $1.67m).

Of course, we’d also need to add to our tally enough money to provide a debt-free home for ourselves and to cover any other existing outstanding debt, so our total asset base value might need to be larger. If we had a $300,000 mortgage and a $30,000 credit card, then we might need to generate an asset base of $2m.

How many properties?

How many properties?

Relying on a net rental yield of 6%, we would need an income-producing asset base of around $1.67m.

If we were to purchase a small medical or office suite for about $650,000 near the heart of a regional town, we might find it would attract a gross rental yield of 10–12%.

If we also purchased a small confined retail outlet for $600,000 in a shopping strip in a suburb with zoning changes that allowed for an increase in the residential population, the yield might be about 5%, but demand from businesses to be in that area would drive the rent up rapidly.

And finally, if we were to purchase a two-bedroom apartment for about $520,000 in an area targeting ‘DINKS’ (‘double-income-no-kids’ couples), we might achieve a rental income of about 4%.

The gross rental yield for our three properties combined would amount to 7.6%, or $127,500 per annum. Of course, the net rental yield would be less, but as commercial tenants would pay the outgoings, more of the gross rental income would be preserved. In addition, we’d need to be confident about the rate of occupancy for each of our properties.

The point: it will only take three properties that have been well chosen to provide the income we are after. The trick, though, is to buy them with cash

How to make this happen?

The solution here lies in the answer to a different question. When would you like to retire?

If we are looking to remove ourselves from the burden of earning an income in around 25 years, then time is on our side and a consistent effort applied to a slow and steady approach will likely see us through to the lifestyle we want to live, when we want to live it.

We could identify suburbs that have good growth potential in the short term. From there, we might investigate our chosen suburb to find those pockets where the houses in those streets are valued at around the median price, as this is what people who are looking to buy in this suburb would be expecting to pay.

Then, we’d watch these streets for new listings. When something comes up for about 5–10% under the median price, then we would go and make an offer and begin to negotiate to secure the property. Having purchased the property, we’d simply rent it out while watching prices rise.

When the price begins to flatten off after the growth, we would then paint it, style or stage it, fix up the landscaping and sell it. And repeat!

Riding waves of growth like this has the potential to make more money, more rapidly, than ‘buy and hold’ alone. Remember, we need about $2m in cash to pay off our home loan and credit card, and provide a passive income to the tune of $100,000 per year. Twenty-five years is not a lot of time to hold – hope and pray you’ll get there! A more actively managed approach is likely to yield a more certain outcome.

If, on the other hand, we are looking to exit the workforce in about five years, then time is against us and we will need to become actively and aggressively involved in our property investing by adding value through two fundamental processes.

If a property is difficult to live in due to its age, deterioration, design or structure, then there is an opportunity to improve it. If we solve that problem by renovating, then we can put back onto the market a product that people are willing to dig deeper into their pockets to own. In so doing, we will be entitled to receive a reward or profit for our effort.

The number of people that can dwell in a property is typically dependent upon the number of bedrooms. By increasing the number of bedrooms we can increase the number of people able to live there. If we solve this problem through construction, then we can again put back onto the market a product that people are willing to dig deeper into their pockets to own. In so doing, we are entitled to receive a reward or profit for our effort.

For the greatest reward for our effort, we would want to satisfy both objectives simultaneously. We would want to put back onto the market multiple dwellings beautifully presented!

It’s important to note that the notion of ‘chucking in’ the day job to be a full-time investor is an objective worth fighting for, particularly because, in order to enjoy such a freedom, you are unlikely to need more than three reasonably priced, well-selected properties.

However, the question that really needs to be answered is: when do you wish to retire? Your answer determines the nature of your investing activity.

If you choose a path with time on your side, then a more passive effort can be applied. If you wish to follow a more aggressive path, then it is critical to grow into the skills needed to deliver on your objective, because such a path is not for the faint-hearted – but then neither is early retirement!

Brendan Kelly is a director of the RESULTS Mentoring Program, education that helps members achieve the success they want through property

Disclaimer: The advice contained in this article is for general information only and should not be taken as financial advice. Please make sure to speak to a qualified professional person before making any investment decision.

This article first appeared in MPA's sister publication Your Investment Property

How many properties do you need to own before you can comfortably live off the returns, and is it ever really safe to quit your day job and become a full-time investor?

There persists a romantic notion about ‘chucking in’ the day job, moving to a tropical beach and living out your days in paradise. Needless to say, the facts of life tend to tarnish those romantic notions and replace them with a certain pragmatic necessity to be around our families, friends, great medical care, services, conveniences and familiarity.

Nonetheless, the dream of being able to retire early, or at the very least retire comfortably, continues to drive thousands of people into investing in property.

The question remains, however: Is it ever really safe to quit our day job and become a full-time property investor? When it comes to our day job, more often than not, there is a very real feeling of comfort we get to enjoy when we stick with ‘the devil we know’. It’s fair to assume that if we have been successfully employed for some time and if we do our job well, then we can surely feel secure about our ability to put food on the table and keep a roof over our heads. Isn’t it?

Employment, however, offers no guarantee and tends to mask a fundamental flaw in relying on earned income.

If we think about it a little, we begin to see that employment is simply the act of exchanging our time for money. In its simplest form, this act of exchange occurs on an hourly basis. If we offer our time and skill to serve the company for an hour, we’ll get financially compensated. If we don’t work the hour, we won’t get the money.

Of course, the more skill you can apply for your employer, the more valuable you are to the organisation, and therefore the more they will compensate you for every hour you work, in order to encourage you to stay.

It is important to notice here, though, that you need to work the hour before you get paid – and therein we find the flaw. If for some reason you are no longer able to invest that hour into your job, you are then unable to hold up your end of the agreement and your ability to earn an income evaporates.

Owning an asset base big enough to generate an income to live off is more durable and reliable for generating an income than working harder at staying employed and relying on blood and bone!

The point: not only is it safe to quit your day job to become a full-time property investor (when your alternative income is in place), but it is safer to do that than it is to rely on remaining employed to secure your financial future.

Income and yield

In order to get a grip on how to create an alternative income, we need to be clear on how much

income is enough, and what might be the rate of return we can expect from our investments.

When the question around ‘how much’ gets asked among people who talk about living the dream, a general consensus begins to emerge, suggesting that about $100,000 per annum would be enough. Realistically, such a measure is a very personal thing and it would be wise to invest some time to try to determine the cost of the life you want to live very clearly for yourself. However, let’s go with $100,000 as being a great starting point for our alternative income.

We also need to consider the rate of return we believe we can achieve from our investing.

If we owned residential houses in major CBDs, we might expect a gross rental yield of about 2.5–5%. If we held residential property in more regional areas, we might expect a gross rental yield to the tune of about 4–7%. Of course, if we owned high-yielding commercial properties or properties in selected mining towns or rural locations, we might be able to generate gross rental yields in the order of 6–14%. So knowing this, what might be a fair and reasonable net rental yield?

If we decide to own a mixed portfolio of properties in different areas without debt, let’s say, we might be able to average a net rental yield somewhere in the vicinity of 6%. Using this rate of return, we can now determine the size of the asset base we require to live the life we want without being employed (see box on p37 for how we calculated a value of $1.67m).

Of course, we’d also need to add to our tally enough money to provide a debt-free home for ourselves and to cover any other existing outstanding debt, so our total asset base value might need to be larger. If we had a $300,000 mortgage and a $30,000 credit card, then we might need to generate an asset base of $2m.

How many properties?

How many properties? Relying on a net rental yield of 6%, we would need an income-producing asset base of around $1.67m.

If we were to purchase a small medical or office suite for about $650,000 near the heart of a regional town, we might find it would attract a gross rental yield of 10–12%.

If we also purchased a small confined retail outlet for $600,000 in a shopping strip in a suburb with zoning changes that allowed for an increase in the residential population, the yield might be about 5%, but demand from businesses to be in that area would drive the rent up rapidly.

And finally, if we were to purchase a two-bedroom apartment for about $520,000 in an area targeting ‘DINKS’ (‘double-income-no-kids’ couples), we might achieve a rental income of about 4%.

The gross rental yield for our three properties combined would amount to 7.6%, or $127,500 per annum. Of course, the net rental yield would be less, but as commercial tenants would pay the outgoings, more of the gross rental income would be preserved. In addition, we’d need to be confident about the rate of occupancy for each of our properties.

The point: it will only take three properties that have been well chosen to provide the income we are after. The trick, though, is to buy them with cash

How to make this happen?

The solution here lies in the answer to a different question. When would you like to retire?

If we are looking to remove ourselves from the burden of earning an income in around 25 years, then time is on our side and a consistent effort applied to a slow and steady approach will likely see us through to the lifestyle we want to live, when we want to live it.

We could identify suburbs that have good growth potential in the short term. From there, we might investigate our chosen suburb to find those pockets where the houses in those streets are valued at around the median price, as this is what people who are looking to buy in this suburb would be expecting to pay.

Then, we’d watch these streets for new listings. When something comes up for about 5–10% under the median price, then we would go and make an offer and begin to negotiate to secure the property. Having purchased the property, we’d simply rent it out while watching prices rise.

When the price begins to flatten off after the growth, we would then paint it, style or stage it, fix up the landscaping and sell it. And repeat!

Riding waves of growth like this has the potential to make more money, more rapidly, than ‘buy and hold’ alone. Remember, we need about $2m in cash to pay off our home loan and credit card, and provide a passive income to the tune of $100,000 per year. Twenty-five years is not a lot of time to hold – hope and pray you’ll get there! A more actively managed approach is likely to yield a more certain outcome.

If, on the other hand, we are looking to exit the workforce in about five years, then time is against us and we will need to become actively and aggressively involved in our property investing by adding value through two fundamental processes.

- Cosmetic renovations

If a property is difficult to live in due to its age, deterioration, design or structure, then there is an opportunity to improve it. If we solve that problem by renovating, then we can put back onto the market a product that people are willing to dig deeper into their pockets to own. In so doing, we will be entitled to receive a reward or profit for our effort.

- Structural upgrade

The number of people that can dwell in a property is typically dependent upon the number of bedrooms. By increasing the number of bedrooms we can increase the number of people able to live there. If we solve this problem through construction, then we can again put back onto the market a product that people are willing to dig deeper into their pockets to own. In so doing, we are entitled to receive a reward or profit for our effort.

For the greatest reward for our effort, we would want to satisfy both objectives simultaneously. We would want to put back onto the market multiple dwellings beautifully presented!

It’s important to note that the notion of ‘chucking in’ the day job to be a full-time investor is an objective worth fighting for, particularly because, in order to enjoy such a freedom, you are unlikely to need more than three reasonably priced, well-selected properties.

However, the question that really needs to be answered is: when do you wish to retire? Your answer determines the nature of your investing activity.

If you choose a path with time on your side, then a more passive effort can be applied. If you wish to follow a more aggressive path, then it is critical to grow into the skills needed to deliver on your objective, because such a path is not for the faint-hearted – but then neither is early retirement!

Brendan Kelly is a director of the RESULTS Mentoring Program, education that helps members achieve the success they want through property

Disclaimer: The advice contained in this article is for general information only and should not be taken as financial advice. Please make sure to speak to a qualified professional person before making any investment decision.

This article first appeared in MPA's sister publication Your Investment Property