From 1 July, customers were able to start sharing their data as the next phase of open banking kicked in – but is it enough, and what will the new environment look like for mortgage brokers?

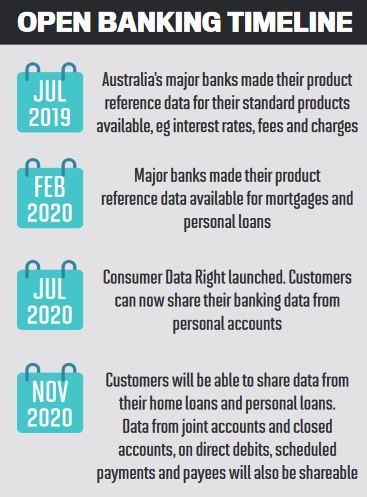

The Consumer Data Right (CDR) was officially launched on 1 July, heralding a new era of open banking in which consumers can choose to share their data in order to access more personalised financial products and services.

All four major banks are now able to share their customers’ data upon request, but this is set to ramp up over the following months, and by the end of the year it is expected that dozens more companies will be accredited. While the CDR only currently relates to deposit and transaction accounts and credit and debit cards, from 1 November this will be extended to include data on home loans, investment loans, personal loans and joint accounts.

Australian Banking Association CEO Anna Bligh said the system would give consumers greater access to personal information, as well as the ability to allow banks to provide third parties with safe and secure access to their data.

“From today, customers will be able to give permission to accredited third parties to access their banking data while they search for a better deal on banking products,” she said.

“This sharing of data is a watershed moment for competition in the banking industry and, in time, will enable every Australian to use their data for their own benefit.”

While the finance industry has been preparing for open banking for a long time, Lumi founder and CEO Yanir Yakutiel said it could not have come soon enough.

The change to open banking means that fintechs like Lumi will now be able to access the same data on customers’ current accounts and credit history, etc., so they can make better decisions on who to lend to.

As an SME lender, Lumi has been providing crucial finance to businesses throughout the COVID-19 pandemic as banks have acted slowly in distributing funds.

“We have just taken a very accurate snapshot of their income, and we have done it in a matter of minutes rather than a week” Robert Bell, 86 400

“Fewer bad loans are a benefit to everybody and cannot come fast enough,” Yakutiel said. “It would have been hugely beneficial to have this data made available at the start of the pandemic.”

For some lenders, however, the data capture allowed by open banking is something they already have. As a fintech, 86 400 prides itself on being able to capture data and analyse it within minutes.

Recently celebrating its first full year since receiving its banking licence, 86 400 was one of 10 lenders testing open banking back in September last year. While this has been paused and the group uses its own “open-banking-like” system, CEO Robert Bell says he supports open banking and will look to use it when there is more data available.

“It becomes more useful when more data is available; the four big banks have made a very limited data set available. If we’re talking in a year’s time or two years’ time, the use of data is really going to make a difference,” Bell said.

For a mortgage broker, he says not much will change with open banking; it is up to the lender to satisfy itself with respect to the borrower’s income and expenses. A mortgage broker will ask all the initial questions, and when they submit an application it will include the customer’s bank credentials.

The lender will take a one-time accurate snapshot of their accounts, using smart algorithms to sort the data out. What this means for the mortgage broker is much faster turnaround times.

“This sharing of data is a watershed moment for competition ... and, in time, will enable every Australian to use their data for their own benefit” Anna Bligh, ABA

“The lender will have just taken a very accurate snapshot of their income, and will have done it in a matter of minutes rather than a week, but we do that at the moment,” Bell said. “We have been providing open-banking-like benefits to our customers for the last 12 months. We didn’t want to wait for open banking, so we’re well positioned to transition when we can.

“In the future, with more participants and better data, we’d be using open banking to do the same thing.”

FBAA managing director Peter White said it was still too early to tell what impact open banking would have for mortgage brokers, but the future looked bright and he encouraged brokers to embrace it.

“I think the whole opportunity around open banking here will be really good for our industry,” White said. “It will help drive the broking industry further, in combination with the best interests duty.”

White believes the BID guidance, along-side open banking, will provide a strong positioning statement that brokers can use to bolster their proposition. It will show customers that not only are brokers required to act in their clients’ best interests but they can also turn loans around more quickly, thanks to the fluidity of data sharing created by open gateways.

“When you’re trying to gather data on a client or to be able to restructure a mort-gage, open banking should deliver some-thing that is a much quicker means of sharing that data from a mortgage point of view,” he said.

“I was overseas on a study tour last year speaking to guys in the UK about their open banking experience,” he said. “They’re expecting Australia to really step forward in big strides on this and overtake the UK and other markets around the world in regard to the use and the fluidity and functionalities of open data.”

To prepare for this new way forward, White said brokers should take the time to understand how the technology will work.

“The most important thing brokers need to be doing is making sure they are tech-savvy, that they understand what this tech-nology will and won’t do, and how it will work in their systems,” he said.

“This is where we’re going. It may be new in Australia, but it’s happening around the world, and the technology driver is where we’re all destined to be.”