MPA's guide to engaging with a FHB in 2015, from marketing to grants and more

MPA's guide to engaging with a FHB in 2015, from marketing to grants and more

You might think you know what a first home buyer looks like.

The mountains of newspaper print lavished on the subject have produced a stereotype, the ‘basement graduate’, who can barely nab a job, let alone scrape together the money to move away from home (and don’t even bother trying to live in Sydney). So it’s understandable why brokers might see chasing such a client as simply not worth the effort.

The mountains of newspaper print lavished on the subject have produced a stereotype, the ‘basement graduate’, who can barely nab a job, let alone scrape together the money to move away from home (and don’t even bother trying to live in Sydney). So it’s understandable why brokers might see chasing such a client as simply not worth the effort.

We want to introduce you to a different cast of characters: the clued-up young professional, the business-minded rentvestor and the keen young couple with a spotless credit history. They’re all first home buyers, but not the type you’re likely to read about. And while you might not know about them, they’re more likely to seek a broker’s help than ever before.

Read on for advice from expert brokers and lenders on how you can engage with Australia’s real first home buyer market, and defy the headlines.

AFFORDABILITY

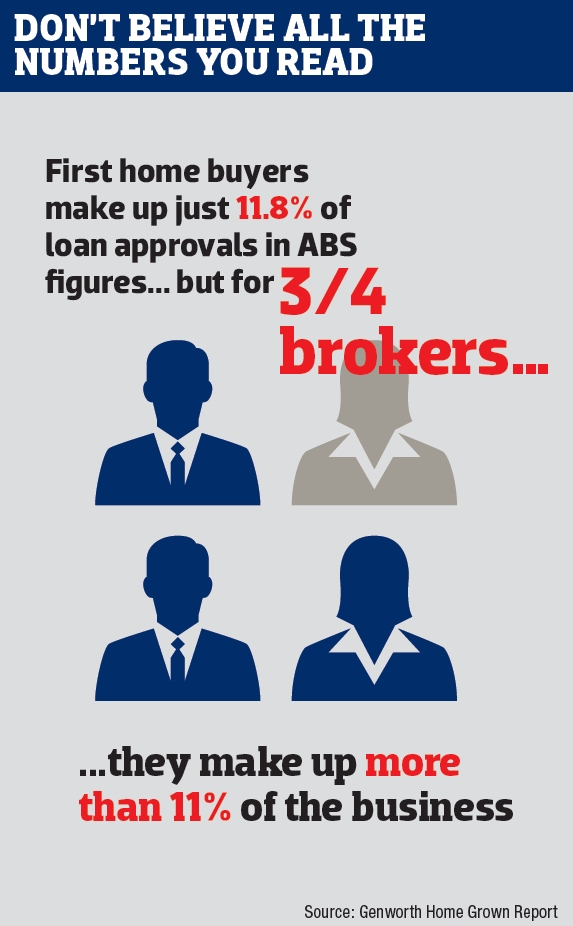

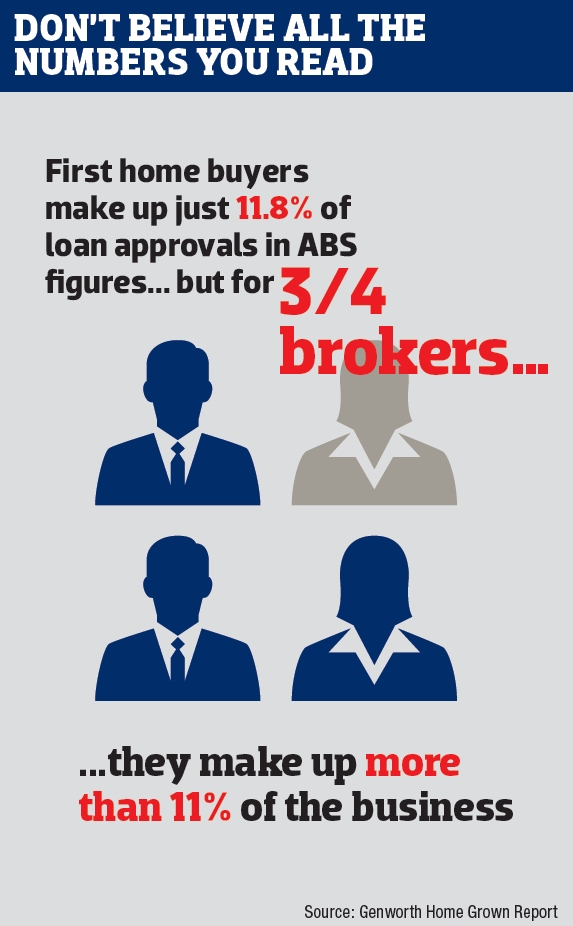

First home buyers are undoubtedly in a challenging position at the moment. Rising prices in Sydney and Melbourne in particular and falling government assistance mean first home buyers make up just 11.8% of new loans, according to the ABS. However, this figure is disputed; some banks only identify first home buyers by those that use government grants, thereby ignoring investors, those going for established properties, and those simply not using the grant.

Moreover grants, and affordability, vary hugely by state. First home buyers in Sydney and Victoria may be struggling, but Simon Kahl, general manager of The Loan Company, says that’s not the whole story in Perth: “We’re still above the long-term trend … I think [first home buyers] are relatively well-positioned. I think affordability will always be a factor, in terms of banks changing policies and shying away from the 95% LVR space.” Changes in affordability in WA are generally manifested in shrinking lot sizes, he adds.

At a national level, first home buyers are not immune from the lure of record-low interest rates. One in five prospective first home buyers intended to buy in 2014, up from one in eight in 2013, according to a survey by RAMS. Sixty-five per cent of respondents said now was a good time to buy, and 70% said rising interest rates would not put them off, although both numbers fell slightly from last year.

“There is a recognition amongst the group that they need to get on that property ladder, they recognise the importance of that first step and making it sooner rather than later,” explains RAMS CEO Martine Jager. “People are waiting later to get into the first home buyers market, but now is the right time.”

CLUED UP YOUNG PROFESSIONALS

Waiting for the right time is producing a different type of first home buyer: the clued-up young professional. Broker Theo Jansen is himself a young professional, but we talked to him about his particular client base at Mortgage Choice Melbourne. How was the first home buyer market faring in his eyes?

“We’ve definitely seen a notable decrease,” Jansen replies. That’s odd, he explains, because “serviceability tends to be one of the strongest out of most of the people we’re dealing with”. The first home buyers Jansen deals with are relatively wellpaid young professionals working in Melbourne’s CBD and usually “have got some sort of deposit”. Although well paid, deposits remain a struggle; “I’ve seen many clients earning more than $100,000 each and together they can’t get a deposit together because they’re renting.”

In addition to being wealthier, Jansen’s clients are also likely to be older. Those over the age of 36 made up 41% of RAMS’ survey respondents; those under 25 just 18% (a sharp change from last year). Jansen client’s are “late twenties to early thirties – more later twenties”. As he points out, these clients have worked for seven or eight years and have relatively good incomes. Moreover older clients have affected Jansen’s approach as a broker.

In addition to being wealthier, Jansen’s clients are also likely to be older. Those over the age of 36 made up 41% of RAMS’ survey respondents; those under 25 just 18% (a sharp change from last year). Jansen client’s are “late twenties to early thirties – more later twenties”. As he points out, these clients have worked for seven or eight years and have relatively good incomes. Moreover older clients have affected Jansen’s approach as a broker.

For a start, his clients are generally less naive; in fact “the complete opposite”, Jansen argues. “I’d say first home buyers are pretty well-educated these days as to what they can and can’t do. Everyone knows how lending works these days – gone are the days where people would come in with $5,000 in the bank account and want to buy something.”

Parental gifts and guarantees – recently touted by Smartline and others as a way to get on the housing ladder – aren’t so popular among Jansen’s clients. “I find that a lot of first home buyers would rather do it themselves,” he explains. “Maybe it’s just an emotional thing; I have clients whose parents have heaps of cash and equity and so forth, but they say we’d rather put it together ourselves and not get the parents involved.” Therefore he rarely brings up the conversation himself; clients looking at the option usually mention it to him.

“When they really get nervous is once they’ve purchased,” Jansen notes. For him, the handholding which is generally associated with first home buyers is generally required in “the time between getting a finance course and loan approval [which] is a long time mentally for first home buyers”.

Brokers targeting such clients, he adds, need to have patience: “You can’t get every deal … An hour’s conversation about banks’ products – who cares? At the end of the day the client wants to know where they’ve got to be; how much are their repayments roughly, set a savings goal based on what the repayments are going to be, touch base in 12 months and if they’ve saved they’ve saved; if they haven’t they haven’t.”

RENTVESTORS

First home buyers are more clued up than before, and perhaps none more so than the ‘rentvestors’ – a term coined by real estate firm LJ Hooker for those buying their first property to rent out while themselves remaining in central-city rental properties, or in the family home.

“The great Australian dream of home ownership is not fading away, it’s just that the goal posts are changing,” John Kolenda of 1300 Home Loan told Australian Broker magazine. “These Gen Ys enjoy the inner city lifestyle and are happy to rent in those areas or live at home with their parents but they also see the advantages of investing in property in suburbs where they can afford to buy.”

Generation Y, often referred to as millennials, are those born from the 1980s onwards. Fifty-seven per cent of generation Y respondents to Mortgage Choice’s 2014 first home buyers survey wanted “to set myself up financially for the future by getting my foot in the property market door”, while 54% of prospective buyers in another Mortgage Choice survey felt ‘priced out’ of areas they’d like to live in. So it could make sense to buy an investment property in an affordable suburb, without sacrificing an inner-city lifestyle.

Generation Y, often referred to as millennials, are those born from the 1980s onwards. Fifty-seven per cent of generation Y respondents to Mortgage Choice’s 2014 first home buyers survey wanted “to set myself up financially for the future by getting my foot in the property market door”, while 54% of prospective buyers in another Mortgage Choice survey felt ‘priced out’ of areas they’d like to live in. So it could make sense to buy an investment property in an affordable suburb, without sacrificing an inner-city lifestyle.

While mainstream media are now beginning to eagerly talk about rentvestors, the brokers we talked to were cautious about the phenomenon. Jansen says the higher deposit demanded by lenders for investment properties can put the option beyond reach: “Unless you’ve got someone backing you with a gift, buying something as an investment to start off with is a great idea in principle but to actually get the money to it is a whole other saga.”

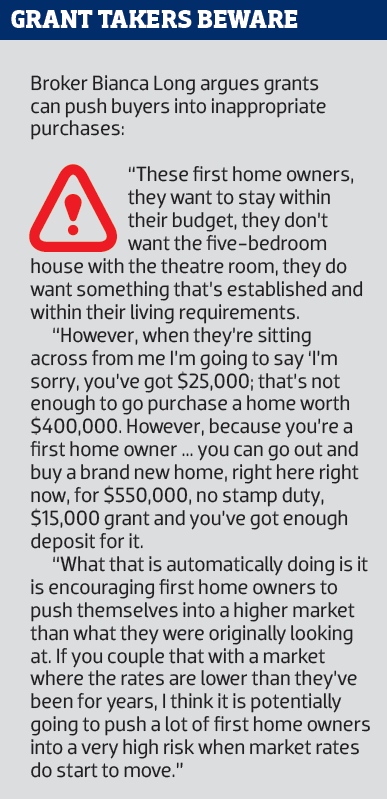

Similarly Kahl doesn’t encounter many rentvestors in Perth: “I’ve never seen a trend towards a large number of first home buyers buying a property to rent it out.” Bianca Long of Mortgage Choice Glenwood and Blacktown told MPA rentvestors had been a trend earlier in 2014: “A lot of the fi rst home owners were prepared [to use] their First Home Owner Grant for the sake of getting into the market.” However, in recent months “we’ve seen that option soften a lot for first home buyers, and that’s simply based on banking policy” – referring to the stricter LVRs and mortgage insurance demanded of investors by lenders.

KEEN YOUNG COUPLES

While rentvestors are a group widely forecasted but perhaps yet to actually materialise, there exists another group which most commentators assumed had disappeared: young couples (aged 25 or under), looking to settle down in a home together.

We were introduced to this group by Bianca Long, whose location in western Sydney means she is at the frontline of shifting first home buyer patterns. She describes the intense construction in her suburbs as ‘phenomenal’, and reckons it’s being driven by first home buyers fleeing central Sydney prices, and chasing first home buyer grants.

What’s really phenomenal about Long’s area is the clients: “We notice they’re coming in younger and younger, we’ve got a lot of them in their early 20s that are coming through who actually have quite substantial deposits.” The appetite of young people for buying a house, argues Long, “absolutely has not diminished, it is simply a case of reassessing based on affordability, lifestyle and deposits and it means they have to change direction when looking where to put down roots”.

It’d be tempting to assume Long’s clients are at the margins of the market, dependent on particularly lenient lenders willing to overlook problematic details. Not so, Long explains: “I have seen such a huge change in this industry. When I came in it was about ‘how many credit cards do you have’ [or] ‘how many personal loans do you have’ … it’s not uncommon now for my fi rst home buyers not to have any liabilities against them whatsoever … they don’t even hold a $2,000 credit card. A lot of them are living with mum and dad and injecting everything they’ve got into it.”

Long says her young customers therefore present as “excellent clients”; they often have joint incomes, residential stability from living at home, no dependants and no debts. Crucially, the banks have relaxed their policies on genuine savings, allowing first home buyers to use rental ledgers and other documents. Loan Company’s general manager Kahl also praised the attempts of particular banks to adapt to first home buyers’ situations.

Dealing with particularly young couples does mean that Long often deals with parents. A common fear of brokers in this sector is that their conversations could be inaccurately passed on to suspicious parents, who then try to block the process. Long deals with this by finding out early if parents are likely to be involved, and then involving them in actual meetings as much as possible. Parents can in fact be a valuable referral source, she adds: “Either the parents know the broker or know somebody [that does] and have built up that relationship that way.”

Handholding and patience is necessary in this market, insists Long. “Patience is key … people are often receiving a lot of advice, whether it be truth or not, on the way they should be turning, and it really does confuse the buyer greatly.” This is confounded by borrowers doing their own research online, without understanding the material they’re reading. Long, along with her team in the office, counters this by explaining the buying process in its entirety at her initial meeting with the client.

THE FUTURE FIRST HOME BUYER

THE FUTURE FIRST HOME BUYER

Evidently the appetite for bricks and mortar, the ‘great Australian dream’, still thrives within young Australians. So what will the first home buyer of the future look like?

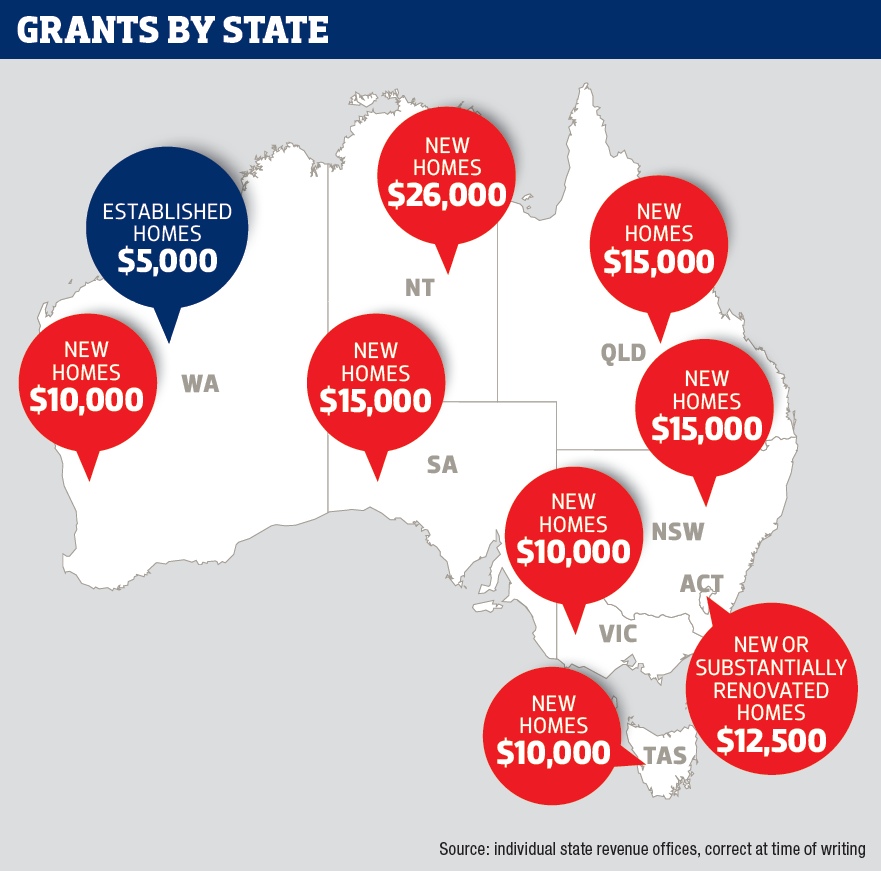

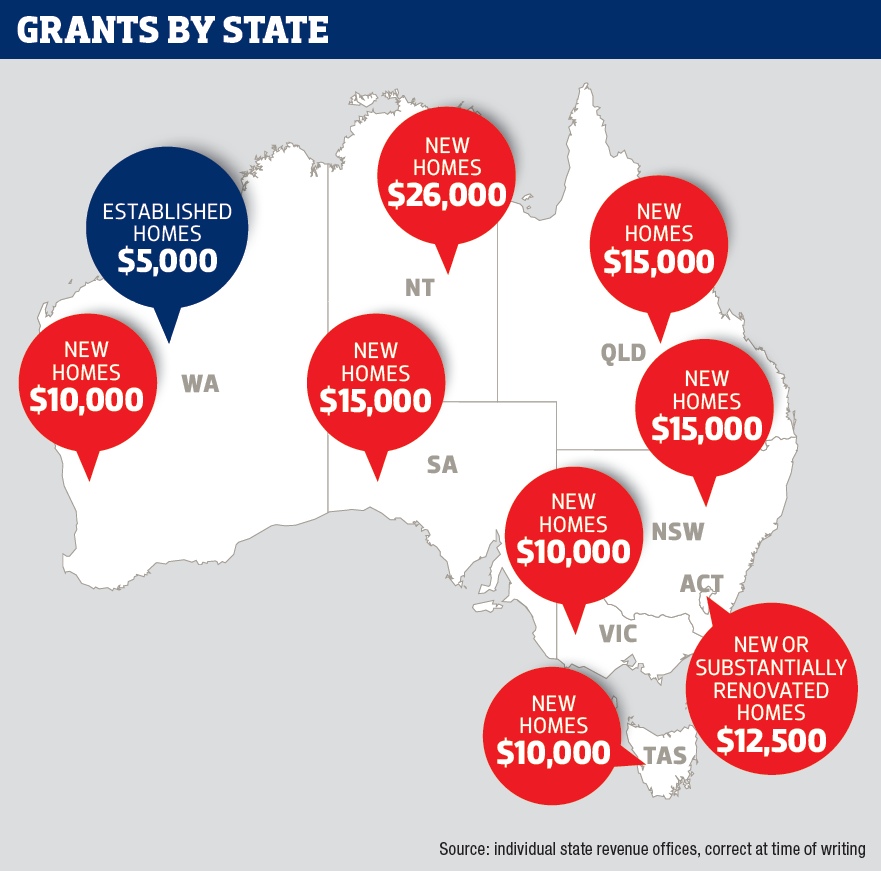

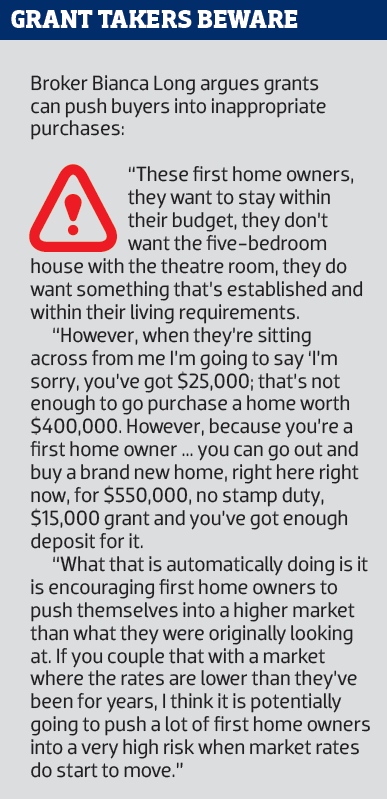

That will depend, for a start, on the availability and criteria of First Home Owner Grants. These have been pared down substantially across all states, and for some are now available only for new builds. Genworth’s Home Grown survey found the industry highly sceptical of grants’ effectiveness: ME Bank CEO Jamie McPhee was quoted as saying “First Home Owner Grants just get more people chasing the same number of products, and that just pushes up prices. Try to get land released and encourage building of new dwellings”.

However, this is not a universal view. Departing Mortgage Choice CEO Michael Russell told the audience at the franchise’s recent media lunch that he did not believe First Home Owner Grants inflated prices. Furthermore, 2014 saw house prices outpace wages, and although price growth has slowed more recently, this fundamental gap of wages and prices will continue to inspire calls for improved grants.

Stamp duty was another theme raised by a couple of the brokers we talked to. In Western Australia, stamp duty is waived for values of up to $400,000 on vacant land for first home buyers, which Kahl called a significant cost-saving for his clients. Jansen suggested the stamp duty concession threshold was too low in Victoria, and should be raised from its current level of $600,000 to $650,000 or more.

The Real Estate Institute of New South Wales has also called for stamp duty thresholds to be raised. REINSW deputy president John Cunningham commented that “the current incentives for first home buyers are simply not working. By offering grants on new-builds only, they are pitting first home buyers against cashed-up investors as well as foreign investors”. He argued that thresholds were based on out-dated figures from 25 years ago.

One suggestion, made by South Australia Senator Nick Xenephon in July 2014, was that first home buyers should be allowed to use their superannuation to fund their first home. The call was backed by Senator Matthew Canavan and also Mortgage Choice, on the grounds that higher deposits would reduce LMI costs.

The inspiration for Xenephon’s plan is Canada and its Home Buyers Plan, where borrowers can access up to $25,000 a year (CAD) from their super, providing they pay the money back over the next 15 years. However, any proposal to further mix SMSF and property will depend on the results of the Financial Systems Inquiry, which at the time of writing was yet to be released.

THE ROLE OF THE INDUSTRY

While it’s generally assumed first home buyers are the government’s problem, the industry also has an important role to play, lenders in particular.

Specialist lenders have been especially helpful to The Loan Company, Kahl argues. Keystart, a government-owned lender in Western Australia, provides very high LVR loans (including a 98% product) to clients in certain areas and with certain incomes: “It’s a great government initiative which really does hold up the market,” explains Kahl.

Yet specialist lenders account for a tiny fraction of the market, and first home buyers will continue looking at more established lenders. What the brokers featured in this article overwhelmingly told MPA is that lenders need to work harder to recognise first home buyers’ specific situations. This could involve further relaxation of genuine savings policies, higher LVR loans, or products designed for those with high incomes but low deposit savings.

Of course nothing will change if lenders – and brokers – stick with the old stereotypes. So stop lamenting the situation of the basement graduate: the clued-up young professional, the rentvestor and the keen young couple are out there, and looking for your business.

You might think you know what a first home buyer looks like.

The mountains of newspaper print lavished on the subject have produced a stereotype, the ‘basement graduate’, who can barely nab a job, let alone scrape together the money to move away from home (and don’t even bother trying to live in Sydney). So it’s understandable why brokers might see chasing such a client as simply not worth the effort.

The mountains of newspaper print lavished on the subject have produced a stereotype, the ‘basement graduate’, who can barely nab a job, let alone scrape together the money to move away from home (and don’t even bother trying to live in Sydney). So it’s understandable why brokers might see chasing such a client as simply not worth the effort.We want to introduce you to a different cast of characters: the clued-up young professional, the business-minded rentvestor and the keen young couple with a spotless credit history. They’re all first home buyers, but not the type you’re likely to read about. And while you might not know about them, they’re more likely to seek a broker’s help than ever before.

Read on for advice from expert brokers and lenders on how you can engage with Australia’s real first home buyer market, and defy the headlines.

AFFORDABILITY

First home buyers are undoubtedly in a challenging position at the moment. Rising prices in Sydney and Melbourne in particular and falling government assistance mean first home buyers make up just 11.8% of new loans, according to the ABS. However, this figure is disputed; some banks only identify first home buyers by those that use government grants, thereby ignoring investors, those going for established properties, and those simply not using the grant.

Moreover grants, and affordability, vary hugely by state. First home buyers in Sydney and Victoria may be struggling, but Simon Kahl, general manager of The Loan Company, says that’s not the whole story in Perth: “We’re still above the long-term trend … I think [first home buyers] are relatively well-positioned. I think affordability will always be a factor, in terms of banks changing policies and shying away from the 95% LVR space.” Changes in affordability in WA are generally manifested in shrinking lot sizes, he adds.

At a national level, first home buyers are not immune from the lure of record-low interest rates. One in five prospective first home buyers intended to buy in 2014, up from one in eight in 2013, according to a survey by RAMS. Sixty-five per cent of respondents said now was a good time to buy, and 70% said rising interest rates would not put them off, although both numbers fell slightly from last year.

“There is a recognition amongst the group that they need to get on that property ladder, they recognise the importance of that first step and making it sooner rather than later,” explains RAMS CEO Martine Jager. “People are waiting later to get into the first home buyers market, but now is the right time.”

CLUED UP YOUNG PROFESSIONALS

Waiting for the right time is producing a different type of first home buyer: the clued-up young professional. Broker Theo Jansen is himself a young professional, but we talked to him about his particular client base at Mortgage Choice Melbourne. How was the first home buyer market faring in his eyes?

“We’ve definitely seen a notable decrease,” Jansen replies. That’s odd, he explains, because “serviceability tends to be one of the strongest out of most of the people we’re dealing with”. The first home buyers Jansen deals with are relatively wellpaid young professionals working in Melbourne’s CBD and usually “have got some sort of deposit”. Although well paid, deposits remain a struggle; “I’ve seen many clients earning more than $100,000 each and together they can’t get a deposit together because they’re renting.”

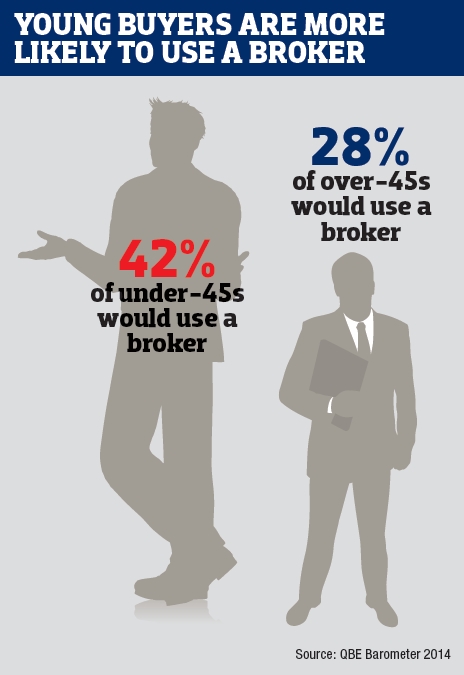

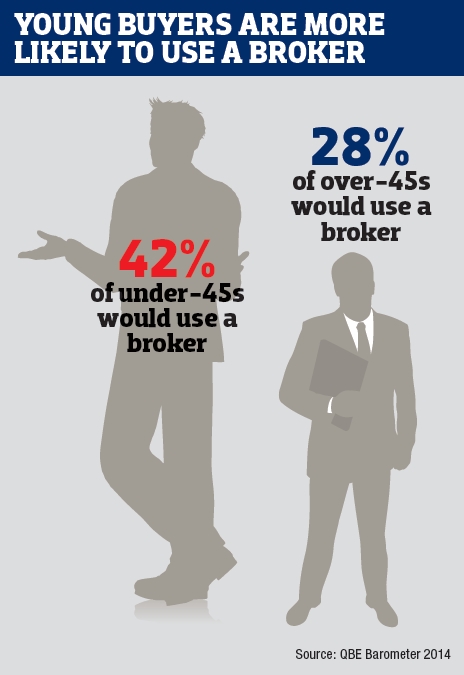

In addition to being wealthier, Jansen’s clients are also likely to be older. Those over the age of 36 made up 41% of RAMS’ survey respondents; those under 25 just 18% (a sharp change from last year). Jansen client’s are “late twenties to early thirties – more later twenties”. As he points out, these clients have worked for seven or eight years and have relatively good incomes. Moreover older clients have affected Jansen’s approach as a broker.

In addition to being wealthier, Jansen’s clients are also likely to be older. Those over the age of 36 made up 41% of RAMS’ survey respondents; those under 25 just 18% (a sharp change from last year). Jansen client’s are “late twenties to early thirties – more later twenties”. As he points out, these clients have worked for seven or eight years and have relatively good incomes. Moreover older clients have affected Jansen’s approach as a broker.For a start, his clients are generally less naive; in fact “the complete opposite”, Jansen argues. “I’d say first home buyers are pretty well-educated these days as to what they can and can’t do. Everyone knows how lending works these days – gone are the days where people would come in with $5,000 in the bank account and want to buy something.”

Parental gifts and guarantees – recently touted by Smartline and others as a way to get on the housing ladder – aren’t so popular among Jansen’s clients. “I find that a lot of first home buyers would rather do it themselves,” he explains. “Maybe it’s just an emotional thing; I have clients whose parents have heaps of cash and equity and so forth, but they say we’d rather put it together ourselves and not get the parents involved.” Therefore he rarely brings up the conversation himself; clients looking at the option usually mention it to him.

“When they really get nervous is once they’ve purchased,” Jansen notes. For him, the handholding which is generally associated with first home buyers is generally required in “the time between getting a finance course and loan approval [which] is a long time mentally for first home buyers”.

Brokers targeting such clients, he adds, need to have patience: “You can’t get every deal … An hour’s conversation about banks’ products – who cares? At the end of the day the client wants to know where they’ve got to be; how much are their repayments roughly, set a savings goal based on what the repayments are going to be, touch base in 12 months and if they’ve saved they’ve saved; if they haven’t they haven’t.”

RENTVESTORS

First home buyers are more clued up than before, and perhaps none more so than the ‘rentvestors’ – a term coined by real estate firm LJ Hooker for those buying their first property to rent out while themselves remaining in central-city rental properties, or in the family home.

“The great Australian dream of home ownership is not fading away, it’s just that the goal posts are changing,” John Kolenda of 1300 Home Loan told Australian Broker magazine. “These Gen Ys enjoy the inner city lifestyle and are happy to rent in those areas or live at home with their parents but they also see the advantages of investing in property in suburbs where they can afford to buy.”

Generation Y, often referred to as millennials, are those born from the 1980s onwards. Fifty-seven per cent of generation Y respondents to Mortgage Choice’s 2014 first home buyers survey wanted “to set myself up financially for the future by getting my foot in the property market door”, while 54% of prospective buyers in another Mortgage Choice survey felt ‘priced out’ of areas they’d like to live in. So it could make sense to buy an investment property in an affordable suburb, without sacrificing an inner-city lifestyle.

Generation Y, often referred to as millennials, are those born from the 1980s onwards. Fifty-seven per cent of generation Y respondents to Mortgage Choice’s 2014 first home buyers survey wanted “to set myself up financially for the future by getting my foot in the property market door”, while 54% of prospective buyers in another Mortgage Choice survey felt ‘priced out’ of areas they’d like to live in. So it could make sense to buy an investment property in an affordable suburb, without sacrificing an inner-city lifestyle.While mainstream media are now beginning to eagerly talk about rentvestors, the brokers we talked to were cautious about the phenomenon. Jansen says the higher deposit demanded by lenders for investment properties can put the option beyond reach: “Unless you’ve got someone backing you with a gift, buying something as an investment to start off with is a great idea in principle but to actually get the money to it is a whole other saga.”

Similarly Kahl doesn’t encounter many rentvestors in Perth: “I’ve never seen a trend towards a large number of first home buyers buying a property to rent it out.” Bianca Long of Mortgage Choice Glenwood and Blacktown told MPA rentvestors had been a trend earlier in 2014: “A lot of the fi rst home owners were prepared [to use] their First Home Owner Grant for the sake of getting into the market.” However, in recent months “we’ve seen that option soften a lot for first home buyers, and that’s simply based on banking policy” – referring to the stricter LVRs and mortgage insurance demanded of investors by lenders.

KEEN YOUNG COUPLES

While rentvestors are a group widely forecasted but perhaps yet to actually materialise, there exists another group which most commentators assumed had disappeared: young couples (aged 25 or under), looking to settle down in a home together.

We were introduced to this group by Bianca Long, whose location in western Sydney means she is at the frontline of shifting first home buyer patterns. She describes the intense construction in her suburbs as ‘phenomenal’, and reckons it’s being driven by first home buyers fleeing central Sydney prices, and chasing first home buyer grants.

What’s really phenomenal about Long’s area is the clients: “We notice they’re coming in younger and younger, we’ve got a lot of them in their early 20s that are coming through who actually have quite substantial deposits.” The appetite of young people for buying a house, argues Long, “absolutely has not diminished, it is simply a case of reassessing based on affordability, lifestyle and deposits and it means they have to change direction when looking where to put down roots”.

It’d be tempting to assume Long’s clients are at the margins of the market, dependent on particularly lenient lenders willing to overlook problematic details. Not so, Long explains: “I have seen such a huge change in this industry. When I came in it was about ‘how many credit cards do you have’ [or] ‘how many personal loans do you have’ … it’s not uncommon now for my fi rst home buyers not to have any liabilities against them whatsoever … they don’t even hold a $2,000 credit card. A lot of them are living with mum and dad and injecting everything they’ve got into it.”

Long says her young customers therefore present as “excellent clients”; they often have joint incomes, residential stability from living at home, no dependants and no debts. Crucially, the banks have relaxed their policies on genuine savings, allowing first home buyers to use rental ledgers and other documents. Loan Company’s general manager Kahl also praised the attempts of particular banks to adapt to first home buyers’ situations.

Dealing with particularly young couples does mean that Long often deals with parents. A common fear of brokers in this sector is that their conversations could be inaccurately passed on to suspicious parents, who then try to block the process. Long deals with this by finding out early if parents are likely to be involved, and then involving them in actual meetings as much as possible. Parents can in fact be a valuable referral source, she adds: “Either the parents know the broker or know somebody [that does] and have built up that relationship that way.”

Handholding and patience is necessary in this market, insists Long. “Patience is key … people are often receiving a lot of advice, whether it be truth or not, on the way they should be turning, and it really does confuse the buyer greatly.” This is confounded by borrowers doing their own research online, without understanding the material they’re reading. Long, along with her team in the office, counters this by explaining the buying process in its entirety at her initial meeting with the client.

THE FUTURE FIRST HOME BUYER

THE FUTURE FIRST HOME BUYEREvidently the appetite for bricks and mortar, the ‘great Australian dream’, still thrives within young Australians. So what will the first home buyer of the future look like?

That will depend, for a start, on the availability and criteria of First Home Owner Grants. These have been pared down substantially across all states, and for some are now available only for new builds. Genworth’s Home Grown survey found the industry highly sceptical of grants’ effectiveness: ME Bank CEO Jamie McPhee was quoted as saying “First Home Owner Grants just get more people chasing the same number of products, and that just pushes up prices. Try to get land released and encourage building of new dwellings”.

However, this is not a universal view. Departing Mortgage Choice CEO Michael Russell told the audience at the franchise’s recent media lunch that he did not believe First Home Owner Grants inflated prices. Furthermore, 2014 saw house prices outpace wages, and although price growth has slowed more recently, this fundamental gap of wages and prices will continue to inspire calls for improved grants.

Stamp duty was another theme raised by a couple of the brokers we talked to. In Western Australia, stamp duty is waived for values of up to $400,000 on vacant land for first home buyers, which Kahl called a significant cost-saving for his clients. Jansen suggested the stamp duty concession threshold was too low in Victoria, and should be raised from its current level of $600,000 to $650,000 or more.

The Real Estate Institute of New South Wales has also called for stamp duty thresholds to be raised. REINSW deputy president John Cunningham commented that “the current incentives for first home buyers are simply not working. By offering grants on new-builds only, they are pitting first home buyers against cashed-up investors as well as foreign investors”. He argued that thresholds were based on out-dated figures from 25 years ago.

One suggestion, made by South Australia Senator Nick Xenephon in July 2014, was that first home buyers should be allowed to use their superannuation to fund their first home. The call was backed by Senator Matthew Canavan and also Mortgage Choice, on the grounds that higher deposits would reduce LMI costs.

The inspiration for Xenephon’s plan is Canada and its Home Buyers Plan, where borrowers can access up to $25,000 a year (CAD) from their super, providing they pay the money back over the next 15 years. However, any proposal to further mix SMSF and property will depend on the results of the Financial Systems Inquiry, which at the time of writing was yet to be released.

THE ROLE OF THE INDUSTRY

While it’s generally assumed first home buyers are the government’s problem, the industry also has an important role to play, lenders in particular.

Specialist lenders have been especially helpful to The Loan Company, Kahl argues. Keystart, a government-owned lender in Western Australia, provides very high LVR loans (including a 98% product) to clients in certain areas and with certain incomes: “It’s a great government initiative which really does hold up the market,” explains Kahl.

Yet specialist lenders account for a tiny fraction of the market, and first home buyers will continue looking at more established lenders. What the brokers featured in this article overwhelmingly told MPA is that lenders need to work harder to recognise first home buyers’ specific situations. This could involve further relaxation of genuine savings policies, higher LVR loans, or products designed for those with high incomes but low deposit savings.

Of course nothing will change if lenders – and brokers – stick with the old stereotypes. So stop lamenting the situation of the basement graduate: the clued-up young professional, the rentvestor and the keen young couple are out there, and looking for your business.