The commercial broking king embarks on a new challenge to shape the industry's future

Known for the multimillion-dollar deals he settles, this top commercial broker has embarked on the new challenge of shaping the decisions and directions of commercial broking in his new role on CAFBA's board of directors

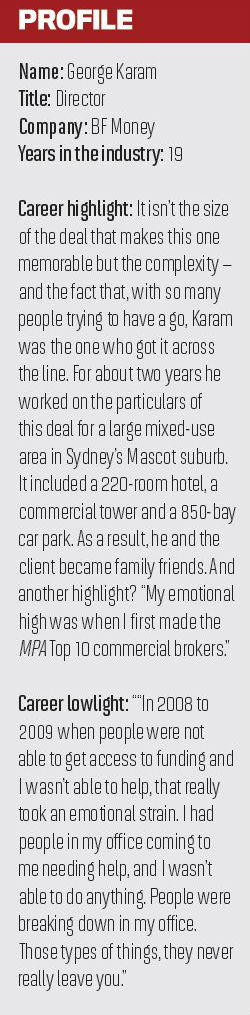

Most brokers are probably familiar with George Karam’s name and face. The industry stalwart has been crowned MPA’s Top Commercial Broker twice (2015 and 2016), in addition to winning dozens of other awards. He’s one of a handful of commercial brokers settling hundreds of millions of dollars in deals every year – and he’s still humble.

While Karam remains the active director of BF Money, his firm based in Parramatta, he has also embarked on a new challenge, joining the board of directors of the Commercial & Asset Finance Brokers Association (CAFBA), where he’ll be helping to shape the decisions and direction of the industry.

Being involved in CAFBA is about having the “ability to have a voice for something that affects such a huge part of my life”, Karam tells MPA.

What appealed to him about the organisation was its acknowledgement that it needed to shift from solely representing equipment finance brokers to including all commercial brokers – a change he thought was much needed.

“I share the organisation’s values and beliefs. I was aware that they were working on a strategic plan to widen their scope, so when they finally did it and published that work … it really appealed to me and said things that I really believe in.”

While residential brokers have long had representation in the MFAA and the FBAA, commercial brokers have traditionally been adrift without a reliable and constant voice to advocate on their behalf in policy debates.

As more residential brokers transitioned into writing commercial deals, CAFBA realised it needed to take a

“Having been in the game for about 19 years now, it is a breath of fresh air because we’ve got very little airtime with our unique [commercial] set of issues and concerns in the past.”

Lending to a business is not the same as lending to a consumer. It involves different circumstances and compliance requirements and relies on brokers to have the right skill sets and education to get the job done, Karam says.

Commercial finance broking is complex. Made up of three main disciplines – general business banking, equipment and asset finance, and commercial property finance – each has its own culture, remuneration agreements and protocols, Karam says.

“The future for commercial broking is very optimistic. ... The class of clients that see value in what we do and seek out our services is better than I’ve ever seen”

The most established is equipment finance, which is the “quintessential extension” of the supply chain for the lender, and sales and commission processes are generally understood by bank lending officers and brokers. The property finance space, on the other hand, in which Karam predominantly plays, is at the other end of the spectrum, with each lender dealing with brokers differently.

“Each is trying to manufacture its own rules for engagement, how they engage and what they expect of the broker; how many brokers they want to accredit, how much property fi nance they want, and how they want to engage with the third party channel.”

Karam recalls when lenders didn’t even have a distinct third party channel for commercial loans. Today, remuneration for property finance is paid and negotiated deal by deal. Yet a broker can still write and maintain commercial accreditation by going to residential lending refresher courses and residential PD days to obtain CPD points.

“I think residential brokers do an amazing job, and there’s no reason why they can’t write commercial deals and have commercial accreditations. What I would like to see is a requirement for ongoing education and investment in gaining knowledge if you want to maintain your commercial accreditation, which doesn’t really happen at the moment.”

A key objective of CAFBA’s strategic plan for 2017–20 is to reform broker education to make it specific to commercial finance. It plans to develop entry-level, tertiary and postgraduate qualifications and use these to recruit new and more diverse entrants to the profession.

In April, it took the first step. It launched the Certificate IV in Financial Services: Commercial and Equipment Finance to teach new entrants the basics of commercial and equipment finance, which is the first curriculum dedicated to this pursuit.

“Whilst there were bits and pieces around, there was not a definitive, recognised industry curriculum, so CAFBA set about developing one,” the association said in a news release.

Its long-term goal is to introduce an industry-wide qualification similar to the Certified Lease & Finance Professional (CLFP) designation for commercial equipment fi nance professionals in the US, which ensures competency through testing and continuing education. CAFBA has now partnered with the foundation behind the CLFP to adapt the course for the Australian market.

The residential effect

While the home loan market has been the main focus of the royal commission, there are lessons to be learned from those discussions for the commercial broking sector too.

Karam sees those lessons as “the need for self-regulation, the need to professionalise and the need to have consensus for what we stand up for as an industry, because undoubtedly there will be flow-on effects. We’re already starting to feel that … from the scrutiny, the compliance and the way that loans are written and what you can do and what you can’t do.”

“What I would like to see is a requirement for ongoing education and investment in gaining knowledge if you want to maintain your commercial accreditation”

As changes in the residential broking market influence the commercial lending space, Karam believes CAFBA could take a leading role in setting the bar for education.

“The future for commercial broking is very optimistic. The things that we’re getting involved in, the types of transactions that we’re seeing, the class of clients that see value in what we do and seek out our services is better than I’ve ever seen, and I think that trend is only going to continue.”