The Murray Inquiry advises brokers to ‘disclose ownership structures’ to clients.

The Murray Inquiry has recommended mortgage brokers should ‘disclose ownership structures’ to clients. But explaining the reality of vertical integration to customers is easier said than done, writes Sam Richardson.

The publication of the Financial System Inquiry’s final report has been met with rave reviews. “A blueprint for the future of Australia’s financial system” (ABC), “an important step” (Australian Bankers’ Association), and finally “a paradigm shift” (David Murray himself).

To be specific, the “paradigm shift” Murray referred to is a new attitude to financial literacy, he told the Committee for the Economic Development of Australia. “We started looking at other industries where the focus of regulation is to deal with the information imbalance faced by consumers. We decided also that in financial services we would never close the gap fully on financial literacy, and this pushed us down the path of this paradigm shift from the Wallace Inquiry.”

To be specific, the “paradigm shift” Murray referred to is a new attitude to financial literacy, he told the Committee for the Economic Development of Australia. “We started looking at other industries where the focus of regulation is to deal with the information imbalance faced by consumers. We decided also that in financial services we would never close the gap fully on financial literacy, and this pushed us down the path of this paradigm shift from the Wallace Inquiry.”

Essentially, the report insists producers and distributors of financial products can no longer assume consumers are financially literate. It warns that “the existing framework relies heavily on disclosure, financial advice and financial literacy. However, disclosure can be ineffective for a number of reasons, including consumer disengagement, complexity of documents and products, behavioural biases, misaligned interest and low financial literacy”.

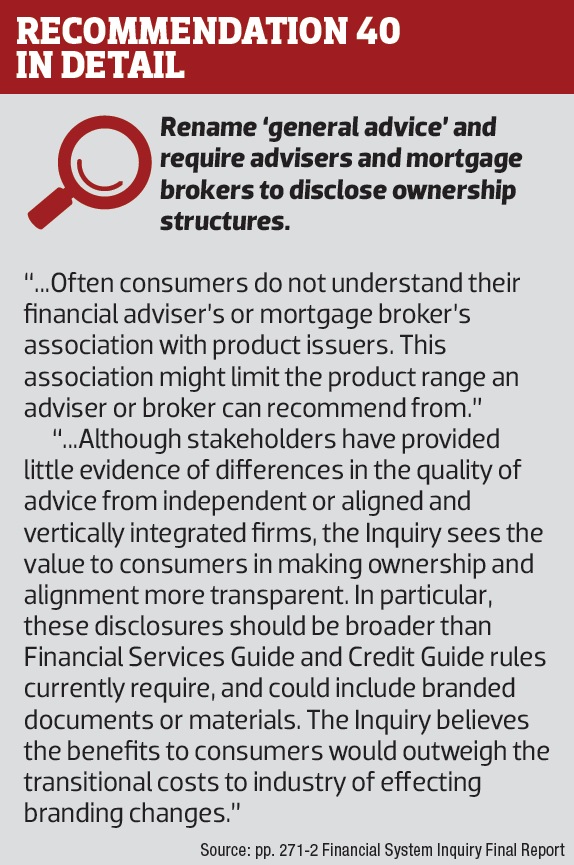

It’s therefore interesting that, of 44 recommendations in the report, the one that’s most directly relevant to brokers, Recommendation 40, calls for “mortgage brokers to disclose ownership structures”. So, how should brokers go about disclosing the industry’s complexity to the (apparently) financially illiterate Australian public?

THE INDUSTRY SUPPORTS DISCLOSURE

If Murray meant to shake up the industry with Recommendation 40, he doesn’t appear to have succeeded. Aussie Home Loans’ John Symond told MPA that “it doesn’t worry me, I think it’s fine. We’re not hiding anything that’s embarrassing or not good, it’s the biggest, strongest bank in the land”. Symond was referring to Commonwealth Bank’s 80% stake in the franchise brokerage, perhaps the most publicised ownership of a franchise brokerage network by a lender, although there are a number of other examples.

Industry bodies appear similarly relaxed; Siobhan Hayden, CEO of the MFAA, called Recommendation 40 “a reasonable request’, albeit one that “would benefit consumers dealing with financial planners more than those currently dealing with mortgage brokers”. FBAA CEO Peter White told MPA that “I can see a lot of brokers getting up in arms about this, but I can see a positive. You can sell this – if you’re owned by a major bank, you’re actually dealing with a firm which is without question of incredible integrity and has major strength behind it”.

Finally, the brokers on the ground MPA talked to also expressed reserved support. Mark Davis of the Australian Lending & Investment Centre told MPA “we don’t see overall ownership of the product manufacture as a major issue”; Justin Doobov of Intelligent Finance noted that, while he didn’t oppose ownership disclosure, it wasn’t something he or the customer often discussed. Broker John Whitten of Individual Home Loans had a similar opinion: “I certainly wouldn’t have a problem with [disclosure] because I really don’t know if customers are concerned.”

HOW DISCLOSURE COULD WORK

Given a welcoming reception by the industry, it seems that Recommendation 40 might be one of the most likely FSI recommendations to become policy. The danger comes in thrashing out what ‘ownership’ and vertical integration means, what exactly needs to be disclosed, and how.

In its wording, the recommendation suggested disclosure going beyond the existing Credit Guide, disclosure which “could include branded documents or materials”. Symond doesn’t agree: “I can’t see any organisation [doing that]. You take Commonwealth Bank; they might own a hundred subsidiaries; they’re not going to put that on everything; they’d have to have a booklet!”

“You look at Commonwealth Bank’s letterhead, it doesn’t have Bankwest, and Bankwest is a lot bigger than Aussie Home Loans. It’s the same with Westpac. But there’s nothing wrong with having [ownership disclosure] where you can read it, not just miniscule print at the bottom of a page saying ‘a subsidiary of Westpac or Commonwealth Bank’ – that’s fine”.

Hayden is also unsure about branded documents: “Brokers have their own business model. I think what you will see in quote documents and disclosure documents is that they will say ‘my business is managed or owned or part owned by NAB or Macquarie … there’ll be some sort of disclosure statement, maybe in bold. I think that would be more in line with what we’ll see introduced rather than branded documents which would clash in our industry; it wouldn’t work.”

Recommendation 40 has mainly been driven by issues in the financial planning industry, Hayden explains, where planners generally offer products from a single lender, unlike brokers. In fact the three studies cited in the recommendation all refer primarily to financial planners, despite a large number of broker bodies and aggregators giving submissions to the inquiry. If Recommendation 40 gets turned into regulation – or self-regulation – brokers will demand to be recognised as brokers, rather than another branch of advisors, even as diversification blurs the boundaries.

LENDERS AND AGGREGATORS

As well as how to disclose, brokers will want to know what to disclose. It seems any regulation will compel brokerages which might have to disclose bank ownership, but what about those brokerages who use an aggregator owned by a bank?

Here, the problem of low financial literacy again comes to the fore: most consumers don’t know what an aggregator is. Whitten couldn’t recall a single customer asking about aggregators in 30 years of broking, although he said he does already disclose his aggregator when recommending its white label products. And if a customer did enquire further, “I would advise that my aggregator is PLAN Australia, which is owned by National Australia Bank, but that I’m not employed by them: they provide a service to me in providing market intelligence and collecting my commissions”.

What worried Whitten was potential clients seeing aggregators as a controlling influence on brokers rather than a “cost of doing business”, as he puts it. Intelligent Finance’s Doobov deals with enquiries about his aggregator more often, from around one in five clients, he reckons. When asked, “I explain that it gives us buying power. The benefit of the banks owning mortgage broking businesses and aggregators in the channel, while I understand there are downsides, shows they have a vested interest in the channel being successful, otherwise they wouldn’t be investing so much money in it”.

MPA asked Hayden for her opinion on consumer awareness of aggregators: “I don’t think they understand an aggregator and I don’t think they need to in many ways: an aggregator is there to provide services and support to an individual broking business; that doesn’t impede the broker’s ability to do their job.”

While there’s potential for alarming consumers by disclosing aggregators, it’s up to the broker to reassure them, argues Doobov: “The consumer might start thinking ‘oh, what’s the reason they’re doing this’, but if we show them that’s the right lender and that’s the cheapest interest rate, rather than commission, all of our clients trust us and are coming to us because of that trust factor.”

VERTICAL INTEGRATION IN BANKING

As well as the specific recommendations to disclose brokerage ownership, the Murray Inquiry calls for more transparency in the industry, including with regard to bank ownership of other banks. The brokers we spoke to argued they weren’t hiding bank ownership at all, in fact (and perhaps disappointingly for smaller players) they were using it as a selling point.

“We would explain the positives to vertical integration,” explains ALIC’s Davis, “the economies of scale when you consolidate operations or support functions to provide a higher level of service. You can also have greater capital investment into technology, market and support with companies like CBA over Bankwest or WBC with Bank of Melbourne/St.George etc. You can still have the subsidiaries run competing strategies or even boutique strategies.”

While Doobov uses a similar argument when necessary, he also adds that Intelligent Finance urges the client to look at the loan itself, rather than the lender: “We take a couple of steps back; instead of talking about what they want, let’s talk about what they need, and map out the structure of the loan first, without looking at the lender specifics. The actual lender that we put them with isn’t part of the equation at the start.”

Even if explaining vertical integration doesn’t become mandatory, it is likely to become more important. As NAB Broker head Steve Kane explained at MPA’s Major Bank Roundtable, other players are looking to gain a toehold in third-party mortgages. “I think we’re a bit fixated with banks at the moment because it’s popular with the Murray Inquiry. The reality is I think the gamechanger will be other institutional investors, whether they be foreign or otherwise, coming in and buying into the distribution channel, because they will see there’s a capital requirement.”

WHAT HAPPENS NOW?

Clearly Recommendation 40 is just a recommendation. However, it is a difficult recommendation to ignore in the eyes of consumers and the mainstream media, particularly if the financial planning industry is seen to enact changes before brokers do.

If regulation does result from the Financial System Inquiry, it’ll be self-regulation, suggests Hayden, and she believes it’ll be driven by vertically integrated lenders themselves: “I think most lenders who are integrated with aggregators would be comfortable with disclosure; I can’t see why they wouldn’t.” But before that happens the MFAA will collect stakeholders’ opinions to determine the cost of increased disclosure, and present findings to regulators in March, Hayden adds.

Independent brokers and non-major and nonbanks lenders have long been calling for a serious debate on vertical integration, and it seems David Murray’s report certainly provides the impetus for such a debate. The key is to prevent regulators overreacting, maintains Peter White: “You can go too far with these things and [should have] great caution with these things because that’s what happened under the NCCP. We tend to feel that disclosure and education are synonyms; they are not. The more disclosure you have does not mean the person is better educated or informed.”

This article orginally appeared in MPA magazine's February edition.