MPA talks to brokers about whether Gen Ys are after financial advice or not and how they prefer to seek it.

For all the claims that home ownership is now ‘out of reach’, Gen Ys are getting into property, and the property industry is scrambling to adapt to them.

The latest effort comes from professional services firm KPMG, which looked at the younger generation’s attitudes towards finance in its report Banking on the Future: The Expectations of the Gen Y Professional.

Young professionals are vital, of course, not only because they have more money to spend but also because they can be more demanding of service providers. Bear in mind, however, that KPMG is not talking about just any young professionals – they conducted this survey on more than 1,400 KPMG employees in Australia. This doesn’t make the report irrelevant – they’re still young professionals and potential homebuyers – but it does help explain the results.

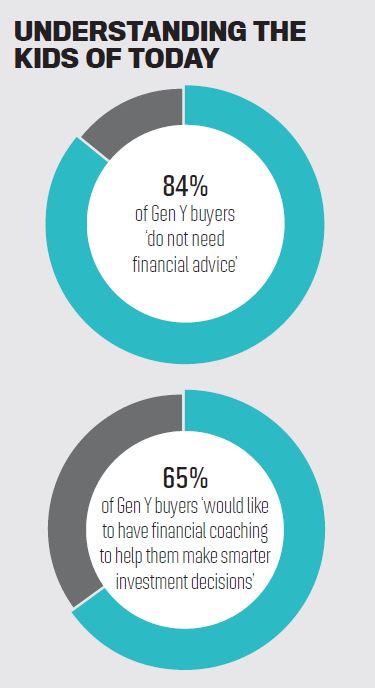

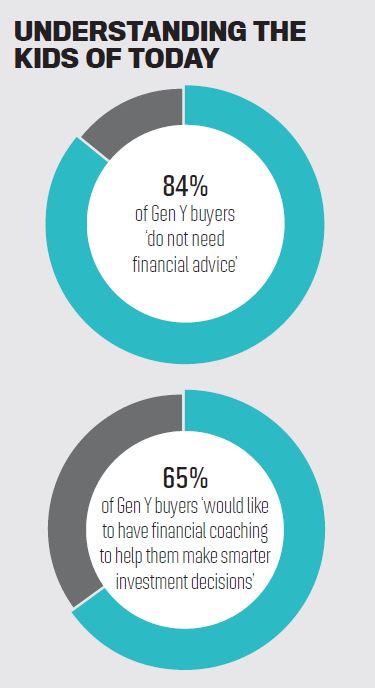

Two findings really stand out: 84% of respondents claim they ‘do not need financial advice’, while 65% ‘would like to have financial coaching to help them make smarter investment decisions’. On face value, these results seem somewhat contradictory, so MPA asked two brokers who specialise in younger buyers to take a look.

Theo Jansen of Mortgage Choice Melbourne agreed that the results were unclear, believing they reflected distrust of financial advice in the ‘financial planning’ sense. He did understand the desire for financial coaching; he has integrated an educational aspect in his meetings with all buyers: “It definitely all comes down to education. When I speak to clients, it’s not ‘This is what we’re going to do’; that’s a bit of an old-school approach. It’s ‘Here’s what we could do’.”

Meanwhile, Bianca Long of Sydney-based Mortgage Choice Glenwood was particularly sceptical of the 84% figure, dismissing it as “hogwash”. In her experience, Gen Y clients want more advice, not less, due to their desire to rapidly build investment property portfolios. “The Gen Ys coming in who are so investment-savvy … what I am seeing is a lot of the younger guys wanting to sit down and discuss things with accountants, and I don’t think I’ve ever seen the young guys saying ‘I’d better get myself a good accountant’.”

Clearly, the 84% statistic may be misleading because of its wording. However, the desire for ‘financial coaching’ is relevant, and suggests that brokers need to involve Gen Y clients more in the reasoning behind their decisions. As Jansen points out, this requires a balancing act: “From my perspective, and considering the market is flooded with brokers, you do need to be the nice guy and give as much information as possible, without being too nice and not trying to close the deal.”

Not so tech-savvy after all

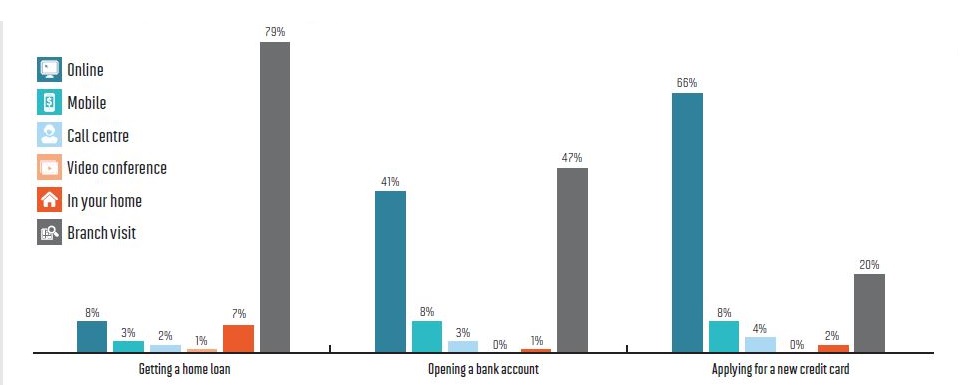

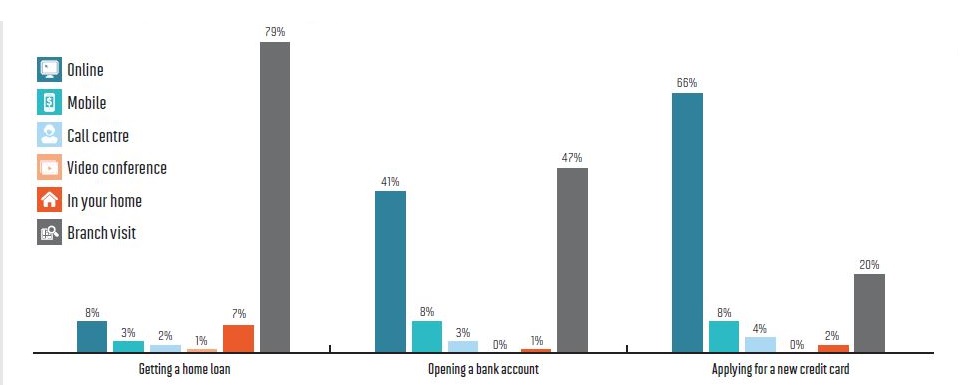

Young people seeking a home loan still overwhelmingly prefer face-to-face branch visits. Interestingly, 70% of respondents didn't see themselves using social media for banking - but whether that also applies to dealing with a broker is less clear.

The latest effort comes from professional services firm KPMG, which looked at the younger generation’s attitudes towards finance in its report Banking on the Future: The Expectations of the Gen Y Professional.

Young professionals are vital, of course, not only because they have more money to spend but also because they can be more demanding of service providers. Bear in mind, however, that KPMG is not talking about just any young professionals – they conducted this survey on more than 1,400 KPMG employees in Australia. This doesn’t make the report irrelevant – they’re still young professionals and potential homebuyers – but it does help explain the results.

Two findings really stand out: 84% of respondents claim they ‘do not need financial advice’, while 65% ‘would like to have financial coaching to help them make smarter investment decisions’. On face value, these results seem somewhat contradictory, so MPA asked two brokers who specialise in younger buyers to take a look.

Theo Jansen of Mortgage Choice Melbourne agreed that the results were unclear, believing they reflected distrust of financial advice in the ‘financial planning’ sense. He did understand the desire for financial coaching; he has integrated an educational aspect in his meetings with all buyers: “It definitely all comes down to education. When I speak to clients, it’s not ‘This is what we’re going to do’; that’s a bit of an old-school approach. It’s ‘Here’s what we could do’.”

Meanwhile, Bianca Long of Sydney-based Mortgage Choice Glenwood was particularly sceptical of the 84% figure, dismissing it as “hogwash”. In her experience, Gen Y clients want more advice, not less, due to their desire to rapidly build investment property portfolios. “The Gen Ys coming in who are so investment-savvy … what I am seeing is a lot of the younger guys wanting to sit down and discuss things with accountants, and I don’t think I’ve ever seen the young guys saying ‘I’d better get myself a good accountant’.”

Clearly, the 84% statistic may be misleading because of its wording. However, the desire for ‘financial coaching’ is relevant, and suggests that brokers need to involve Gen Y clients more in the reasoning behind their decisions. As Jansen points out, this requires a balancing act: “From my perspective, and considering the market is flooded with brokers, you do need to be the nice guy and give as much information as possible, without being too nice and not trying to close the deal.”

Not so tech-savvy after all

Young people seeking a home loan still overwhelmingly prefer face-to-face branch visits. Interestingly, 70% of respondents didn't see themselves using social media for banking - but whether that also applies to dealing with a broker is less clear.