Economists weigh in on latest CPI figures

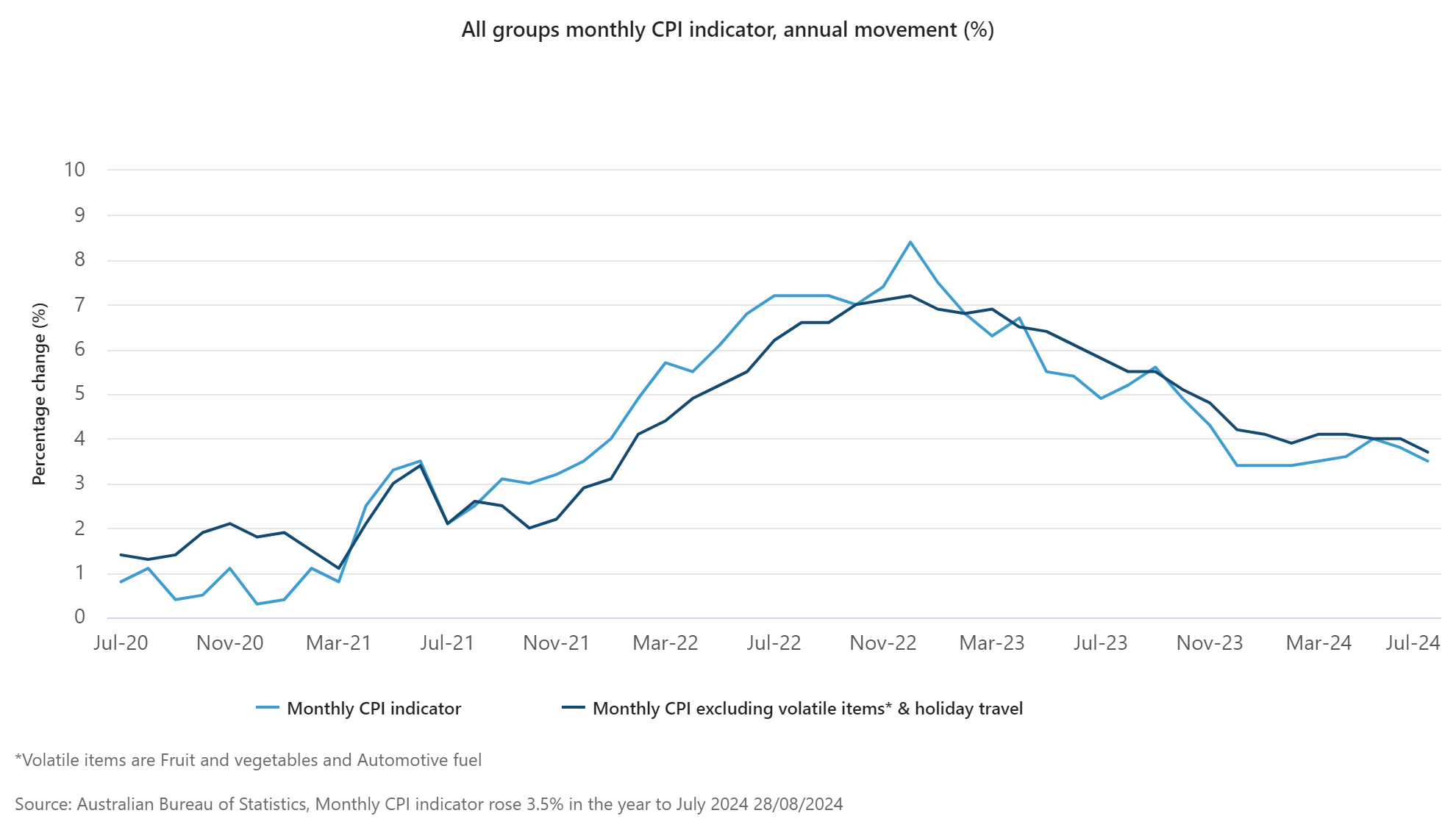

Australia’s inflation rate eased to 3.5% in July 2024, down from 3.8% in June, according to the latest Consumer Price Index (CPI) data from the Australian Bureau of Statistics (ABS).

The July CPI figure marks the lowest annual inflation rate since December 2021, with the decline largely driven by a significant drop in electricity prices due to new government rebates, offsetting increases in housing costs and other sector.

“The first instalments of the 2024-25 Commonwealth Energy Bill Relief Fund rebates began in Queensland and Western Australia from July 2024, with other states and territories to follow,” said Leigh Merrington, ABS acting head of prices statistics. “Altogether, these rebates led to a 6.4% fall in electricity prices in the month of July. Excluding the rebates, electricity prices would have risen 0.9%.”

Housing costs, a significant contributor to inflation, rose 4% in the year to July, with rents increasing by 6.9%, down slightly from June’s 7.1%. New dwelling prices continued to rise at an annual rate of 5.0%, reflecting the ongoing pass-through of higher labour and material costs by builders.

Treasurer Jim Chalmers (pictured above left) highlighted the positive impact of government measures on inflation but cautioned that more work is needed.

“It’s a promising result, but we’re not complacent because we know that people are still under pressure,” he said. “We’ve made welcome and encouraging progress in the fight against inflation, but we want it to moderate further and faster.”

Economist Stephen Koukoulas (pictured above centre) expressed optimism about the future inflation trend.

“Inflation is well contained,” Koukoulas said. “Annual inflation is back down to 3.5% and will almost certainly be below 3% in August.

“The things that drive inflation – demand, supply and wages – are all pointing to inflation being in the target for the next few years. Maybe longer and with downside risks from the rise in unemployment.”

See LinkedIn post here.

However, economist Saul Eslake (pictured above right) offered a more cautious view, noting that underlying inflation remains above the Reserve Bank of Australia’s (RBA) target range of 2-3%.

“3.8% is still a fair way above the top end of the RBA’s target range,” Eslake said. “As such, it’s hard to see the RBA cutting rates in November, and then twice more in the first half of 2025, as the financial markets are still pricing – notwithstanding the explicit indication RBA governor Michele Bullock provided on two separate occasions after this month’s board meeting that such pricing was ‘not aligned’ with the board’s thinking.

“I'm maintaining the view I’ve held since November last year that the RBA won’t be cutting interest rates this year – no matter what the US Federal Reserve does at its next meeting, and the two after that.”

Have something to say about this story? Let us know in the comments below.