Dr Kiran Thapa, PHD, DFS(FP), MEngSc, BE is a broker with a difference; coming from an engineering background in Nepal and studying finance at UTS, he's now taking the skills he learned to the world of broking

Dr Kiran Thapa, PHD, DFS(FP), MEngSc, BE is a broker with a difference; coming from an engineering background in Nepal and studying finance at UTS, he's now taking the skills he learned to the world of broking

Dr Kiran Thapa, PHD, DFS(FP), MEngSc, BE is a broker with a difference; coming from an engineering background in Nepal and studying finance at UTS, he's now taking the skills he learned to the world of brokingHow many brokers have written a book? Or have a PhD? Of course, many would say that such qualifications have little to do with day-to-day broking. But Kiran Thapa, CEO of CAPKON Investments, shows that a technical background is no bar to entering the profession, and that investing in education can pay dividends.

CAPKON Investments is based in Summer Hill, in Sydney’s Inner West. However Thapa spent his early years and professional life in a somewhat more exotic destination: Nepal. He comes from Nuwākot, just 70km from Kathmandu but a gruelling three hour drive to the capital. He made the journey for university – earning a degree in engineering – before working as an engineer in remote parts of the country, writing a Nepali-language textbook on engineering in 2005. In fact Thapa only arrived in Australia in 2006, to do a Masters in Engineering at the University of Melbourne.

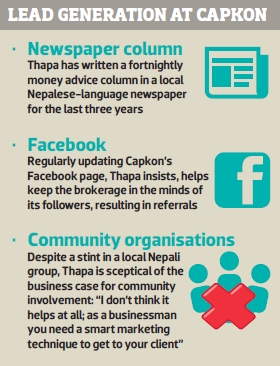

Nuwākot to Melbourne is no small journey and in 2007 Thapa was still working as a traffic engineer and not interested in broking. The GFC changed all that, he recalls: “everyone was talking about finance, it was all over the TV, wherever you go doctors, engineers, all were talking about finance. It was then I realised, it doesn’t matter what field you are in, this is something that affects everyone, and I thought this is something I need knowledge of.” Thapa’s unorthodox reaction – which he describes as a moment of ‘self-realisation’, led him to Sydney’s UTS, doing a Finance PhD in the utility of social media forums for stock market investors (apparently they’re not very useful). Finally in 2011, after two years of deliberating, CAPKON settled its first loan.

Broking certainly doesn’t require a finance PhD, but Thapa is convinced the letters after his name are not wasted: “I think it is one of the main attracting factors for people to come to my door. There are two things: one, even if I’m not near my laptop or computer, I can still calculate what your repayments are going to be like, what the banks are doing … and second I think it’s about integrity as well. [Clients think] ‘if this guy has to spend his life and his savings on education for 30 years he’s in it for the long run, he’s not going to get the money and run away’.” Teaching undergraduates during his years in academia has also helped Thapa deal with confused clients.

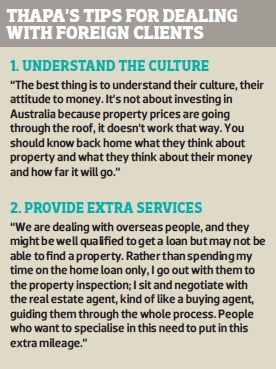

CAPKON’s clients, Thapa tells me, are mainly Nepali immigrants. His engineering links help here; “in 2006 and 2007 we had a lot of engineers coming over to be permanent residents … other people came over to do their studies and now they are permanent residents.” In many ways these Nepali immigrants are ideal clients: “dual income, no kids, 20% savings” – and most of them, Thapa points out, speak excellent English because of their occupation.

Thapa’s strategy for CAPKON is closely tied to the Nepali community. While his qualifications might point him towards commercial broking, he doesn’t feel his clientele are ready: “We may have one or two cases of people trying to buy commercial property and needing loans, but in general more than 80% of my clients are still trying to find their first home … I’m just going with the community sentiment and the development of the community and from that I can see [commercial] could be the future, but not at this stage.”

Australia’s flourishing Nepali community is also taking Thapa far from the confines of Sydney. Indeed his second biggest client base is located in Darwin, and I talked to him on the way back from a barbeque-based seminar for potential clients in Dubbo. He dismisses the idea that migrants tend to stick to the big cities: “what has happened recently is because of permanent residency issues, people who have qualified based on their education and experience alone have to go to regional areas … they go out there, and once they are out there they want to buy a house, raise a family and stuff like that.” Thapa does however insist that trips must be worth his while: five or six potential clients in a distant location doesn’t interest him.

In Thapa’s view, CAPKON’s community-driven approach is a success story “doing eight to nine million dollars a month, 23–24 loans a month, and considering we’ve got just one broker and I’ve never worked for anyone [in broking] before … this is a great achievement and I’m very happy”. Now he wants to combine the three threads which have so far defined his career: his Nepali links, his engineering experience and his academic education.

In Thapa’s view, CAPKON’s community-driven approach is a success story “doing eight to nine million dollars a month, 23–24 loans a month, and considering we’ve got just one broker and I’ve never worked for anyone [in broking] before … this is a great achievement and I’m very happy”. Now he wants to combine the three threads which have so far defined his career: his Nepali links, his engineering experience and his academic education.“In the next five years, since we have the background of engineering and working at local council, we’ll be definitely heading to more commercial finance,” Thapa explains. “I think that’s the right combination for my education, knowledge and skillset.” He’s still involved in engineering, in an infrastructure company called Fusion Technology Group, on the corporate and strategy side. The company employs 45 engineers, and uses some of its revenue to buy investment properties, utilising Thapa’s broking expertise.

Secondly, Thapa wants to start another venture to help CAPKON retain clients. It is about collective investment, he loosely explains: “all my CAPKON clients will become automatic stakeholders, and I’ll be giving them part of trail commission in return for them buying a stake in a company. If they want to buy more, they can do that.” The funds he raises will be invested in infrastructure and commercial property. The key element is that if clients want to leave CAPKON for another brokerage, they have to sell their stake in Thapa’s collective investment vehicle. The plan’s just ‘in the pipeline’, according to Thapa, but he want to get it moving over the next five years.

Hearing Thapa’s story, one could get an impression of someone making up for lost time – time, some might cynically suggest, wasted in education. Then again, you could see Thapa’s experience and expertise outside of broking as directly benefitting him within broking, not least his curiosity: when he’s not taking his kids for long drives or attending community events he spends time reading the financial papers. Perhaps it’s the desire to learn, rather than learning itself, which really makes Kiran Thapa a broker with a difference.

This issue is from Mortgage Professional Australia's December issue. Get the issue to read more!