Majors' performance has stabilised in the first half in line with the previous half's results

Australia’s major banks reported a combined profit after tax of $15 billion for the first half of fiscal year 2024, marking a 10.5% decline compared to the same period last year, according to KPMG’s latest analysis.

“FY23 was very much a year of two halves, with a record first half profit performance and a softer second half,” said Steve Jackson (pictured left), head of banking and capital markets at KPMG Australia.

“The majors’ performance has stabilised in 1H24 in line with the 2H23 position. Profits have come off from the highs of 1H23, but income is broadly flat, the pace of margin erosion has slowed, and operating expenses have reduced modestly compared to 2H23.”

The KPMG report also revealed that total operating income for the period remained steady at $44.5 billion, only slightly down by 0.02% from the previous half-year and a decline from the record $45.7 billion in early 2023.

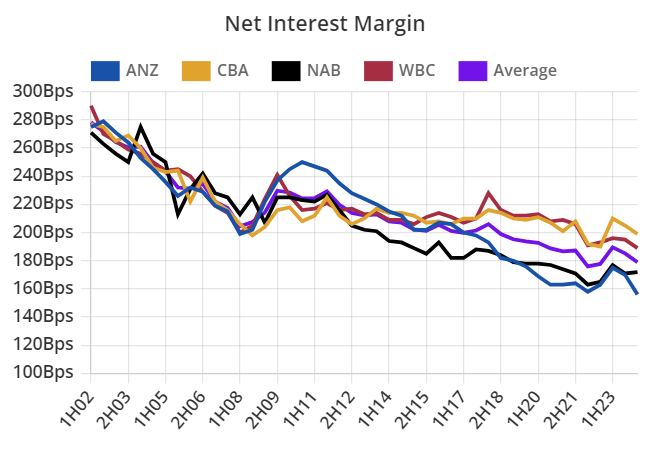

Despite a 1.9% increase in interest-earning assets, net interest income dropped by 0.5% to $36.8 billion due to continued margin pressures exacerbated by intense competition in the mortgage market and rising deposit funding costs.

Average net interest margin (NIM) for the period was 179 basis points, down from 190 basis points in the first half of 2023 and 184 basis points in the latter half.

“Despite the ongoing strong competition and higher funding costs, the squeeze on net interest margins has moderated in the first half of the financial year,” said Kim Lawry (pictured right), banking partner at KPMG Australia.

On the expense front, operating costs, which had been increasing in 2023, dropped by 1% from the second half of the year. The cost-to-income ratio improved to 48.7%, down 40 basis points from the prior period but still up 348 basis points from early 2023 levels. Personnel costs, a significant component of operating expenses, also fell slightly.

Impairment charges for the period were $1.21 billion, about 13% lower than the previous year. The average provision for gross loans and advances held steady at 0.68%, and total impaired loans rose by 2.2%, a reflection of the ongoing growth in overall portfolios.

The banks maintained robust capital and liquidity positions, with the average liquidity coverage ratio (LCR) increasing to 135.3% and the common equity tier 1 (CET1) ratio reaching 12.6%. Interim dividends also saw an average increase of 2.9% compared to the first half of 2023.

“These results demonstrate the continued strength of the majors, maintaining asset base growth, healthy capital and liquidity positions, and with credit quality continuing to show no significant signs of stress,” said Maria Trinci, banking partner at KPMG Australia.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.