New options have emerged to help struggling first home buyers get a mortgage and assist brokers in creating a client for life

First home buyers have become a classic ‘bad news story’ within the industry. Whereas 2015 saw fi rst home buyer anger rise to the surface – most notably when then-treasurer Joe Hockey suggested the solution was “to get a good job that pays good money” – 2016 has seen this embarrassing subject pushed aside entirely.

The prospects for first home buyers are grim, and unlikely to get better. Indeed, in his introduction to March’s Housing Aff ordability Report, Adelaide Bank general manager Damian Percy noted, “The fact that many young families, particularly those in Melbourne and Sydney, now see home ownership as something their parents achieved but they likely never will, is a national tragedy.”

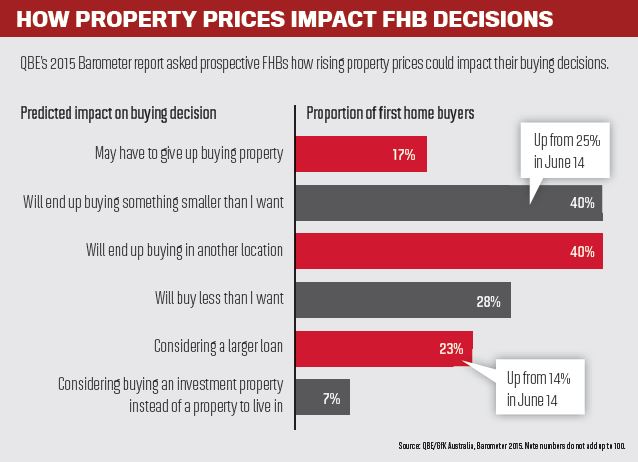

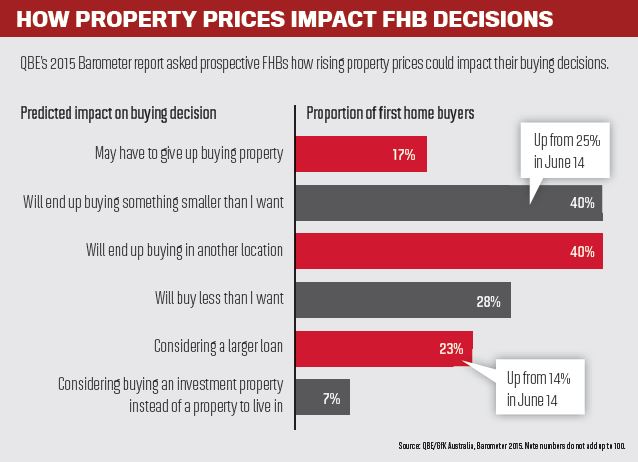

The report did fi nd that the number of FHBs had increased in every state except WA, but a proportion of the owner-occupied market still remained well below the long-term average – 15% compared to the long-term average of 19.7%. Whilst QBE/BIS Shrapnel’s Housing Outlook 2015-18 reports prices in some cities will fall, Robert Mellor, managing director of BIS Shrapnel, told MPA that “until we get to fl at price growth or small declines, or income growth gets to 3-4%, we won’t see an increase in first home buyer activity.”

Moreover, regulators are unlikely to look kindly on a type of lending which by its nature involves high LVRs and borrowers with limited assets. Meanwhile, the vehemently negative reaction to Labor’s suggestions regarding negative gearing means political parties will hardly be inclined to get involved in housing-related debates.

All of which mean that FHBs’ best friends are now brokers and lenders. Whatever your reason for dealing with FHB clients – and there are several that remain compelling – this article will present various ways to overcome the deposit gap, the changing preferences of fi rst home buyers, and the ways that brokers can position themselves in this space.

Understanding 2016’s first home buyers

Understanding 2016’s first home buyers

When dealing with FHBs, brokers should note the characteristics of this group have changed considerably in recent years. “The average age of Australians buying homes has shot up over the last decade,” notes Me bank’s general manager of broker sales Lino Pelaccia. “Many fi rst home buyers are now predominantly in their 30s and 40s.” A rising average age has two implications – the fi rst of which is that older borrowers have had longer to save for a deposit and may earn higher incomes.

Higher wages won’t by themselves solve the deposit gap, according to Richard Irving, head of third party at Bank Australia. “There is also an interesting profile starting to take shape where individuals who have a very good servicing capacity just can’t get enough money together to meet genuine savings requirements.” Nor does it mean that parents and relatives can be safely ignored. In fact, parental involvement is growing due to guarantees and gifts, as discussed below.

The second implication of older borrowers is that brokers cannot assume they’re dealing with the ‘digital native’ generation, according to Adelaide Bank head Percy. A large amount has been written on marketing approaches for younger buyers (see our own take on this in MPA 15.11), but brokers would be advised to instead focus on a particular message and keep their marketing broad-based.

And what is that message? In its most basic form, it’s that you will help your client to get on the housing ladder and challenge negative perceptions held by FHBs, some of which are not grounded in reality. For example, a recent study by Commonwealth Bank found that 50% of potential home buyers overestimate the median dwelling price of their capital city which, according to general manager of broker sales Sam Boer “indicates there is a gap in perception and reality when it comes to affordability”.

Adelaide Bank’s Percy sees the perception challenge as being two-fold. “There’s a real risk that fi rst home buyers start to give up, that they start to form the view that a. it’s too hard to get in, and b. once they do get in, the financial stresses and pressures that will come from carrying debt will create hardship.”

Overcoming the deposit gap

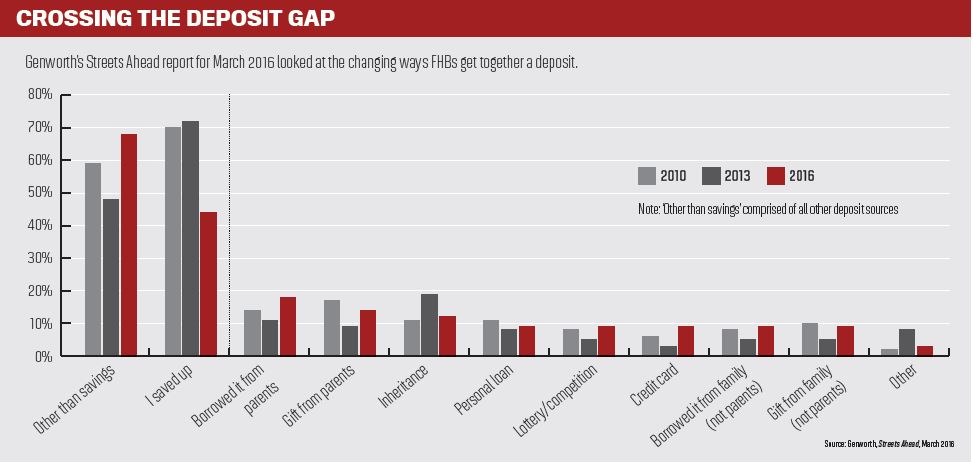

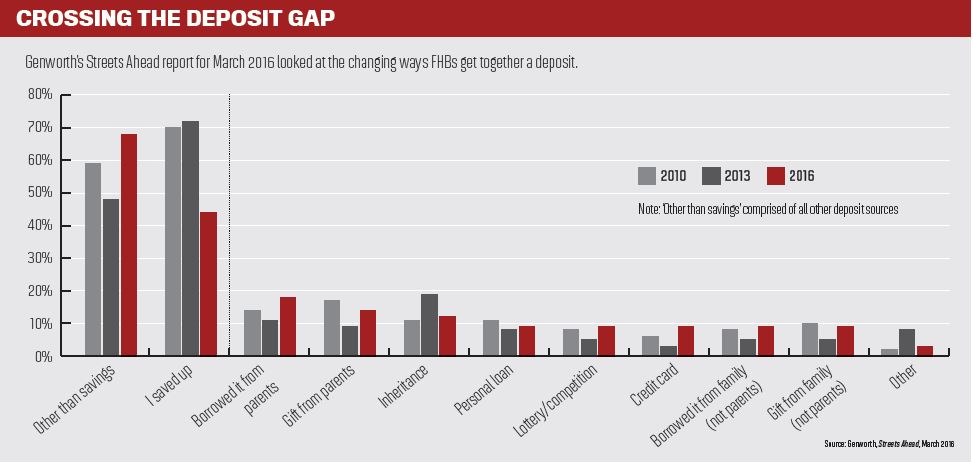

The challenges of FHBs are epitomised by their struggle to get a deposit together, and for many, the solution lies in parental guarantees. Previously a niche option, parental guarantees, where borrowers use the equity in their parents’ home as security, have ballooned. At Bank Australia they fi nd that over 50% of FHB applications “now have some sort of support from parents”.

All the lenders involved in this piece off er some sort of guarantor options, and it’s worth noting that parents may be more open to this option then you’d think. Parents also read about declining affordability, observes Percy from Adelaide Bank, and want to help their kids out. “They’re useful tools and increasingly, as a parent of a 10- and 12-year old, you start to look at housing for your kids and you almost assume you’ll have a role.”

Financial gifts, where parents provide some of the fi nance needed for the deposit, are also becoming more popular, Bank Australia have found, and is now quite common. It’s worth noting here that lenders will want assurance that the money is indeed a gift and there is no expectation from parents it will be repaid.

Less traditionally, some lenders, such as CBA, have begun to introduce shared property products. “Our Property Share product allows customers to split the cost of buying a home with family and friends, explains Sam Boer, “while retaining individual control of your finances”. Irving says Bank Australia can also look at this kind of arrangement. “It is less about a specific product and more about understanding how to structure an arrangement.”

Research by Me bank found that 14% of buyers purchased jointly with parents, 12% with other family and 4% with friends, and Pelaccia sees that growing further. “With property values remaining strong, the trend of co-buying looks set to gain momentum.” He recommends drawing up a formal co-ownership agreement with a solicitor, which “will set out in writing how various possibilities will be handled by everyone – from the arrival of a partner on the scene to what happens when one owner wants to sell up.”

Whilst property share products may seem exotic, it’s important to remember even guarantor loans carry risks. “We need to be careful not to undersell the risks of parental guarantees to parents,” says Percy. “It’s a guarantee and all guarantees have risks. If it wasn’t the transfer of some sort of risk from the bank to the parents, the bank wouldn’t guarantee it in the first place.” Suncorp’s Degetto advises brokers to meet independently with guarantors to make sure they understand this fact. Irving from Bank Australia urges brokers “to consider the ‘exit strategy’ for guarantors… It is also important for brokers to make sure the guarantee is ‘limited’ and not a guarantee of the entire loan.”

guarantors to make sure they understand this fact. Irving from Bank Australia urges brokers “to consider the ‘exit strategy’ for guarantors… It is also important for brokers to make sure the guarantee is ‘limited’ and not a guarantee of the entire loan.”

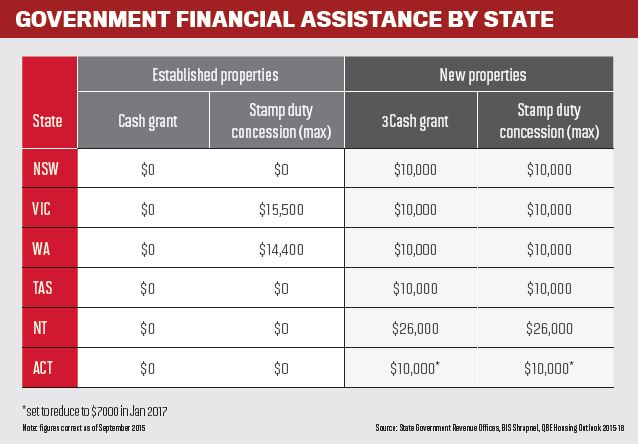

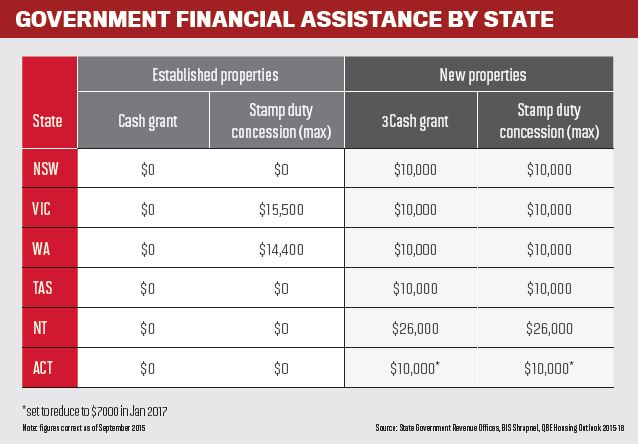

First home buyer grants vary considerably by state (see the accompanying table), and have been slashed in recent years, but should of course still be considered. In some cases, brokers may wish to look at the government-backed lenders in the market, who can offer solutions for those on low incomes or from disadvantaged groups. Examples include HomeStart Finance in South Australia and KeyStart Finance in Western Australia.

Looking forward, a risk-free ‘quick fix’ for the deposit gap remains a distant prospect. One solution, suggested by Adelaide Bank’s Percy, is equity-based loans, where those looking to invest can take a share of a first home buyer’s loan, and take a share of any appreciation in the property’s price. These products exist – Adelaide Bank introduced theirs in 2006 – but have been held back by the unwillingness of superfunds, the most obvious investor, to get involved.

Features of loans

Receiving less attention than deposits, but still important to brokers, is what sort of loans FHBs are after. FHBs have traditionally been associated with simple low-cost, high-LVR products, and Me boss Pelaccia finds this is still the case. “Our basic home loan – our no-nonsense loan without all the bells and whistles – is popular with first home buyers.” FHBs do want a redraw facility, but are less keen on application or ongoing fees, he adds. Irving sees the same at Bank Australia, where offsets have not been particularly popular, whilst noting there has been some enquiry from FHBs about interest-only options.

Other banks, however, argue that FHB preferences are changing. “Over time, we have seen a shift towards package loans with all the benefits of flexible payments and offset facilities,” observes Suncorp’s Degetto. “The focus for consumers has very much been on saving interest where possible in order to pay off their loan quicker.” He’s also seeing low interest rates encouraging FHBs to fix some or all of their loans to provide security around repayments. Furthermore, he finds some FHBs looking for loans with lower LVRs and more competitive rates, which they access through guarantors and parental gifts.

According to Commonwealth Bank and Adelaide Bank, FHBs are looking for more control over their repayments. FHBs won’t just settle for a bill coming through the door, explains Adelaide Bank’s Percy. They want interactivity through offsets and budgeting tools, ideally using technology, such as mobile applications. Indeed, Percy believes that brokers should look at challenges around repayments, not just the deposit, when selecting products. “Brokers and banks have an obligation to keep an eye on that sort of thing… You’ve just given that person the largest debt they’ve ever had.”

Taking the long-term view

Taking the long-term view

So far this article has been focused on products, but of course brokers in all areas of lending are looking to build long-term relationships. In the case of FHBs, brokers do this by starting that relationship long before the loan has settled, helping borrowers with their savings journey. Suncorp boss Degetto believes brokers play a pivotal role here. “It is important brokers position themselves as an invaluable source of knowledge and expertise in this market.”

Percy agrees, and picks out as an example Bluebay Home Loans, an associate of Adelaide Bank. Their brokers work with borrowers for six to nine months, helping them save for a deposit. This gives their brokers an advantage when the borrower is in a position to buy. “The broker will have greater insights than anybody else and, generally, they get a lot of respect and love from those first home buyers for having assisted them.”

There are ways brokers can engage with prospective FHBs even earlier. Financial planners have become increasingly interested in young professionals in their mid-20s, attempting to reach them through technology-driven, low-cost planning options. One growing trend, which is relevant to brokers, is the use of margin lending to help prospective FHBs grow their wealth from a low base. To find out more, MPA talked to Julie McKay and Keith Hilsdon, who work in wealth management at Bendigo and Adelaide Bank.

McKay and Hilsdon aim their Investment Funds Multiplier product at clients aged 22-23, who want to build wealth faster than a term deposit would do, whilst spending much of their income on leisure activities. The bank then loans them money to invest in equities – most financial planners advise 50% gearing – and starting with $1000, the client makes contributions of $250 a month upwards. The advantage, according to Hilsdon, is that “you’re building credit worthiness in the eyes of a bank, and you’re also building up your portfolio of assets… When it comes to sit down with your bank you’ve demonstrated a track record of repaying a loan and invested in assets that will return value.”

Owing to the GFC, margin lending has a poor reputation, and isn’t something a broker can formally recommend, cautions McKay. “Certainly, if the broker isn’t accredited to give advice, they can only direct the customer to a financial planner or to the MoneySmart website.” Brokers should also be aware of the timeframes involved, according to McKay. “This is a medium-term plan. It’s a couple of years out for people, but it’s a sensible way of doing it, and it doesn’t entail them hoping they win the lottery or something like that, because I don’t think that’s realistic.”

Margin lending products do not offer commission to the broker, and indeed many brokers will look at the entire ‘savings journey’ approach and ask, ‘What’s the payoff?’ It’s a question lenders struggle to answer. In the investor lending space, some brokerages now charge borrowers for a package of all-round advice, or, in the case of AMA Brokerage of the Year, The Australian Lending and Investment Centre charges borrowers if they decline to take up a service after committing. However, in their recent submission to ASIC’s ongoing remuneration review, aggregator AFG argued that FHBs would particularly suffer if fee-for-service was mandatory, as they already lack resources, meaning they would go straight to lenders to minimise costs.

For most brokers therefore, the commercial incentive to deal with FHBs remains the same – that these become clients for life, with accompanying referrals for life. “First home buyers turn into second home buyers, who turn into third home buyers,” comments Adelaide Bank’s Percy. Me bank’s Pelaccia also notes this possibility for repeat business, whilst adding that FHBs continue to represent “a fair share of the market”.

In terms of personal referrals, FHBs are particularly valuable to brokers because a settled loan creates further clients in grateful mums, dads and relatives. Given the continual bad news around affordability, prospective first home buyers are looking for ways to get on the ladder and personal referrals from friends count the most. Marketing yourself as a specialist can work well here, explains Percy. “Being able to create a story around your business, where you’re helping them get what they want and you’re prepared to assist them earlier than others, adds to that opportunity for referrals and positive feedback.”

Finally, there is a moral case for helping first home buyers. Almost all the lenders MPA spoke to for this article made this point, but we’ve chosen to end with the argument from Bank Australia’s Irving. “Our job, collectively across the industry, is to find a way to work together on solutions for first home buyers. Affordable housing is one of the biggest challenges for the country and accessibility to finance in turn needs to seriously be considered. We need solutions.”

WHATEVER HAPPENED TO RENTVESTORS?

Last time MPA covered the FHB sector, in early 2015, we wrote about ‘rentvestors’ – those buyers whose first purchase is an investment property in an affordable suburb, whilst they themselves continue to rent and enjoy the inner city lifestyle, who LJ Hooker flagged as a growing trend. Seven per cent of FHBs told QBE’s Barometer in early 2015 that they would consider buying an investment property instead of one to live in.

Rentvestors still exist, but were hit particularly hard by APRA’s restrictions on investor lending later in 2015. “The one who has been disadvantaged the most is the person who has never bought before and they don’t want to buy the family home – they want to buy the investment property,” Simon Pressley of Propertyology told the Brisbane Courier Mail. “They are the ones who have been hit hardest because all investors have to raise around a 20% deposit. Brokers will have to work a lot harder.”

The prospects for first home buyers are grim, and unlikely to get better. Indeed, in his introduction to March’s Housing Aff ordability Report, Adelaide Bank general manager Damian Percy noted, “The fact that many young families, particularly those in Melbourne and Sydney, now see home ownership as something their parents achieved but they likely never will, is a national tragedy.”

The report did fi nd that the number of FHBs had increased in every state except WA, but a proportion of the owner-occupied market still remained well below the long-term average – 15% compared to the long-term average of 19.7%. Whilst QBE/BIS Shrapnel’s Housing Outlook 2015-18 reports prices in some cities will fall, Robert Mellor, managing director of BIS Shrapnel, told MPA that “until we get to fl at price growth or small declines, or income growth gets to 3-4%, we won’t see an increase in first home buyer activity.”

Moreover, regulators are unlikely to look kindly on a type of lending which by its nature involves high LVRs and borrowers with limited assets. Meanwhile, the vehemently negative reaction to Labor’s suggestions regarding negative gearing means political parties will hardly be inclined to get involved in housing-related debates.

All of which mean that FHBs’ best friends are now brokers and lenders. Whatever your reason for dealing with FHB clients – and there are several that remain compelling – this article will present various ways to overcome the deposit gap, the changing preferences of fi rst home buyers, and the ways that brokers can position themselves in this space.

Understanding 2016’s first home buyers

Understanding 2016’s first home buyersWhen dealing with FHBs, brokers should note the characteristics of this group have changed considerably in recent years. “The average age of Australians buying homes has shot up over the last decade,” notes Me bank’s general manager of broker sales Lino Pelaccia. “Many fi rst home buyers are now predominantly in their 30s and 40s.” A rising average age has two implications – the fi rst of which is that older borrowers have had longer to save for a deposit and may earn higher incomes.

Higher wages won’t by themselves solve the deposit gap, according to Richard Irving, head of third party at Bank Australia. “There is also an interesting profile starting to take shape where individuals who have a very good servicing capacity just can’t get enough money together to meet genuine savings requirements.” Nor does it mean that parents and relatives can be safely ignored. In fact, parental involvement is growing due to guarantees and gifts, as discussed below.

The second implication of older borrowers is that brokers cannot assume they’re dealing with the ‘digital native’ generation, according to Adelaide Bank head Percy. A large amount has been written on marketing approaches for younger buyers (see our own take on this in MPA 15.11), but brokers would be advised to instead focus on a particular message and keep their marketing broad-based.

And what is that message? In its most basic form, it’s that you will help your client to get on the housing ladder and challenge negative perceptions held by FHBs, some of which are not grounded in reality. For example, a recent study by Commonwealth Bank found that 50% of potential home buyers overestimate the median dwelling price of their capital city which, according to general manager of broker sales Sam Boer “indicates there is a gap in perception and reality when it comes to affordability”.

Adelaide Bank’s Percy sees the perception challenge as being two-fold. “There’s a real risk that fi rst home buyers start to give up, that they start to form the view that a. it’s too hard to get in, and b. once they do get in, the financial stresses and pressures that will come from carrying debt will create hardship.”

Overcoming the deposit gap

The challenges of FHBs are epitomised by their struggle to get a deposit together, and for many, the solution lies in parental guarantees. Previously a niche option, parental guarantees, where borrowers use the equity in their parents’ home as security, have ballooned. At Bank Australia they fi nd that over 50% of FHB applications “now have some sort of support from parents”.

All the lenders involved in this piece off er some sort of guarantor options, and it’s worth noting that parents may be more open to this option then you’d think. Parents also read about declining affordability, observes Percy from Adelaide Bank, and want to help their kids out. “They’re useful tools and increasingly, as a parent of a 10- and 12-year old, you start to look at housing for your kids and you almost assume you’ll have a role.”

Financial gifts, where parents provide some of the fi nance needed for the deposit, are also becoming more popular, Bank Australia have found, and is now quite common. It’s worth noting here that lenders will want assurance that the money is indeed a gift and there is no expectation from parents it will be repaid.

Less traditionally, some lenders, such as CBA, have begun to introduce shared property products. “Our Property Share product allows customers to split the cost of buying a home with family and friends, explains Sam Boer, “while retaining individual control of your finances”. Irving says Bank Australia can also look at this kind of arrangement. “It is less about a specific product and more about understanding how to structure an arrangement.”

Research by Me bank found that 14% of buyers purchased jointly with parents, 12% with other family and 4% with friends, and Pelaccia sees that growing further. “With property values remaining strong, the trend of co-buying looks set to gain momentum.” He recommends drawing up a formal co-ownership agreement with a solicitor, which “will set out in writing how various possibilities will be handled by everyone – from the arrival of a partner on the scene to what happens when one owner wants to sell up.”

Whilst property share products may seem exotic, it’s important to remember even guarantor loans carry risks. “We need to be careful not to undersell the risks of parental guarantees to parents,” says Percy. “It’s a guarantee and all guarantees have risks. If it wasn’t the transfer of some sort of risk from the bank to the parents, the bank wouldn’t guarantee it in the first place.” Suncorp’s Degetto advises brokers to meet independently with

guarantors to make sure they understand this fact. Irving from Bank Australia urges brokers “to consider the ‘exit strategy’ for guarantors… It is also important for brokers to make sure the guarantee is ‘limited’ and not a guarantee of the entire loan.”

guarantors to make sure they understand this fact. Irving from Bank Australia urges brokers “to consider the ‘exit strategy’ for guarantors… It is also important for brokers to make sure the guarantee is ‘limited’ and not a guarantee of the entire loan.”First home buyer grants vary considerably by state (see the accompanying table), and have been slashed in recent years, but should of course still be considered. In some cases, brokers may wish to look at the government-backed lenders in the market, who can offer solutions for those on low incomes or from disadvantaged groups. Examples include HomeStart Finance in South Australia and KeyStart Finance in Western Australia.

Looking forward, a risk-free ‘quick fix’ for the deposit gap remains a distant prospect. One solution, suggested by Adelaide Bank’s Percy, is equity-based loans, where those looking to invest can take a share of a first home buyer’s loan, and take a share of any appreciation in the property’s price. These products exist – Adelaide Bank introduced theirs in 2006 – but have been held back by the unwillingness of superfunds, the most obvious investor, to get involved.

Features of loans

Receiving less attention than deposits, but still important to brokers, is what sort of loans FHBs are after. FHBs have traditionally been associated with simple low-cost, high-LVR products, and Me boss Pelaccia finds this is still the case. “Our basic home loan – our no-nonsense loan without all the bells and whistles – is popular with first home buyers.” FHBs do want a redraw facility, but are less keen on application or ongoing fees, he adds. Irving sees the same at Bank Australia, where offsets have not been particularly popular, whilst noting there has been some enquiry from FHBs about interest-only options.

Other banks, however, argue that FHB preferences are changing. “Over time, we have seen a shift towards package loans with all the benefits of flexible payments and offset facilities,” observes Suncorp’s Degetto. “The focus for consumers has very much been on saving interest where possible in order to pay off their loan quicker.” He’s also seeing low interest rates encouraging FHBs to fix some or all of their loans to provide security around repayments. Furthermore, he finds some FHBs looking for loans with lower LVRs and more competitive rates, which they access through guarantors and parental gifts.

According to Commonwealth Bank and Adelaide Bank, FHBs are looking for more control over their repayments. FHBs won’t just settle for a bill coming through the door, explains Adelaide Bank’s Percy. They want interactivity through offsets and budgeting tools, ideally using technology, such as mobile applications. Indeed, Percy believes that brokers should look at challenges around repayments, not just the deposit, when selecting products. “Brokers and banks have an obligation to keep an eye on that sort of thing… You’ve just given that person the largest debt they’ve ever had.”

Taking the long-term view

Taking the long-term viewSo far this article has been focused on products, but of course brokers in all areas of lending are looking to build long-term relationships. In the case of FHBs, brokers do this by starting that relationship long before the loan has settled, helping borrowers with their savings journey. Suncorp boss Degetto believes brokers play a pivotal role here. “It is important brokers position themselves as an invaluable source of knowledge and expertise in this market.”

Percy agrees, and picks out as an example Bluebay Home Loans, an associate of Adelaide Bank. Their brokers work with borrowers for six to nine months, helping them save for a deposit. This gives their brokers an advantage when the borrower is in a position to buy. “The broker will have greater insights than anybody else and, generally, they get a lot of respect and love from those first home buyers for having assisted them.”

There are ways brokers can engage with prospective FHBs even earlier. Financial planners have become increasingly interested in young professionals in their mid-20s, attempting to reach them through technology-driven, low-cost planning options. One growing trend, which is relevant to brokers, is the use of margin lending to help prospective FHBs grow their wealth from a low base. To find out more, MPA talked to Julie McKay and Keith Hilsdon, who work in wealth management at Bendigo and Adelaide Bank.

McKay and Hilsdon aim their Investment Funds Multiplier product at clients aged 22-23, who want to build wealth faster than a term deposit would do, whilst spending much of their income on leisure activities. The bank then loans them money to invest in equities – most financial planners advise 50% gearing – and starting with $1000, the client makes contributions of $250 a month upwards. The advantage, according to Hilsdon, is that “you’re building credit worthiness in the eyes of a bank, and you’re also building up your portfolio of assets… When it comes to sit down with your bank you’ve demonstrated a track record of repaying a loan and invested in assets that will return value.”

Owing to the GFC, margin lending has a poor reputation, and isn’t something a broker can formally recommend, cautions McKay. “Certainly, if the broker isn’t accredited to give advice, they can only direct the customer to a financial planner or to the MoneySmart website.” Brokers should also be aware of the timeframes involved, according to McKay. “This is a medium-term plan. It’s a couple of years out for people, but it’s a sensible way of doing it, and it doesn’t entail them hoping they win the lottery or something like that, because I don’t think that’s realistic.”

Margin lending products do not offer commission to the broker, and indeed many brokers will look at the entire ‘savings journey’ approach and ask, ‘What’s the payoff?’ It’s a question lenders struggle to answer. In the investor lending space, some brokerages now charge borrowers for a package of all-round advice, or, in the case of AMA Brokerage of the Year, The Australian Lending and Investment Centre charges borrowers if they decline to take up a service after committing. However, in their recent submission to ASIC’s ongoing remuneration review, aggregator AFG argued that FHBs would particularly suffer if fee-for-service was mandatory, as they already lack resources, meaning they would go straight to lenders to minimise costs.

For most brokers therefore, the commercial incentive to deal with FHBs remains the same – that these become clients for life, with accompanying referrals for life. “First home buyers turn into second home buyers, who turn into third home buyers,” comments Adelaide Bank’s Percy. Me bank’s Pelaccia also notes this possibility for repeat business, whilst adding that FHBs continue to represent “a fair share of the market”.

In terms of personal referrals, FHBs are particularly valuable to brokers because a settled loan creates further clients in grateful mums, dads and relatives. Given the continual bad news around affordability, prospective first home buyers are looking for ways to get on the ladder and personal referrals from friends count the most. Marketing yourself as a specialist can work well here, explains Percy. “Being able to create a story around your business, where you’re helping them get what they want and you’re prepared to assist them earlier than others, adds to that opportunity for referrals and positive feedback.”

Finally, there is a moral case for helping first home buyers. Almost all the lenders MPA spoke to for this article made this point, but we’ve chosen to end with the argument from Bank Australia’s Irving. “Our job, collectively across the industry, is to find a way to work together on solutions for first home buyers. Affordable housing is one of the biggest challenges for the country and accessibility to finance in turn needs to seriously be considered. We need solutions.”

WHATEVER HAPPENED TO RENTVESTORS?

Last time MPA covered the FHB sector, in early 2015, we wrote about ‘rentvestors’ – those buyers whose first purchase is an investment property in an affordable suburb, whilst they themselves continue to rent and enjoy the inner city lifestyle, who LJ Hooker flagged as a growing trend. Seven per cent of FHBs told QBE’s Barometer in early 2015 that they would consider buying an investment property instead of one to live in.

Rentvestors still exist, but were hit particularly hard by APRA’s restrictions on investor lending later in 2015. “The one who has been disadvantaged the most is the person who has never bought before and they don’t want to buy the family home – they want to buy the investment property,” Simon Pressley of Propertyology told the Brisbane Courier Mail. “They are the ones who have been hit hardest because all investors have to raise around a 20% deposit. Brokers will have to work a lot harder.”